Owning a boat brings incredible freedom the open water, peaceful mornings at the marina, thrilling fishing trips, or simply cruising with family and friends. But with that freedom comes responsibility. Your vessel represents a significant investment, and the risks on the water are real. That’s where marine insurance becomes essential.

If you’re a first-time boat owner or you’ve been navigating for years, understanding marine insurance can feel overwhelming. What exactly does it cover? How much do you need? What happens if something goes wrong miles from shore?

Here we’ll break down everything you need to know about marine insurance in clear, straightforward terms. By the end, you’ll understand how to protect your boat, your passengers, and your financial security on the water.

What Is Marine Insurance?

Marine insurance is specialized coverage designed to protect boats, watercraft, and related assets from various risks. Unlike standard property insurance or auto insurance, marine policies are specifically built around the unique challenges of owning and operating vessels.

At its core, marine insurance protects you against physical damage to your boat, liability if someone gets injured, and various other maritime-specific risks. Think of it as a safety net that keeps your investment and peace of mind intact when unexpected events occur.

Marine insurance isn’t just one blanket policy, it comes in different forms depending on what you own and how you use it. A small fishing boat needs different coverage than a luxury yacht or a commercial vessel used for charter services.

Why Boat Owners Need Marine Insurance?

You might wonder if marine insurance is really necessary, especially if you’re a careful boater. Here’s the reality: accidents happen even to the most experienced captains.

1. Financial Protection

Boats are expensive. Repairing hull damage, replacing engines, or dealing with total loss can cost tens of thousands of dollars or more. Without insurance, you’re paying out of pocket for everything.

2. Liability Coverage

If your boat damages another vessel, injures a passenger, or causes property damage at the marina, you could face serious legal and financial consequences. Marine insurance includes liability protection that can save you from devastating lawsuits.

3. Lender Requirements

If you financed your boat, your lender almost certainly requires insurance. Even if you own your vessel outright, many marinas mandate proof of coverage before allowing you to dock.

4. Peace of Mind

Knowing you’re protected lets you enjoy your time on the water without constant worry. Whether you’re caught in unexpected weather or dealing with equipment failure, insurance means you’re covered.

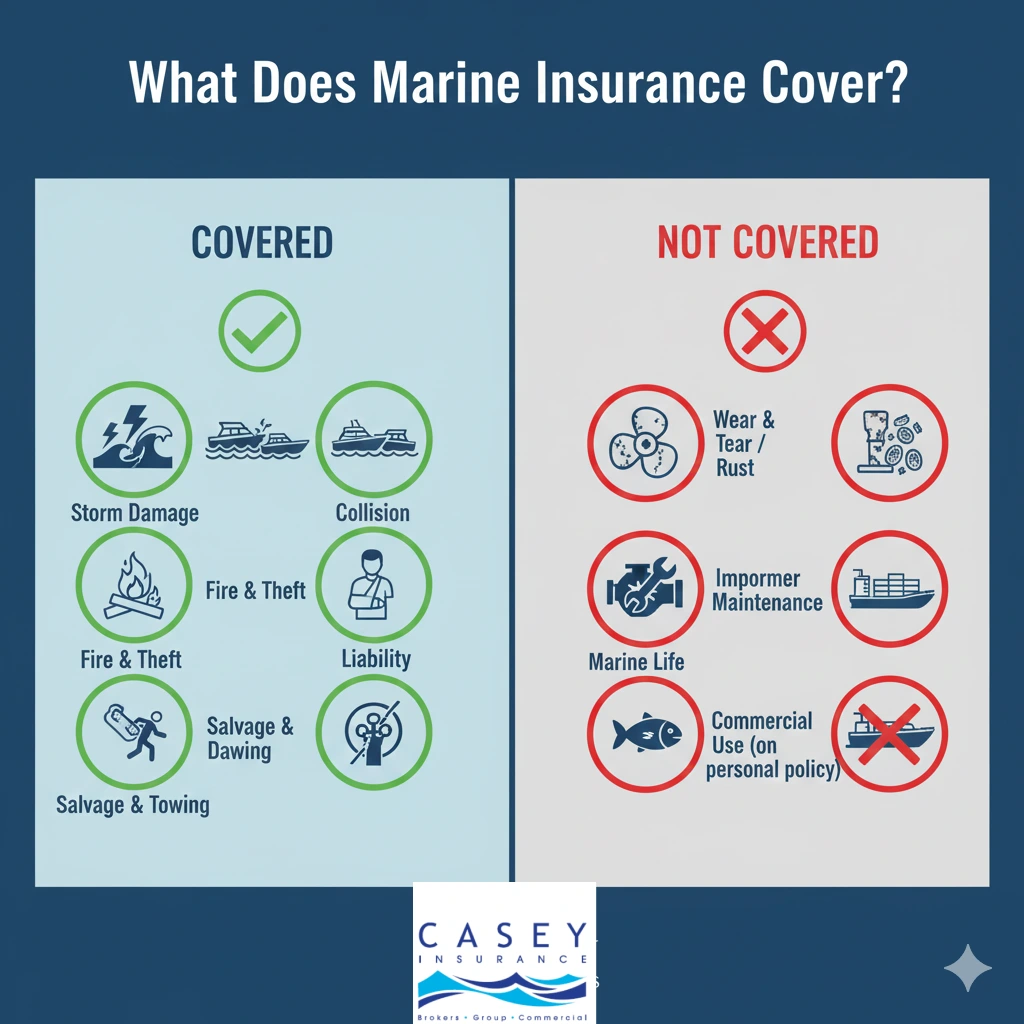

What Does Marine Insurance Cover?

Understanding what your policy covers is crucial. Most comprehensive marine insurance policies include several key protection areas.

1. Physical Damage Coverage

This is the foundation of any boat insurance policy. Physical damage coverage protects your vessel against:

- Collision with other boats, docks, or underwater objects

- Storms, hurricanes, and severe weather damage

- Fire and explosions

- Theft and vandalism

- Sinking

- Grounding on sandbars or reefs

Most policies cover your boat on an agreed value or actual cash value basis. Agreed value means you and the insurer agree upfront on the boat’s worth, and that’s what you’ll receive if it’s totaled. Actual cash value accounts for depreciation, which means you’ll get less over time.

2. Liability Protection

Liability coverage protects you when you’re legally responsible for injuries or damage. This includes:

- Bodily injury to passengers, swimmers, or people on other boats

- Property damage to other vessels, docks, or structures

- Legal defense costs if you’re sued

- Medical payments for injured parties

Standard policies typically offer $300,000 to $500,000 in liability coverage, but you can increase this amount based on your needs and assets.

3. Medical Payments Coverage

This pays for medical expenses if you or your passengers are injured on your boat, regardless of who’s at fault. It covers immediate medical care, ambulance services, and follow-up treatment within a specified time frame.

4. Uninsured Boater Coverage

Just like uninsured motorist coverage in auto insurance, this protects you if you’re hit by a boater who doesn’t have insurance or doesn’t have enough coverage to pay for your damages.

5. Personal Property and Equipment

Your policy can cover items on your boat including:

- Fishing gear and tackle

- Navigation electronics and GPS systems

- Safety equipment

- Personal belongings

- Boat trailers (though some policies require separate coverage)

6. Towing and Assistance

If your boat breaks down on the water, towing coverage pays for emergency services to get you back to shore or to a repair facility. This is similar to roadside assistance for cars and can save you hundreds or thousands in towing fees.

Types of Marine Insurance Policies

Different boats and uses require different coverage approaches. Here are the main types of marine insurance you should know about.

1. Yacht and Pleasure Craft Insurance

This is standard coverage for recreational boats used for personal enjoyment. It includes all the protections mentioned above and is designed for private boat owners who aren’t using their vessels commercially.

If you own a sailboat, powerboat, or yacht for weekend trips and vacations, Personal Marine Insurance is what you need.

2. Commercial Marine Insurance

If you use your boat for business charter fishing, water taxi services, tours, or any paid activity you need commercial coverage. Personal policies won’t cover commercial operations.

Marine Business Insurance provides higher liability limits and specialized protections for business-related maritime activities.

3. Cargo Insurance

For those transporting goods by water, Cargo Insurance protects the merchandise you’re moving. This is essential for commercial operators but can also apply if you’re regularly transporting valuable items.

4. Hull and Machinery Insurance

This specialized coverage focuses specifically on the physical vessel and its mechanical systems. Hull & Machinery Insurance is particularly important for larger vessels and commercial operations where engine and structural damage can result in massive repair bills.

What Marine Insurance Typically Doesn’t Cover?

Understanding exclusions is just as important as knowing what’s covered. Most standard policies don’t cover:

- Wear and Tear

Normal deterioration, rust, corrosion, and gradual damage from age aren’t covered. Insurance is for sudden, unexpected events, not maintenance issues.

- Improper Maintenance

If damage results from neglecting your boat failing to winterize, ignoring known problems, or skipping required maintenance your claim may be denied.

- Illegal Activities

Coverage doesn’t apply if you’re doing something illegal when the loss occurs, such as operating under the influence or violating navigation laws.

- War and Nuclear Events

Like most insurance policies, marine coverage excludes damage from war, terrorism, or nuclear incidents.

- Commercial Use on Personal Policies

If you have personal coverage but use your boat for paid charters or other business, that’s not covered. You need commercial coverage instead.

- Marine Life Damage

Some policies exclude or limit coverage for damage caused by marine organisms, insects, or animals.

How Much Does Marine Insurance Cost?

The cost of boat insurance varies widely based on several factors:

Boat Value and Type

More expensive boats cost more to insure. A $20,000 fishing boat will have much lower premiums than a $200,000 yacht.

How You Use Your Boat

Recreational use is cheaper than commercial use. How often you use it and where you navigate also matter.

Your Location

Boats in hurricane-prone areas or regions with high theft rates cost more to insure. Your storage location and marina versus home also affects rates.

Your Experience

Experienced boaters with clean records typically get better rates. Taking boating safety courses can sometimes earn you discounts.

Coverage Limits and Deductibles

Higher coverage limits increase premiums. Choosing higher deductibles lowers your premium but means you pay more out of pocket when filing claims.

Typical Cost Ranges

For a basic recreational boat valued at $20,000-$50,000, expect to pay roughly $300-$500 annually. Larger yachts can run $1,000-$3,000 or more per year. Commercial policies vary even more widely based on operations.

Many insurers offer discounts for:

- Completing boating safety courses

- Installing safety equipment beyond minimum requirements

- Bundling with other policies like Home Insurance or Auto Insurance

- Having multiple boats insured

- Being claim-free for several years

Choosing the Right Marine Insurance Coverage

Selecting appropriate coverage requires honest assessment of your situation.

- Assess Your Boat’s Value

Get a professional appraisal or use reliable valuation guides. Don’t underinsure to save on premiums you’ll regret it when filing a claim.

- Consider Your Usage

Weekend cruising requires different coverage than frequent fishing trips or extended cruises. Be honest about how you use your boat.

- Evaluate Your Liability Risk

If you regularly have guests aboard or operate in busy waters, higher liability limits make sense. Consider your personal assets too the more you have, the more protection you need.

- Review Lender Requirements

If you’re financing, understand exactly what coverage your lender requires. Don’t assume the minimum meets all your needs.

Think About Additional Coverage

Depending on your situation, consider adding:

- Increased medical payments coverage

- Higher personal property limits for expensive equipment

- Pollution liability coverage

- Wreck removal coverage

- Diminishing deductibles for claim-free years

- Read the Fine Print

Understand your policy’s navigation territory limits, lay-up periods (when you can’t use the boat without notice), and required safety equipment. Violations can void coverage.

What to Do After a Boat Accident or Loss?

If the worst happens, knowing what to do protects your claim.

- Ensure Safety First – Get everyone to safety and seek medical attention for injuries immediately.

- Document Everything – Take photos and videos of all damage from multiple angles. Get contact information from witnesses and other parties involved.

- Report to Authorities – Contact the Coast Guard or local marine police if required. Many jurisdictions require reporting for accidents involving injuries, deaths, or significant property damage.

- Notify Your Insurer Promptly – Contact your insurance company as soon as possible. Delayed reporting can complicate or jeopardize your claim.

- Don’t Admit Fault – Provide facts but avoid making statements about fault or liability at the scene.

- Preserve Evidence – Don’t make repairs before the insurer inspects damage unless necessary to prevent further loss.

- Keep Records – Save all receipts, correspondence, and documentation related to the incident and claim.

Marine Insurance vs. Boat Insurance: Is There a Difference?

You’ll hear both terms used, and they’re often interchangeable when discussing recreational vessels. However, “marine insurance” is the broader term encompassing all watercraft and maritime activities, including commercial operations, cargo transport, and large vessels.

“Boat insurance” typically refers specifically to policies for smaller recreational watercraft. When you’re shopping for coverage, either term works, but make sure you’re getting a policy that matches your specific needs.

Common Marine Insurance Mistakes to Avoid

1. Underinsuring Your Boat

Choosing lower coverage to save money backfires when you need to file a claim. Your boat’s value can increase with upgrades, so review coverage annually.

2. Not Updating Your Policy

If you add expensive electronics, change your boat’s use, or make significant modifications, notify your insurer. Otherwise, those items or activities might not be covered.

3. Ignoring Policy Exclusions

Don’t assume everything is covered. Read your policy carefully and ask questions about anything unclear.

4. Letting Coverage Lapse

Even during months you don’t use your boat, maintain coverage. Theft, weather damage, and other risks don’t take seasonal breaks.

5 Choosing Based on Price Alone

The cheapest policy isn’t always the best value. Compare coverage, customer service, claims handling, and financial strength ratings.

Working with Marine Insurance Professionals

Marine insurance involves specialized knowledge. Working with an experienced marine insurance agent or broker who understands boats and maritime risks makes a significant difference.

A knowledgeable professional can:

- Recommend appropriate coverage levels based on your specific situation

- Explain complex policy language in plain terms

- Help you find discounts and savings opportunities

- Advocate for you during the claims process

- Update your coverage as your needs change

Look for agents or companies specializing in marine insurance rather than general insurance providers. Their expertise in maritime risks, boat values, and coverage nuances proves invaluable.

Our team specializes in Marine Insurance and understands the unique challenges boat owners face. We help you navigate coverage options and find protection that truly fits your needs.

The Future of Marine Insurance in 2026

The marine insurance industry continues evolving with new technologies and changing risks.

Technology Integration

Many insurers now offer discounts for boats equipped with GPS tracking, security systems, and safety technology. Some use telematics to monitor boat usage and adjust premiums accordingly.

Climate Considerations

With increasing severe weather events, insurers are adapting coverage and pricing models. Boat owners in high-risk areas may see changes in coverage availability and costs.

Simplified Digital Processes

Getting quotes, managing policies, and filing claims is becoming more streamlined through digital platforms and mobile apps.

Protecting Your Investment and Your Peace of Mind

Marine insurance isn’t just another expense, it’s essential protection for your significant investment and your financial security. The right coverage means you can enjoy your time on the water knowing you’re protected against whatever challenges arise.

Take time to assess your needs, compare options, and work with experienced professionals who understand marine risks. Your boat represents freedom, adventure, and cherished memories. Protecting it properly ensures those experiences continue for years to come.

If you’re ready to explore comprehensive marine insurance options, our experienced team can help you find coverage that fits your vessel, your activities, and your budget. We also provide specialized coverage including Worker Compensation for marine business employees.

FAQs About Marine Insurance

Yes, even smaller boats benefit from insurance coverage. While the premium may be modest, liability protection alone is worth it. If you accidentally injure someone or damage another vessel, the costs can far exceed your boat’s value. Additionally, theft and weather damage can happen to any boat regardless of size.

It depends on your policy. Some marine insurance policies include trailer coverage and cover the boat during transport, while others require separate trailer insurance or may not cover incidents that occur while towing. Review your policy carefully and ask about transport coverage if you regularly trailer your boat, make sure it’s explicitly covered during both transport and storage.

Yes, but you’ll need specialized liveaboard coverage. Standard recreational boat insurance typically doesn’t cover full-time living situations. Liveaboard policies address unique risks and needs, including higher liability limits, personal property coverage similar to homeowners insurance, and protection for your living situation. Be upfront with insurers about liveaboard status concealing it can void your policy.

Most policies have specific navigation limits defining where your boat is covered, often coastal waters within a certain distance from shore or specific geographic regions. If you plan to travel beyond these limits or into international waters, you’ll need to notify your insurer and possibly purchase additional coverage. Always check your policy’s navigation territory before planning extended cruises or trips to foreign waters.