You’re driving responsibly, obeying traffic laws, when another driver runs a red light and slams into your vehicle. You suffer serious injuries requiring surgery, months of rehabilitation, and extended time off work. Medical bills exceed $150,000, and you’ve lost $40,000 in wages.

Then you discover the devastating truth: the at-fault driver has no insurance whatsoever or carries only the state minimum $25,000 coverage. Your injuries and losses total $190,000, but you can’t recover what doesn’t exist. Without uninsured and underinsured motorist coverage, you’re left paying these catastrophic costs yourself despite being completely innocent.

This nightmare scenario happens thousands of times daily across America. Understanding uninsured and underinsured motorist coverage and why you absolutely need both could save you from financial devastation.

What Is Uninsured Motorist Coverage?

Uninsured motorist (UM) coverage protects you when at-fault drivers have no insurance at all.

What Uninsured Motorist Coverage Pays For

Uninsured Motorist Bodily Injury (UMBI): Covers your medical expenses, lost wages, pain and suffering, and other injury-related costs when uninsured drivers cause accidents.

Uninsured Motorist Property Damage (UMPD): Pays for vehicle and property damage caused by uninsured drivers (available in some states, not all).

UM coverage essentially steps in to provide the compensation you should receive from the at-fault driver’s liability insurance if they had any.

Common Uninsured Motorist Scenarios

UM coverage applies when:

- Hit by completely uninsured drivers who never purchased insurance

- Hit-and-run accidents where the at-fault driver flees and isn’t identified

- Drivers with lapsed policies whose coverage canceled before accidents

- Stolen vehicle accidents where thieves cause crashes

- Phantom vehicle accidents forcing you off roads without direct contact

Without UM coverage, you’re left pursuing uninsured drivers personally often impossible when they lack assets to collect against.

What Is Underinsured Motorist Coverage?

Underinsured motorist (UIM) coverage protects you when at-fault drivers carry insurance, but not enough to cover your damages fully.

The Underinsured Driver Problem

Many drivers carry only state minimum liability coverage:

- California: 15/30/5 ($15,000 per person)

- Florida: 10/20/10 ($10,000 per person)

- Texas: 30/60/25 ($30,000 per person)

These minimums are grossly inadequate for serious injuries. If you suffer $200,000 in damages but the at-fault driver carries only $30,000 coverage, you face a $170,000 gap unless you have UIM coverage.

How Underinsured Motorist Coverage Works

UIM coverage pays the difference between the at-fault driver’s inadequate limits and your actual damages, up to your UIM policy limits.

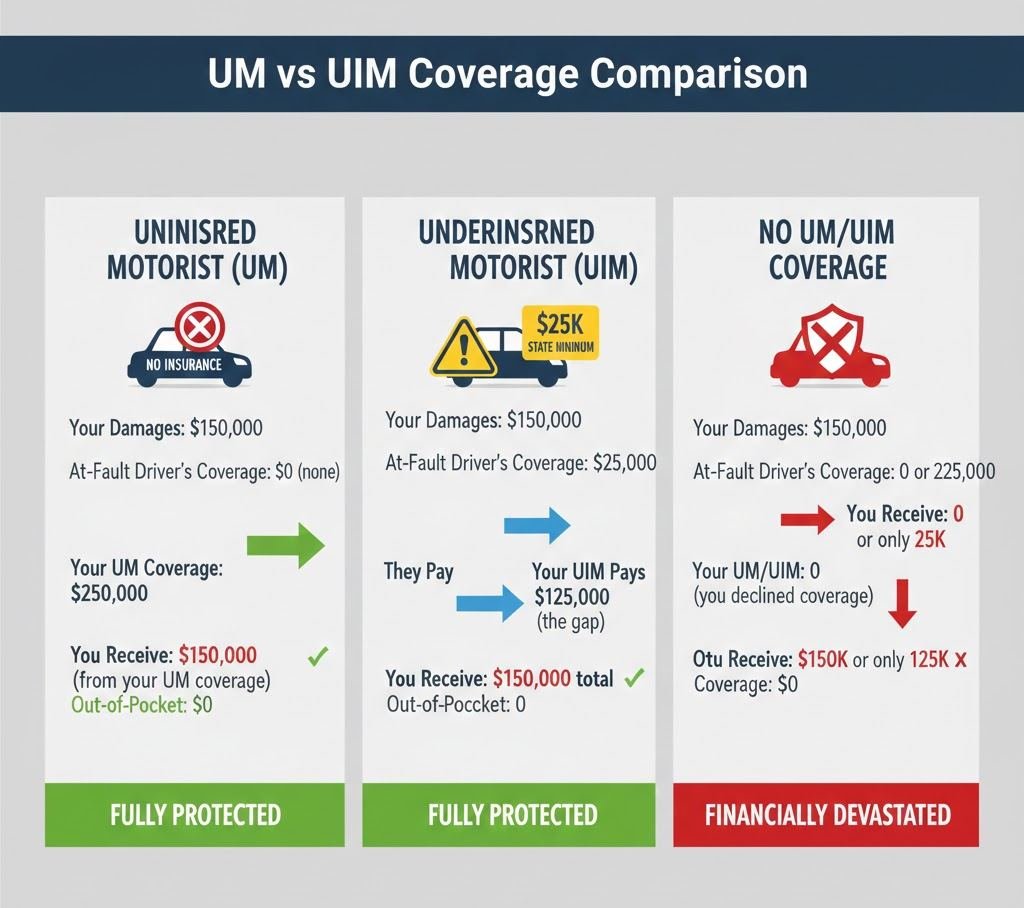

Example:

- Your injuries total $200,000

- At-fault driver’s liability coverage: $30,000

- Your UIM coverage: $250,000

- At-fault driver’s insurance pays: $30,000

- Your UIM coverage pays: $170,000 (the gap)

- Total you receive: $200,000

Without UIM coverage, you’d receive only the at-fault driver’s $30,000, leaving you personally responsible for $170,000 in medical bills and lost wages despite being completely innocent.

Key Differences: Uninsured vs Underinsured Coverage

While similar, these coverages address different problems.

| Feature | Uninsured Motorist (UM) | Underinsured Motorist (UIM) |

|---|---|---|

| Covers | At-fault drivers with ZERO insurance | At-fault drivers with SOME insurance, but not enough |

| When It Applies | No insurance exists to pay claims | Insurance exists but inadequate for damages |

| Common Scenarios | Hit-and-runs, unlicensed drivers, lapsed policies | Drivers with state minimums causing serious injuries |

| How Much Pays | Up to your UM limits for total damages | Covers gap between their limits and your damages |

| Requires Proof | Must prove other driver uninsured | Must prove their coverage insufficient |

| Availability | Required in many states | Optional in most states |

Many insurance companies bundle UM and UIM together as “UM/UIM coverage” with a single limit applying to both scenarios.

Why You Desperately Need Both Coverages

The statistics are alarming and demonstrate why these coverages are essential.

Uninsured Driver Statistics

According to the Insurance Research Council:

- 12.6% of drivers nationally are uninsured (1 in 8 drivers)

- Some states exceed 25% uninsured rates (Mississippi, Michigan, Tennessee)

- Florida has 20%+ uninsured drivers

- California has 16%+ uninsured drivers

Every time you drive, you face substantial probability of encountering uninsured drivers. Without UM coverage, you’re completely vulnerable.

The Underinsured Driver Reality

Even insured drivers often carry inadequate coverage:

- Approximately 30-40% of insured drivers carry only state minimum liability

- State minimums haven’t kept pace with medical costs or vehicle values

- Serious injuries easily exceed minimums by hundreds of thousands

Combined, roughly 40-50% of drivers either have no insurance or inadequate coverage. Without UM/UIM protection, you’re gambling with your financial security on every trip.

Real Financial Impact

Consider these realistic injury scenarios:

Moderate Injury: Broken bones requiring surgery, 3 months recovery

- Medical costs: $75,000

- Lost wages: $18,000

- Pain and suffering: $25,000

- Total damages: $118,000

Serious Injury: Traumatic brain injury, permanent disability

- Medical costs: $450,000

- Lost wages and reduced earning capacity: $800,000

- Pain and suffering: $500,000

- Total damages: $1,750,000

Without UM/UIM coverage, you bear these costs yourself if at-fault drivers lack adequate insurance. These aren’t worst-case scenarios they’re common claim amounts.

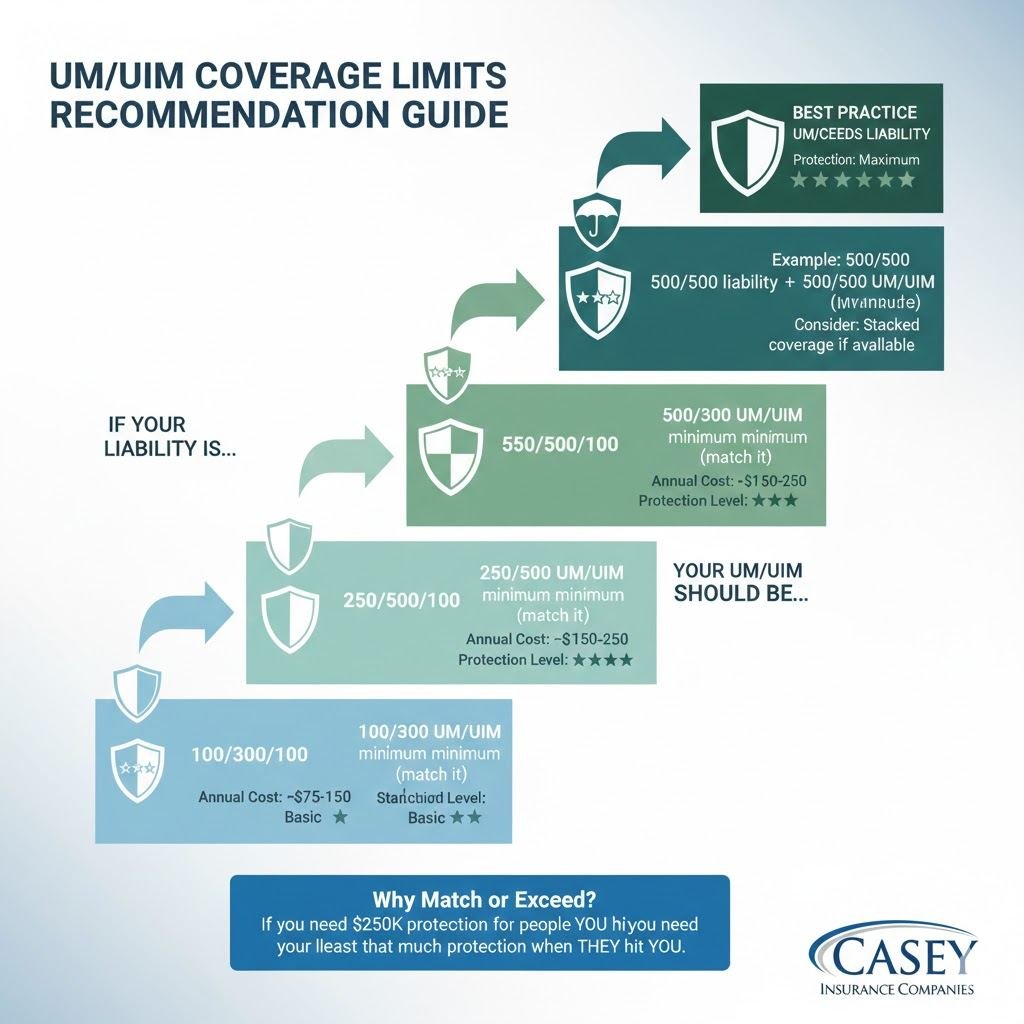

How Much UM/UIM Coverage You Need

Recommended coverage should match or exceed your liability limits.

The Matching Principle

If you carry 250/500 liability coverage, carry 250/500 UM/UIM coverage.

Why? If you’ve determined you need $250,000 per person protection for damages you might cause others, you need at least that much protection for damages others cause you.

Many experts recommend UM/UIM limits exceeding liability limits since you can’t control other drivers’ coverage decisions but can protect yourself.

Recommended Minimum Levels

Basic Protection: 100/300 UM/UIM

- Adequate for moderate accidents

- Better than nothing, but limited for serious injuries

Standard Protection: 250/500 UM/UIM

- Good protection for most scenarios

- Recommended minimum for families and homeowners

Enhanced Protection: 500/500 or higher UM/UIM

- Comprehensive protection for serious accidents

- Appropriate when carrying high liability limits

- Essential for high-income households

Special Considerations

Increase UM/UIM coverage if you:

- Live in states with high uninsured driver rates

- Have high medical costs or ongoing health conditions

- Depend on your income to support family

- Drive in congested urban areas with higher accident rates

- Have substantial assets to protect

Some insurers allow UM/UIM limits exceeding your liability limits consider this for maximum protection.

Stacked vs Non-Stacked UM/UIM Coverage

Some states offer “stacking” options that significantly increase coverage.

Non-Stacked Coverage (Standard)

UM/UIM limits apply per accident regardless of how many vehicles you insure.

Example: You insure two vehicles with 100/300 UM/UIM on each. In an accident, you receive maximum $100,000 per person / $300,000 total the limits from one policy.

Stacked Coverage

UM/UIM limits multiply by the number of vehicles you insure.

Example: You insure two vehicles with 100/300 UM/UIM on each. With stacking, limits become 200/600 (doubled).

Three vehicles with stacking would provide 300/900 limits.

Stacking Costs and Availability

- Cost: Stacking typically increases premiums 15-30%

- Availability: Not offered in all states

- Worth It: Usually yes if you insure multiple vehicles and want maximum protection

Stacking essentially provides umbrella-like protection specifically for UM/UIM claims at reasonable cost.

What UM/UIM Coverage Doesn’t Include

Understanding exclusions prevents false assumptions.

Common Exclusions

Your Own Vehicle Damage: UM/UIM covers injuries, not your car repairs in most states. You need collision coverage for that (though some states include UMPD).

Intentional Acts: If someone deliberately hits you, UM/UIM may not apply this becomes a criminal matter.

Accidents You Cause: UM/UIM only applies when others are at fault.

Business Use: Personal UM/UIM excludes commercial vehicle use.

Injuries Already Covered: If your health insurance or workers’ compensation already paid medical bills, UM/UIM won’t duplicate payments (though it may cover amounts those don’t cover).

The Cost of UM/UIM Coverage

These essential protections cost far less than most people expect.

Typical Premium Costs

UM/UIM coverage costs approximately:

- $50-$150 annually for 100/300 limits

- $100-$250 annually for 250/500 limits

- $150-$350 annually for 500/500 limits

Costs vary by state, your driving record, vehicle type, and insurer.

Why It’s So Affordable

UM/UIM coverage is inexpensive because:

- Claim frequency is relatively low compared to collision claims

- You’re not at fault (limits fraudulent claims)

- Coverage limits cap maximum payouts

- Most accidents don’t result in UM/UIM claims

For roughly $10-25 monthly, you protect yourself from potentially catastrophic financial losses. This is insurance’s best value proposition.

UM/UIM Requirements by State

State laws regarding UM/UIM coverage vary significantly.

Required in These States

Several states mandate UM coverage:

- Illinois, Kansas, Maine, Maryland, Massachusetts, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Oregon, South Carolina, South Dakota, Vermont, Virginia, West Virginia, Wisconsin, Washington DC

Offered but Optional

Most states offer UM/UIM but don’t require it:

- California, Colorado, Florida, Texas, and most others

Rejection Requirements

In states where UM/UIM is optional, insurers typically require written rejection if you decline coverage—they want documented proof you were offered protection and refused it.

Never sign rejection forms. The small premium savings isn’t worth the massive exposure.

When UM/UIM Claims Become Complex

Filing UM/UIM claims can involve complications requiring careful navigation.

Proving the Other Driver Was At Fault

For UM/UIM to pay, you must prove:

- The other driver caused the accident

- Their insurance is nonexistent or insufficient

- Your damages exceed their coverage

In hit-and-run cases, proving fault without the other driver present requires thorough documentation, witness statements, and sometimes accident reconstruction.

Dealing with Your Own Insurance Company

UM/UIM claims mean your own insurer pays your claim creating potential conflicts:

- They may dispute fault determinations

- They might challenge injury severity or medical necessity

- Claim values may be disputed

Having comprehensive auto insurance doesn’t guarantee smooth UM/UIM claims. Document everything thoroughly.

When to Consider Legal Representation

Consult attorneys specializing in UM/UIM claims if:

- Injuries are serious or permanent

- Your insurer denies or undervalues claims

- Disputes arise about fault or coverage

- Claim values exceed $50,000

- Multiple insurance companies are involved

Protecting Your Family Completely

UM/UIM coverage protects you, but ensure family members are also covered.

Who’s Protected Under Your UM/UIM

Coverage typically extends to:

- You and resident family members when driving your insured vehicles

- You and family members when driving other vehicles

- Passengers in your vehicle injured by uninsured/underinsured drivers

Coordinating with Other Policies

If multiple household members have auto insurance with UM/UIM coverage, claims may access multiple policies, potentially increasing total protection.

Ensure all household vehicles carry adequate UM/UIM don’t assume one family member’s coverage protects everyone in all scenarios.

The Bottom Line: Essential Protection You Can’t Skip

Uninsured and underinsured motorist coverage isn’t optional it’s essential protection against the reality that millions of drivers either have no insurance or carry dangerously inadequate coverage.

With 40-50% of drivers either uninsured or underinsured, you face substantial probability of serious accidents where the at-fault driver can’t compensate you adequately. Without UM/UIM coverage, you’re left with catastrophic medical bills, lost wages, and permanent financial damage despite being completely innocent.

For $10-25 monthly, UM/UIM coverage protects you from this devastating scenario. Never decline this coverage to save insignificant money.

Our auto insurance specialists ensure clients carry adequate Uninsured/Underinsured Motorist Coverage alongside appropriate Liability Coverage. We provide comprehensive Auto Insurance guidance and help bundle with Home Insurance for maximum savings.

Frequently Asked Questions

Typically no—UM/UIM claims usually don’t increase your rates since you weren’t at fault. However, policies vary by insurer and state. Some companies offer accident forgiveness even for UM claims. Check with your specific insurer, but most won’t penalize you for being a victim of uninsured drivers.

No, you can’t recover the same damages twice. If the at-fault driver has some insurance, their policy pays first up to its limits. Your UIM coverage then pays the difference between their limits and your damages, up to your UIM limits. Total recovery can’t exceed actual damages.

Yes—most UM/UIM policies cover you as a pedestrian or bicyclist struck by uninsured/underinsured vehicles. This is valuable protection extending beyond just vehicle accidents. If you frequently walk or bike in traffic, verify your policy includes this coverage.