When shopping for auto insurance, you’ll encounter two types of coverage that sound similar but protect your vehicle in completely different ways: collision and comprehensive insurance. Many drivers don’t understand the distinction until they need to file a claim and discover they’re not covered for the damage they’ve suffered.

Understanding the difference between these coverages helps you make informed decisions about protecting your vehicle and your wallet. Some drivers need both, some need only one, and some can skip both entirely. The key is knowing which category you fall into.

What Is Collision Insurance?

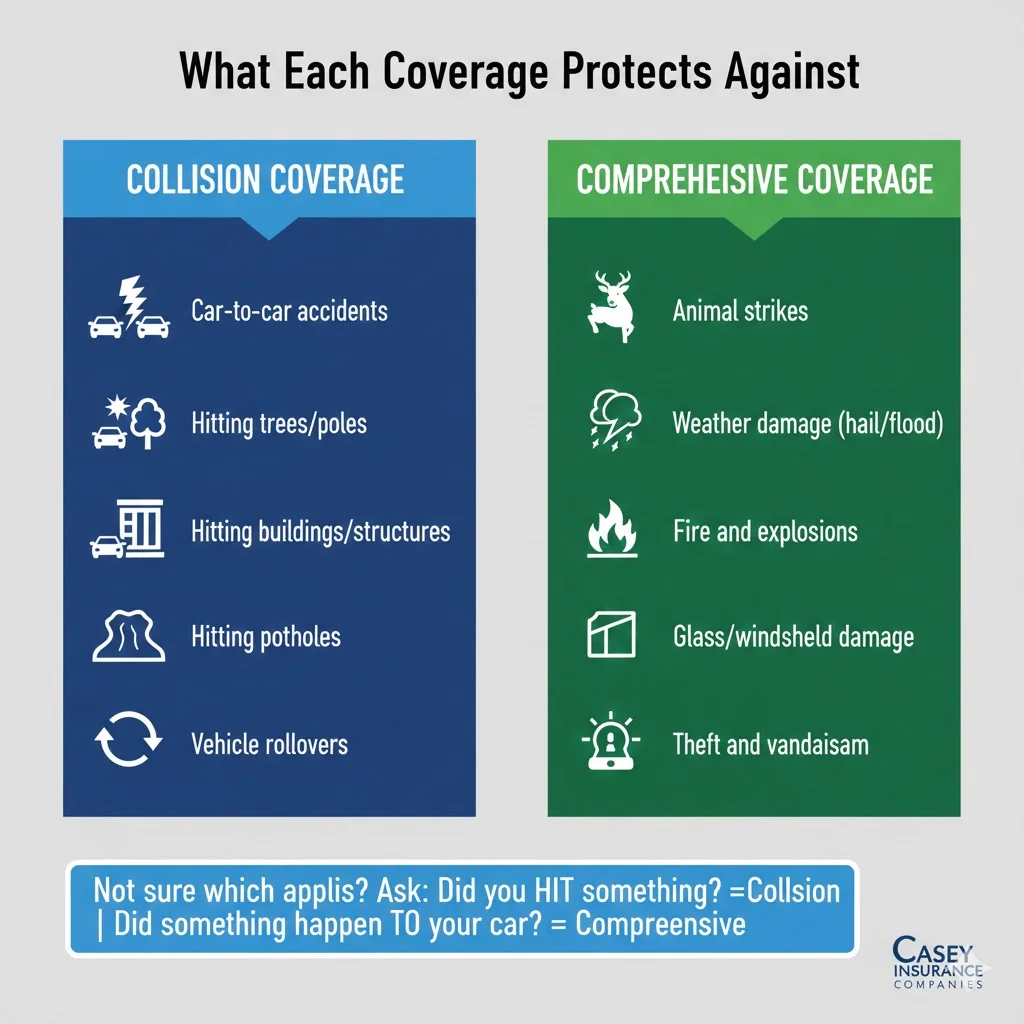

Collision insurance covers damage to your vehicle when it hits (or is hit by) another object, regardless of who’s at fault.

What Collision Coverage Pays For

Collision insurance covers repairs or replacement when your vehicle:

- Collides with another vehicle (whether you caused the accident or not)

- Hits stationary objects like guardrails, poles, trees, or buildings

- Strikes road hazards such as potholes or curbs

- Rolls over due to any cause

- Gets hit while parked by another vehicle (even if they don’t leave information)

The key word is “collision” your car must physically impact something. This coverage applies whether you’re moving or parked, at fault or not at fault.

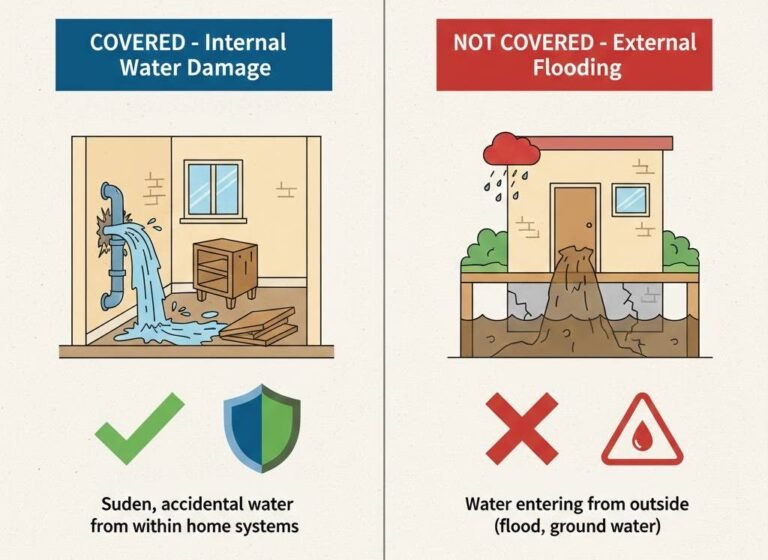

What Collision Insurance Doesn’t Cover

Collision coverage has important limitations:

- Other people’s vehicles or property (your liability coverage pays for that)

- Injuries to you or passengers (medical payments/PIP covers this)

- Non-collision damage like theft, vandalism, or weather (comprehensive covers these)

- Mechanical breakdowns or failures (not insurable events)

- Wear and tear or depreciation (normal vehicle aging)

How Collision Claims Work

When you file a collision claim, you pay your deductible (typically $500-$2,000) and your insurer pays the remaining repair or replacement costs up to your vehicle’s actual cash value.

Example: You hit a deer crossing the road (actually covered by comprehensive, not collision). Wait you swerve to avoid the deer and hit a tree instead. That’s collision. Your car sustains $6,000 damage. With a $1,000 deductible, you pay $1,000 and insurance pays $5,000.

What Is Comprehensive Insurance?

Comprehensive insurance covers damage to your vehicle from most non-collision events essentially everything else that can damage your car besides hitting something.

What Comprehensive Coverage Pays For

Comprehensive insurance protects your vehicle against:

- Theft and vandalism (stolen vehicle or deliberate damage)

- Weather damage from hail, floods, hurricanes, tornadoes, or lightning

- Fire and explosions (including electrical fires)

- Falling objects like tree branches, rocks, or debris

- Animal strikes (hitting deer, elk, or other animals)

- Glass damage from rocks, vandalism, or unknown causes

- Civil disturbances like riots causing vehicle damage

- Natural disasters including earthquakes (in some policies)

Think of comprehensive as covering “acts of God” and other perils beyond your control that don’t involve colliding with anything.

What Comprehensive Insurance Doesn’t Cover

Like collision, comprehensive has exclusions:

- Collision damage (that’s what collision coverage is for)

- Personal belongings stolen from your car (homeowners/renters insurance covers these)

- Mechanical failures (regular maintenance and breakdowns aren’t covered)

- Intentional damage you cause (insurance doesn’t cover deliberate acts)

- Wear and tear (normal depreciation and aging)

How Comprehensive Claims Work

Comprehensive claims work similarly to collision you pay your deductible (often lower than collision deductibles, typically $250-$1,000) and insurance covers the rest.

Example: Hail damages your car, creating $4,000 in bodywork and paint repairs. With a $500 comprehensive deductible, you pay $500 and insurance covers $3,500.

Key Differences Between Collision and Comprehensive

Understanding the distinctions helps you make coverage decisions.

| Feature | Collision Insurance | Comprehensive Insurance |

|---|---|---|

| What It Covers | Damage from hitting objects or vehicles | Damage from non-collision events |

| Common Claims | Accidents with other cars, hitting poles/trees, rollovers | Theft, vandalism, weather, animal strikes, fire |

| At-Fault Coverage | Yes—covers you even if accident was your fault | N/A—no fault involved in most comprehensive claims |

| Typical Deductible | $500-$2,000 | $250-$1,000 |

| Average Cost | Higher (more frequent claims) | Lower (less frequent claims) |

| When Required | When financing/leasing vehicle | When financing/leasing vehicle |

| Example Scenario | You rear-end another car | Tree falls on your parked car |

The simple way to remember: If your car hits something or something hits it involving another vehicle or object, it’s collision. If damage comes from weather, theft, animals, or other non-collision events, it’s comprehensive.

Do You Need Both Collision and Comprehensive?

Whether you need one, both, or neither depends on your specific situation.

When You MUST Have Both

Financed or Leased Vehicles: Lenders and leasing companies require both collision and comprehensive coverage to protect their investment. You can’t skip these until you own your vehicle outright.

When You SHOULD Have Both

Even without financing requirements, consider keeping both coverages if:

- Your vehicle is worth $4,000+: The potential loss exceeds the cost of coverage. Calculate: If your car is worth $15,000 and annual collision/comprehensive costs $800, it’s worthwhile protection.

- You can’t afford to replace your vehicle: If losing your car would create financial hardship and you couldn’t replace it from savings, maintain full coverage.

- You drive in high-risk areas: Urban areas with high accident rates, regions prone to hail or flooding, or areas with frequent animal strikes make coverage valuable.

- You have a long commute: More time on the road increases accident probability, making collision coverage especially important.

When You Might Drop One or Both

Consider dropping collision, comprehensive, or both if:

- Your vehicle’s value is very low: When your car is worth $3,000 or less, annual premiums plus deductibles might exceed potential payouts. If collision/comprehensive costs $600/year with $1,000 deductibles, you’re paying significant money to protect minimal value.

- You have substantial savings: If you could replace your vehicle from savings without financial strain, you’re essentially self-insuring sometimes the smart financial choice for older vehicles.

- The 10% rule: Financial experts suggest dropping coverage when annual premiums exceed 10% of your vehicle’s value. For a $4,000 car, if collision and comprehensive cost $500+ annually, consider dropping them.

How Much Do Collision and Comprehensive Cost?

Costs vary significantly based on multiple factors.

Average Premium Costs

Collision Insurance: $300-$800 annually for most drivers Comprehensive Insurance: $150-$400 annually for most drivers Combined: $450-$1,200 annually

Factors Affecting Your Rates

- Vehicle Value: More expensive cars cost more to insure

- Vehicle Age: Newer cars have higher premiums

- Deductible Amount: Higher deductibles reduce premiums 15-30%

- Your Location: Urban areas and weather-prone regions cost more

- Driving Record: Accidents and violations increase rates

- Credit Score: Better credit often means lower premiums (in states where allowed)

- Annual Mileage: More miles driven = higher rates

Deductible Choices Impact Costs

Choosing higher deductibles reduces premiums:

- $500 → $1,000 deductible: Save 15-25% on premiums

- $1,000 → $2,000 deductible: Save additional 15-20%

Example: Reducing collision premium from $600 to $450 annually by increasing deductible from $500 to $1,500 saves $150/year. If you remain claim-free for three years, you’ve saved $450—enough to cover most of the higher deductible if you eventually need it.

Making the Right Coverage Decision

Follow this decision framework to determine what coverage you need.

Step 1: Determine Your Vehicle’s Value

Check your car’s actual cash value using:

- Kelley Blue Book (kbb.com)

- NADA Guides (nadaguides.com)

- Edmunds (edmunds.com)

Use the “trade-in” value for realistic estimates of what insurance would pay.

Step 2: Calculate the Cost-Benefit

Get quotes for:

- Liability only

- Liability + Comprehensive

- Liability + Collision

- Full coverage (Liability + Collision + Comprehensive)

Compare costs against your vehicle’s value and replacement budget.

Step 3: Consider Your Risk Tolerance and Financial Situation

Ask yourself:

- Can I afford to replace my vehicle from savings if totaled?

- What’s my appetite for risk?

- How would losing my vehicle affect my life?

- Am I in a high-claim-probability situation?

Conservative approach: Keep both coverages until vehicle value drops below $5,000 Moderate approach: Keep both while vehicle is worth $3,000+ Aggressive approach: Drop both once you own the vehicle outright and have adequate savings

Step 4: Review Your Complete Auto Coverage

Don’t focus solely on collision and comprehensive. Ensure you have adequate:

Liability Coverage: Protects you when you cause accidents essential and legally required. Carry at least $100,000/$300,000/$100,000, preferably higher.

Uninsured/Underinsured Motorist Coverage: Protects you from drivers without adequate insurance crucial protection many people overlook.

Medical Payments/PIP: Covers your medical expenses after accidents regardless of fault.

Never sacrifice liability or uninsured motorist coverage to save money. These protect you from financial catastrophe. Only adjust collision and comprehensive as cost-saving measures.

Common Mistakes to Avoid

1: Dropping Coverage Too Soon: Don’t drop collision/comprehensive on newer vehicles just to save money if you couldn’t afford to replace them.

2: Keeping Coverage Too Long: Paying $700 annually to insure a $2,000 car doesn’t make financial sense.

3: Choosing Deductibles You Can’t Afford: $2,500 deductibles save money until you have a claim and can’t pay the deductible.

4: Not Understanding What’s Covered: Assuming comprehensive covers collisions or collision covers theft leads to claim surprises.

5: Focusing Only on Premium Cost: Cheapest isn’t always best ensure adequate coverage across all policy components.

The Bottom Line

Collision and comprehensive insurance protect your vehicle investment, but they’re not always necessary. Your decision should balance vehicle value, financial situation, risk tolerance, and replacement ability.

For most drivers with newer vehicles or those they can’t afford to replace, maintaining both coverages makes sense. For drivers with older, lower-value vehicles and adequate savings, dropping one or both can save money without excessive risk.

Whatever you decide, ensure you maintain robust liability coverage and uninsured motorist protection these protect you from financial devastation, not just vehicle replacement costs.

Our auto insurance specialists help drivers understand coverage options and make informed decisions balancing protection with affordability. We provide comprehensive Auto Insurance guidance and help bundle policies with Home Insurance for maximum savings.

Frequently Asked Questions

Hit-and-run accidents involving your parked car are typically covered under collision insurance, not comprehensive, because it involves impact with another vehicle. You’d pay your collision deductible, and your insurer would cover repairs. However, your uninsured motorist property damage coverage might apply in some states, potentially with a lower or no deductible.

Animal strikes are covered under comprehensive insurance, not collision even though you technically collided with the animal. Insurance categorizes this as comprehensive because animals are unpredictable hazards like weather or falling objects. If you swerve to avoid an animal and hit a tree or guardrail instead, that’s collision coverage.

Collision claims, especially at-fault accidents, typically increase your rates at renewal. Comprehensive claims often have less impact on rates since they involve circumstances beyond your control. However, multiple claims of any type can affect your premiums. Some insurers offer accident forgiveness programs where your first claim doesn’t increase rates.