Owning a luxury yacht represents the pinnacle of maritime achievement, a combination of sophisticated engineering, refined craftsmanship, and substantial financial investment. Even your vessel is valued at $500,000 or $5 million, it deserves insurance protection that matches its caliber.

Yet many yacht owners make a critical mistake: they assume standard marine insurance adequately protects their high-value vessels. The reality is far different. Luxury yachts face unique risks, operate in challenging environments, and require specialized coverage that typical boat insurance simply doesn’t provide.

The consequences of inadequate coverage can be devastating. A yacht owner who discovers their $2 million vessel is underinsured after a total loss, or learns their standard policy won’t cover their captain and crew, faces financial exposure that could have been prevented with proper high-value yacht insurance.

Let’s explore exactly why luxury yachts require specialized insurance, what distinguishes high-value coverage from standard policies, and how to ensure your significant investment receives the protection it deserves.

What Qualifies as a High-Value Yacht?

The insurance industry doesn’t have a universal definition, but high-value yachts generally share certain characteristics that separate them from standard recreational boats.

1. Value Thresholds

Most insurers consider vessels valued above $300,000-$500,000 as high-value yachts requiring specialized coverage. Once you cross into seven-figure territory, standard marine policies become completely inadequate.

However, value alone doesn’t determine whether you need yacht-specific insurance. A $400,000 fishing boat and a $400,000 motor yacht require vastly different coverage approaches.

2. Size and Complexity

Yachts typically measure 40 feet or larger, though some smaller vessels with exceptional value or features also qualify for yacht insurance. The distinguishing factor is complexity multiple staterooms, sophisticated systems, professional-grade electronics, and luxury amenities that standard policies don’t adequately address.

3. Usage Patterns

High-value yachts often undertake extended cruising, international voyages, or require professional captains and crew. These usage patterns create exposures that recreational boat policies simply don’t contemplate or cover.

Why Standard Marine Insurance Falls Short for Luxury Yachts?

Understanding why typical boat insurance fails luxury yacht owners helps clarify the need for specialized coverage.

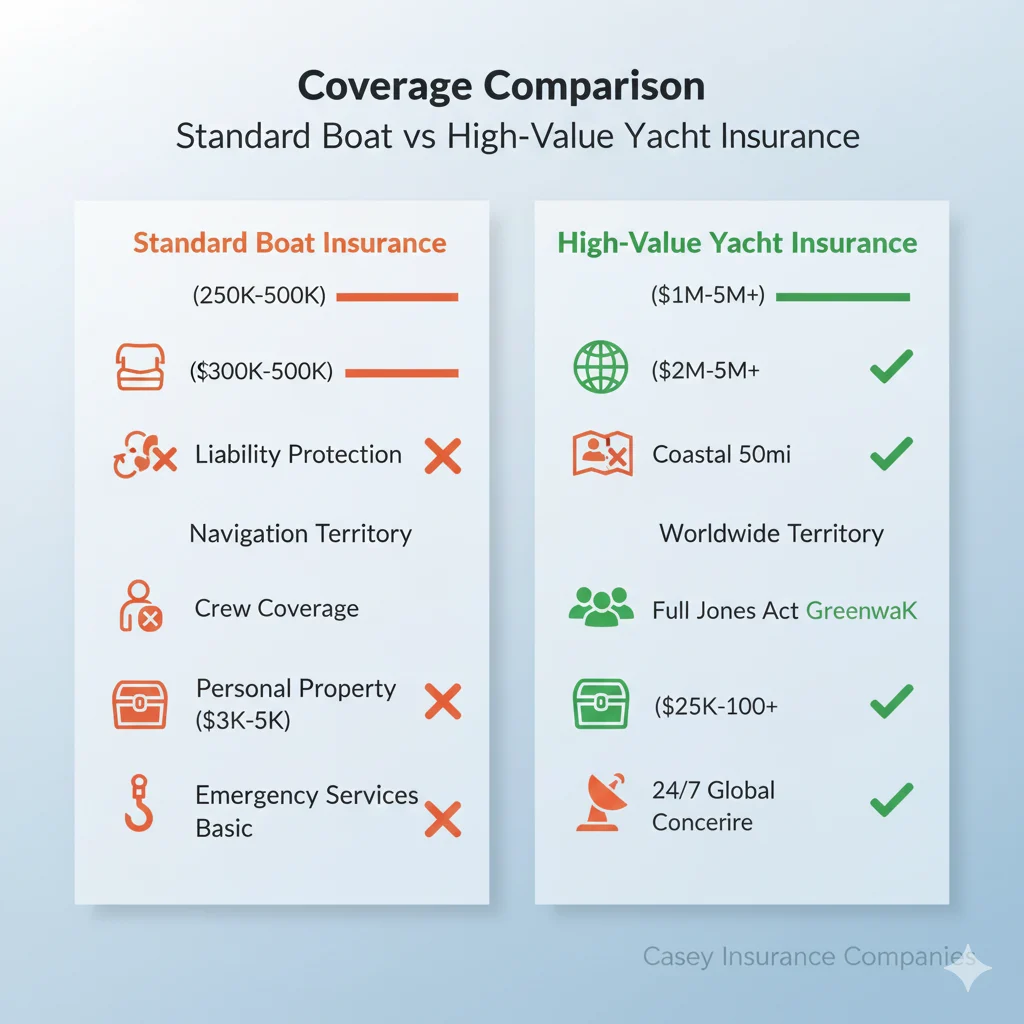

1. Inadequate Coverage Limits

Standard marine policies typically max out at $250,000-$500,000 in hull coverage. If your yacht is worth $1.5 million, you’re underinsured by $1 million or more a catastrophic gap if total loss occurs.

Even policies offering higher limits rarely provide the comprehensive protection yachts require. Coverage components designed for $75,000 cabin cruisers don’t scale appropriately to million-dollar vessels.

2. Insufficient Liability Protection

Standard policies offer $300,000-$500,000 in liability coverage. For high-net-worth yacht owners, this represents dangerous exposure. A serious injury incident involving guests can result in multi-million dollar lawsuits.

Your personal assets homes, investments, business interests become targets when yacht liability claims exceed policy limits. Luxury yacht owners need $2-$5 million or more in liability protection, which standard policies don’t provide.

3. Limited Navigation Territories

Many standard policies restrict coverage to coastal waters within 50-100 miles of shore. Yacht owners planning Caribbean cruises, transatlantic passages, or Mediterranean voyages find their policies worthless once they venture beyond these boundaries.

High-value yachts are built for serious cruising. Your insurance should accommodate your vessel’s capabilities, not artificially restrict where you can safely operate.

4. Lack of Crew Coverage

Standard boat insurance assumes owner-operators without professional crew. The moment you hire a captain, mate, chef, or steward, you need coverage for:

- Crew member injuries under maritime law (Jones Act liability)

- Crew medical expenses and repatriation

- Professional crew negligence

- Crew quarters and personal belongings

These exposures don’t exist on recreational boats but are critical for crewed yachts. Standard policies provide zero protection in these areas.

Unique Risks Facing High-Value Yachts

Luxury yachts encounter specific risks that smaller vessels rarely face, requiring specialized insurance responses.

1. Complex Mechanical and Electronic Systems

Modern luxury yachts feature sophisticated stabilization systems, advanced propulsion, extensive electronics suites, and integrated automation worth hundreds of thousands of dollars. When these systems fail, repair costs quickly escalate into six figures.

Standard policies often exclude or severely limit coverage for mechanical breakdown, electronics failures, or gradual equipment deterioration exactly the types of issues that plague complex yacht systems.

2. International Operations and Foreign Waters

Cruising to foreign countries creates unique insurance challenges:

- Compliance with foreign insurance requirements

- Coverage for incidents in international waters

- Protection meeting foreign port regulations

- Crew documentation and work permits

- Customs and importation issues

Our High-Value Worldwide Navigation coverage specifically addresses these international cruising needs.

3. Extended Time Away from Home Port

Luxury yacht owners often cruise for months at a time, thousands of miles from home. This creates challenges standard policies don’t contemplate:

- Emergency repairs in remote locations

- Towing over vast distances

- Crew replacement in foreign ports

- Medical evacuation for serious injuries

- Extended stay coverage if repairs take months

High-value yacht insurance includes concierge-level support services that help navigate these situations when you’re far from familiar resources.

4. Hurricane and Named Storm Exposure

Yachts in hurricane-prone regions face substantial storm risks. A direct hit can total even the sturdiest vessel or cause hundreds of thousands in damage.

Standard policies often provide minimal hurricane coverage or require you to move the yacht to approved safe harbors on short notice sometimes impossible during cruising. Our High-Value Yacht Hurricane Coverage offers comprehensive named storm protection designed for luxury vessels.

5. Environmental Liability

Larger yachts carry more fuel, increasing environmental risk if leaks or spills occur. Cleanup costs for significant fuel spills can reach $200,000-$500,000 or more, plus penalties and fines.

Standard policies typically include only $50,000-$100,000 in pollution liability, grossly inadequate for vessels carrying 500-2,000 gallons of fuel. High-value policies provide $500,000 to $1 million or more in environmental coverage.

Key Components of High-Value Yacht Insurance

Specialized yacht coverage includes components specifically designed for luxury vessels and their unique operational needs.

1. Comprehensive Hull and Machinery Coverage

Our High-Value Yacht Hull Coverage protects your vessel’s physical structure and mechanical systems with:

- Agreed Value Protection:

You and the insurer agree upfront on your yacht’s value. In total loss situations, you receive this full amount without depreciation disputes. - All-Risk Coverage:

Protection against all perils except specifically excluded items, rather than named-perils-only coverage common in standard policies. - Total Loss and Constructive Total Loss:

If repair costs exceed 75-80% of yacht value, insurers typically declare constructive total loss and pay the agreed value rather than forcing expensive repairs that diminish vessel worth. - Partial Loss Coverage:

Comprehensive repair or replacement of damaged components using original equipment manufacturers (OEM) parts rather than generic replacements.

2. Enhanced Liability Protection

High-Value Yacht Liability coverage includes:

- Elevated Limits: $2 million to $5 million or higher, matching your asset protection needs and potential exposure from serious incidents.

- Protection and Indemnity (P&I): Specialized maritime liability covering crew injuries, passenger claims, collision liability, and wreck removal obligations.

- Jones Act Liability: Coverage for crew member injuries under U.S. maritime law, which provides more generous compensation than standard workers’ compensation.

- Uninsured Boater Coverage: Protection when you’re hit by uninsured or underinsured vessels surprisingly common even in luxury boating circles.

- Legal Defense Costs: Separate from liability limits, ensuring policy limits remain available for settlements while legal expenses are covered independently.

3. Personal Effects and Equipment

High-value yachts contain expensive belongings requiring specialized coverage:

- Electronics and navigation equipment often totaling $100,000-$300,000+

- Luxury furnishings, artwork, and décor

- Water toys (tenders, jet skis, diving equipment) worth $50,000-$200,000

- Owner and guest personal property

- Provisioning and supplies for extended cruising

Standard $3,000-$5,000 personal property limits are laughably inadequate. Yacht policies provide $25,000-$100,000+ in base coverage plus scheduled coverage for specific high-value items.

4. Crew Coverage and Charter Endorsements

If you employ professional crew or charter your yacht, specialized endorsements address:

- Commercial Crew Coverage: Protection for captain, mates, engineers, stewards, and chef under maritime employment law.

- Charter Liability: If you occasionally charter your yacht to offset ownership costs, proper commercial coverage is mandatory. Personal policies void entirely when generating income from your vessel.

Our Charter Commercial Lines Insurance provides appropriate coverage for yachts used in charter operations, whether bareboat, captained, or demise charter arrangements.

5. Worldwide Navigation Coverage

Unlike standard policies limiting you to coastal waters, high-value yacht insurance provides genuine worldwide cruising capabilities.

High Value yacht’s Worldwide Navigation coverage includes:

- Mediterranean, Caribbean, and South Pacific cruising

- Transatlantic and transpacific passages

- Seasonal migration between cruising grounds

- Extended international stays

- Compliance with foreign insurance requirements

Territorial limitations can be adjusted based on your actual cruising plans, ensuring you’re covered wherever your yacht takes you.

6. Emergency Assistance and Concierge Services

Premium yacht insurance includes services that standard policies never contemplate:

- 24/7 global emergency assistance hotlines

- Coordination of repairs in foreign ports

- Crew travel and replacement services

- Medical evacuation and repatriation

- Customs and documentation assistance

- Access to global network of qualified marine surveyors and repair facilities

- Emergency parts shipping and expediting

These services provide immense value during crises when you’re thousands of miles from home in unfamiliar locations.

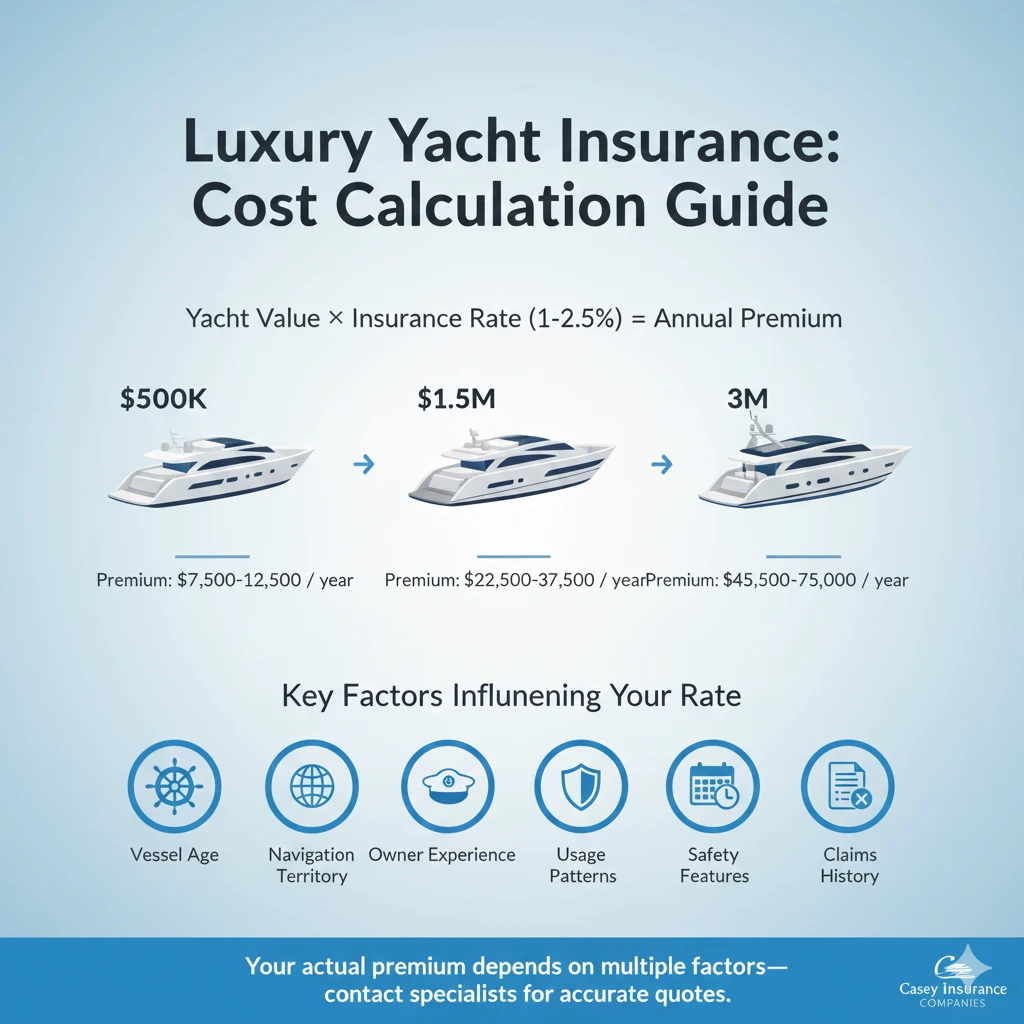

The Cost of High-Value Yacht Insurance

Luxury yacht insurance represents a significant but necessary expense proportional to vessel value and usage.

Premium Factors

Insurers calculate yacht premiums based on:

- Yacht Value: Premiums typically run 1-2.5% of insured value annually. A $2 million yacht costs $20,000-$50,000 annually depending on other factors.

- Vessel Type and Construction: Powerboats generally cost more than sailboats due to higher speeds and complex mechanical systems. Construction quality and builder reputation affect rates.

- Age and Condition: Newer yachts (under 10 years) receive better rates. Well-maintained older yachts with recent surveys get favorable consideration, while vessels showing deferred maintenance face higher premiums or coverage restrictions.

- Navigation Territory: Worldwide coverage costs more than regional cruising. Hurricane-prone areas command premium increases of 20-40%.

- Usage Patterns: Full-time liveaboards pay more than seasonal cruisers. Charter operations increase premiums substantially.

- Owner Experience: Experienced yacht captains with clean records receive better rates. First-time yacht owners or those with claims history pay premiums 15-30% higher.

- Crew Considerations: Professional captain and crew increase both coverage needs and costs but may qualify for discounts due to professional operation.

- Deductibles: Higher deductibles reduce premiums. Typical yacht deductibles range from $5,000-$50,000 depending on vessel value.

Is It Worth the Investment?

Consider that annual insurance costs of $30,000-$40,000 on a $2 million yacht represent just 1.5-2% of vessel value. Compared to the potential financial devastation of uninsured or underinsured losses, proper coverage is essential risk management.

High-net-worth individuals face particular vulnerability. Your assets beyond the yacht real estate, investment portfolios, business interests all become targets in liability claims exceeding insurance limits. Adequate coverage protects your entire financial picture, not just the yacht.

How to Choose the Right High-Value Yacht Insurance?

Selecting appropriate luxury yacht coverage requires careful evaluation of your specific situation.

Assess Your Coverage Needs

Consider:

- Current yacht value: Get professional appraisals, not just purchase price

- Cruising plans: Where you’ll actually operate, not just where you might someday go

- Crew requirements: Professional captain, full crew, or owner-operated

- Charter intentions: Any income generation requires commercial coverage

- Asset protection needs: Total net worth determines necessary liability limits

Compare Specialized Yacht Insurers

Not all marine insurers understand luxury yachts. Look for:

- Companies specializing in high-value vessels

- Experience with your yacht type and size

- Global claims handling capabilities

- Relationships with international repair facilities

- Responsive service and knowledgeable underwriters

Verify Coverage Details

Don’t assume anything. Confirm:

- Agreed value amount matches current market value

- Navigation territories cover your actual cruising plans

- Liability limits adequately protect your assets

- Personal property and equipment coverage matches actual value

- Crew coverage if applicable

- Hurricane and named storm protection in your area

- Pollution and environmental liability limits

Review Exclusions Carefully

Every policy excludes certain risks. Common exclusions include:

- Wear and tear and gradual deterioration

- Manufacturer defects (though sometimes covered under warranties)

- Racing activities without specific endorsements

- War and nuclear events

- Intentional acts and illegal activities

Understand what’s excluded so you can address gaps through other means or accept calculated risks.

Bundling Yacht Insurance with Other High-Value Coverage

Many luxury yacht owners benefit from bundling marine insurance with other high-net-worth coverage.

Comprehensive High-Value Insurance Programs

Consider consolidating:

- High-value yacht insurance

- Luxury home insurance for primary and secondary residences

- High-value auto insurance for exotic and luxury vehicles

- Valuable collections coverage for art, jewelry, and collectibles

- Excess liability (umbrella) coverage providing additional protection across all policies

Benefits of Bundling

Multi-Policy Discounts: Save 10-20% when bundling multiple high-value policies with one insurer.

Coordinated Coverage: Ensure no gaps or overlaps between different policy types. One experienced agent managing all coverage provides peace of mind.

Simplified Claims: Single point of contact for all insurance needs streamlines communication and claim coordination.

Relationship Benefits: High-value clients often receive enhanced service, dedicated representatives, and preferential treatment.

Working with Experienced Yacht Insurance Specialists

High-value yacht insurance requires specialized expertise that general insurance agents rarely possess.

What to Look for in a Yacht Insurance Specialist

Choose agents or brokers who:

- Focus specifically on high-value marine insurance

- Understand luxury yachts and their operational complexities

- Represent multiple specialized yacht insurers

- Provide personalized service and ongoing consultation

- Have yacht ownership experience themselves or extensive client history

- Offer global support and emergency assistance resources

Questions to Ask Prospective Insurers

Before committing, verify:

- “How many yachts over $500,000 have you insured?”

- “What’s your experience with [your yacht type/size]?”

- “How are claims handled in foreign ports?”

- “What emergency assistance services do you provide globally?”

- “Can you provide references from similar clients?”

- “How quickly can coverage be adjusted if my cruising plans change?”

Protecting Your Investment and Your Peace of Mind

Luxury yacht ownership represents significant financial investment and provides extraordinary lifestyle benefits. Protecting both properly requires insurance coverage specifically designed for high-value vessels and the unique risks they face.

Standard marine insurance adequate for $50,000 fishing boats, fails catastrophically when applied to million-dollar yachts. The coverage gaps, insufficient limits, and lack of specialized services create exposures that should never exist for high-net-worth yacht owners.

High-value yacht insurance costs more because it delivers dramatically more protection. Agreed value coverage protecting your full investment, multi-million dollar liability limits safeguarding your assets, worldwide navigation enabling the cruising your yacht was built for, and concierge services supporting you anywhere in the world these aren’t luxuries, they’re necessities.

Your yacht deserves protection matching its quality and value. More importantly, you deserve peace of mind knowing that your significant investment and personal assets are properly protected against the real risks luxury yacht ownership entails.

Our Private Client Luxury Yacht Insurance specialists understand high-value vessels and the discerning owners who appreciate them. We provide comprehensive coverage, personalized service, and the expertise that luxury yacht insurance demands.

For related insurance needs, we also provide specialized Commercial Insurance including General Liability, Workers Compensation, and Commercial Auto coverage for marine industry businesses.

FAQs About High-Value Yacht Insurance

While there’s no universal definition, most insurers consider vessels valued above $300,000-$500,000 or measuring 40+ feet as yachts requiring specialized coverage. However, value and size aren’t the only factors—complexity matters too. A 45-foot yacht with multiple staterooms, sophisticated systems, and extended cruising capabilities needs yacht-specific coverage even if valued at $350,000, while a simpler 45-foot fishing boat might be adequately covered under enhanced recreational marine insurance.

Yes, several strategies reduce costs while maintaining proper protection. First, increase your deductible moving from $10,000 to $25,000 might save 15-20% annually. If you can comfortably absorb larger deductibles, the savings compound over years. Second, install and maintain advanced safety systems (fire suppression, monitoring, tracking) that qualify for discounts of 5-15%. Third, obtain captain’s licenses or advanced boating certifications demonstrating competence. Fourth, maintain a claims-free record many insurers offer diminishing deductibles or premium reductions after 3-5 claim-free years. Fifth, bundle your yacht insurance with home and auto coverage for multi-policy discounts of 10-20%. Finally, accurately define your navigation territory if you cruise primarily in the Chesapeake Bay, don’t pay for Caribbean coverage you never use.

No, absolutely not—this is critical to understand. Personal high-value yacht insurance explicitly excludes any commercial use, and chartering your yacht for income (even occasionally, even to offset costs) is commercial activity. Your personal policy provides zero coverage during charter operations, meaning you have no protection for damage or liability claims arising during charter use. You need proper commercial charter insurance before accepting any compensation for yacht use.

Quality high-value yacht insurance includes worldwide claims handling capabilities through international networks of marine surveyors, adjusters, and repair facilities. When incidents occur abroad, you contact your insurer’s 24/7 emergency line, and they coordinate local response—arranging surveyors, recommending qualified repair yards, authorizing emergency repairs, and managing the claims process despite distance and foreign jurisdictions.