The marine insurance landscape is shifting dramatically in 2026. Premiums are rising faster than they have in years, insurers are tightening underwriting standards, and boat owners are discovering unexpected coverage gaps in policies they thought were comprehensive.

If you’ve received a renewal notice with a 25-40% premium increase, you’re not alone. Climate change, inflation, rising repair costs, and increased claim frequency are reshaping the entire marine insurance market. But higher premiums don’t automatically mean better protection many boat owners are paying more while actually having less coverage.

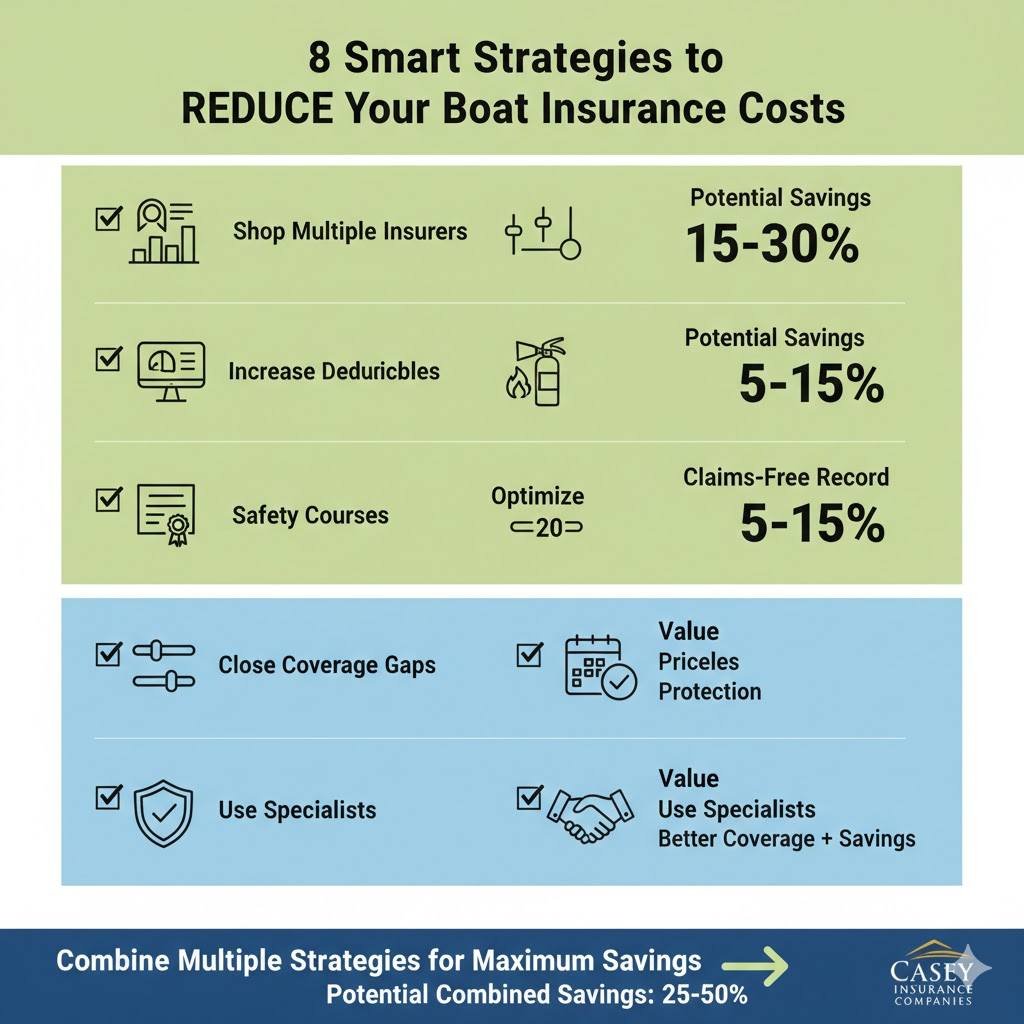

The good news? Strategic approaches can help you lower premiums without sacrificing essential protection and close dangerous coverage gaps before you need to file claims. Here’s what you need to know about navigating the 2026 marine insurance market.

Understanding the 2026 Marine Insurance Market

Before addressing solutions, understanding why premiums are rising helps you make informed decisions.

Why Marine Insurance Costs Are Increasing?

- Climate-Related Losses: Hurricane Ian (2022), Idalia (2023), and recent Atlantic storm seasons have generated billions in marine claims. Insurers are adjusting premiums to reflect this new reality, especially in coastal areas.

- Inflation and Repair Costs: Boat repairs cost 30-50% more than pre-pandemic levels. Parts, materials, and skilled marine labor have all increased dramatically. Higher repair costs mean higher claims, which translate to higher premiums.

- Supply Chain Issues: Replacement parts for boats especially older models remain difficult to source, extending repair times and increasing costs. Total loss declarations are more common when repairs become economically unfeasible.

- Increased Claim Frequency: More boats on the water, less experienced operators (pandemic boat-buying surge), and aging vessels all contribute to higher accident and claim rates.

- Reinsurance Costs: Insurance companies themselves purchase reinsurance to cover catastrophic losses. Reinsurance costs have surged 25-60% in some markets, and these costs pass directly to policyholders.

Common Coverage Gaps Emerging in 2026

As insurers tighten underwriting, new exclusions and limitations are appearing:

- Higher Hurricane Deductibles: Percentage-based hurricane deductibles increasing from 2-5% to 5-10% in high-risk areas

- Restricted Navigation Territories: Some insurers reducing offshore distance limits or excluding certain high-risk cruising areas

- Electronics and Equipment Sublimits: New caps on coverage for expensive electronics, fishing gear, and accessories

- Age-Related Restrictions: Older vessels (15+ years) facing higher premiums, coverage restrictions, or outright declination

- Maintenance Requirements: Stricter survey requirements and mandatory maintenance schedules with coverage voidance for non-compliance

- Named Storm Exclusions: Some policies now excluding coverage during certain portions of hurricane season or in specific geographic zones

Strategy 1: Shop Smarter, Not Just Cheaper

When premiums jump, the instinct is finding the lowest price. But shopping solely on cost often creates more problems than it solves.

Compare Multiple Specialized Marine Insurers

Don’t just get one quote obtain 3-5 quotes from insurers specializing in marine coverage:

- Marine Insurance Specialists: Companies focusing exclusively on boats understand maritime risks and often provide better value than general insurers adding boat coverage as an afterthought.

- Different Underwriting Approaches: Insurers assess risk differently. One company might heavily penalize your boat’s age while another focuses more on your experience and claims history.

- Bundling Opportunities: Many insurers offer 10-25% discounts when bundling boat coverage with Home Insurance and Auto Insurance.

Compare Coverage, Not Just Premiums

A policy costing $400 less annually might have:

- Higher deductibles ($5,000 vs. $2,500)

- Lower liability limits ($300,000 vs. $1,000,000)

- Restrictive navigation territories

- Limited personal property coverage

- Inferior claims service

Create a comparison spreadsheet including:

- Annual premium

- Hull coverage limits and deductible

- Liability limits

- Hurricane/named storm deductible

- Navigation territory

- Personal property limits

- Towing and assistance coverage

- Insurer financial strength rating

- Claims handling reputation

Strategy 2: Increase Deductibles Strategically

Higher deductibles reduce premiums sometimes substantially. But this strategy requires careful consideration.

How Much Deductibles Reduce Premiums

Typical savings from deductible increases:

Standard Deductible Changes:

- $1,000 → $2,500: Saves 10-15% annually

- $2,500 → $5,000: Saves additional 12-18%

- $5,000 → $10,000: Saves additional 15-20%

Hurricane Deductible Changes:

- 2% → 5%: Saves 15-25% annually

- 5% → 7%: Saves additional 8-12%

When Higher Deductibles Make Sense

Consider higher deductibles if you:

- Have adequate emergency savings covering the deductible amount

- Rarely file small claims

- Own older boats where minor damage might not warrant claims anyway

- Want to save on premiums for larger, higher-value vessels

When to Keep Lower Deductibles

Maintain lower deductibles if:

- Emergency savings are limited

- You operate in congested areas with higher accident probability

- Your boat is financed (lenders sometimes restrict deductible amounts)

- You prefer peace of mind over premium savings

Never increase deductibles beyond what you can comfortably afford during emergencies. Saving $500 annually isn’t worthwhile if a $10,000 deductible creates financial hardship during claims.

Strategy 3: Invest in Loss Prevention and Safety Equipment

Insurers reward proactive risk reduction with premium discounts and better coverage terms.

Safety Equipment Discounts

Modern safety and security equipment qualifies for premium reductions:

- GPS Tracking Systems: 5-10% discount. Devices like SPOT, Garmin inReach, or similar tracking systems help locate stolen boats and assist emergency services.

- Fire Suppression Systems: 5-8% discount. Automatic engine room fire suppression systems significantly reduce fire claim severity.

- Enhanced Security: 3-7% discount. Quality locking systems, alarm systems, and security monitoring reduce theft risk.

- Modern Electronics: 2-5% discount. Up-to-date navigation electronics, radar, and communication systems prevent accidents.

- Bilge Monitoring: 3-5% discount. High-water alarms and automated bilge pump systems prevent sinking from slow leaks.

Initial equipment investment often pays for itself within 2-4 years through premium savings while providing genuine protection benefits.

Maintenance and Surveys

Well-maintained vessels with recent surveys get favorable underwriting:

Regular Surveys: Professional surveys every 2-3 years demonstrate vessel condition and identify issues before they become claims. Insurers reward this with better rates.

Documented Maintenance: Keep detailed records of all maintenance with receipts and photos. This proves proper care and can prevent claim denials for “neglect.”

Winterization Certification: For boats in freezing climates, professional winterization with documentation prevents freeze damage claims and may qualify for discounts.

Professional Cleanings: Bottom cleaning, anti-fouling treatments, and professional detailing demonstrate care and prevent deterioration.

Strategy 4: Take Boating Safety Courses

Completing approved boating safety courses reduces premiums while genuinely improving your skills.

Course Discounts

Most insurers offer 5-15% discounts for completing courses from:

U.S. Coast Guard Auxiliary: Free courses covering fundamental boating safety

U.S. Power Squadrons (America’s Boating Club): Comprehensive courses from basic to advanced

State Boating Education Programs: Many states offer certification courses

Advanced Courses: Offshore navigation, weather, diesel maintenance courses qualify for additional discounts

Multi-Year Benefits

Boating course discounts typically apply annually for 3-5 years from completion. A course taking 8-12 hours can save $100-$300 annually—excellent return on time investment.

Courses also reduce accident probability through better knowledge the best premium reduction comes from claims-free history.

Strategy 5: Optimize Your Coverage Structure

Reviewing and adjusting coverage components can reduce costs while maintaining essential protection.

Right-Size Your Hull Coverage

Actual Cash Value vs. Agreed Value: For older boats (10+ years), actual cash value coverage costs 10-20% less than agreed value. If depreciation has reduced your boat’s value significantly and you’re comfortable accepting depreciated payouts, this saves money.

Exclude Older Equipment: Some policies allow excluding older, lower-value equipment from coverage, reducing premiums. Only do this for truly replaceable items you can afford to replace out-of-pocket.

Adjust Personal Property Limits: If you no longer carry expensive electronics or fishing gear aboard, reduce personal property coverage limits accordingly.

Don’t Reduce Liability Coverage

Never reduce liability limits to save money. The premium difference between $300,000 and $1,000,000 liability is often just $150-$300 annually minimal compared to protecting your assets from lawsuits.

Proper Liability Coverage protects everything you own. This isn’t where you cut costs.

Review Navigation Territory Needs

If you actually only boat in local inland waters, don’t pay for offshore coastal coverage you never use. Conversely, if you do venture offshore, ensure you have proper Worldwide Navigation coverage rather than risking coverage violations.

Strategy 6: Maintain a Claims-Free Record

Your claims history dramatically affects premiums. Strategic claim decisions save money long-term.

When to File Claims vs. Pay Out-of-Pocket

File Claims For:

- Major damage exceeding $5,000-$10,000

- Total or constructive total loss

- Liability situations involving third parties

- Injuries requiring medical attention

- Any situation potentially creating future liability

Consider Paying Out-of-Pocket For:

- Damage barely exceeding your deductible

- Minor cosmetic issues under $2,000-$3,000

- Situations where claim filing might increase future premiums more than repair costs

Claims-Free Discounts

Many insurers offer:

- 5-10% discount after 3 claim-free years

- 10-15% discount after 5 claim-free years

- Diminishing deductibles reducing $100-$250 annually when claim-free

Over time, avoiding small claims saves far more through claims-free discounts than claim payouts would have provided.

Strategy 7: Address Coverage Gaps Proactively

While reducing premiums, ensure you’re not creating dangerous coverage gaps.

Common Gaps to Close

- Hurricane Season Coverage: Verify your Hurricane Coverage includes adequate haul-out reimbursement and understand your hurricane deductible clearly.

- Charter Activities: If you use platforms like Boatsetter or GetMyBoat, personal policies void coverage. Obtain proper Bareboat Charter Insurance before generating any income.

- Equipment and Electronics: Modern electronics, fishing gear, and accessories often exceed standard personal property sublimits. Schedule high-value items specifically.

- Towing and Assistance: Ensure adequate towing coverage, especially if you boat in remote areas or offshore. Basic policies often include only $500-$1,000 towing limits inadequate for serious groundings or offshore towing.

- Pollution Liability: Standard $50,000-$100,000 pollution liability limits may be inadequate. Consider increasing to $300,000-$500,000, especially for larger vessels.

High-Value and Luxury Yacht Considerations

Owners of vessels valued above $300,000 should review:

- High-Value Yacht Hull Coverage ensuring agreed value protection

- High-Value Yacht Liability with $2-5 million limits

- High-Value Worldwide Navigation if you cruise internationally

- Specialized High-Value Yacht Hurricane Coverage

Strategy 8: Work with Marine Insurance Specialists

Generic insurance agents treating boats as an afterthought to home and auto policies rarely secure best value or identify coverage gaps.

Benefits of Marine Specialists

- Market Knowledge: Specialists know which insurers currently offer competitive rates for your vessel type, age, and usage.

- Coverage Expertise: They identify gaps in policies and recommend appropriate coverage without over-insuring.

- Claims Advocacy: When filing claims, specialists advocate for you, knowing how marine claims should be handled.

- Multiple Carrier Access: Specialists represent multiple marine insurers, allowing true comparison shopping.

- Long-Term Relationships: Building relationships with specialists who understand your needs provides better service year after year.

What to Expect in the 2026 Market

Looking ahead, marine insurance market trends include:

Continued Premium Pressure: Expect premiums to remain elevated or increase further in hurricane-prone areas and for older vessels.

Technology Integration: More insurers offering discounts for tracking devices, monitoring systems, and telematics.

Stricter Underwriting: Increased survey requirements, maintenance verification, and documentation standards.

Climate-Based Pricing: More sophisticated geographic risk assessment affecting coastal versus inland pricing.

Coverage Specialization: Growing distinction between basic recreational coverage and enhanced protection for serious cruisers.

Taking Action in 2026

The changing marine insurance market requires proactive approach rather than passive renewal acceptance.

Before Your Renewal:

- Request quotes from 3-5 marine insurers 60 days before renewal

- Review your current coverage for gaps and unnecessary costs

- Gather documentation: survey reports, maintenance records, safety equipment lists

- Calculate whether deductible increases make financial sense

- Research applicable boating safety courses

- Assess whether your coverage matches actual boat usage

During Shopping:

- Compare coverage comprehensively, not just premiums

- Ask about all available discounts

- Verify navigation territories match your cruising

- Understand all deductibles clearly

- Check insurer financial strength ratings

- Read policy exclusions carefully

After Purchase:

- Document your boat’s condition with photos/video

- Keep insurance certificates and policy documents accessible

- Mark calendar for survey scheduling (if required)

- Schedule boating safety courses

- Review marina and lender insurance requirement compliance

Protecting Your Investment Wisely

The 2026 marine insurance market is challenging, but informed boat owners can reduce costs while maintaining or even improving protection quality.

Focus on genuine value rather than lowest price. Small premium savings mean nothing if coverage gaps leave you personally liable for $100,000+ in losses. Conversely, paying for coverage you don’t need wastes money better spent elsewhere.

Strategic deductible increases, safety equipment investments, boating education, claims-free history, and working with specialized professionals all contribute to lower costs and better protection.

Our marine insurance specialists help boat owners navigate the 2026 market, identifying money-saving opportunities while closing dangerous coverage gaps. Whether you need Private Marine Insurance, Private Client Luxury Yacht coverage, or Charter Commercial Lines Insurance, we provide expert guidance ensuring you have appropriate protection at competitive rates.

We also offer comprehensive Commercial Insurance including General Liability and Workers Compensation for marine-related businesses.

Frequently Asked Questions

Often yes, if savings are substantial (20%+ annually). Most insurers allow mid-term cancellation with pro-rated refunds for unused premium. Calculate whether savings after cancellation fees exceed the hassle. Ensure no coverage gaps during the transition obtain written confirmation from the new insurer before canceling existing coverage.

Coastal boat owners in hurricane-prone areas (Florida, Gulf Coast, Southeast Atlantic) should expect 15-35% increases for 2026 renewals, with some seeing 40-50% increases depending on vessel age, location specifics, and claims history. Inland and northern coastal areas typically see 8-20% increases. Shop aggressively if your increase exceeds these ranges.

Online comparison sites provide starting points but rarely capture marine insurance complexity. They often don’t include specialized marine insurers offering best value, may not properly assess navigation limits or coverage nuances, and lack expertise for unusual vessels or usage. Use them for initial research but work with marine specialists for final decisions.