When shopping for boat insurance, you’ve probably encountered terms like “pleasure craft insurance,” “private marine insurance,” “yacht insurance,” and “standard boat insurance” used seemingly interchangeably. But are they really the same thing? And more importantly, does the distinction matter for your coverage?

The answer is yes, it absolutely matters. The type of policy you choose directly impacts what’s covered, how much you pay, and whether you’re truly protected when you need to file a claim.

Many boat owners unknowingly purchase the wrong type of coverage because they don’t understand the differences between pleasure craft insurance and standard boat insurance. Some end up overpaying for protection they don’t need, while others discover critical gaps only after an expensive incident occurs.

Here we’ll explain the differences between pleasure craft insurance and standard boat insurance. We’ll help you decide which type is best for your vessel no matter it’s a small fishing boat, a weekend cruiser, or a luxury yacht.

Understanding the Core Terminology

Before diving into differences, let’s clarify what these terms actually mean in the insurance industry.

What Is Pleasure Craft Insurance?

Pleasure craft insurance is specialized marine coverage designed specifically for vessels used exclusively for personal recreation. The key word here is “pleasure” these policies cover boats used for enjoyment, not business or income generation.

Pleasure craft policies typically cover:

- Private recreational boats used for family outings, fishing, and cruising

- Sailboats and powerboats operated by owners or their family/friends

- Vessels that never engage in commercial activities or paid charters

- Boats stored at private docks, marinas, or home storage

The defining characteristic is non-commercial use. Your pleasure craft policy assumes you’re using your boat purely for personal enjoyment without generating any income from it.

What Is Standard Boat Insurance?

“Standard boat insurance” is actually a broader, less precise term that encompasses various types of marine coverage. When insurers use this phrase, they’re typically referring to basic recreational boat policies that provide fundamental protection for smaller, less expensive vessels.

Standard boat insurance usually includes:

- Basic hull coverage for physical damage

- Liability protection for accidents

- Medical payments coverage

- Limited personal property coverage

- Standard navigation territory restrictions

The term “standard” often implies a more basic, straightforward policy without extensive customization or high-value vessel considerations.

How the Industry Actually Uses These Terms

Here’s where it gets confusing: different insurance companies use these terms differently. Some use “pleasure craft” and “boat insurance” interchangeably when referring to personal recreational coverage. Others differentiate based on vessel size, value, or coverage sophistication.

Generally, the industry follows this pattern:

- Boat insurance: Basic policies for smaller vessels under 26 feet

- Pleasure craft insurance: Mid-range policies for recreational vessels of various sizes

- Yacht insurance: Premium policies for high-value vessels typically over 40 feet

- Marine insurance: Umbrella term covering all watercraft insurance types

Understanding how your specific insurer defines these terms matters more than industry-wide definitions.

Key Differences Between Pleasure Craft and Standard Boat Insurance

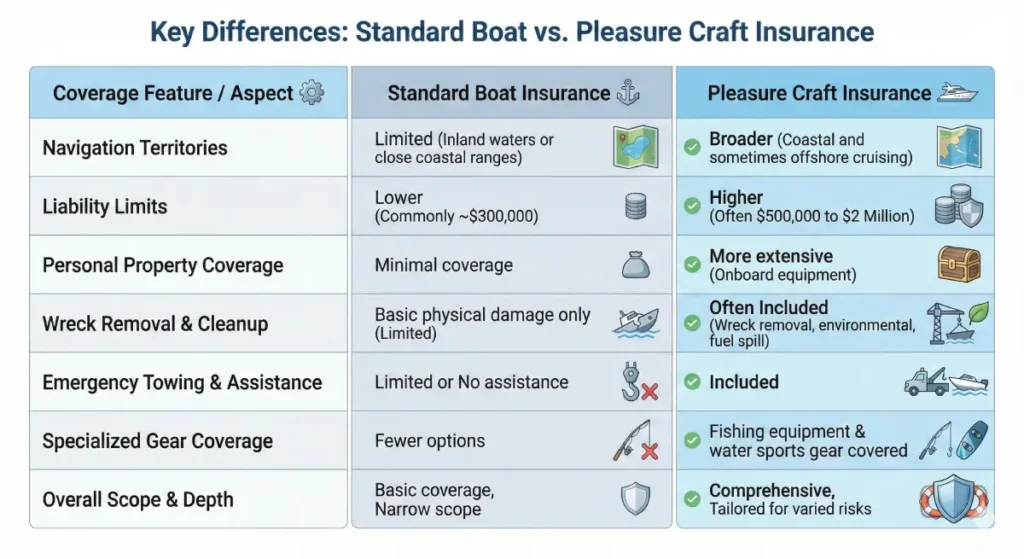

While terminology varies, there are real, meaningful differences between what’s typically offered as pleasure craft insurance versus basic standard boat policies.

Coverage Scope and Breadth

Pleasure Craft Insurance typically offers more comprehensive protection tailored to serious recreational boating. These policies often include:

- Broader navigation territories allowing coastal and sometimes offshore cruising

- Higher liability limits (often $500,000 to $2 million)

- More extensive personal property coverage for onboard equipment

- Wreck removal and environmental cleanup coverage

- Uninsured boater protection

- Fuel spill liability

- Emergency towing and assistance

- Fishing equipment and water sports gear coverage

Standard Boat Insurance usually provides basic coverage with narrower scope:

- Limited navigation areas (often inland waters only or close coastal ranges)

- Lower liability limits ($300,000 is common)

- Minimal personal property coverage

- Basic physical damage coverage only

- Limited or no towing assistance

- Fewer optional endorsements available

The difference isn’t just what’s included, it’s the depth of each coverage component. Pleasure craft policies are designed for vessels that venture farther, carry more equipment, and face more varied risks.

Vessel Eligibility and Value Considerations

Pleasure Craft Insurance typically covers:

- Boats valued from $25,000 to several hundred thousand dollars

- Vessels from 20 feet to around 60 feet

- Both powerboats and sailboats with complex systems

- Boats with significant electronics, fishing equipment, or custom features

- Vessels requiring agreed value coverage to protect investment

Standard Boat Insurance usually targets:

- Smaller vessels valued under $50,000

- Boats under 26 feet in length

- Simple powerboats, fishing boats, and pontoons

- Vessels with minimal electronics or equipment

- Coverage often on actual cash value basis with depreciation

If you own a $75,000 center console with $15,000 in electronics and fishing gear, standard boat insurance likely won’t adequately protect your investment. Pleasure craft insurance better matches your needs.

Policy Customization and Flexibility

Pleasure Craft Insurance offers extensive customization:

- Flexible navigation territory options

- Choice between agreed value and actual cash value

- Multiple deductible options

- Add-ons for specific equipment or activities

- Seasonal use discounts

- Trailer coverage options

- Personal effects schedules for expensive items

Standard Boat Insurance provides limited flexibility:

- Fixed navigation territories with little modification

- Predetermined coverage limits

- Standard deductibles with few choices

- Minimal add-on options

- One-size-fits-most approach

Serious boat owners need flexibility to match coverage to their actual usage patterns and marine insurance risk exposure. Pleasure craft policies deliver this; standard policies don’t.

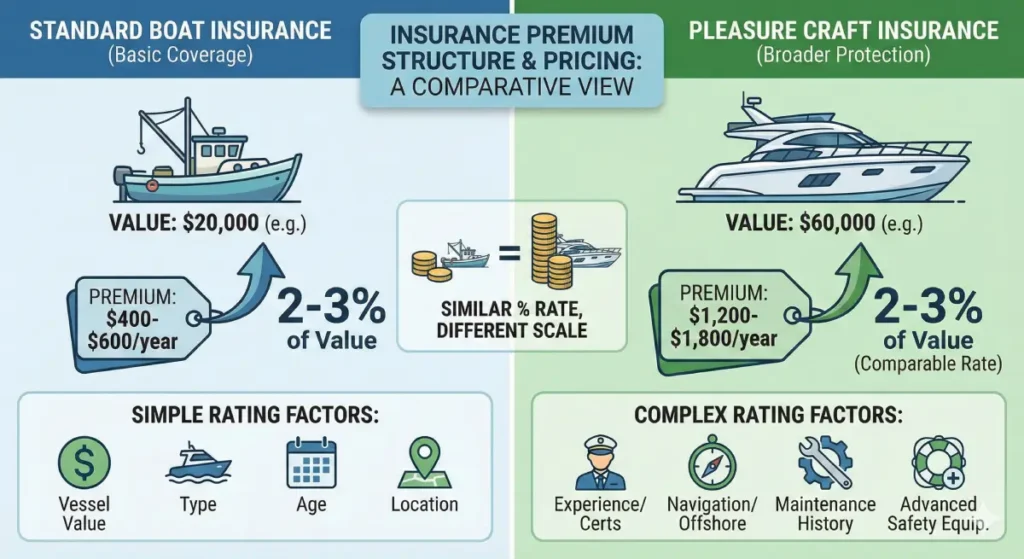

Premium Structure and Pricing

Pleasure craft insurance typically costs more in absolute terms because it covers higher-value vessels with broader protection. However, the cost as a percentage of vessel value is often comparable or even lower than standard boat insurance.

Example Comparison:

- $20,000 fishing boat with standard insurance: $400-600/year (2-3% of value)

- $60,000 cabin cruiser with pleasure craft insurance: $1,200-1,800/year (2-3% of value)

The larger absolute premium reflects greater coverage, not necessarily higher rates relative to value and risk.

Premium factors also differ. Pleasure craft insurers consider:

- Your boating experience and certifications

- Where you navigate and how far offshore

- Vessel maintenance history

- Safety equipment beyond minimum requirements

Standard boat insurance uses simpler rating factors focused primarily on vessel value, type, age, and location.

Who Needs Pleasure Craft Insurance?

Certain boat owners clearly benefit from pleasure craft insurance over basic policies.

Owners of Mid to Large Recreational Vessels

If your boat is over 26 feet or valued above $50,000, pleasure craft insurance usually provides better protection. These vessels represent significant investments requiring comprehensive coverage that standard policies don’t offer.

Cabin cruisers, larger center consoles, express boats, and cruising sailboats fall into this category. The additional equipment, complex systems, and higher replacement costs demand more robust insurance.

Boats Used for Extended Cruising

Weekend lake trips differ dramatically from multi-day coastal cruising or offshore passages. If you regularly venture beyond protected waters or take your boat on extended trips, you need the broader navigation territories and enhanced coverage that pleasure craft policies provide.

Standard boat insurance often restricts coverage to specific inland waters or very limited coastal ranges. Violating these restrictions voids your coverage entirely a risk not worth taking.

Vessels with Significant Equipment Investment

Modern boats carry expensive electronics: GPS chart plotters, radar systems, fish finders, autopilots, communication equipment, and entertainment systems. Add fishing gear, water sports equipment, and safety devices, and you’ve invested thousands beyond the boat itself.

Standard policies typically limit personal property coverage to $1,000-$3,000 total. If you have $10,000-$20,000 in equipment, that’s grossly inadequate. Pleasure craft insurance offers higher limits and scheduled equipment coverage ensuring full replacement.

Experienced Boaters Wanting Comprehensive Protection

Experienced captains understand the risks on the water and want complete protection. They value higher liability limits, environmental coverage, worldwide navigation options, and quality claims service.

Pleasure craft policies cater to knowledgeable boat owners who recognize that adequate insurance is essential risk management, not just a lender requirement. These owners prioritize coverage quality over premium savings.

Boat Owners in Hurricane-Prone Regions

Coastal areas facing hurricane risks require special coverage considerations. Pleasure craft policies often include or offer hurricane haul-out coverage, storm preparation reimbursement, and adequate protection for hurricane-related damage.

Standard policies may exclude hurricane coverage entirely or provide such limited protection that owners face significant out-of-pocket costs after storms. Our Private Marine Insurance includes comprehensive hurricane coverage designed for coastal boaters.

Who Might Be Fine with Standard Boat Insurance?

Not everyone needs the comprehensive protection of pleasure craft insurance. Some boat owners are adequately served by standard policies.

Owners of Small, Inexpensive Boats

If you own a basic fishing boat, small pontoon, or runabout valued under $15,000-$20,000, standard insurance may be sufficient. These vessels represent smaller financial exposure, carry minimal equipment, and typically operate in protected waters.

When total loss wouldn’t create financial hardship and you don’t need extensive coverage, paying for comprehensive pleasure craft insurance makes little sense.

Boats Used Only on Inland Lakes and Rivers

Boats that never leave calm inland waters face fewer risks than coastal vessels. Standard insurance policies designed for inland use provide adequate protection for these limited operations.

If your boat stays on a small lake or river and you have no plans to venture into coastal waters, standard coverage matching your actual use saves money without sacrificing necessary protection.

New Boat Owners Still Learning

First-time boat owners sometimes start with more basic coverage while they’re learning and determining their long-term boating patterns. As you gain experience and understand your actual needs, you can upgrade to more comprehensive pleasure craft insurance.

This approach works if you’re starting with a less expensive vessel and aren’t sure how much you’ll use it or where you’ll cruise.

Budget-Conscious Owners Accepting More Risk

Some owners consciously choose to self-insure certain risks to reduce premiums. They carry higher deductibles, accept lower coverage limits, and rely on emergency savings for smaller incidents.

This is a legitimate risk management choice if you understand exactly what you’re not covered for and can financially handle those exposures. Just ensure you’re making informed decisions, not inadvertently creating dangerous gaps.

Understanding Private Marine Insurance

“Private marine insurance” is essentially another term for pleasure craft insurance, emphasizing that the coverage is for privately owned, non-commercial vessels. Insurance companies use this terminology to distinguish recreational boat ownership from commercial marine operations.

Our Private Marine Insurance program specifically serves recreational boat owners with comprehensive protection including:

- Hull Coverage protecting your vessel’s physical structure and systems

- Liability Coverage for bodily injury and property damage you cause

- Worldwide Navigation options for cruisers venturing beyond U.S. waters

- Hurricane Coverage essential for coastal boat owners

Private marine insurance recognizes that recreational boat owners have different needs than commercial operators. Your insurance should reflect how you actually use your vessel for personal enjoyment, not business.

Luxury Yacht Insurance: Another Category Entirely

Once vessel values exceed several hundred thousand dollars or lengths surpass 40-60 feet, you’re looking at yacht insurance rather than pleasure craft or standard boat coverage.

Yacht insurance provides:

- Very high coverage limits matching multimillion-dollar values

- Extensive liability protection ($2-5 million or more)

- Captain and crew coverage

- Worldwide navigation as standard

- High-value personal property and equipment schedules

- Sophisticated risk management services

Our Private Client Luxury Yacht Insurance program serves high-net-worth yacht owners with specialized coverage including:

- High-Value Yacht Hull Coverage for expensive vessels

- High-Value Yacht Liability with elevated limits

- High-Value Worldwide Navigation for global cruising

- High-Value Yacht Hurricane Coverage designed for premium vessels

Yacht insurance isn’t just pleasure craft insurance with higher limits it’s a distinctly different product with specialized underwriting, claims handling, and risk management appropriate for luxury vessels.

Commercial vs. Recreational: A Critical Distinction

The most important distinction in marine insurance isn’t between “pleasure craft” and “standard boat” coverage it’s between recreational and commercial use.

Recreational (Personal) Use:

- Operating your boat for personal enjoyment

- Taking family and friends out without compensation

- Fishing, cruising, water sports for fun

- No income generation from vessel operations

Commercial Use:

- Charter fishing or sailing for paying customers

- Water taxi or passenger transport services

- Boat rental operations

- Using your vessel for any business purpose

- Accepting compensation for boat-related activities

Using your boat commercially while insured under a personal pleasure craft policy voids your coverage entirely. Even occasional commercial activities require proper Charter Commercial Lines Insurance.

We offer specialized charter coverage including:

- Bareboat Charter Insurance for self-charter operations

- Captained Charter Insurance for crewed charters

- Demise Charter Insurance for long-term charter arrangements

Never risk operating commercially on recreational coverage. The premium difference is worth the proper protection.

Navigation Territory Considerations Pleasure Craft vs Standard Boat Insurance

Where you can legally operate your boat under your policy is a critical yet often overlooked distinction.

Standard Boat Insurance Navigation Limits

Basic policies typically restrict coverage to:

- Specific inland waters (named lakes or rivers)

- Coastal waters within 5-20 miles of shore

- Regional limitations (East Coast only, Great Lakes only, etc.)

- Seasonal restrictions preventing offshore passages during certain months

Violating these limits voids all coverage. If you’re 30 miles offshore when your policy limits you to 20 miles, and something happens, your claim will be denied.

Pleasure Craft Insurance Navigation Options

Pleasure craft policies offer much more flexibility:

- Broader coastal ranges (often 75-250 miles offshore)

- Interstate navigation along entire coastlines

- Options for offshore passages and island cruising

- Ability to add international waters (Bahamas, Caribbean, Mexico)

- Temporary navigation extensions for specific trips

Serious cruisers need this flexibility. Our Worldwide Navigation coverage extends protection to international waters for adventurous boat owners.

Liability Limits: How Much Is Enough?

Liability coverage protects you when you’re responsible for injuries or property damage. The limits you carry make an enormous difference.

Standard Boat Insurance Liability

Basic policies typically offer:

- $300,000 liability limits

- Limited or no uninsured boater coverage

- Basic medical payments ($5,000-$10,000)

- No pollution or environmental liability

In today’s litigious environment, $300,000 in liability coverage is dangerously inadequate. A serious injury incident can easily result in claims exceeding $500,000 or even millions.

Pleasure Craft Insurance Liability

Comprehensive policies provide:

- $500,000 to $2 million liability limits

- Uninsured boater protection

- Higher medical payments coverage

- Pollution and fuel spill liability

- Wreck removal coverage

- Legal defense costs

Higher liability limits cost relatively little compared to the protection they provide. The difference between $300,000 and $1 million coverage might only be $100-$200 annually—money well spent for dramatically better protection.

Personal Property and Equipment Coverage

Boats carry expensive gear that standard policies inadequately protect.

What Boats Typically Carry

Modern recreational vessels often include:

- Electronics: $5,000-$20,000 (GPS, radar, fish finders, communication)

- Fishing equipment: $2,000-$10,000 (rods, reels, tackle, nets)

- Safety gear: $1,000-$5,000 (life rafts, EPIRBs, flares)

- Water sports equipment: $1,000-$5,000 (wakeboards, skis, tubes)

- Personal belongings: $2,000-$10,000 (clothing, provisions, recreational items)

Total equipment value easily reaches $15,000-$50,000 beyond the boat itself.

Standard Policy Equipment Coverage

Basic boat insurance typically provides:

- $1,000-$3,000 total personal property coverage

- No scheduled equipment coverage

- Mysterious disappearance exclusions

- Low per-item limits

If you file a claim for $15,000 in stolen equipment, you’ll recover only a fraction under standard coverage.

Pleasure Craft Equipment Protection

Comprehensive policies offer:

- $5,000-$15,000 base personal property coverage

- Option to schedule high-value items separately

- Broader coverage for theft and disappearance

- Replacement cost rather than depreciated value

- Fishing equipment and water sports gear endorsements

Proper equipment coverage ensures you can actually replace what you lose without massive out-of-pocket expenses.

Deductibles and Claims Handling

How deductibles work and how claims are handled differs between policy types.

Deductible Structures

Standard Boat Insurance:

- Simple flat deductibles ($500-$1,000)

- Same deductible applies to all claims

- Limited options for customization

Pleasure Craft Insurance:

- Multiple deductible options ($500-$5,000+)

- Separate deductibles for different coverage types

- Hurricane deductibles (often percentage-based: 2-5% of insured value)

- Diminishing deductibles rewarding claims-free years

Choosing appropriate deductibles balances premium costs with out-of-pocket risk. Higher deductibles reduce premiums but mean you pay more when filing claims.

Claims Service Quality

This is where policy differences become crystal clear. When you need to file a claim, service quality matters enormously.

Standard Boat Insurance Claims:

- Often handled by general adjusters unfamiliar with boats

- Slower processing due to less marine expertise

- More disputes over valuation and coverage

- Limited support during emergencies

Pleasure Craft Insurance Claims:

- Specialized marine adjusters understanding boats

- Faster processing with marine-specific expertise

- Fair settlement practices with proper valuations

- Emergency assistance services

- Support finding qualified repair facilities

After a serious incident—especially in remote locations or unfamiliar waters—having an insurer with genuine marine expertise and support resources makes all the difference.

How to Choose the Right Coverage for Your Boat

Selecting between pleasure craft and standard boat insurance requires honest assessment of your situation.

1. Evaluate Your Vessel

Consider:

- Value: Boats over $50,000 generally need pleasure craft coverage

- Size: Vessels over 26 feet benefit from comprehensive policies

- Complexity: Boats with complex systems, multiple engines, or extensive electronics need robust coverage

- Age: Newer boats warrant agreed value protection

2. Assess Your Usage Patterns

Think about:

- Where you boat: Inland only vs. coastal vs. offshore

- How often: Occasional weekend use vs. extensive cruising

- What activities: Simple cruising vs. fishing vs. water sports vs. diving

- Who operates: Just you vs. family members vs. guests

3. Consider Your Risk Tolerance

Evaluate:

- Financial capacity: Could you absorb a $50,000 loss without insurance?

- Liability exposure: What assets do you need to protect from lawsuits?

- Equipment investment: How much have you invested beyond the boat itself?

- Peace of mind value: What’s freedom from worry worth to you?

4. Compare Actual Policy Details

Don’t just compare premiums—examine:

- Specific coverage limits for each component

- Navigation territory boundaries

- Exclusions and limitations

- Deductible options

- Additional coverages available

- Claims handling reputation

Get quotes for both standard and pleasure craft coverage, then compare what you’re actually getting for each price point.

5. Bundling Marine Insurance with Other Policies

Many boat owners can save money by bundling marine insurance with other coverage.

Multi-Policy Discounts

Combining your boat insurance with Home Insurance and Auto Insurance through one insurer typically earns 10-25% discounts on all policies.

The convenience of single-provider service and unified claims handling adds value beyond premium savings.

Coverage Coordination

Bundling also helps ensure proper coverage coordination. Your home policy’s liability and your boat policy’s liability should work together seamlessly. Your auto policy should properly cover boat trailer towing.

An experienced agent managing all your policies ensures no gaps or unnecessary overlaps exist between different coverage types.

Questions to Ask Your Insurance Provider Before Boat Insurance

When shopping for pleasure craft or boat insurance, ask these essential questions:

- “What exactly does this policy cover and what’s excluded?” Get specifics, not generalities.

- “What are the navigation territory limits and can they be extended?” Verify you can legally boat where you actually go.

- “Is this agreed value or actual cash value coverage?” Understand how claims will be settled.

- “What are the liability limits and can I increase them?” Ensure adequate protection for your asset level.

- “How much personal property and equipment coverage is included?” Verify it matches your actual equipment value.

- “What deductible options are available?” Compare cost savings vs. out-of-pocket risk.

- “Are there any operator restrictions or requirements?” Know who can legally captain your boat under the policy.

- “What’s the claims process and what support do you provide?” Understand service quality before needing it.

- “What discounts am I eligible for?” Ensure you’re getting all savings you qualify for.

- “How does this compare to your other marine policy options?” Have the agent explain differences between their standard and comprehensive offerings.

Working with Marine Insurance Specialists

Marine insurance requires specialized knowledge that general insurance agents often lack. Working with professionals who focus specifically on boats and maritime risks ensures you get appropriate coverage and expert guidance.

Look for agents or brokers who:

- Specialize in marine insurance rather than treating it as an add-on

- Represent multiple marine insurers for comparison shopping

- Understand boats, navigation, and maritime risks from experience

- Ask detailed questions about your vessel and usage

- Explain coverage options clearly without pressure tactics

- Provide ongoing service, not just policy sales

Our team specializes in Marine Insurance for recreational boat owners and commercial operators. We help match the right coverage type to your specific needs, ensuring you’re neither underinsured nor overpaying for protection you don’t need.

For business-related insurance needs, we also provide Commercial Auto, General Liability, and Workers Compensation coverage for marine-related businesses.

Your Boat Deserves Proper Protection

Your boat represents freedom, adventure, family memories, and significant financial investment. Protecting it properly ensures those experiences continue without the stress of inadequate coverage or devastating out-of-pocket expenses.

Whether you choose pleasure craft insurance, standard boat insurance, or specialized yacht coverage, the key is matching your policy to your actual needs rather than making assumptions about what “boat insurance” includes.

Take time to evaluate your vessel, usage patterns, and risk exposure. Compare policy details, not just premiums. Work with knowledgeable marine insurance professionals who understand boats and can guide you toward appropriate protection.

The difference between pleasure craft and standard boat insurance isn’t just terminology it’s the level of protection, flexibility, and peace of mind you receive. Make the choice that truly protects your investment and lets you enjoy your time on the water with confidence.

Question May You in mind about Pleasure Craft and Boat Insurance

Yes, most insurers allow mid-policy changes, though the process varies by company. If you upgrade to a larger boat, add significant equipment, or plan extended cruising that exceeds your current policy’s navigation limits, contact your insurer immediately to discuss upgrading coverage. They’ll typically calculate a pro-rated premium adjustment for the remaining policy period. Some insurers may require a new survey for more comprehensive coverage, especially for vessels over $75,000 or older boats.

Trailer coverage varies significantly between policies. Some pleasure craft policies automatically include your trailer up to a specific limit (often $5,000-$10,000), while others exclude trailers entirely or offer them as optional endorsements. Standard boat policies frequently exclude trailers or provide only minimal coverage. If you have an expensive custom trailer worth $3,000-$8,000, verify it’s specifically covered and for adequate value.

Absolutely. Standard personal property coverage in both pleasure craft and basic boat policies typically maxes out at $3,000-$5,000 total, with per-item limits of $500-$1,000. If you have $15,000 in electronics and $8,000 in fishing gear permanently installed or stored aboard, you’re dramatically underinsured. Request scheduled personal property endorsements or equipment floaters that specifically list high-value items with their values.