When you’re responsible for a vessel whether it’s a family sailboat or a commercial charter operation understanding your liability exposure is crucial. Two terms often surface in this context: marine liability insurance and Protection & Indemnity (P&I) Insurance. While they both protect you from third-party claims, they are not interchangeable. Confusing them can lead to significant coverage gaps. This guide will demystify these two essential types of coverage, explaining their origins, key differences, and which one is the right fit for your maritime activities. By the end, you’ll know exactly how to structure your protection to safeguard your assets and your peace of mind.

Key Differences B/W P&I and Marine Liability Insurance

While both cover liability, their structure and scope are distinct. The table below summarizes the core differences before we dive into the details.

| Feature | Marine Liability Insurance | Protection & Indemnity (P&I) Insurance |

|---|---|---|

| Policy Basis | A fixed policy with specific, pre-defined limits and exclusions. | Often written on a “mutual” or “club” basis, with unlimited coverage (subject to club rules). |

| Primary Focus | Covers fundamental third-party risks like bodily injury and property damage. | Provides exceptionally broad coverage, including unique maritime risks and crew liabilities. |

| Coverage Scope | Defined and limited by the policy wording. | Designed to be expansive, covering liabilities not typically found in standard policies. |

| Common For | Recreational boats, small commercial vessels, yacht owners. | Large commercial shipowners, charter companies, operators with complex risks. |

| Claim Handling | Claims are paid up to the policy limit. | The P&I Club provides support, guidance, and financial backing for claims. |

Deep Dive: Marine Liability Insurance

Marine liability insurance is the foundational third-party coverage familiar to most boat and yacht owners. It’s typically purchased as a discrete policy or as part of a larger hull coverage package.

What It Covers

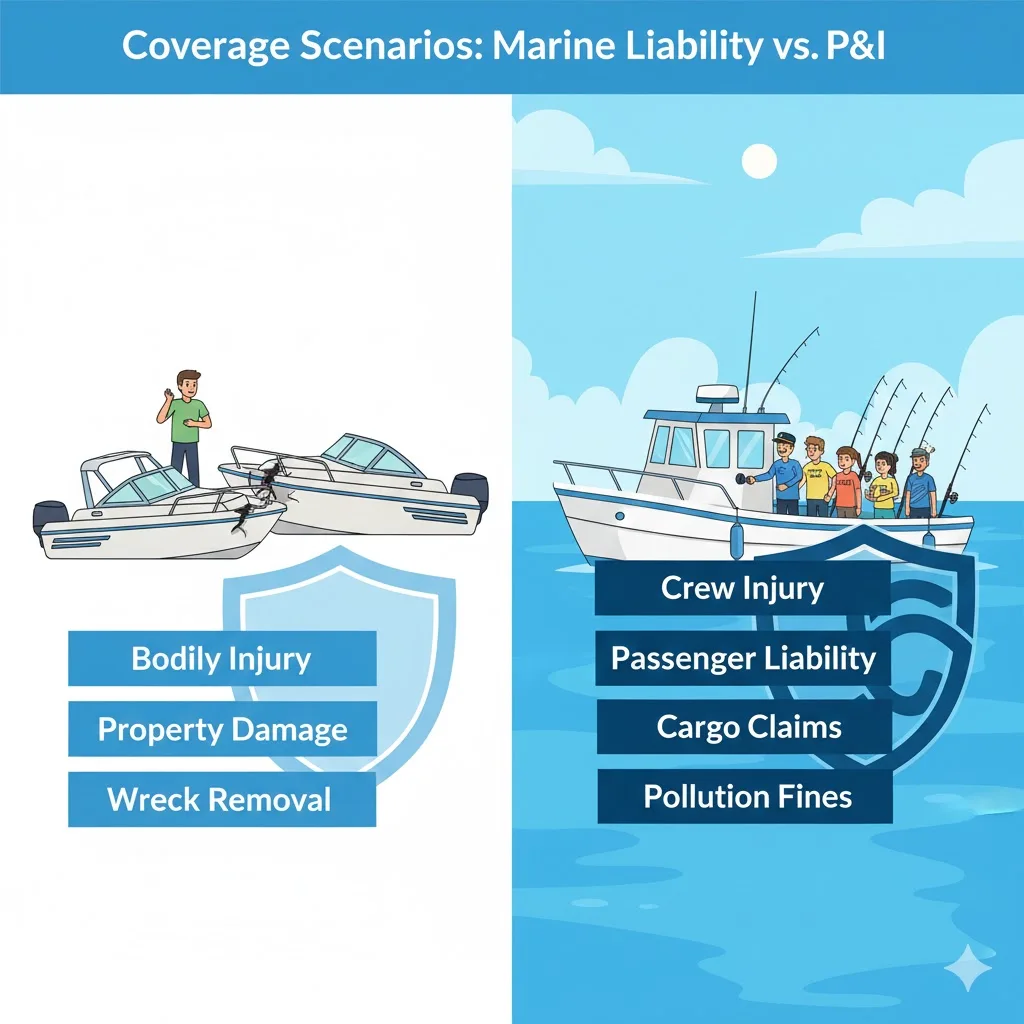

This insurance is designed to cover your legal liability for:

- Bodily Injury: Medical expenses, lost wages, and pain and suffering if someone is hurt on your boat or due to its operation.

- Property Damage: Repair or replacement costs if you damage someone else’s property, such as another boat, a dock, or a marina structure.

- Wreck Removal: A critical coverage that pays for the cost of removing your sunken or stranded vessel if authorities demand it to protect navigable waterways.

- Pollution Liability: Covers the cleanup costs and resulting damages from a sudden and accidental fuel or oil spill, typically up to a sub-limit.

For most private boat owners and many small commercial operators, a robust marine liability policy is the cornerstone of their risk management. It directly addresses the most common and catastrophic risks they face on the water.

Deep Dive: Protection & Indemnity (P&I) Insurance

P&I insurance has its roots in the 19th-century mutual insurance clubs formed by shipowners. The “Protection” part originally covered third-party liabilities (similar to standard liability), while the “Indemnity” part covered losses to the shipowner themselves, like crew injury. Today, it represents the broadest form of maritime liability coverage available.

The “Mutual” or “Club” Model

Unlike a traditional insurance company, a P&I Club is a mutual association of shipowners. Members pay “calls” (premiums) into a collective fund, which is used to pay claims. This structure allows for unlimited coverage (in principle) and a shared interest in safety and loss prevention. The club also provides expert claims handling and legal support on a global scale.

What It Covers

A P&I policy includes standard liability coverages but goes much further, addressing the unique complexities of commercial maritime operations:

- Crew Liabilities: Covers injury, illness, death, repatriation, and even wages of seafarers a primary concern that standard marine liability often excludes or limits.

- Passenger Liabilities: Essential for charter operations, covering injury or death of paying passengers.

- Cargo Damage: Liability for damage to or loss of cargo carried on the insured vessel.

- Collision Liability: The “Running Down Clause” covers your share of liability when in collision with another vessel (complementing your hull insurance).

- Fines & Penalties: Can cover fines incurred for unintentional violations of regulations (e.g., accidental pollution, customs documentation errors).

- Stowaway and Refugee Costs: A very specific but costly risk for commercial vessels trading internationally.

- Quarantine Expenses: Arising from illness on board.

Which One Do You Need? Making the Right Choice

Your need is determined by the nature, size, and use of your vessel.

- For Recreational & Private Yacht Owners: A comprehensive marine liability insurance policy is almost always sufficient and appropriate. It is cost-effective and covers the spectrum of risks you are likely to encounter. For owners of high-value yachts, ensuring your liability limits are high enough is crucial, and your policy can often be tailored with endorsements.

- For Commercial Marine Businesses: The line blurs here. Smaller commercial operators (like a day-charter fishing boat) might be adequately covered by a commercial marine liability policy. However, as operations grow in complexity—carrying more passengers, employing crew, operating larger vessels, or trading internationally—the need for P&I coverage increases.

- The Blended Solution: Many charter companies and yacht owners who charter their vessels carry a primary marine liability policy with high limits and then purchase a smaller, excess-layer P&I policy to fill gaps and gain access to the club’s expert legal and claims network. This is a savvy way to secure broad P&I coverage without the full cost of a full club entry.

Conclusion: Two Sides of the Same Shield

Think of marine liability insurance as your essential, standardized armor it protects the vital areas. P&I insurance is the enhanced, custom-fitted suit that covers every joint and vulnerability for those engaged in the complex theater of commercial maritime activity. The worst mistake is assuming you have one when you need the other.

Don’t navigate these complex waters alone. Consult with a specialist marine insurance broker who can analyze your specific operations. They can structure a layered approach, ensuring you have no gaps in your liability coverage while optimizing your premium.

Are you confident your liability protection matches your real-world risk? Contact the maritime insurance experts at Casey Insurance Companies today. We’ll analyze your current coverage, explain the nuances of P&I versus standard liability, and design a solution that shields your business and your assets from the unexpected.

Frequently Asked Questions

Yes, this is a classic scenario covered under the bodily injury liability section of your standard marine liability insurance. Your policy would cover their medical expenses and potentially related legal costs, up to your policy’s limit. This is a key reason why skippers should ensure all passengers understand basic safety rules.

It can be. Coverage for paid captains and crew is a defining feature of P&I insurance. However, some enhanced commercial marine liability policies may offer limited crew medical coverage as an endorsement. A true P&I approach provides more comprehensive protection for wages, injury, illness, and repatriation, which is crucial for responsible commercial operators. You can learn more about your specific obligations in our guide to captained charter insurance.

No, that’s a common misconception. While the largest P&I Clubs cater to ocean-going fleets, there are P&I providers and club facilities designed for smaller commercial vessels, including charter yachts, passenger ferries, tugboats, and offshore service vessels. The key is the commercial nature and complexity of the risk, not solely the vessel’s size.

The first step is a detailed risk assessment with a broker who has access to both standard commercial insurance markets and P&I Clubs. Be prepared to discuss your operations in detail: vessel particulars, crew size and employment terms, passenger activities, navigation areas, and charter contracts. This information is essential for a broker to market your risk appropriately and secure the right coverage at a competitive price.