Your boat’s hull is its foundation, the structural backbone protecting everything inside while keeping water where it belongs: outside. Hull damage can range from minor gelcoat scratches costing a few hundred dollars to catastrophic breaches resulting in total loss worth hundreds of thousands.

Marine hull insurance protects this critical component, but many boat owners don’t fully understand what their coverage actually includes until they file a claim. The difference between “comprehensive hull coverage” and what’s genuinely covered often surprises owners facing denied claims for damage they assumed was protected.

If you own a modest fishing boat or a luxury yacht, understanding exactly what marine hull insurance covers and critically, what it excludes prevents costly surprises when you need protection most.

What Is Marine Hull Insurance?

Marine hull insurance protects the physical structure and permanently attached components of your vessel against damage or loss. Think of it as similar to comprehensive and collision coverage for your car, but specifically designed for boats and the unique risks they face.

Hull coverage forms the foundation of any boat insurance policy. While liability protects you from claims by others, hull insurance protects your actual investment in the vessel itself.

Hull vs. Hull & Machinery Coverage

You’ll often see “hull insurance” and “hull & machinery insurance” used in marine policies. Here’s the distinction:

- Hull Insurance covers the boat’s physical structure the hull, deck, superstructure, and permanently attached fixtures and fittings.

- Hull & Machinery Insurance extends coverage to include propulsion systems, engines, generators, and mechanical equipment. This comprehensive approach protects both structure and systems.

Most modern boat insurance policies bundle these together as “hull and machinery coverage,” though they’re technically separate components. Our Hull Coverage for private vessels and High-Value Yacht Hull Coverage for luxury yachts provide comprehensive protection for both structural and mechanical components.

What Marine Hull Insurance Covers?

Quality hull insurance protects against numerous perils that threaten your vessel’s structure and systems.

Collision and Impact Damage

Hull coverage protects when your boat strikes or is struck by:

- Other vessels while underway or docked

- Fixed objects like docks, pilings, bridges, or seawalls

- Floating or submerged debris

- Underwater obstructions including rocks, sandbars, or reefs

Even you hit something or something hits you, hull insurance covers the repair costs. This includes structural damage, broken through-hulls, damaged running gear, and related repairs necessary to restore your vessel.

Weather and Storm Damage

Marine hull insurance covers damage from weather events including:

- Hurricanes and named storms

- Lightning strikes damaging hull, deck, or systems

- Heavy rain causing water intrusion

- High winds damaging superstructure, canvas, or railings

- Hail damage to decks and topsides

- Flooding from storm surge

Weather coverage typically includes both damage occurring while you’re aboard and when the vessel is unattended at dock or mooring. However, hurricane coverage often requires compliance with haul-out requirements, review our Hurricane Coverage guide for high-value vessels for details on storm protection.

Fire and Explosion

Hull policies cover fire damage whether caused by:

- Engine room fires from fuel or electrical issues

- Galley fires from cooking equipment

- Electrical fires from faulty wiring or equipment

- Fuel system explosions

- Battery explosions or fires

Coverage includes not just fire damage itself but also smoke damage, heat damage to surrounding components, and water damage from firefighting efforts.

Theft and Vandalism

Your hull coverage protects against:

- Total theft of the entire vessel

- Theft of permanently attached equipment (engines, electronics, fixtures)

- Vandalism causing structural or cosmetic damage

- Malicious damage by third parties

Note that theft coverage typically requires evidence of forced entry. Items that simply disappear without clear theft evidence may not be covered this is called “mysterious disappearance” and is commonly excluded.

Sinking

If your boat sinks due to covered causes, hull insurance pays for:

- Vessel recovery and salvage operations

- Damage assessment

- Repairs if economically feasible

- Total loss payment if the vessel is beyond economical repair

- Wreck removal if required by authorities

Sinking coverage applies whether caused by hull breach, failed through-hull fittings, storm conditions, or other covered perils but not from lack of maintenance or gradual water intrusion you should have discovered and prevented.

Grounding and Stranding

Running aground or becoming stranded triggers hull coverage for:

- Hull damage from impact with the bottom

- Running gear damage (props, shafts, rudders, skegs)

- Keel damage on sailboats

- Towing and salvage to refloat the vessel

- Emergency repairs preventing further damage

Both accidental groundings (hitting unexpected shallows) and navigational error groundings are typically covered, though repeated groundings suggesting incompetence may affect renewability.

What Marine Hull Insurance Doesn’t Cover?

Understanding exclusions is as important as knowing what’s covered. These common situations typically aren’t protected by standard hull policies.

Wear and Tear and Gradual Deterioration

Hull insurance covers sudden, accidental damage not normal aging or deterioration from use:

Not Covered:

- Gelcoat oxidation and fading from sun exposure

- Bottom paint deterioration

- Aging and brittle hoses, seals, and gaskets

- Corrosion from normal saltwater exposure

- Wood rot from aging or moisture

- Worn bearings, bushings, or mechanical components

- Degraded upholstery and canvas from weather

These are maintenance issues, not insurable events. Budget for regular maintenance separately from insurance protection.

Maintenance-Related Failures

Damage resulting from deferred or inadequate maintenance isn’t covered:

Excluded Situations:

- Engine failure from neglected oil changes or cooling system maintenance

- Hull blistering (osmosis) from inadequate barrier coat maintenance

- Through-hull failure from corroded or aged fittings never replaced

- Electrical system damage from connections left unmaintained

- Mold and mildew from inadequate ventilation and cleaning

Insurers expect owners to maintain vessels properly. Failure to do so voids coverage for resulting damage. Document your maintenance with receipts and records this proves you’ve fulfilled your responsibility if claims arise.

Freezing Damage

Winter freeze damage is commonly excluded or severely limited:

Typical Exclusions:

- Cracked engine blocks from improper winterization

- Burst water tanks and plumbing

- Split hoses and fittings

- Damaged heat exchangers

Most policies require professional winterization or detailed proof you followed proper procedures. Even with coverage, deductibles apply and repeated freeze claims may lead to non-renewal. Prevention through proper winterization is essential insurance won’t cover negligence.

Vermin, Marine Growth, and Electrolysis

Damage from biological sources and electrical corrosion typically isn’t covered:

Common Exclusions:

- Barnacle and marine growth damage

- Wood-boring worm damage (teredo worms)

- Rodent damage to wiring, upholstery, or systems

- Electrolysis and galvanic corrosion from stray electrical currents

- Deterioration from lack of proper zincs (sacrificial anodes)

These issues result from inadequate maintenance, improper storage, or neglected electrical systems, all owner responsibilities rather than insurable perils.

Manufacturer Defects and Warranty Issues

Hull insurance doesn’t replace manufacturer warranties:

Not Covered:

- Defective manufacturing or materials

- Design flaws causing system failures

- Recalled components or systems

- Poor workmanship by builders or repair facilities

These issues should be addressed through manufacturer warranties, builder guarantees, or claims against repair facilities. Insurance covers accidents and unexpected events, not product defects.

Unseaworthiness and Neglect

Operating an unseaworthy vessel or neglecting known problems voids coverage:

Coverage Voiding Situations:

- Operating with known mechanical issues

- Ignoring obvious hull damage or leaks

- Failing to secure hatches or through-hulls properly

- Operating without required safety equipment

- Knowingly exceeding safe operating conditions

Insurers require owners to maintain seaworthy vessels and operate responsibly. Neglect or recklessness voids protection.

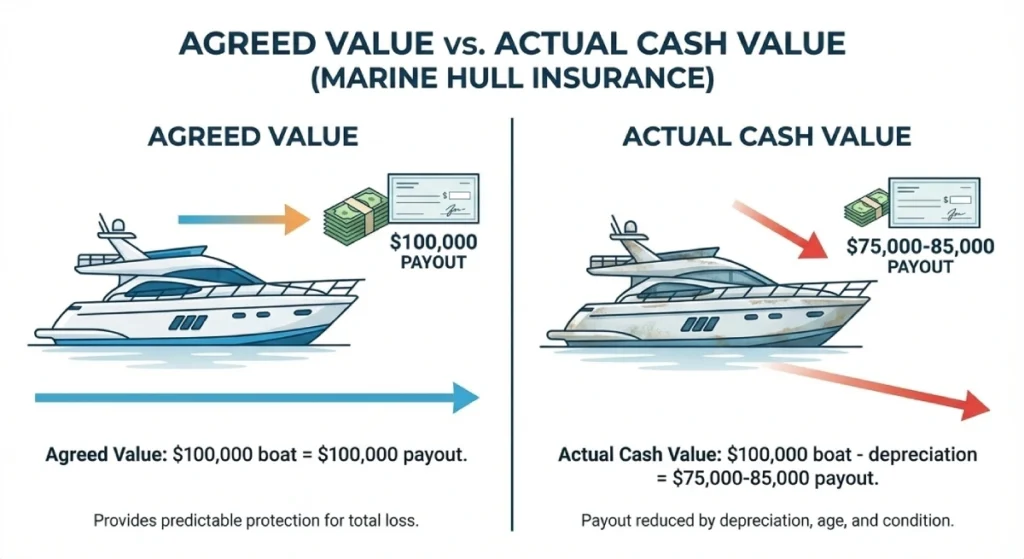

Agreed Value vs. Actual Cash Value Hull Coverage

How your hull is valued dramatically affects claim settlements.

Agreed Value Coverage

With agreed value, you and your insurer agree on your boat’s value when purchasing the policy. If total loss occurs, you receive this agreed amount regardless of depreciation or market fluctuations.

Benefits:

- Predictable total loss payout

- No depreciation disputes during claims

- Protection against market downturns

- Clear value understanding from policy inception

Considerations:

- Slightly higher premiums (typically 10-15% more)

- Requires periodic value reassessment

- Must support agreed value with surveys or appraisals

Agreed value makes sense for boats over $50,000, newer vessels, or well-maintained boats where depreciation doesn’t reflect actual condition. Our High-Value Yacht Hull Coverage typically uses agreed value to protect luxury vessel investments properly.

Actual Cash Value Coverage

Actual cash value pays your boat’s current market value at time of loss, accounting for age, condition, and depreciation.

Benefits:

- Lower premiums

- Simpler underwriting

- Appropriate for older or basic vessels

Drawbacks:

- Depreciation reduces payout over time

- Market value disputes during claims

- May not cover replacement with comparable vessel

- Uncertainty about actual settlement amounts

Actual cash value works for older boats, lower-value vessels, or situations where replacement cost isn’t critical.

Total Loss vs. Partial Loss Claims

Understanding how insurers handle different loss severities helps set expectations.

Constructive Total Loss

When repair costs reach 75-80% of your boat’s insured value, insurers typically declare “constructive total loss” rather than repairing. You receive the full insured value, and the insurer takes the damaged vessel.

This protects you from diminished value issues, boats with extensive repair history sell for less than comparable undamaged vessels. Constructive total loss gives you funds to purchase a replacement without inheriting a damaged vessel’s reduced value.

Partial Loss and Repairs

For repairable damage, hull insurance covers:

- Labor costs at reasonable rates

- Parts and materials at current prices

- Haul-out fees for bottom work

- Storage during repairs

- Related costs making repairs possible

Most policies specify repairs use “like kind and quality” materials original equipment manufacturer (OEM) parts or equivalent quality. Upgrades beyond original specifications aren’t covered unless you pay the difference.

Betterment and Depreciation

When replacing components, insurers may apply “betterment” charges you pay for the improved condition of new parts versus worn originals.

Example: If your 10-year-old engine is damaged beyond repair and replaced with new, the insurer might pay 60% (reflecting depreciation) while you cover 40% (betterment). This prevents owners from profiting through insurance by receiving brand-new equipment replacing worn components.

Deductibles in Hull Insurance Coverage

Hull insurance always includes deductibles amounts you pay before insurance covers the rest.

Standard Deductibles

Typical hull deductibles range from $500-$5,000 for recreational boats and $5,000-$50,000 for high-value yachts. Higher deductibles reduce premiums but increase out-of-pocket costs when filing claims.

Choose deductibles you can comfortably afford. Saving $300 annually with a $5,000 deductible instead of $1,000 isn’t worthwhile if you can’t handle the higher out-of-pocket expense during claims.

Special Deductibles

Certain situations trigger different deductibles:

Hurricane Deductibles: Named storm damage often requires percentage-based deductibles (2-10% of insured value) rather than flat amounts. A 5% hurricane deductible on a $500,000 yacht means $25,000 out-of-pocket.

Salvage and Towing Deductibles: Some policies apply separate deductibles for salvage operations after groundings or sinkings.

Navigational Territory Violations: Operating outside covered areas may increase deductibles or void coverage entirely.

Review all deductible provisions carefully, the surprises occur during claims when it’s too late to change them.

Hull Insurance for Different Vessel Types

Hull coverage needs vary by vessel type and value.

Recreational Powerboats and Fishing Boats

Standard recreational vessels benefit from straightforward hull coverage protecting against common risks. These policies focus on collision, weather, theft, and sinking with manageable deductibles and actual cash value or modest agreed value amounts.

Sailboats

Sailboat hull coverage must address unique considerations:

- Keel damage from groundings

- Mast and rigging damage

- Sail damage from storms or accidents

- Through-hull fittings below waterline

Quality sailboat policies include these specialized components within hull coverage.

High-Value Yachts

Luxury yachts require enhanced hull protection including:

- Higher coverage limits matching multi-million dollar values

- Agreed value protection preventing depreciation issues

- Comprehensive electronics and systems coverage

- Worldwide navigation coverage

- Enhanced salvage and recovery provisions

High-Value Yacht Hull Coverage addresses these sophisticated needs with appropriate limits and provisions.

Filing Hull Insurance Claims

Understanding the claims process helps ensure smooth settlements.

Immediate Steps After Damage

- Document thoroughly with photos and videos from multiple angles

- Prevent further damage with emergency repairs (usually covered)

- Notify your insurer immediately—most require 24-72 hour reporting

- Don’t make permanent repairs before surveyor inspection

- Gather supporting documentation—receipts, logs, witness statements

Working with Marine Surveyors

Insurers dispatch marine surveyors to assess damage and verify coverage. Surveyors:

- Inspect damage extent and cause

- Estimate repair costs

- Determine if damage is covered under policy terms

- Verify vessel condition and maintenance history

- Recommend repair approaches

Professional surveyors protect both you and insurers by providing objective damage assessments. Cooperate fully and provide all requested documentation.

Choosing Repair Facilities

Most policies allow you to choose repair facilities, though insurers may require approved yards for major work. Consider:

- Facility’s reputation and experience with your vessel type

- Quality of workmanship and materials

- Timeline for completing repairs

- Warranty on repair work

- Insurance company relationships

Quality insurers maintain networks of approved facilities known for proper work and fair pricing.

Protecting Your Hull Investment

Marine hull insurance is essential protection, but prevention remains your best strategy.

Maintain your vessel properly with regular inspections, prompt repairs, and documented maintenance. Operate responsibly within your experience level and vessel capabilities. Store and secure your boat properly when not in use.

Quality hull coverage from experienced marine insurers provides the safety net protecting your investment when prevention fails. Whether you need Hull Coverage for recreational vessels or High-Value Yacht Hull Coverage for luxury yachts, proper protection ensures you’re covered when it matters most.

We also provide comprehensive coverage including Liability Coverage and Worldwide Navigation for serious cruisers, plus Commercial Insurance for marine-related businesses.

FAQs About Marine Hull Insurance

Yes, hull coverage typically protects against damage from navigational errors, groundings, collisions, and operational mistakes, as long as they’re accidental. Intentional damage isn’t covered, and repeated incidents suggesting incompetence may affect renewability, but honest mistakes are covered perils.

Yes, salvage and recovery costs are typically covered up to policy limits when sinking results from covered perils. However, if sinking resulted from neglect (you ignored bilge pump failure, didn’t maintain through-hulls, or left hatches open), the claim may be denied as preventable.

Coverage depends on cause and your deductible. If scratches result from a covered event (collision, vandalism), they’re covered minus your deductible. However, if your deductible is $1,000 and repairs cost $800, filing a claim doesn’t make sense. Gradual wear and minor deterioration from normal use aren’t covered only sudden, accidental damage qualifies.

You must notify your insurer of significant modifications including engine upgrades. The new engine should be covered once reported and your policy is updated to reflect increased value and specifications. Failing to report modifications can void coverage or result in inadequate protection if the undisclosed equipment is damaged.