A single moment of inattention on the water can change your life forever. Your boat drifts into another vessel causing $50,000 in damage. A guest slips on your deck and suffers serious injuries requiring surgery. You accidentally run over a swimmer, resulting in catastrophic injuries and a million-dollar lawsuit.

These aren’t hypothetical scenarios, they happen to careful, experienced boat owners every season. The financial consequences can be devastating, potentially costing you everything you’ve worked to build: your home, savings, investments, and future earnings.

Marine liability insurance stands between you and financial ruin when accidents occur. Yet many boat owners either carry inadequate limits or don’t fully understand what their liability coverage actually protects.

What Is Marine Liability Insurance?

Marine liability insurance protects you when you’re legally responsible for injuries to others or damage to their property while operating your boat. It covers both your legal defense costs and any settlements or judgments against you.

Think of it as the marine equivalent of auto liability insurance but with potentially higher stakes. Serious boating accidents can result in multi-million dollar claims that standard coverage limits simply can’t handle.

How Marine Liability Differs from Hull Coverage

It’s crucial to understand that hull and liability coverage protect completely different things:

- Hull Coverage: Protects your boat’s physical structure, equipmentand your property.

- Liability Coverage: Protects you from claims by others when you damage their property or injure people—their losses for which you’re responsible.

You need both. Hull coverage repairs your boat after accidents; liability coverage protects your personal assets when you’re responsible for others’ losses.

Our Liability Coverage for private vessels and High-Value Yacht Liability for luxury yachts provide comprehensive protection tailored to your exposure level.

What Marine Liability Insurance Covers?

Quality marine liability coverage protects you across multiple scenarios where you’re found legally responsible for others’ losses.

1. Bodily Injury to Third Parties

Liability coverage pays when your boat operation causes injuries to:

- Passengers on other vessels

- Swimmers and water skiers

- People on docks or shore

- Guests aboard your boat (in some circumstances)

- Other boat operators

Coverage includes medical expenses, lost wages, pain and suffering, permanent disability compensation, and wrongful death claims. A serious injury can easily result in $500,000 to several million in damages—far exceeding most standard policy limits.

2. Property Damage to Other Vessels and Property

When you damage others’ property, liability coverage pays for:

- Other boats you collide with

- Docks, pilings, and marina structures

- Private property along shorelines

- Navigation aids and buoys

- Other watercraft and equipment

Even minor collisions with luxury yachts can result in $25,000-$100,000 repair bills. Major collisions easily reach six figures. Your liability coverage protects you from bearing these costs personally.

3. Legal Defense Costs

One of liability insurance’s most valuable components is legal defense coverage. Even if you’re not ultimately found liable, defending yourself against claims costs tens or hundreds of thousands in attorney fees, expert witnesses, and court costs.

Quality policies provide legal defense separate from liability limits meaning defense costs don’t reduce the amount available for settlements. This distinction matters enormously in complex cases requiring extensive legal work.

4. Medical Payments Coverage

Most liability policies include medical payments coverage a no-fault component paying medical expenses for injured people regardless of who caused the accident. This typically covers:

- Emergency medical treatment

- Hospital costs

- Follow-up care within specified timeframes

- Ambulance and emergency transport

Medical payments limits usually range from $5,000-$25,000 per person. While modest, this coverage helps injured parties receive immediate care and can prevent minor injuries from becoming major liability claims.

5. Pollution and Fuel Spill Liability

Environmental liability protects you when your boat leaks fuel or oil causing pollution. Coverage includes:

- Cleanup and remediation costs

- Environmental damage claims

- Regulatory fines and penalties (in some policies)

- Legal defense against environmental claims

Standard policies often include only $50,000-$100,000 pollution liability—potentially inadequate for significant spills. Consider higher limits, especially for larger vessels carrying more fuel.

6. Wreck Removal Liability

If your boat sinks and becomes a navigation hazard or environmental threat, you’re legally responsible for removal costs. Wreck removal coverage included in quality liability policies pays for:

- Salvage operations

- Vessel recovery

- Disposal of the wreck

- Related environmental cleanup

Removing a sunken vessel can cost $20,000-$100,000+ depending on depth, location, and vessel size. Without coverage, you’re personally liable for these expenses.

Why Standard Liability Limits Aren’t Enough

Many boat owners carry minimal liability coverage without understanding their actual exposure.

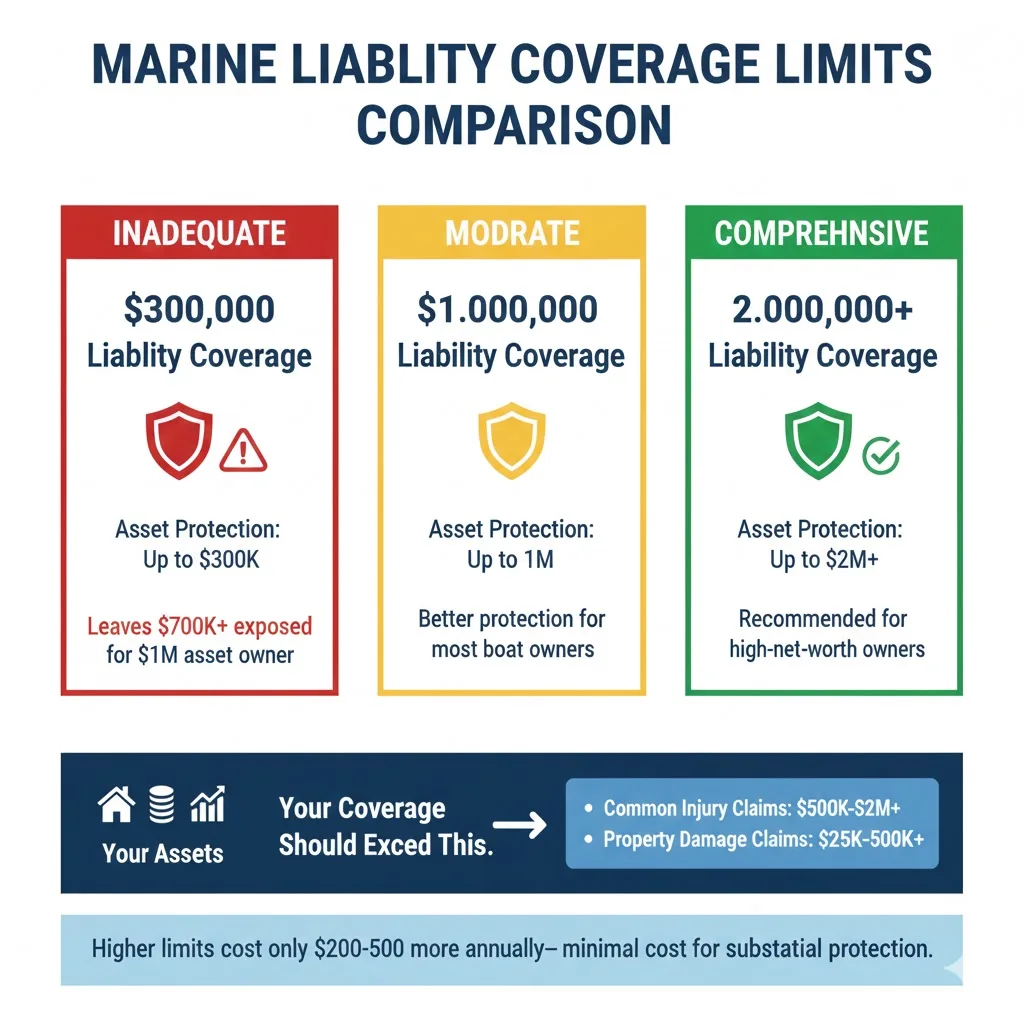

The $300,000 Problem

Standard recreational boat policies often include just $300,000 in liability coverage. While this sounds substantial, consider these scenarios:

Scenario 1: You collide with another boat, injuring two people. One suffers a serious back injury requiring surgery, resulting in $250,000 in medical bills and lost wages. The second suffers a broken leg costing $75,000.

Total: $325,000—exceeding your $300,000 limit by $25,000 you pay personally.

Scenario 2: You accidentally run over a swimmer causing permanent disability. The jury awards $1.5 million. Your insurance pays $300,000. You’re personally liable for $1.2 million potentially forcing bankruptcy, home sale, and wage garnishment for years.

These aren’t worst-case scenarios they’re real claims that occur regularly.

Protecting Your Assets

The liability coverage you need depends on your total assets. If a lawsuit exceeds your insurance limits, plaintiffs can pursue:

- Your home and other real estate

- Investment accounts and savings

- Business interests

- Retirement accounts (in some states)

- Future earnings through wage garnishment

High-net-worth individuals face particular vulnerability. If you have $2 million in assets but carry only $300,000 liability coverage, you’re essentially self-insuring $1.7 million of exposure.

Recommended Liability Limits

Consider these minimum guidelines:

- Basic Boat Owners (modest assets, smaller vessels): $500,000-$1 million

- Mid-Range Boat Owners (moderate assets, mid-size vessels): $1-2 million

- High-Value Yacht Owners (substantial assets, luxury vessels): $2-5 million or more

Higher liability limits cost relatively little compared to the protection provided. Moving from $300,000 to $1 million coverage might increase premiums only $150-$300 annually minimal compared to the additional $700,000 in protection.

Uninsured and Underinsured Boater Coverage

Not every boat on the water carries adequate insurance or any insurance at all. This creates additional risk for you.

The Uninsured Boater Problem

Studies suggest 10-20% of boats operate without insurance. When an uninsured boater damages your vessel or injures you, you can’t recover from their insurance because they don’t have any.

While you can sue them personally, collecting judgments from uninsured individuals is often impossible—they frequently lack assets worth pursuing.

How Uninsured Boater Coverage Protects You

Uninsured boater coverage (included in or added to your liability policy) protects you when:

- Uninsured boats cause damage or injuries

- Hit-and-run incidents occur

- Underinsured boaters cause damages exceeding their coverage

This coverage essentially provides liability protection you can claim against your own policy when others can’t pay for damages they cause. Limits typically match your liability limits, providing substantial protection.

Situations Where Liability Coverage Applies

Understanding when your liability coverage protects you prevents misunderstandings about protection scope.

While Operating Your Vessel

Standard situations where coverage applies:

- Navigating in open water

- Docking and mooring operations

- Towing water skiers or tubers

- Operating at speed or idle

- Any lawful vessel operation

Coverage follows you as the boat operator during normal use within your policy’s navigation territory.

1. Guest and Passenger Injuries

Liability coverage for passenger injuries varies by policy structure. Some policies cover passenger injuries under liability coverage; others exclude them or provide coverage only under medical payments provisions.

Clarify exactly how your policy handles passenger injuries this represents significant exposure given how frequently guests sustain injuries aboard boats.

2. Tender and Dinghy Operations

If your boat carries a tender or dinghy, verify coverage extends to these craft when operating independently. Some policies cover tenders automatically; others require specific endorsements.

3. Navigation Territory Limitations

Your liability coverage applies only within your policy’s navigation territory. Operating outside these boundaries even briefly can void all coverage. Review territory limits before any trip and obtain extensions when needed.

What Marine Liability Insurance Doesn’t Cover

Like all insurance, liability coverage includes important exclusions and limitations.

Intentional Acts and Illegal Activity

Coverage excludes injuries or damage you cause intentionally or while engaged in illegal activities:

- Operating under the influence

- Reckless or criminal behavior

- Intentional ramming or damage

- Illegal racing or stunts

These exclusions are universal no liability policy covers intentional wrongdoing.

Business and Commercial Use

Personal liability policies exclude commercial operations. If you charter your boat, give paid lessons, transport passengers for hire, or use your vessel for any business purpose, you need commercial liability coverage.

Operating commercially on personal coverage voids all protection, you have zero coverage for incidents occurring during commercial use. Our Charter Commercial Lines Insurance provides appropriate commercial liability protection.

War, Nuclear Events, and Terrorism

Standard exclusions include damage from war, terrorism, nuclear events, and similar catastrophic circumstances. These require specialized coverage rarely available to private boat owners.

Contractual Liability

Liability coverage protects you from tort liability (legal responsibility under law) but doesn’t cover contractual obligations. If you sign agreements assuming liability beyond legal requirements, those aren’t covered unless specifically endorsed.

How Much Liability Coverage Do You Really Need?

Determining appropriate liability limits requires honest assessment of your situation.

Asset Protection Formula

A simple formula: Liability Coverage ≥ Total Net Worth + 2-3 Years Future Earnings

If you have $1.5 million in assets and earn $150,000 annually, carry at least $2 million in liability coverage. This protects current assets plus provides buffer for future earning potential.

Risk Factor Considerations

Increase coverage based on these risk factors:

Higher Risk = Higher Coverage Needed:

- Frequent operation in congested waters

- High-speed vessels

- Extensive passenger carrying

- Less experienced operators

- Alcohol consumption aboard (even if operator abstains)

- Operation in areas with expensive vessels

Lower Risk Considerations:

- Experienced operators only

- Calm, uncongested waters

- Lower speeds

- Minimal passenger carrying

- Strict safety protocols

Umbrella and Excess Liability

For substantial assets, consider umbrella liability policies providing additional coverage beyond your marine policy limits. Umbrella policies typically offer $1-5 million in additional coverage at reasonable cost, protecting you across all your insurance policies (boat, home, auto).

Liability Coverage for Different Vessel Types

Coverage needs vary based on what you own and how you use it.

1. Small Recreational Boats

Basic fishing boats and runabouts (under 26 feet) typically need $500,000-$1 million liability coverage. These vessels operate in less congested areas at moderate speeds with fewer passengers, creating moderate risk profiles.

2. Cabin Cruisers and Mid-Size Vessels

Larger powerboats (26-40 feet) that carry more passengers and operate in varied conditions should carry $1-2 million liability coverage. These vessels present increased injury and damage potential warranting higher protection.

3. Luxury Yachts and High-Value Vessels

Yachts over 40 feet or valued above $500,000 require $2-5 million or more in liability coverage. These vessels:

- Operate in congested high-value areas

- Carry numerous passengers

- May employ professional crew

- Present substantial damage potential to expensive surrounding vessels

Our High-Value Yacht Liability provides appropriate coverage for luxury vessels with elevated exposure levels.

4. Sailboats

Sailboat liability considerations include:

- Collision potential from limited maneuverability

- Rigging hazards to nearby vessels

- Crew and passenger injuries from sail handling

- Racing activities (require special endorsements)

Carry liability limits commensurate with your vessel size and operating profile $1-2 million for typical cruising sailboats.

Filing Liability Claims

If incidents occur where you might be liable, proper response protects your interests.

Immediate Actions After Incidents

- Ensure safety first—address injuries and prevent further danger

- Document everything—photos, witness information, conditions

- Exchange information with other parties—insurance, contact details

- Report to authorities if required (Coast Guard for serious incidents)

- Notify your insurer immediately—most require 24-72 hour reporting

- Don’t admit fault—provide facts but avoid liability statements

Working with Your Insurer

After reporting claims, your insurer:

- Assigns adjusters to investigate

- Provides legal defense if claims or suits are filed

- Negotiates settlements on your behalf

- Pays covered claims up to policy limits

Cooperate fully with your insurer. They’re legally obligated to defend and protect your interests within policy terms.

Legal Representation

Your liability coverage includes legal defense. The insurer typically assigns attorneys to represent you. If you’re uncomfortable with assigned counsel or face potential excess liability, you can hire your own attorney at your expense.

Why Marine Liability Insurance Is Non-Negotiable

Every boat owner regardless of experience, vessel size, or operating area needs substantial marine liability coverage. The financial exposure from a single serious incident can exceed a lifetime of insurance premiums.

Don’t treat liability coverage as an optional expense or area to save money. It’s essential protection for your financial security and peace of mind on the water.

Our experienced team helps boat owners understand their actual liability exposure and secure appropriate coverage protecting their assets. Whether you need Liability Coverage for recreational vessels or High-Value Yacht Liability for luxury yachts, proper protection ensures you’re covered when it matters most.

We also provide comprehensive coverage including Hull Coverage, Hurricane Coverage, and related Personal Lines Insurance protecting all your valuable assets.

Frequently Asked Questions

Some homeowner policies include very limited watercraft liability—typically only for boats under 25 horsepower or sailboats under 26 feet. This coverage is minimal ($100,000-$300,000 maximum) and inadequate for serious claims. Any substantial boat requires dedicated marine liability insurance with appropriate limits.

Yes. As the vessel owner, you’re generally liable for accidents occurring when others operate your boat with your permission. Your liability coverage extends to authorized operators, but this is why operator restrictions in your policy matter. Never let unqualified people operate your vessel.

Marine accidents follow fault-based liability, not no-fault systems. If you’re partially or fully at fault, your liability coverage pays your share of damages. If you’re not at fault, the other party’s insurance should cover damages. However, uninsured boater coverage protects you if at-fault parties lack adequate insurance.