Insurance mistakes don’t reveal themselves until you need to file a claim when it’s too late to fix them. These common insurance coverage mistakes cost homeowners and drivers thousands in denied claims, inadequate coverage, or overpayment for protection they don’t need.

Avoiding these seven critical errors protects your financial security and ensures you’re actually covered when disasters strike.

1. Buying Insurance Based Solely on Price

The Mistake: Choosing the cheapest policy without comparing actual coverage.

The Cost: The $400 policy that’s $300 cheaper than competitors often has:

- Lower coverage limits leaving you underinsured

- Higher deductibles you can’t afford

- Fewer coverage options

- Poor claims service

- Inferior financial stability

How to Fix: Compare coverage details, not just premiums. The cheapest policy is worthless if it doesn’t pay claims when needed.

2. Underinsuring Your Home’s Dwelling Coverage

The Mistake: Insuring for market value, mortgage amount, or tax assessment instead of replacement cost.

The Cost: Your home’s market value is $450,000 but rebuilding costs $550,000. After a total loss, you’re $100,000 short to rebuild insurance only pays $450,000.

How to Fix: Insure for full replacement cost, not market value. Get professional replacement cost estimates and update coverage annually as construction costs rise.

3. Carrying Inadequate Liability Limits

The Mistake: Keeping state minimum auto liability ($25,000-$50,000) or standard home liability ($100,000-$300,000).

The Cost: You cause a serious accident resulting in $500,000 in medical bills and lost wages. Your $100,000 liability pays its limit. You’re personally liable for $400,000—potentially forcing bankruptcy, wage garnishment, and asset seizure.

How to Fix: Carry auto liability and home liability coverage at least equal to your total net worth. Minimum recommendations: $500,000-$1 million for most homeowners. Add umbrella coverage for comprehensive protection.

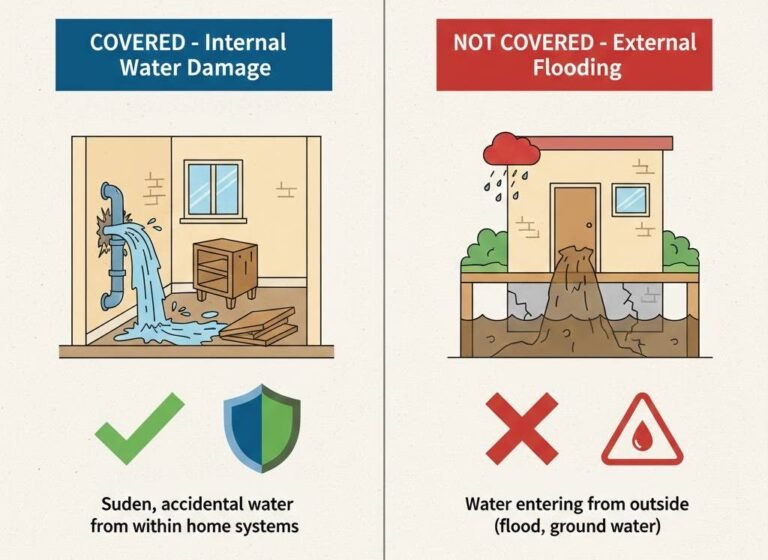

4. Not Understanding What’s Actually Covered

The Mistake: Assuming “comprehensive” or “full coverage” means everything is covered.

The Cost: Your basement floods from heavy rain. You assume your homeowners policy covers it but external flooding is excluded. You face $40,000 in uncovered repairs because you didn’t have flood insurance.

How to Fix: Read your policy carefully. Understand major exclusions:

- Floods (require separate policies)

- Earthquakes (need endorsements)

- Sewer backup (need endorsements)

- Business activities (need commercial coverage)

5. Failing to Schedule High-Value Items

The Mistake: Not separately listing jewelry, art, or collectibles on your policy.

The Cost: You have $15,000 in jewelry stolen. Your personal property coverage includes only $1,500 sublimit for jewelry theft. You lose $13,500 in uncovered value.

How to Fix: Schedule high-value items separately with specific values. Cost is typically 1-3% of item value annually minimal compared to protection provided.

6. Not Updating Coverage After Life Changes

The Mistake: Never reviewing insurance after:

- Home renovations increasing value

- Acquiring valuable possessions

- Adding teenage drivers

- Starting home businesses

- Installing pools or trampolines

The Cost: Your kitchen remodel added $75,000 to rebuilding costs, but you never increased dwelling coverage. After a fire, you’re $75,000 short. Or your teen driver causes a $300,000 accident but you never increased liability limits you’re personally liable for amounts exceeding coverage.

How to Fix: Review coverage annually and after major life changes. Update limits, add endorsements, and adjust coverage matching your current situation.

7. Filing Small Claims You Can Afford

The Mistake: Filing claims for damage slightly above your deductible.

The Cost: You file a $1,800 claim with a $1,000 deductible, receiving $800. However, this claim increases your premiums 20% for 3-5 years—costing $2,000-$3,000 in additional premiums. You lost $1,200-$2,200 by filing the claim.

How to Fix: Only file claims for:

- Major damage exceeding $5,000-$10,000

- Liability situations involving third parties

- Total losses

- Damage you can’t afford yourself

Pay out-of-pocket for minor damage. Claims-free discounts increase over time, saving more than small claim payouts.

Bonus Mistakes to Avoid

Dropping Collision and Comprehensive Too Soon: Keep coverage until vehicle value drops below $3,000-$4,000, not just when loans are paid off.

Ignoring Uninsured Motorist Coverage: 12.6% of drivers are uninsured. This coverage protects you from inadequately insured at-fault drivers.

Not Bundling Policies: Combining home and auto insurance with one insurer saves 15-25% on both policies.

Forgetting to Update Beneficiaries: Life changes require updating policy beneficiaries divorce, deaths, or births affect who receives benefits.

Protect Yourself from Costly Mistakes

These common insurance coverage mistakes to avoid are completely preventable with proper understanding and regular policy reviews. Don’t discover inadequate coverage, dangerous gaps, or missed opportunities only after it’s too late to fix them.

Review your policies annually, understand what’s covered and excluded, maintain adequate limits, and work with knowledgeable insurance professionals ensuring comprehensive protection.

The few hours spent properly managing your insurance saves thousands or tens of thousands in avoided mistakes, adequate coverage, and optimized protection.

Frequently Asked Questions

Review annually at renewal and whenever major life changes occur—home improvements, new vehicles, marriage/divorce, children, significant asset growth, or starting businesses. Life changes affect both coverage needs and potential discounts.

Absolutely. Increasing liability from $300,000 to $1 million typically costs just $150-$300 annually—minimal compared to protecting hundreds of thousands in assets from lawsuits. Higher limits provide essential financial security.

Yes. Most insurers allow mid-term cancellation with pro-rated refunds. If you discover significantly better coverage or gaps in current policies, switch immediately rather than waiting months for renewal. Ensure no coverage gaps during transition.