Auto liability insurance is the only coverage legally required in most states, yet it’s also the most misunderstood. Many drivers carry state minimum limits thinking they’re adequately protected only to discover after serious accidents that their coverage falls drastically short of the damages they owe.

Here’s the harsh reality: If you cause an accident resulting in $500,000 in medical bills and lost wages but carry only $100,000 in liability coverage, you’re personally responsible for the remaining $400,000. Plaintiffs can pursue your home, savings, wages, and future earnings to collect what your insurance doesn’t cover.

Here in this guide we’ll explain exactly what auto liability insurance covers, why state minimums are dangerously inadequate, and how to determine appropriate coverage protecting your assets and financial future.

What Is Auto Liability Insurance?

Auto liability insurance pays for injuries and property damage you cause to others in accidents where you’re at fault. It’s the foundation of every auto insurance policy and legally mandated in almost every state.

The Two Components of Liability Coverage

Liability coverage includes two distinct parts:

Bodily Injury Liability: Pays for injuries you cause to other people, including:

- Medical expenses and hospital bills

- Rehabilitation and ongoing treatment costs

- Lost wages and loss of earning capacity

- Pain and suffering compensation

- Wrongful death claims if fatalities occur

- Legal defense costs if you’re sued

Property Damage Liability: Pays for damage you cause to others’ property:

- Other vehicles you damage in accidents

- Buildings, fences, or structures you hit

- Mailboxes, guardrails, or traffic signals

- Personal property inside other vehicles

- Utility poles or other public property

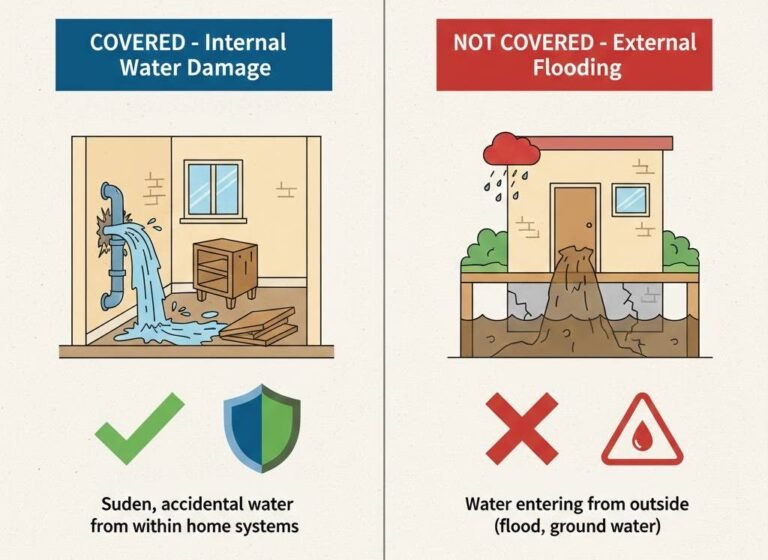

What Liability Insurance Doesn’t Cover

Understanding limitations prevents false assumptions:

- Your Own Injuries: Liability doesn’t cover your medical expenses medical payments/PIP coverage handles this

- Your Own Vehicle Damage: You need collision coverage for your vehicle repairs

- Intentional Acts: Deliberately causing accidents voids coverage

- Business Use: Personal liability excludes commercial vehicle use

- Damage Beyond Policy Limits: You’re personally liable for amounts exceeding your coverage limits

How Auto Liability Limits Work

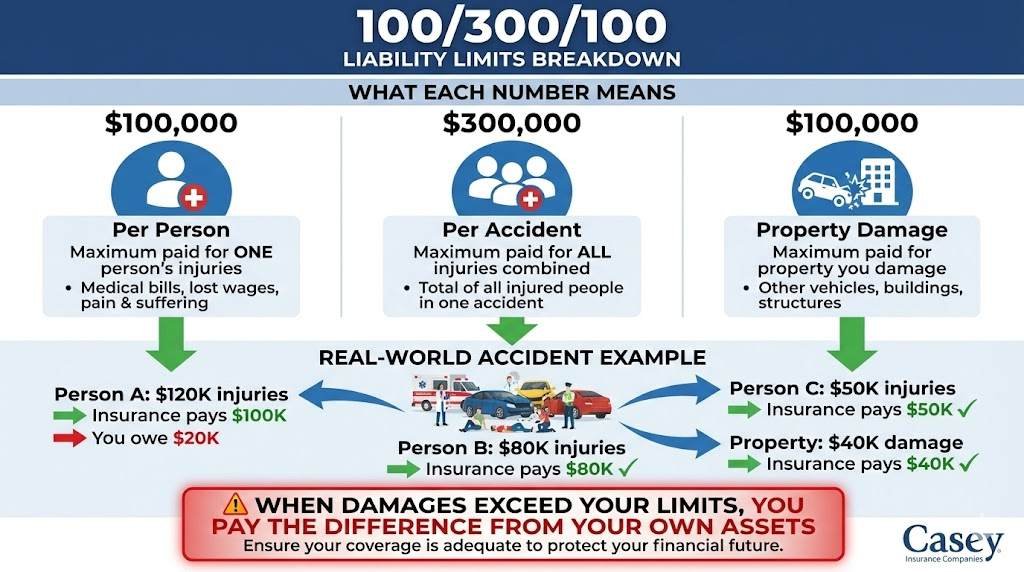

Liability coverage is expressed as three numbers representing maximum payouts per accident.

Understanding the Numbers

You’ll see limits written as: 100/300/100 or $100,000/$300,000/$100,000

- First Number (100): Bodily injury per person maximum paid for one person’s injuries

- Second Number (300): Bodily injury per accident maximum paid for all injuries in one accident combined

- Third Number (100): Property damage per accident maximum paid for property damage you cause

Example in Action:

You cause an accident injuring three people with these damages:

- Person 1: $120,000 in medical bills

- Person 2: $80,000 in medical bills

- Person 3: $50,000 in medical bills

- Total: $250,000 in injuries

With 100/300/100 coverage:

- Person 1 receives $100,000 (your per-person limit), you owe $20,000 personally

- Person 2 receives $80,000 (within limit)

- Person 3 receives $50,000 (within limit)

- Total insurance pays: $230,000, you owe $20,000 from your assets

With only 50/100/50 coverage (common state minimums):

- Person 1 receives $50,000 (your per-person limit), you owe $70,000

- Person 2 receives $50,000 (limit reached), you owe $30,000

- Person 3 receives $0 (total accident limit reached), you owe $50,000

- Total insurance pays: $100,000, you owe $150,000 personally

This demonstrates why adequate limits matter enormously.

State Minimum Requirements vs. Adequate Coverage

Every state (except New Hampshire and Virginia with special provisions) requires minimum liability coverage. These minimums are dangerously inadequate.

Common State Minimum Limits

Low-Requirement States: 25/50/25 or 25/50/10

- Examples: California (15/30/5), Florida (10/20/10), Texas (30/60/25)

Moderate-Requirement States: 50/100/25 to 50/100/50

- Examples: Maine (50/100/25), Utah (25/65/15)

Higher-Requirement States: 100/300/100

- Examples: Alaska (50/100/25), Kansas (25/50/25)

Why State Minimums Are Inadequate

State minimums were established decades ago and haven’t kept pace with medical costs, vehicle values, or legal judgments:

Medical Costs Have Soared: Average hospital stays now cost $15,000-$30,000+. Serious injuries requiring surgery, rehabilitation, and ongoing care easily exceed $100,000-$500,000.

Vehicle Values Have Increased: Modern vehicles cost $30,000-$60,000+. Totaling just one vehicle can approach or exceed property damage minimums.

Multi-Vehicle Accidents: Causing a chain-reaction accident damaging multiple vehicles quickly exhausts low property damage limits.

Legal Judgments Are Substantial: Juries regularly award six and seven-figure judgments for serious injuries involving permanent disabilities, lost earning capacity, or chronic pain.

Carrying state minimums means you’re self-insuring everything above those limits an enormous financial risk for minimal premium savings.

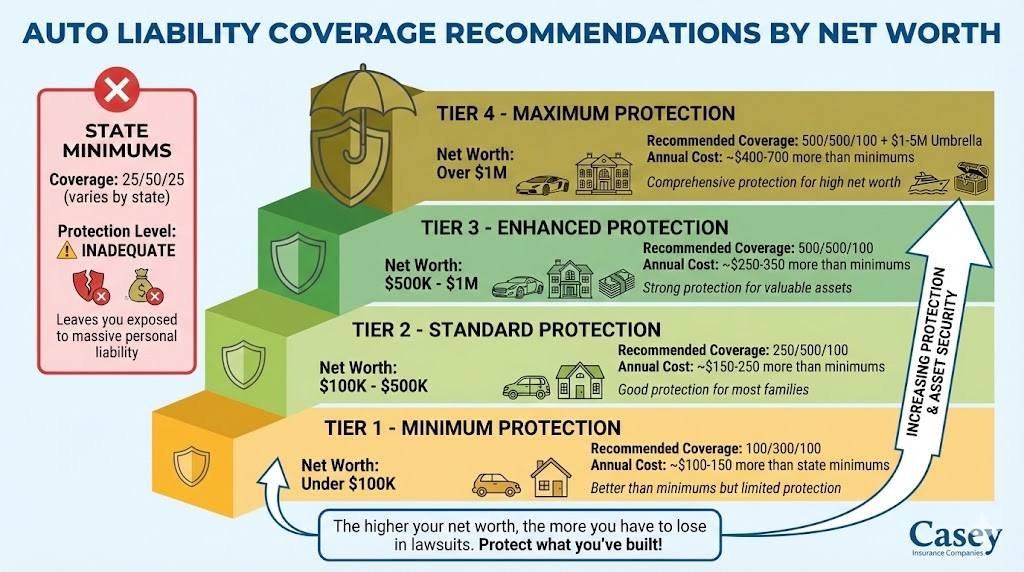

How Much Liability Coverage Do You Actually Need?

Determining appropriate coverage requires honest assessment of your financial situation and risk exposure.

1. The Asset Protection Rule

Basic Guideline: Carry liability coverage at least equal to your total net worth (assets minus debts).

Calculate your net worth:

- Home equity

- Retirement accounts

- Savings and investment accounts

- Vehicle values

- Other assets

Example: If you have $400,000 in total net worth, carry at least $500,000 in combined liability coverage (250/500/100 or higher).

Why: Plaintiffs in lawsuits can pursue all your assets to satisfy judgments exceeding insurance limits. Adequate coverage protects what you’ve built.

2. Recommended Minimum Coverage Levels

Regardless of assets, consider these minimums based on your situation:

Basic Protection (Modest assets, minimal risk): 100/300/100

- Adequate for most single-vehicle accidents

- Protects against common injury scenarios

- Covers most property damage situations

Standard Protection (Moderate assets, typical risk): 250/500/100

- Better protection for serious injuries

- Covers multi-injury accidents more adequately

- Recommended for homeowners and families

Enhanced Protection (Substantial assets, higher risk): 500/500/100 or higher

- Comprehensive protection for serious accidents

- Appropriate for high-net-worth individuals

- Often paired with umbrella policies

High Net Worth ($1M+ assets): 500/500/100 PLUS umbrella coverage

- Maximum liability limits on auto policy

- $1-5 million umbrella policy adding additional protection

- Essential for protecting significant assets

3. Special Considerations Requiring Higher Limits

Increase coverage beyond basic recommendations if you:

Have Teenage Drivers: New drivers have higher accident rates, increasing liability exposure

Drive in Congested Urban Areas: More vehicles and pedestrians mean higher accident probability and severity

Commute Long Distances: More time driving increases exposure

Have High-Value Vehicles: Expensive cars suggest you have assets worth protecting

Own Multiple Properties: Substantial real estate holdings attract larger lawsuits

Run a Business: Business assets can become targets in personal liability suits

Have High Income: Future earning potential is recoverable in judgments

The Cost of Adequate Liability Coverage

Increasing liability limits costs far less than most people expect.

Premium Differences

Typical cost increases for higher limits:

50/100/50 to 100/300/100: +$50-$100 annually

100/300/100 to 250/500/100: +$75-$150 annually

250/500/100 to 500/500/100: +$100-$200 annually

Example: Moving from state minimums (25/50/25) to recommended coverage (250/500/100) might cost just $150-$250 more annually minimal compared to protecting hundreds of thousands in assets from lawsuit exposure.

Why the Increase Is Small

Higher liability limits cost little more because:

- Most claims never reach upper limits

- Increased coverage provides proportionally small additional risk

- Insurers price based on claim frequency more than severity

- The difference between $100,000 and $500,000 limits is small relative to overall policy cost

Skimping on liability coverage to save $10-20 monthly is penny-wise and pound-foolish when facing potential six-figure personal liability.

Umbrella Insurance: The Ultimate Protection

For substantial asset protection, combine maximum auto liability limits with umbrella coverage.

What Umbrella Policies Provide

Umbrella insurance adds $1-5 million (or more) in additional liability coverage above your auto, home, and other policies. When auto liability limits are exhausted, umbrella coverage continues paying.

Example Scenario:

- Auto liability limits: 500/500/100

- Umbrella policy: $2 million

- Total protection: $2.5 million for bodily injury

Cost: Umbrella policies typically cost $150-$300 annually for $1 million coverage, then roughly $75-$100 per additional million.

Who Needs Umbrella Coverage

Consider umbrella policies if you:

- Have net worth exceeding $500,000

- Own multiple properties or rental properties

- Have high income (targets for lawsuits)

- Employ household help (nannies, cleaners, gardeners)

- Own boats, recreational vehicles, or pools

- Want maximum liability protection and peace of mind

Umbrella coverage is remarkably affordable protection for catastrophic liability exposure.

What Happens Without Adequate Coverage

Understanding consequences motivates proper coverage decisions.

Personal Financial Liability

When judgments exceed insurance limits, plaintiffs can pursue:

- Bank account garnishment

- Wage garnishment (often 25% of income until paid)

- Liens against your home and property

- Forced asset sales to satisfy judgments

- Bankruptcy as your only option

Judgments can haunt you for decades, destroying financial security and future opportunities.

Long-Term Impact

Inadequate coverage creates:

- Damaged credit from judgments and liens

- Difficulty obtaining future credit or loans

- Reduced ability to save for retirement

- Stress and anxiety affecting quality of life

- Family financial strain

The few hundred dollars saved annually on insurance premiums pale compared to these potential consequences.

Balancing Coverage and Affordability

If budget concerns prevent purchasing adequate coverage, prioritize strategically.

Cost-Saving Strategies

Increase Deductibles: Raising collision/comprehensive deductibles from $500 to $1,000-$1,500 can save enough to fund higher liability limits

Bundle Policies: Combining auto and home insurance saves 15-25%, freeing budget for better coverage

Shop Around: Liability costs vary significantly between insurers—compare quotes from multiple companies

Maintain Good Driving Record: Clean records earn discounts reducing overall premiums

Take Defensive Driving Courses: Often qualify for 5-10% discounts

Improve Credit Score: Better credit reduces premiums in most states

Drop Unnecessary Coverage: If you own an old vehicle outright, dropping collision/comprehensive frees money for liability protection

Never Sacrifice Liability to Save Money

If budget is tight, reduce other coverage components before touching liability limits. Liability protects you from financial devastation; other coverages protect your vehicle. Your financial future matters more than your car.

Your Path to Proper Protection

Auto liability insurance is non-negotiable protection for your financial security. State minimums provide false security adequate coverage requires thoughtful assessment of your assets, risks, and exposure.

Don’t gamble with everything you own to save $200 annually on insurance. One serious accident can wipe out decades of financial progress if you lack proper liability protection.

Our auto insurance specialists help drivers understand their true liability exposure and secure appropriate coverage protecting their assets and futures. We provide comprehensive Auto Insurance guidance including Collision Coverage, Comprehensive Coverage, and Uninsured Motorist Protection.

Frequently Asked Questions

Generally yes—liability coverage typically follows the driver as secondary coverage. The vehicle owner’s insurance pays first, and your liability coverage may provide additional protection if their limits are exhausted. However, coverage can be complex with borrowed vehicles—verify with your insurer before regularly driving vehicles you don’t own.

No—personal liability coverage excludes commercial use including rideshare. When your rideshare app is active, you need commercial or rideshare-specific coverage. Most personal policies void coverage entirely during commercial use, leaving you with zero protection and unlimited personal liability if accidents occur while ridesharing.

In comparative negligence states, liability is assigned by percentage. If you’re 70% at fault and the other driver 30%, your liability coverage pays 70% of their damages. In contributory negligence states, even 1% fault on the other driver’s part might eliminate your liability entirely. Your state’s laws determine how fault affects liability coverage application.