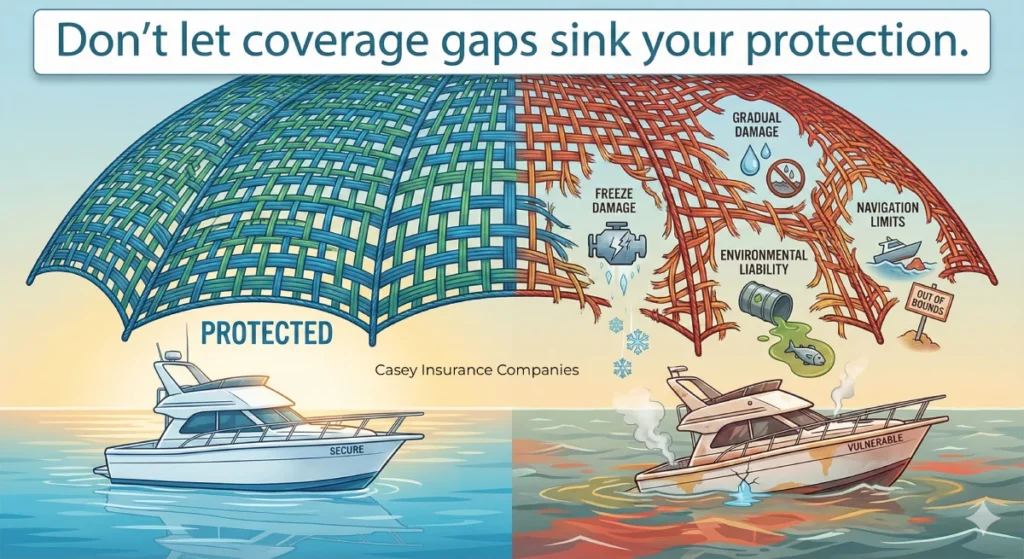

You’ve insured your boat, checked all the boxes, and feel confident you’re protected. But here’s the uncomfortable truth: many boat owners discover coverage gaps only after filing a claim when it’s too late to fix them.

Marine insurance isn’t as straightforward as it seems. Beyond the obvious risks like storms and collisions, there’s a minefield of hidden exposures that catch even experienced boaters off guard. These overlooked risks can leave you facing thousands or tens of thousands in out-of-pocket expenses despite having what you thought was comprehensive coverage.

After reviewing thousands of marine insurance claims and working with boat owners across every experience level, we’ve identified the most common risks that surprise people. These aren’t exotic scenarios they’re real situations that happen regularly to unprepared owners.

Here we’ll walk through ten critical marine insurance risks that most owners don’t fully understand until they face them. More importantly, we’ll show you exactly how to protect yourself against each one. Even you’re a new boat owner or a seasoned captain, you’ll likely discover at least one coverage gap you didn’t know existed.

1. Gradual Water Damage and Osmosis (Not Sudden Accidents)

The Hidden Risk:

Most boat owners know their insurance covers sinking from a sudden hull breach. What they don’t realize is that gradual water intrusion one of the most expensive problems in boating typically isn’t covered at all.

Osmosis, also known as “boat pox,” occurs when water slowly penetrates the gelcoat on fiberglass boats, causing blistering and delamination. Repairing significant osmosis damage can cost $10,000-$50,000 or more. Similarly, slow leaks from aging fittings, deteriorating seals, or worn shaft logs that go unnoticed for weeks can cause extensive damage to engines, electronics, and interior components.

Why It’s Not Covered:

Standard marine insurance policies exclude gradual damage, wear and tear, and deterioration. Coverage applies to sudden, accidental events not problems that develop over time due to aging or inadequate maintenance.

Real Scenario Osmosis Risk:

A boat owner returns to his vessel after two weeks away and discovers the bilge pump failed, allowing slow water seepage from a loosening through-hull fitting to flood the engine compartment. Despite having “comprehensive” coverage, the claim is denied because the damage occurred gradually rather than from a single sudden event.

How to Protect Yourself:

- Inspect your boat frequently, especially during seasons when it’s not in active use

- Test bilge pumps and high-water alarms regularly

- Address small leaks immediately before they become major problems

- Install secondary bilge pump systems with independent power sources

- Consider adding electronic monitoring systems that alert you to water intrusion

- Document your boat’s condition with regular surveys, especially for older vessels

Understanding that maintenance-related issues aren’t covered helps you prioritize prevention and budget for these repairs separately from your insurance protection.

2. Freezing Damage During Winter Storage

The Hidden Risk:

You’d think storing your boat for winter would reduce insurance risk, but improper winterization creates one of the most common and expensive claim categories and many policies severely limit or exclude this coverage.

When water freezes in engines, plumbing systems, or through-hull fittings, the expansion cracks engine blocks, splits hoses, and destroys pumps and sanitation systems. Repairs frequently exceed $5,000-$15,000, sometimes totaling boats that weren’t properly winterized.

Why Coverage Is Limited?

Most policies either exclude freeze damage entirely or require professional winterization and proof of proper procedures. Even with coverage, deductibles often apply, and repeated freeze claims can result in policy non-renewal.

Real Scenario of Freezing Damage:

An owner attempts DIY winterization but misses water trapped in the heat exchanger. When temperatures drop to 15°F, the engine block cracks. The insurance company denies the claim because the owner cannot provide documentation of proper winterization procedures performed by a qualified marine technician.

How to Protect Yourself:

- Have winterization performed by certified marine professionals and keep detailed receipts

- If you winterize yourself, follow manufacturer procedures exactly and document everything with photos and video

- Verify your policy’s specific winterization requirements before storage season

- Consider removing your boat from water for winter storage in freezing climates

- Install low-temperature alarms if your boat stays in the water year-round

- Understand your policy’s lay-up period requirements and coverage restrictions

Some insurers offer reduced premiums during winter lay-up periods but require advance notification and proof of proper storage and winterization. Review these requirements carefully each season.

3. Mysterious Disappearance of Equipment and Personal Property

The Hidden Risk:

Your expensive fishing gear, GPS chart plotter, radar system, or personal belongings disappear from your boat. You file a claim expecting reimbursement, only to learn that “mysterious disappearance” is excluded from most marine insurance policies.

Standard policies cover theft but only when there’s evidence of forced entry. If items simply vanish without proof of break-in, insurers typically deny claims. This includes items lost overboard, equipment that walks away from unsecured boats, and gear that disappears from marinas.

Why It’s Problematic?

Proving forced entry at a marina where multiple people have access is nearly impossible. Items lost overboard during normal use rarely meet the definition of “covered loss.” Personal property coverage has sublimits (often $1,000-$3,000 total) that won’t replace expensive electronics or fishing equipment.

Real Scenario Disappearing Equipment from Boats:

A boat owner returns to his slip to find his $4,500 radar unit, $2,000 worth of fishing rods and reels, and various electronics missing. There’s no visible damage to locks or hatches. The insurance company denies the claim due to lack of forced entry evidence, and the personal property sublimit wouldn’t have covered the full loss anyway.

How to Protect Yourself:

- Remove valuable portable equipment when leaving your boat unattended

- Install and use quality locking systems on all hatches and storage compartments

- Document all equipment with photos, serial numbers, and receipts

- Consider adding a scheduled personal property endorsement for expensive items, which provides broader coverage

- Install security cameras or monitoring systems to provide evidence if theft occurs

- Review your policy’s personal property limits and consider increasing them if you keep valuable gear aboard

- Never leave items unsecured on deck or in open cockpits

Our Personal Marine Insurance specialists can help you add scheduled equipment coverage that protects specific high-value items with fewer restrictions than standard personal property coverage.

4. Electrolysis and Corrosion Damage

The Hidden Risk:

Electrolysis, electrical current flowing through water causing metal corrosion silently destroys underwater metal components. By the time you notice the damage, your props, shafts, through-hulls, and rudders may need expensive replacement. Most owners assume this is covered damage, but it’s typically excluded as gradual deterioration.

Stray electrical currents from faulty wiring, poor grounding, or dock power issues can cause tens of thousands in damage within months, yet standard policies won’t cover it.

Why It’s Not Covered:

Like osmosis, electrolysis is considered preventable maintenance and gradual damage rather than a sudden covered event. Insurers expect owners to maintain proper zincs (sacrificial anodes), monitor electrical systems, and address corrosion before it becomes catastrophic.

Real Scenario of Corrosion Damage:

After one season in a new marina, a sailboat owner discovers severe prop damage and that his stainless steel shaft has corroded significantly. Investigation reveals dock-side electrical issues creating stray currents. Total repair cost: $18,000. The insurance company denies coverage as this is corrosion and gradual damage, not a covered peril.

How to Protect Yourself:

- Inspect and replace zincs regularly according to manufacturer recommendations

- Have underwater metal components inspected annually by a diver or during haul-outs

- Install galvanic isolators or isolation transformers when connecting to shore power

- Test your boat’s electrical system annually for proper grounding and stray currents

- Address any electrical issues immediately

- Choose marinas carefully and ask about electrical system maintenance

- Document the condition of metal components regularly to catch issues early

Prevention is your only real protection here since insurance won’t cover this damage. Budget for regular maintenance and inspections as operating costs rather than expecting insurance reimbursement.

5. Fuel Contamination and Engine Damage

The Hidden Risk:

You fuel up at a marina, then your engine starts running rough or quits completely. Investigation reveals contaminated fuel with water, sediment, or biological growth. The resulting engine damage could cost $5,000-$20,000 to repair, but your insurance likely won’t cover it.

Fuel contamination claims are commonly denied because insurers classify them as maintenance issues or argue that fuel quality problems aren’t covered perils under standard policies.

Why Coverage Is Questionable?

Unless you can prove the marina dispensed contaminated fuel (which requires testing before the problem is discovered) and that the marina is liable, your insurance typically won’t cover contamination damage. Many policies specifically exclude damage from poor fuel quality or contamination.

Real Scenario Fuel Contamination:

After refueling, a boat owner’s twin diesel engines begin misfiring. Diagnosis reveals water and biological contamination in the fuel, requiring complete fuel system cleaning, injector replacement, and pump rebuild. Total cost: $14,000. The insurance claim is denied because fuel contamination falls under maintenance and isn’t a covered peril. The marina claims their fuel was fine and the contamination must have come from the boat’s own tank.

How to Protect Yourself:

- Install quality fuel filters and water separators, and replace them according to schedule

- Treat fuel with stabilizers and biocides, especially during storage

- Keep fuel tanks as full as practical to minimize condensation

- Inspect and clean fuel tanks every few years

- Before leaving a marina after refueling, check your water separator for unusual water presence

- Save fuel receipts and note which marina you used in your log

- Consider adding mechanical breakdown coverage if available, though this rarely covers contamination

- If you suspect bad fuel from a marina, document everything immediately and have fuel tested before running engines

Some boat owners pursue civil claims against marinas that dispensed contaminated fuel, but proving fault is difficult and time-consuming.

6. Navigation Limits Violations

The Hidden Insurance Risk:

Your policy includes specific geographic boundaries where your boat is covered navigation limits. Venture outside these boundaries, even briefly, and any damage or loss may not be covered regardless of the cause.

Many boat owners don’t realize their policies restrict them to specific coastal distances, regions, or water types. A spontaneous trip beyond your covered area voids protection instantly.

Why This Catches Owners Off Guard:

Policy navigation limits are often buried in the details. Common restrictions include:

- Maximum distance from shore (often 75-250 miles for coastal cruisers)

- Specific geographic regions (U.S. waters only, East Coast only, etc.)

- Seasonal restrictions (no offshore passages during hurricane season)

- Approved cruising areas versus prohibited waters

Real Scenario Navigation Limits Violations:

A boat owner with coverage limited to “U.S. coastal waters within 75 miles of shore” decides to cruise to the Bahamas. En route, the vessel suffers storm damage requiring $45,000 in repairs. The claim is denied because the damage occurred outside the policy’s covered navigation territory. The owner hadn’t realized his policy didn’t include international waters or had assumed “nearby” islands would be covered.

How to Protect Yourself:

- Read your policy’s navigation limits carefully before purchasing

- Request navigation territory extensions before planning trips outside covered areas

- Notify your insurer if you’re planning extended cruises or international travel

- Understand seasonal restrictions some policies automatically extend or restrict coverage based on hurricane season

- Consider temporary navigation extensions for specific trips

- Don’t assume “nearby” waters are covered without verification

- Keep detailed logs showing you remained within covered territories in case questions arise

If you regularly cruise multiple regions or take extended trips, work with your insurer to establish appropriate year-round navigation coverage. Our Marine Insurance team helps boat owners establish coverage that matches their actual cruising plans rather than discovering limitations after losses occur.

7. Trailer Accidents and Towing Damage

The Hidden Risk:

Many boat owners don’t realize that damage occurring while their boat is on the trailer being towed falls into a gray area between marine and auto insurance and often isn’t fully covered by either.

If you’re in an auto accident while towing your boat, or if the boat falls off the trailer, or if the trailer breaks causing boat damage, your claim could be denied or only partially covered depending on how your policies are structured.

Why Coverage Gaps Exist?

Some marine policies exclude coverage while the boat is being transported. Others cover the boat but not the trailer. Auto policies typically have limited coverage for towed items. The result is a potential coverage gap where neither policy fully covers transport-related incidents.

Real Scenario Trailer Accidents:

While towing his boat home from the lake, a driver swerves to avoid debris and the boat shifts on the trailer, crushing the transom and damaging the lower unit. Damage estimate: $8,000. His marine policy excludes damage during transport. His auto insurance covers only $1,000 for towed property. He’s responsible for $7,000 out of pocket despite having both marine and auto insurance.

How to Protect Yourself:

- Verify whether your marine policy covers the boat while being towed (many do, but some exclude it)

- Check your auto policy’s coverage for towed items limits are often inadequate

- Ensure your trailer itself is properly insured (marine policy, auto policy, or separate trailer policy)

- Inspect your trailer regularly and maintain it properly mechanical failures causing damage may not be covered

- Use proper tie-downs, straps, and securing methods every time

- Consider a marine policy that explicitly covers transport and trailer coverage

- Never assume coverage, verify before needing it

Some comprehensive marine policies include transport coverage automatically, while others offer it as an endorsement. Clarify this before your first towing trip.

8. Pollution and Environmental Liability

The Hidden Risk:

If your boat sinks, runs aground, or leaks fuel or oil, you’re legally responsible for cleanup costs and environmental damage expenses that can reach hundreds of thousands of dollars. Standard marine liability coverage often provides only minimal pollution coverage, if any.

Federal and state environmental laws hold vessel owners strictly liable for pollution, regardless of fault. Even if mechanical failure causes a fuel spill, you’re responsible for remediation.

Why Standard Coverage Isn’t Enough?

Most marine policies include $50,000-$100,000 in pollution liability coverage sounds like a lot until you face actual cleanup costs. A sunken boat in an ecologically sensitive area can cost $200,000-$500,000+ to raise, remove, and remediate. Fuel spills requiring booming, absorbents, and environmental assessment quickly exceed basic policy limits.

The U.S. Coast Guard and Environmental Protection Agency can pursue boat owners for full cleanup costs, and these claims bypass your insurance entirely in many cases if they exceed policy limits.

Real Scenario Risk of Environmental Liability:

A boat sinks in a protected marina after a through-hull fitting fails. Beyond the boat’s salvage and removal ($35,000), fuel and oil leak into the water requiring emergency response, booming, water quality testing, and environmental remediation ($180,000). The owner’s policy includes only $75,000 pollution coverage, leaving him personally liable for $140,000 in environmental costs plus penalties.

How to Protect Yourself:

- Review your policy’s pollution liability limits they should be separate from general liability Coverage.

- Consider increasing pollution coverage to $300,000-$500,000, which costs relatively little

- Install leak detection systems in engine compartments and fuel tank areas

- Maintain bilge pumps and never pump oily water overboard

- Use absorbent pads in the bilge to capture any oil or fuel residue

- Address even small fuel or oil leaks immediately

- Understand that if your boat sinks, you’re responsible for its removal regardless of cause

- Consider adding wreck removal coverage if your policy doesn’t include it

Environmental liability is one risk where higher coverage limits make sense for all boat owners. The relatively small additional premium is worth the protection given the potentially catastrophic exposure.

9. Marine Business Activities on Personal Policies

The Hidden Risk:

You occasionally take friends fishing and they chip in for fuel. You give a neighbor a few sailing lessons and rent out your boat a few times per year. These seemingly innocent activities void your personal marine insurance coverage because they constitute commercial use.

Insurers draw a hard line between personal recreation and any activity that generates income, however minor. Using your boat commercially while insured personally means you have zero coverage for anything.

Why This Is Dangerous:

Commercial activities dramatically increase liability exposure. If paying passengers are injured or your boat damages property while engaged in commercial use, your personal policy won’t cover the claim. You’re personally liable for all damages, injuries, legal costs, and settlements.

Many boat owners don’t realize that “commercial use” includes:

- Charter fishing or sailing, even occasionally

- Giving paid lessons or instruction

- Transporting people or goods for compensation

- Renting your boat through peer-to-peer platforms

- Using your boat for any business purpose, including promotional activities

Real Scenario:

A boat owner takes a group of coworkers out for “team building” and his employer reimburses him for expenses. During the trip, the boat collides with a dock causing $25,000 in damage and injuring a passenger. His personal marine insurance denies all claims because accepting reimbursement constitutes commercial use. He faces personal liability for injuries, property damage, and legal defense costs exceeding $200,000.

How to Protect Yourself:

- Never accept payment, reimbursement, or compensation for taking people out on your boat if you have personal coverage

- If you want to engage in any commercial activity, obtain proper [link to Marine Business Insurance] before starting

- Be aware that even “sharing expenses” can be considered commercial activity by insurers

- Understand that renting your boat on platforms like Boat setter requires commercial coverage

- Don’t let friends or family use your boat for commercial purposes your policy covers your uses, not theirs

- Read your policy’s definition of commercial use it’s broader than most people expect

Commercial marine insurance costs more, but it’s non-negotiable if you use your boat for any business or income-generating purpose. The cost is far less than the personal liability you face operating commercially on personal coverage.

10. Named Operator Exclusions and Unlisted Operators

The Hidden Risk:

Your policy lists you as the primary operator. One day, you let a friend or family member captain your boat, and they cause an accident. Your claim could be denied because the operator wasn’t listed on your policy or because you didn’t have their experience and qualifications verified.

Many policies require operators to meet specific qualifications boating safety certification, minimum age, certain experience levels or be specifically named. Violations void coverage for that incident.

Why This Creates Problems?

Insurance companies price policies based on operator experience and risk profile. An experienced captain pays less than a novice. If someone with less experience or a poor boating record operates your boat, you’ve altered the risk profile the insurer agreed to cover.

Real Scenario of Named Operator Exclusions:

A boat owner lets his 25-year-old nephew who just bought his first boat captain his 40-foot cruiser. The nephew, unfamiliar with the vessel’s handling, crashes into another boat causing $60,000 in combined damages and injuring two people. The insurance company denies coverage because the nephew wasn’t a listed operator, lacked adequate experience for a vessel that size, and didn’t meet the policy’s minimum operator qualifications (5 years experience operating vessels over 30 feet).

How to Protect Yourself:

- Read your policy’s operator requirements carefully

- List all potential regular operators on your policy, even if this increases premiums slightly

- Verify operator qualification requirements before letting others captain your boat

- Consider adding “any operator” coverage if multiple people regularly operate your vessel (costs more but eliminates this risk)

- Provide adequate instruction and supervision when letting others operate your boat

- Ensure anyone operating your boat has appropriate boating safety certification if required

- Never let intoxicated or impaired people operate your vessel—this voids coverage regardless of operator listing

- Keep documentation of operator qualifications if challenged

Some policies automatically cover any qualified operator, while others restrict coverage to named individuals. Know which type you have and follow requirements strictly. The savings from limiting operators isn’t worth the coverage denial risk.

When to Review Your Marine Insurance Coverage?

These ten risks highlight how important it is to truly understand your coverage rather than assuming protection exists. Review your marine insurance policy in detail:

- Annually, Before Each Season

- Before Any Significant Trip

- After Any Boat Modifications

- When Your Life Situation Changes

- Before Lending Your Boat

Working with Knowledgeable Marine Insurance Professionals

The complexity of marine insurance makes working with specialized professionals essential. Generic insurance agents often don’t understand marine-specific risks and coverage nuances, leading to dangerous gaps.

Look for agents or brokers who:

- Specialize specifically in marine insurance, not general property-casualty coverage

- Understand various boat types and maritime activities

- Ask detailed questions about your boat usage rather than just providing quotes

- Explain coverage details clearly and point out potential exclusions

- Help you understand risks beyond standard policy language

- Have relationships with marine-specific insurers rather than adding boat coverage to homeowner policies

Our marine insurance specialists have seen virtually every type of claim and coverage issue. We help boat owners understand not just what their policies say, but what they actually mean in real-world situations. We also provide specialized coverage including Hull & Machinery Insurance for vessels requiring focused structural and mechanical protection, Hurricane Coverage, and comprehensive Worker Compensation for marine businesses with employees.

What to Do If You Discover a Coverage Gap?

After reading this article, you may realize your current policy has gaps. Here’s what to do:

- Don’t Panic, But Don’t Delay – Coverage gaps are fixable, but only before losses occur

- Contact Your Insurance Provider – Discuss specific concerns and ask about additional coverage or endorsements

- Get Everything in Writing – Verbal assurances mean nothing; policy documents are what matter

- Consider Changing Insurers – If your current provider can’t address gaps, find one who can

- Budget for Proper Coverage – Better coverage costs more, but inadequate coverage costs everything when you need it

Proper Marine Insurance shouldn’t be where you cut corners. Your boat represents significant investment, and liability exposure can be financially devastating. Pay for coverage that actually protects you rather than false security from inadequate policies.

Final Thoughts on Marine Insurance Risks

Marine insurance is complex for good reason maritime activities involve unique, serious risks that don’t exist on land. Boat owners who treat coverage selection casually or shop based solely on price often discover their mistakes at the worst possible time.

Understanding these ten hidden risks puts you ahead of most boat owners. You now know:

- What types of damage typically aren’t covered despite seeming like they should be

- How operator restrictions, navigation limits, and usage definitions affect coverage

- Why maintenance and prevention matter more in marine insurance than other coverage types

- Where coverage gaps commonly exist even in supposedly comprehensive policies

Take time to review your current coverage against these risks. Ask specific questions about each one. Verify that your policy addresses the exposures most relevant to your vessel type and usage. And remember that preventing losses through proper maintenance, safe operation, and risk awareness is always better than filing claims.

Your time on the water should be enjoyable, not stressful. Proper insurance coverage the right coverage, not just any coverage provides genuine peace of mind. Invest the time to get it right, and you’ll enjoy boating knowing you’re truly protected against the risks that matter.

Need help evaluating your current coverage or addressing specific gaps? Our experienced marine insurance team can review your policy in detail, explain what’s covered and what’s not, and help you build protection that actually works when you need it. We also assist with related coverage needs including Luxury Yacht and Captained Charter Insurance CI that complement your marine protection.

FAQs About Marine Insurance Risks

This depends on who was at fault. If the dock damage results from a covered peril like a storm or accident, your marine insurance would cover your boat damage (subject to your deductible), and you might pursue subrogation against the marina to recover your deductible if they were negligent. However, if the damage results from gradual deterioration of marina facilities that you knowingly left your boat against, your claim might be denied as preventable.

Generally, yes marine liability coverage typically follows the boat, not the operator, meaning it covers accidents regardless of who’s at the helm. However, there are critical exceptions: if your friend doesn’t meet the policy’s operator qualification requirements (minimum age, experience, certifications), coverage may be denied. If your friend was intoxicated or behaving recklessly, coverage may be excluded. If you knowingly let an unqualified person operate your boat, the insurer might argue you violated policy terms.

This is a serious situation. Marina agreements typically hold slip tenants responsible for vessel removal if they sink. If you can’t pay, the marina may remove your boat and pursue you legally for costs, potentially placing liens against other property you own. Your marine insurance should include wreck removal coverage (review your policy limits—they should be substantial). If removal costs exceed your coverage, you’re personally liable for the difference. Some marinas require proof of wreck removal coverage before allowing vessels to dock.

Detailed documentation is your best defense. Keep organized records including: dated receipts for all maintenance and repairs, service records from marine technicians, photos showing boat condition at various intervals, logs documenting when you performed maintenance tasks, manufacturer service recommendations and proof you followed them, receipts for parts and supplies, and documentation of inspections or surveys. When filing claims that might be challenged as maintenance-related, provide this documentation proactively.