Hurricane season brings anxiety to every yacht owner along the U.S. coast. From the Carolinas to Texas, Florida to Louisiana, named storms threaten vessels worth hundreds of thousands or millions of dollars. A single hurricane can destroy decades of investment in hours.

Yet many yacht owners don’t fully understand their hurricane coverage or worse, discover critical gaps only after a storm strikes. Standard marine policies often provide minimal storm protection, leaving owners facing massive out-of-pocket losses when hurricanes hit.

If you own a high-value yacht in hurricane-prone regions, understanding your storm damage coverage isn’t optional, it’s essential financial protection.

Understanding Hurricane Season Risks for Yacht Owners

The Atlantic hurricane season runs June 1 through November 30, with peak activity from mid-August through October. Gulf Coast and Southeast Atlantic yacht owners face the highest risk, but storms can strike anywhere from Texas to Maine.

Recent years have proven devastating. Hurricane Ian caused over $112 billion in damage in 2022, destroying hundreds of boats in Florida marinas. Hurricane Ida in 2021 sank or damaged over 200 vessels in Louisiana. These storms don’t discriminate luxury yachts suffer alongside smaller boats when hurricanes make landfall.

The financial exposure is staggering. A $1.5 million yacht can become a total loss in hours. Even yachts that survive often sustain $100,000-$500,000 in damage from storm surge, wind, flooding, debris, and dock collapse. Without proper hurricane coverage, owners bear these costs personally.

What Standard Yacht Policies Actually Cover?

Most yacht insurance policies include some storm coverage, but the details matter enormously.

1. Basic Named Storm Coverage

Standard policies typically cover hurricane and named storm damage as “covered perils.” This means physical damage to your yacht from wind, rain, storm surge, and related causes is covered subject to your deductible and policy limits.

However, coverage comes with significant restrictions and requirements that many owners don’t discover until filing claims.

2. Hurricane Deductibles: The Hidden Cost

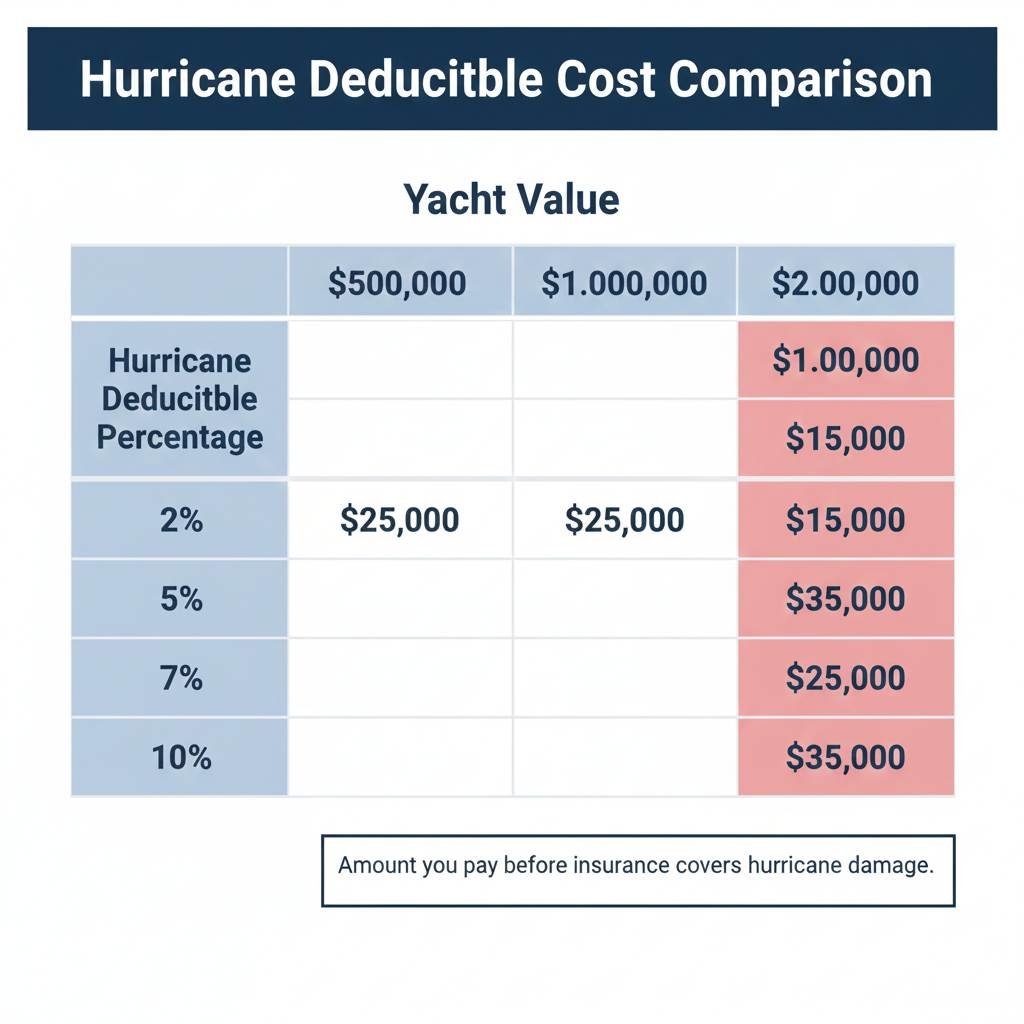

Unlike your standard deductible (typically $5,000-$25,000), hurricane damage triggers special hurricane deductibles. These aren’t flat amounts—they’re percentages of your yacht’s insured value:

- 2% hurricane deductible on a $1 million yacht = $20,000 out-of-pocket

- 5% hurricane deductible on a $2 million yacht = $100,000 out-of-pocket

Coastal regions with highest hurricane risk often require 5-10% hurricane deductibles. A major storm hitting your $1.5 million yacht with a 5% deductible means you pay the first $75,000 in damages before insurance covers anything.

These percentage-based deductibles catch owners off guard. Reading your policy’s hurricane deductible clause before storm season prevents unpleasant surprises.

3. Named Storm Deductible Triggers

Hurricane deductibles activate when the National Hurricane Center designates a tropical storm or hurricane. Once a system receives a name, special deductibles apply to any damage within specific timeframes typically 72 hours before through 72 hours after the storm passes your location.

This means damage from Tropical Storm Alex (not yet hurricane strength) still triggers hurricane deductibles, not your standard deductible.

Hurricane Haul-Out Requirements: A Critical Policy Provision

The most important and most commonly misunderstood aspect of yacht hurricane insurance is the haul-out requirement.

What Haul-Out Requirements Mean?

Most policies include “hurricane haul-out warranties” or “named storm warranties” requiring you to remove your yacht from water and secure it on land when hurricanes threaten your area. Specific requirements vary by policy but typically mandate:

- Hauling out within a specified timeframe (usually 48-72 hours) when a hurricane warning is issued for your area

- Securing the vessel properly on land with adequate tie-downs

- Moving the yacht to an approved storage facility or haul-out location

- Providing proof of haul-out if a claim is filed

Failure to comply voids your hurricane coverage entirely. If you don’t haul out when required and your yacht is damaged, your insurer denies the claim you receive nothing despite paying premiums.

When Haul-Out Is Required?

Policies trigger haul-out requirements when:

- A hurricane warning (not just a watch) is issued for your zip code or county

- The storm’s projected path includes your location within a certain radius (typically 100-150 miles)

- Official warnings are issued within the timeframe specified in your policy

You must monitor National Hurricane Center forecasts and act decisively when warnings are issued. Waiting until the last minute often makes haul-out impossible all local boatyards become overwhelmed and travel becomes dangerous.

Exceptions and Alternatives

Some circumstances exempt you from haul-out requirements:

- Approved Hurricane Holes: Certain protected anchorages designated by insurers as “hurricane holes” may allow you to ride out storms in the water with proper preparation and securing.

- Marina Certification: A few policies waive haul-out if your marina is certified hurricane-resistant with specific structural standards, though this is increasingly rare.

- Impossible Circumstances: If hauling out becomes physically impossible due to storm timing, facility availability, or safety concerns, document everything. Insurers may cover claims if you made genuine good-faith efforts.

- Negotiated Exemptions: Some high-value yacht policies negotiate individual haul-out alternatives based on specific circumstances, though these cost more.

Our High-Value Yacht Hurricane Coverage specialists help yacht owners understand and comply with haul-out requirements while exploring alternatives when appropriate.

Enhanced Hurricane Coverage Options

Standard policies provide basic storm coverage, but high-value yacht owners should consider enhanced protection.

1. Hurricane Haul-Out Reimbursement

Quality policies reimburse haul-out costs when you remove your yacht for storm protection. This typically covers:

- Boatyard fees for hauling and blocking

- Storage fees during the storm period

- Re-launching costs after the threat passes

- Transportation to approved facilities if needed

Reimbursement limits vary from $2,500-$10,000 per storm event. While this doesn’t cover all haul-out costs for large yachts, it offsets a significant portion and incentivizes proper storm preparation.

2. Reduced Hurricane Deductibles

Some insurers offer reduced hurricane deductibles (1-2% instead of 5%) for additional premium. If you’re in high-risk areas, paying an extra $1,000-$3,000 annually to reduce your deductible from 5% to 2% makes financial sense the savings on a single claim far exceed years of additional premiums.

3. Storm Preparation Coverage

Advanced policies cover costs of proper storm preparation:

- Installation of storm shutters or protection

- Additional dock lines and fenders

- Emergency equipment and supplies

- Labor costs for preparation activities

This encourages proactive protection and helps offset the expense of proper storm readiness.

4. Total Loss Replacement

The best high-value yacht policies include total loss replacement guarantees. If your yacht is destroyed by a hurricane and you purchased it within 2-3 years, insurers replace it with a comparable new vessel rather than paying depreciated value.

For newer high-value yachts, this provision provides superior protection over standard agreed value coverage.

Geographic Considerations for Hurricane Coverage

Where you keep your yacht dramatically affects hurricane insurance availability and cost.

1. High-Risk Hurricane Zones

The highest-risk areas face the strictest requirements and highest premiums:

- South Florida (Miami to Palm Beach): Direct hurricane strikes are common. Expect 5-10% hurricane deductibles, mandatory haul-out requirements, and premiums 30-50% higher than non-coastal areas.

- Florida Keys: Extreme exposure with limited haul-out facilities. Some insurers won’t provide Florida hurricane coverage at all; others require documented haul-out plans to mainland facilities.

- Gulf Coast (Louisiana, Mississippi, Alabama, Texas): Frequent hurricane activity with catastrophic potential. Hurricane deductibles of 5-7% are standard.

- North Carolina Outer Banks: Vulnerable barrier islands face significant hurricane risk. Coverage often requires mainland haul-out when storms threaten.

2. Moderate-Risk Areas

These regions see less frequent but still serious hurricane threats:

- Georgia and South Carolina Coast: Hurricane strikes every few years. Expect 2-5% hurricane deductibles with haul-out requirements.

- Northeast Coast (Virginia to New England): Less frequent but capable of devastating hurricanes. Coverage terms are more favorable but still include named storm provisions.

3. Seasonal Migration and Coverage

Many yacht owners migrate seasonally to avoid hurricane exposure:

- Summer in Northeast or Great Lakes

- Winter in Florida or Caribbean

- Moving before hurricane season peaks

Some policies offer premium credits or deductible reductions for seasonal migration away from hurricane zones during peak season. Discuss this with your insurer proving you won’t be in high-risk areas during September-October can significantly reduce costs.

Storm Preparation: Beyond Insurance Requirements

Proper hurricane preparation protects your yacht beyond insurance compliance.

Pre-Season Preparation

Before hurricane season begins:

Identify Haul-Out Facilities: Research and establish relationships with multiple boatyards. During storm threats, facilities book up instantly—having pre-arrangements helps.

Create a Hurricane Plan: Document exactly what you’ll do when storms threaten: which facility you’ll use, who will help, required equipment, transportation logistics.

Inspect and Strengthen: Check dock lines, cleats, fenders, and all securing points. Replace any questionable equipment before season starts.

Inventory Documentation: Photograph and video your yacht’s condition and all equipment. This documentation proves values and pre-storm condition for claims.

Emergency Kit: Stock emergency supplies, tools, extra dock lines, fenders, bilge pump backups, and anything needed for rapid preparation.

When Storms Threaten

As hurricanes approach:

Monitor Forecasts: Check National Hurricane Center updates multiple times daily once storms enter the Gulf or Caribbean.

Act Early: Don’t wait for warnings. When a storm shows potential to threaten your area in 3-5 days, begin preparation. Haul-out facilities become overwhelmed quickly.

Document Everything: Photograph your preparation steps, save receipts, document haul-out timing. This evidence supports claims if disputes arise.

Communicate with Insurers: Some policies require you to notify insurers of your storm preparation actions. Follow these requirements exactly.

Secure Properly: Whether hauling out or staying in water, ensure proper securing with adequate lines, positioning, and protection.

Filing Hurricane Damage Claims

If the worst happens and your yacht sustains hurricane damage, understanding the claims process is critical.

Immediate Post-Storm Actions

After the storm passes safely:

- Document damage thoroughly with photos and videos from every angle

- Contact your insurer immediately—most require claims within 24-72 hours

- Prevent further damage with emergency repairs (usually covered)

- Don’t make major repairs before adjuster inspection

- Keep all receipts for any emergency expenses

- Obtain written estimates from qualified marine repair facilities

Common Claim Complications

Hurricane claims often face challenges:

Haul-Out Documentation: Insurers scrutinize whether you complied with haul-out requirements. Lack of proof can result in complete claim denial.

Deductible Disputes: Ensure you understand which deductible applies—standard or hurricane percentage.

Partial vs. Total Loss: If repair costs approach 75-80% of yacht value, negotiate for total loss settlement rather than expensive repairs that diminish value.

Additional Living Expenses: Some policies cover temporary accommodations if you live aboard and the yacht is uninhabitable.

Dispute Resolution: If claim disputes arise, marine surveyors provide independent assessments that help resolve disagreements.

Quality insurers handle hurricane claims efficiently, understanding the urgency of returning vessels to service. Our Private Client Luxury Yacht program includes responsive claims handling specifically for storm damage situations.

The True Cost of Hurricane Coverage

Hurricane protection costs more in high-risk areas, but the expense pales compared to uninsured losses.

Premium Factors

Hurricane coverage costs depend on:

- Location: Florida and Gulf Coast premiums run 30-60% higher than northern areas

- Yacht value: Higher values mean higher premiums, but percentage rates often improve

- Deductible choices: Accepting higher hurricane deductibles reduces premiums 10-20%

- Safety measures: Hurricane-resistant marinas, haul-out plans, and preparation earn discounts

- Claims history: Storm-related claims increase future premiums significantly

Expect yacht hurricane insurance to add $2,000-$10,000+ annually depending on these factors. A $1 million yacht in South Florida might pay $15,000-$25,000 total annually with hurricane coverage included.

Comparing Coverage Options

When evaluating hurricane coverage:

- Don’t just compare premiums examine hurricane deductibles, haul-out requirements, and coverage limits

- Verify whether haul-out reimbursement is included

- Check if total loss replacement is available

- Understand exactly when haul-out is required

- Confirm coverage applies throughout hurricane season without seasonal exclusions

Cheaper policies often have 7-10% hurricane deductibles and strict haul-out requirements with no reimbursement. Better policies offer 2-3% deductibles, haul-out assistance, and more flexible requirements worth the premium difference.

Alternatives for Uninsurable Situations

Some yacht owners in extreme high-risk areas find traditional hurricane coverage unavailable or prohibitively expensive.

Surplus Lines Insurance

When standard insurers won’t provide coverage, surplus lines (non-admitted) insurers may offer policies. These cost 40-80% more than standard coverage and often include extensive exclusions, but they provide some protection when alternatives don’t exist.

Self-Insurance Strategies

Ultra-high-net-worth yacht owners sometimes self-insure hurricane risks:

- Maintain liquid reserves covering potential total loss

- Carry only liability coverage (required by marinas/lenders)

- Invest in superior physical protection and storm preparation

This strategy only works if you can genuinely afford total loss without financial hardship.

Marina and Facility Selection

Choosing hurricane-resistant marinas and storage facilities significantly reduces risk. Look for:

- Facilities in protected locations away from open water

- Modern infrastructure built to current hurricane codes

- Comprehensive storm preparation services

- Documented track records surviving previous hurricanes

Better facilities may cost more but reduce damage probability and may qualify for insurance discounts.

Working with Hurricane Coverage Specialists

Hurricane insurance for high-value yachts requires expertise that general agents often lack.

Choose insurance professionals who:

- Specialize in coastal and hurricane-prone area yacht coverage

- Understand local storm history and facility options

- Provide clear explanations of haul-out requirements and exceptions

- Offer multiple carrier options for comparison

- Assist with storm preparation planning

- Provide responsive support when storms threaten

Our marine insurance specialists understand hurricane risks along the entire U.S. coast and help yacht owners secure comprehensive protection. We also provide related coverage including Home Insurance with hurricane protection for coastal properties and Commercial Insurance for marine-related businesses.

Protecting Your Investment Before the Storm

Hurricane coverage for high-value yachts isn’t just another insurance policy it’s essential financial protection for assets worth hundreds of thousands or millions of dollars in regions where catastrophic storms strike regularly.

Understanding your coverage details, complying with haul-out requirements, preparing properly before storms threaten, and working with knowledgeable insurance specialists ensures your yacht receives the protection it deserves.

Don’t wait until a hurricane enters the Gulf to review your coverage. Examine your policy now, understand your requirements, create your hurricane plan, and ensure you have adequate protection before the next storm threatens.

Your yacht represents significant investment and countless memories. Proper hurricane coverage protects both, allowing you to weather storm seasons with confidence rather than anxiety.

FAQs

Your policy remains valid for non-hurricane claims, but you’ve violated policy terms which could affect future renewals. More importantly, insurers note haul-out non-compliance in your file. If future hurricanes damage your yacht and you didn’t haul out again, they’ll deny those claims citing pattern of non-compliance. Always follow haul-out requirements when triggered even if the storm ultimately misses your area.

Hurricane deductibles apply per storm event. If two hurricanes hit your area in one season and damage your yacht both times, you pay the hurricane deductible for each claim separately. This is why comprehensive storm preparation and protective measures are so critical in high-risk areas that may experience multiple storms annually.

Yes, and you should notify your insurer of the change. Moving to a better-protected facility or one with haul-out capabilities may actually reduce your premiums or hurricane deductible. However, get written confirmation from your insurer that the new location is acceptable and understand any new requirements before making the move.

This depends on your specific policy. Most high-value yacht policies cover reasonable hurricane preparation expenses including professional captain services for storm avoidance, but verify this explicitly with your insurer. Coverage during transit to safe harbor is typically maintained. Document the necessity (why you couldn’t operate the vessel yourself), keep receipts, and notify your insurer of the plan beforehand when possible.

If you properly hauled out and secured your yacht according to policy requirements but marina infrastructure failure (dock collapse, falling debris from marina buildings, etc.) causes damage, your policy typically covers this. Your insurer may then pursue subrogation against the marina if their negligence caused the infrastructure failure. This is why documentation of your proper haul-out and securing is so important, it proves you met requirements while external factors caused damage.