Comprehensive car insurance sounds like it should cover everything, right? The name certainly suggests complete protection. But here’s the reality: comprehensive coverage protects against specific non-collision risks not everything that can happen to your vehicle.

Many drivers purchase comprehensive auto insurance without truly understanding what it covers. Then they file claims for situations that aren’t covered at all, leading to denials and frustration. Or worse, they skip comprehensive coverage entirely, thinking it’s unnecessary, only to face thousands in uncovered losses when their car is stolen or damaged by hail.

Understanding exactly what comprehensive insurance covers and critically, what it doesn’t helps you make informed decisions about protecting your vehicle and budget.

What Is Comprehensive Auto Insurance?

Comprehensive insurance covers damage to your vehicle from non-collision events. Think of it as protection against “everything else” that can damage your car besides hitting something or being hit.

It’s optional coverage (unless you’re financing or leasing), but it protects you from expensive risks that collision insurance and liability coverage don’t address.

What Comprehensive Coverage Protects Against

Comprehensive insurance covers a wide range of perils beyond your control.

1. Theft and Vandalism

- Total Vehicle Theft: If your car is stolen and not recovered, comprehensive pays its actual cash value minus your deductible.

- Partial Theft: Stolen catalytic converters, wheels, stereos, or other parts are covered.

- Vandalism: Keyed paint, broken windows, slashed tires, or other intentional damage from vandals is covered.

Example: Your car is stolen from a parking lot. With comprehensive coverage and a $500 deductible, if your vehicle is worth $18,000, you receive $17,500.

2. Weather-Related Damage

Comprehensive covers various weather perils:

- Hail Damage: Dents and paint damage from hailstorms—repairs often cost $3,000-$10,000+

- Flood Damage: Water damage from floods, heavy rain, or rising water (but not from driving through standing water intentionally)

- Hurricane and Tornado Damage: Wind damage, flying debris, and water intrusion from storms

- Lightning Strikes: Electrical damage and fire from lightning

Example: A severe hailstorm damages your hood, roof, and trunk. Repairs cost $6,500. With a $1,000 comprehensive deductible, you pay $1,000 and insurance covers $5,500.

3. Fire and Explosions

- Vehicle Fires: Coverage for fires from any cause—electrical failures, accidents, arson, or unknown origins

- Engine Fires: Mechanical or electrical fires originating in engine compartments

Total Loss from Fire: If fire destroys your vehicle completely, comprehensive pays its value

4. Falling Objects and Debris

- Tree Branches or Trees: Damage from falling trees, branches, or limbs

- Rock or Road Debris: Windshield cracks or body damage from flying rocks or debris (including from other vehicles)

- Construction Materials: Damage from falling construction debris, scaffolding, or materials

- Other Falling Objects: Anything that falls onto your vehicle from above

5. Animal Collisions and Damage

- Hitting Animals: Colliding with deer, elk, moose, dogs, or other animals

- Animal-Caused Damage: Rodents chewing wiring, nesting damage, or animals breaking into vehicles

Example: You hit a deer on a rural highway, totaling your vehicle. Comprehensive coverage pays your car’s value minus your deductible—collision doesn’t cover animal strikes.

6. Glass Damage

Windshield Damage: Cracks or chips in windshields from rocks or unknown causes

Window Breakage: Side or rear window damage from vandalism, theft attempts, or debris

Glass-Only Deductible: Some policies offer separate, lower deductibles (or no deductible) specifically for glass claims

Civil Disturbances

Riot Damage: Damage during riots, protests, or civil unrest

Civil Commotion: Vandalism or destruction during mass gatherings or disturbances

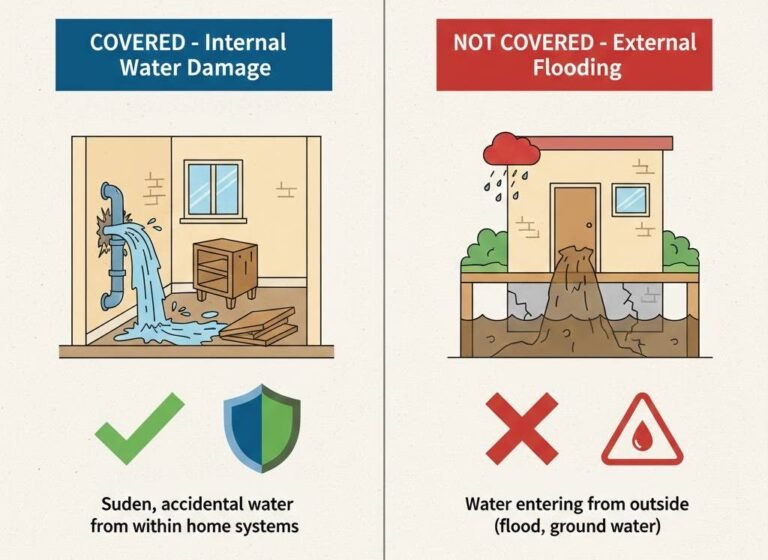

What Comprehensive Insurance DOESN’T Cover

Understanding exclusions prevents claim surprises and helps you recognize coverage gaps.

1. Collision Damage

Not Covered: Damage from hitting other vehicles, objects, or structures, or from rollovers

Why: Collision coverage handles these scenarios—they’re completely separate from comprehensive

Example: You rear-end another car. Comprehensive doesn’t cover your vehicle damage—collision does.

Personal Belongings Inside Your Vehicle

Not Covered: Laptops, phones, clothing, sports equipment, or other personal items stolen from your car

Why: Auto insurance protects the vehicle itself, not contents

Solution: Your homeowners or renters insurance covers personal belongings stolen from vehicles

2. Mechanical Breakdowns and Failures

Not Covered: Engine failures, transmission problems, or normal wear and tear

Why: Insurance covers sudden, unexpected damage—not maintenance issues or mechanical failures

Solution: Extended warranties or mechanical breakdown insurance (MBI) cover these issues

3. Intentional Damage You Cause

Not Covered: Deliberately damaging your own vehicle

Why: Insurance fraud prevention

Example: Intentionally setting fire to your car or causing damage to file insurance claims

4. Normal Wear and Tear

Not Covered: Rust, paint fading, upholstery wear, tire wear, or gradual deterioration

Why: These are expected aging and maintenance issues, not insurable events

5. Custom Equipment and Modifications

Limited Coverage: Aftermarket stereos, custom wheels, performance modifications often have coverage limits ($1,000-$3,000)

Why: Standard policies don’t account for non-factory modifications

Solution: Schedule high-value custom equipment separately or buy specialized coverage

6. Driving-Related Damage

Not Covered: Intentionally driving through deep water causing flood damage, off-road damage to suspensions, or damage from racing

Why: Preventable damage from reckless operation isn’t covered

How Comprehensive Claims Work

Understanding the claims process helps set realistic expectations.

1. Deductibles

You choose comprehensive deductibles when purchasing coverage typically $250, $500, $1,000, or higher. You pay this amount out-of-pocket before insurance covers the rest.

Example: $4,000 theft claim with $500 deductible = you pay $500, insurance pays $3,500

Lower Deductibles: Cost more in premiums but less out-of-pocket during claims

Higher Deductibles: Reduce premiums but increase claim costs

2. Actual Cash Value vs Replacement Cost

Comprehensive coverage pays your vehicle’s actual cash value (ACV) current market value accounting for age, mileage, and condition, not what you paid originally or replacement cost.

Example: You bought your car for $30,000 three years ago. Today it’s worth $20,000 (ACV). Total loss comprehensive claim pays $20,000 minus your deductible, not $30,000.

3. Total Loss Threshold

If repair costs exceed 75-80% of your vehicle’s value, insurers declare “total loss” and pay ACV rather than repairing. You can’t force them to repair vehicles beyond economic repair thresholds.

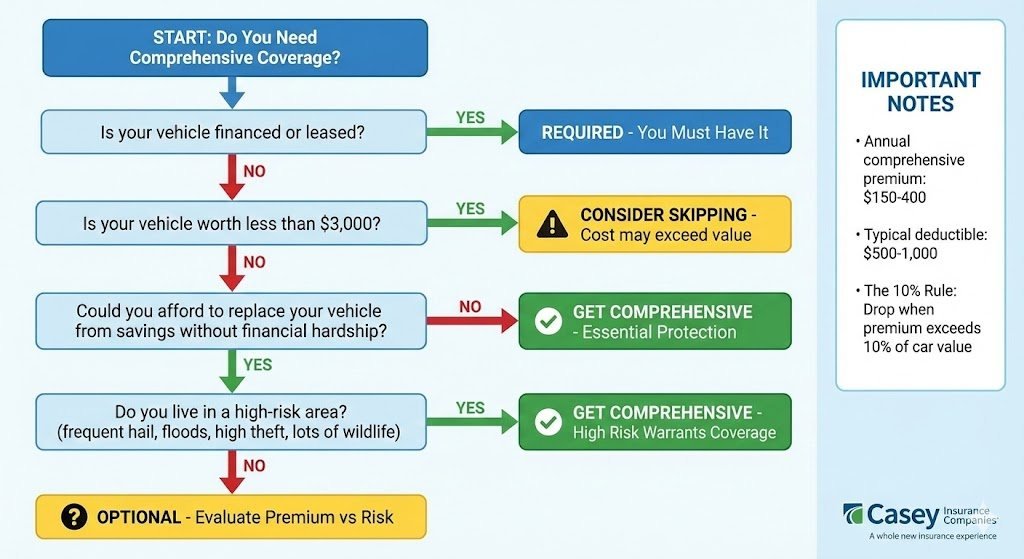

Do You Need Comprehensive Coverage?

Whether comprehensive makes sense depends on your vehicle’s value and your financial situation.

When You MUST Have Comprehensive

Financed or Leased Vehicles: Lenders require comprehensive coverage protecting their investment until you own the vehicle outright.

When You SHOULD Have Comprehensive

Vehicle Worth $4,000+: Potential loss exceeds the modest cost of coverage

Can’t Afford Replacement: If losing your vehicle would create financial hardship

High-Risk Areas: Regions with frequent hail, floods, high theft rates, or abundant wildlife

Newer Vehicles: Comprehensive is worthwhile for vehicles under 10 years old

When You Might Skip Comprehensive

Vehicle Worth Under $3,000: When annual premiums plus deductibles approach vehicle value

Substantial Savings: If you could replace your vehicle from savings without financial strain

The 10% Rule: Drop comprehensive when annual premiums exceed 10% of vehicle value

How Much Does Comprehensive Insurance Cost?

Comprehensive coverage is surprisingly affordable compared to collision insurance.

Average Costs

Typical Range: $150-$400 annually for most drivers

Factors Affecting Cost:

- Vehicle value (higher value = higher premiums)

- Deductible amount (higher deductible = lower premium)

- Location (high-theft or weather-prone areas cost more)

- Your age and driving record

- Claims history

Cost Comparison: Comprehensive typically costs 30-50% less than collision coverage because claim frequency is lower.

Deductible Impact on Premiums

Choosing higher deductibles reduces premiums:

- $250 → $500 deductible: Save 15-20%

- $500 → $1,000 deductible: Save additional 15-25%

Maximizing Your Comprehensive Coverage Value

Reduce Deductibles for Glass Coverage

Many insurers offer $0 or low glass deductibles. Windshield replacements cost $300-$1,000 having no deductible for glass claims is valuable.

Document Your Vehicle’s Condition

Photograph your vehicle regularly showing its condition. This evidence supports valuations during total loss claims.

Install Anti-Theft Devices

Security systems, GPS tracking, and VIN etching qualify for comprehensive premium discounts (5-15%) while genuinely reducing theft risk.

Bundle for Savings

Combine comprehensive coverage with home insurance for 15-25% multi-policy discounts.

Making the Right Coverage Decision

Comprehensive insurance protects against unpredictable risks you can’t prevent theft, weather, animals, vandalism. For most drivers with vehicles worth protecting, it’s affordable coverage providing essential protection.

Evaluate your vehicle’s value, replacement ability, and local risks. If your car is worth $5,000+ and you’d struggle to replace it from savings, comprehensive coverage is wise financial protection costing just $10-30 monthly.

Our auto insurance specialists help you understand coverage options and build protection matching your needs. We provide comprehensive Auto Insurance guidance including Collision Coverage, Liability Coverage, and Uninsured Motorist Protection.

Frequently Asked Questions

Comprehensive coverage pays for falling object damage branches, trees, or anything falling onto your vehicle from above. This is a non-collision event covered specifically under comprehensive, not collision coverage.

Generally yes, but insurers may deny claims if you intentionally drove through obviously dangerous deep water. Unavoidable flood situations or rising water damaging parked vehicles are clearly covered. Reckless decisions to drive through flooded roads might face coverage challenges.

Comprehensive claims typically have less rate impact than collision or at-fault liability claims since they involve circumstances beyond your control. However, multiple comprehensive claims may affect renewal rates. One hail damage or theft claim usually won’t significantly increase premiums.