Planning to cruise the Mediterranean, explore Caribbean islands, or undertake a Pacific crossing in your superyacht? Before you cast off for international waters, understanding your insurance coverage becomes absolutely critical.

Many yacht owners discover too late that their marine insurance doesn’t extend beyond U.S. coastal waters or worse, that it provides coverage in international waters but doesn’t meet foreign country requirements. The result? You’re operating without valid protection thousands of miles from home, potentially facing catastrophic financial exposure if incidents occur.

Worldwide navigation coverage isn’t just about extending geographic boundaries on your policy. It involves complex considerations including foreign regulations, international maritime law, crew documentation, emergency services in remote locations, and coordination across multiple jurisdictions.

Planning a season in the Mediterranean, island-hopping through the South Pacific, or circumnavigating the globe, this article will guide you about worldwide yacht insurance coverage before leaving U.S. waters.

Understanding Navigation Territory Limits

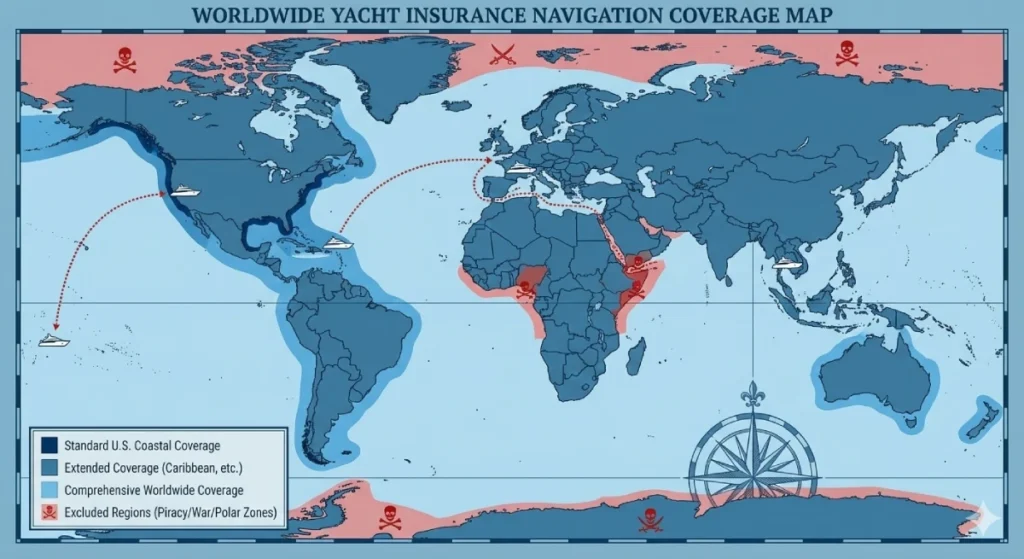

Every marine insurance policy includes navigation territory definitions specific geographic boundaries where your coverage applies. Operating outside these boundaries voids your protection entirely, regardless of what happens.

Standard U.S. Coastal Coverage

Most recreational yacht policies limit coverage to:

- U.S. coastal waters within 75-200 miles of shore

- Inland waters including the Great Lakes and major river systems

- Seasonal restrictions preventing offshore passages during hurricane season

- Specific geographic boundaries (East Coast only, Gulf Coast only, Pacific Coast only)

These limitations work fine for coastal cruising but completely fail international voyagers.

What “Worldwide Navigation” Actually Means?

Worldwide navigation coverage extends your insurance protection to essentially any navigable waters globally, including:

- Mediterranean Sea and European coastal waters

- Caribbean islands and Central American waters

- South Pacific island nations

- Transatlantic and transpacific ocean passages

- Southeast Asian waters

- Australian and New Zealand coasts

- South American waters

- African coastal regions

However, “worldwide” doesn’t mean unrestricted. Most policies still exclude specific high-risk areas including active war zones, piracy regions, or politically unstable areas. Insurers update these exclusions regularly based on current threats.

Our High-Value Worldwide Navigation coverage provides comprehensive international cruising protection designed for superyacht owners planning extensive global voyages.

Does Yacht Insurance Cover International Waters?

The short answer: only if your policy specifically includes international or worldwide navigation coverage. Standard policies absolutely do not.

International Waters vs. Foreign Territorial Waters

Understanding the distinction matters for insurance purposes:

- International Waters (high seas) lie beyond any country’s territorial jurisdiction—typically beyond 12 nautical miles from coastlines. Here, your yacht flies under your flag state’s laws and regulations.

- Foreign Territorial Waters fall within a nation’s jurisdiction, typically extending 12 nautical miles from shore, sometimes further for exclusive economic zones. Here, you must comply with that country’s maritime laws and insurance requirements.

Your worldwide navigation coverage must address both scenarios. Operating in international waters requires your insurer’s authorization for extended offshore passages. Entering foreign territorial waters may require additional documentation proving adequate coverage meeting that nation’s specific requirements.

U.S. vs. International Coverage Differences

Standard U.S.-only coverage differs dramatically from worldwide policies:

U.S. Coverage Limitations:

- No protection in foreign waters or international waters beyond policy limits

- Claims occurring outside covered territory are denied entirely

- Emergency services only within U.S. coastal areas

- No compliance with foreign insurance requirements

Worldwide Coverage Benefits:

- Protection anywhere within agreed navigation territory

- Coverage for extended offshore passages

- Compliance documentation for foreign ports

- International claims handling and emergency services

- Foreign repair facility authorization

Before any international voyage, verify your policy explicitly includes worldwide navigation. Don’t assume confirm in writing.

Foreign Country Insurance Requirements

Nearly every nation requires visiting vessels to carry minimum insurance coverage and provide proof upon entry.

Common International Requirements

Most countries mandate:

- Minimum Liability Coverage: Typically $300,000 to $1 million in third-party liability protection. European Union ports often require €2-3 million.

- Pollution Liability: Separate environmental coverage, usually $100,000-$500,000, protecting against fuel spills and environmental damage.

- Wreck Removal Coverage: Proof you can pay to remove your vessel if it sinks or becomes a navigation hazard.

- Local Insurance Certificates: Many nations require you to obtain local certificates or “blue cards” proving coverage validity in their waters.

Regional Variations

Different regions have specific requirements:

- European Union: Requires substantial liability coverage and strict pollution protection. Many Mediterranean countries require pre-arrival insurance documentation.

- Caribbean Nations: Requirements vary widely by island. Some require minimal coverage; others mandate significant liability limits.

- Pacific Islands: Remote nations often have minimal formal requirements but may require proof of adequate coverage for port entry.

- Southeast Asia: Requirements vary dramatically by country. Some have stringent rules; others have minimal oversight.

Failure to provide adequate documentation can result in denied port entry, fines, detention of your vessel, or forced departure.

Coverage Components Essential for International Cruising

Worldwide navigation requires more than just extended geographic boundaries you need comprehensive coverage components specifically designed for international operations.

Hull and Machinery Protection Abroad

Your hull coverage must extend internationally, addressing:

- Foreign Repair Facilities: Authorization to use non-U.S. repair yards with different labor rates, parts availability, and quality standards.

- Currency Fluctuations: Claims settled in foreign currencies can create exchange rate complications. Quality policies address this clearly.

- Extended Repair Times: International repairs often take longer due to parts shipping, customs clearance, and facility availability. Policies should cover extended layover costs.

- Salvage and Towing: Emergency services in remote international waters cost exponentially more than coastal U.S. assistance. Ensure adequate coverage.

International Liability Coverage

Liability protection becomes more complex internationally:

- Foreign Jurisdiction Claims: Legal systems vary dramatically. Your policy should provide defense in foreign courts and cover settlements under international maritime law.

- Crew Injuries Abroad: Maritime employment law differs by flag state and incident location. Comprehensive coverage addresses these complications.

- Third-Party Damage in Foreign Ports: Collisions or property damage in foreign marinas create complex liability situations requiring specialized coverage.

- Higher Minimum Limits: Carry $2-5 million in liability coverage for international cruising. Many regions require or strongly recommend these elevated limits.

Medical and Emergency Services

International medical situations require specialized coverage:

- Crew Medical Care: Comprehensive medical coverage for crew injuries or illness in foreign countries where healthcare costs and quality vary dramatically.

- Medical Evacuation: Emergency transportation from remote locations to adequate medical facilities can cost $50,000-$100,000+.

- Repatriation: Coverage for returning injured crew members to their home countries.

- Guest Medical: Protection if guests aboard suffer injuries or medical emergencies requiring care abroad.

Planning Your International Cruising Route

Your insurance considerations should inform route planning, not just follow it.

Advance Notice Requirements

Most worldwide policies require advance notification before:

- Transatlantic or transpacific crossings

- Extended passages over specific distances (typically 500+ nautical miles offshore)

- Entering certain high-risk regions

- Seasonal voyages during hurricane or typhoon seasons

Notify your insurer 30-60 days before major passages. Some require approval; others simply need notification but may adjust terms or premiums.

Seasonal Restrictions and Approvals

Worldwide coverage often includes seasonal limitations:

- Hurricane Season: Caribbean and Gulf of Mexico passages may be restricted June through November. Some insurers require vessels to relocate to safer regions or take shelter during peak storm periods.

- Typhoon Season: Western Pacific and Southeast Asian waters face restrictions during typhoon season (June-November).

- High-Risk Periods: Mediterranean mistral season, Southern Ocean winter passages, and monsoon periods may require special approval.

Violating seasonal restrictions voids coverage. Plan your cruising schedule around these limitations or obtain specific seasonal endorsements.

Excluded Regions and High-Risk Areas

Even “worldwide” coverage excludes certain regions:

War Zones: Active conflict areas are universally excluded. These change regularly verify current exclusions before planning routes.

Piracy Regions: Areas with significant piracy risk (historically parts of Somalia, Gulf of Aden, certain Southeast Asian waters) may be excluded or require additional premium and security measures.

Sanctioned Nations: U.S. sanctions prohibit travel to certain countries. Your insurance won’t cover claims in sanctioned nations regardless of policy terms.

Polar Regions: Arctic and Antarctic waters typically require special endorsements due to extreme conditions and limited emergency services.

Review your policy’s current exclusion list and verify any questionable routes with your insurer before departure.

Crew Considerations for International Voyaging

Professional crew on international voyages create unique insurance requirements.

1. Crew Coverage Requirements

Comprehensive crew coverage for worldwide cruising includes:

Jones Act Liability: U.S.-flagged vessels must provide this coverage for American crew regardless of location when injuries occur.

Foreign Crew Regulations: Crew from different nations have varying protections under their home country laws and international maritime conventions.

Work Permits and Documentation: Crew working in foreign waters need proper documentation. Insurance should cover legal issues arising from documentation problems.

Crew Repatriation: Coverage for returning crew to home countries from foreign ports if they’re injured, ill, or employment terminates.

2. Flag State Implications

Your yacht’s flag registration affects insurance coverage internationally:

U.S. Flag: Subjects you to U.S. maritime law globally, including Jones Act crew protections and Coast Guard regulations.

Foreign Flags of Convenience: Many superyacht owners register under flags like Cayman Islands, Marshall Islands, or Malta for regulatory and tax advantages. This changes insurance requirements and crew protections.

Dual Registration: Some yachts maintain dual registration. Ensure your insurance addresses complications from this arrangement.

Your flag state determines which maritime laws govern your vessel internationally. Align your insurance coverage with your chosen flag’s requirements.

3. Emergency Services and Claims Handling Abroad

When emergencies occur thousands of miles from home, your insurer’s international capabilities become critical.

24/7 Global Assistance

Quality worldwide navigation coverage includes:

Emergency Hotlines: Direct access to claims specialists and emergency coordinators regardless of time zone.

Multilingual Support: Representatives speaking languages relevant to your cruising regions.

Local Service Coordination: Networks of approved surveyors, repair facilities, and maritime services globally.

Parts and Equipment Sourcing: Assistance locating and shipping parts to remote locations, managing customs clearance.

4, Claims Processing from Abroad

International claims involve complications that domestic claims never face:

Initial Reporting: Must occur promptly despite time zones, communication challenges, or remote locations. Most policies require claims reporting within 24-72 hours.

Foreign Surveyors: Insurers dispatch approved surveyors to assess damage. In remote locations, this can take days or weeks.

Repair Authorization: You’ll typically need insurer approval before proceeding with repairs, though emergency repairs preventing further damage are usually pre-authorized.

Payment Logistics: Foreign repair facilities may require payment before releasing your vessel. Your insurer should advance funds or provide guarantees to reputable facilities.

Documentation Requirements: Foreign claims require extensive documentation: estimates, invoices, photos, surveyor reports, police reports if applicable, and customs documentation.

Choose insurers with proven international claims experience. Their global networks and established procedures make enormous differences during crises abroad.

5. Cost Considerations for Worldwide Coverage

Worldwide navigation coverage costs more than restricted coastal policies, but the increase may be more modest than you expect.

Premium Factors

Worldwide coverage premiums depend on:

Cruising Plans: Comprehensive worldwide coverage costs 20-40% more than U.S. coastal-only. Limited international endorsements (Caribbean only, Mediterranean season only) cost less.

Vessel Value: Higher-value superyachts already pay substantial premiums. The worldwide endorsement represents a smaller percentage increase.

Flag Registration: Foreign flag registrations may reduce or increase premiums depending on the flag state and its maritime safety record.

Experience: Extensive international cruising experience with clean records earn better rates. First-time world cruisers pay premium increases of 15-30%.

Crew: Professional captain and crew may reduce premiums due to greater expertise, offsetting some worldwide coverage costs.

Safety Equipment: Advanced navigation, communication, and safety systems qualify for discounts that partially offset worldwide coverage increases.

Is Worldwide Coverage Worth the Cost?

For serious cruisers, worldwide coverage isn’t optional—it’s essential. The premium increase of $5,000-$15,000 annually provides protection worth millions if incidents occur abroad.

Consider what’s at risk: your multi-million dollar vessel, personal liability potentially reaching $10+ million, crew welfare, and guest safety. Operating internationally without proper coverage exposes you to catastrophic financial loss.

Preparing Your Yacht for International Cruising

Beyond insurance, properly preparing your vessel for worldwide cruising protects your investment and ensures compliance.

Required Documentation

Organize and maintain:

Insurance Certificates: Multiple copies including originals, translated versions for non-English countries, and digital backups.

Registration and Documentation: Current vessel registration, foreign flag documentation if applicable, radio licenses.

Safety Certificates: Required safety equipment certifications, SOLAS compliance if applicable, pollution prevention certificates.

Crew Documentation: Passports, visas, crew lists, maritime credentials, work permits.

Customs Documents: Ship’s stores declarations, equipment lists, temporary import documents.

Safety and Communication Equipment

Ensure your vessel includes:

Advanced Navigation: GPS, radar, electronic charts covering your route, backup systems.

Communication Systems: Satellite phone, VHF radio, SSB radio for offshore passages, EPIRB (Emergency Position Indicating Radio Beacon).

Safety Equipment: Life rafts, survival suits, medical supplies, firefighting equipment beyond minimum requirements.

Monitoring Systems: Tracking systems allowing your insurer and emergency services to locate you anywhere globally.

Quality insurers provide checklists of required equipment and documentation for worldwide cruising.

Working with Worldwide Navigation Insurance Specialists

International yacht insurance requires expertise that general marine agents rarely possess.

Finding the Right Insurance Partner

Look for agents and insurers with:

- International Experience: Extensive history insuring worldwide cruising yachts, not just coastal vessels.

- Global Networks: Established relationships with international surveyors, repair facilities, and maritime services.

- Multiple Cruiser References: Client testimonials from yacht owners who’ve actually cruised internationally with their coverage.

- Responsive Communication: Agents available across time zones who understand international cruising realities.

- Comprehensive Service: Not just policy sales but ongoing support including route consultations, documentation assistance, and emergency coordination.

Our Private Client Luxury Yacht specialists understand international cruising requirements and provide the comprehensive worldwide coverage serious voyagers need.

Your Passport to Safe International Cruising

Worldwide navigation coverage transforms your superyacht from a coastal cruiser into a global explorer. The freedom to cruise Mediterranean islands, explore Caribbean waters, cross oceans, and discover remote Pacific destinations represents the ultimate yachting experience.

But this freedom requires proper protection. Operating internationally without comprehensive worldwide coverage exposes you to financial risks that could end not just your voyage but threaten your entire financial security.

Before you cast off for international waters, ensure you have genuine worldwide navigation coverage from insurers who understand global cruising. Verify your policy meets foreign requirements, provides adequate liability protection, includes emergency services anywhere you’ll cruise, and offers expert claims handling across international boundaries.

The investment in proper worldwide coverage is modest compared to your yacht’s value and the experiences international cruising provides. More importantly, it delivers peace of mind that you’re truly protected wherever your adventures take you.

Ready to explore worldwide navigation coverage for your international cruising plans? Our experienced team helps superyacht owners secure comprehensive protection for global voyaging, ensuring you’re properly covered from departure through return—and everywhere in between.

For additional coverage needs, we provide specialized Commercial Insurance and comprehensive Personal Lines Insurance protecting all your valuable assets.

Frequently Asked Questions About Worldwide Yacht Navigation Coverage

Notify your insurer at least 30-60 days before major international passages, especially transatlantic or transpacific crossings. This provides time to review your route, confirm coverage applies to planned destinations, secure any necessary endorsements, obtain required documentation for foreign ports, and address any policy adjustments needed. Some insurers require formal approval for certain passages—waiting until departure is too late if approval is denied or modifications needed. For extended world cruising (6+ months), discuss plans even earlier to ensure comprehensive arrangements. Last-minute notifications create unnecessary stress and may result in coverage gaps if your insurer needs time to coordinate international protections.

Quality worldwide navigation policies include emergency response capabilities even in remote locations without local representatives. Your insurer typically dispatches an approved surveyor from the nearest available location (potentially from another country) to assess damage. Meanwhile, you document everything thoroughly with photos, videos, written descriptions, and estimates from local facilities. Your insurer’s 24/7 emergency line coordinates this process, often authorizing emergency repairs preventing further damage before surveyors arrive. For major claims in extremely remote locations, surveyors may take 3-7 days to reach you.

Coverage for tenders, jet skis, and water toys varies by policy. Many high-value yacht policies automatically include tenders and water toys within your navigation territory, including foreign countries, but with sub limits (typically $25,000-$100,000 depending on equipment value). However, some policies require separate scheduling of high-value tenders or have restrictions on powered tenders over certain sizes.

This is complex and exactly why specialized international yacht insurance matters. Maritime law varies by jurisdiction, and liability claims may be governed by: the law where the incident occurred, your yacht’s flag state law, international maritime conventions, or the plaintiff’s home country law depending on circumstances. Quality worldwide navigation policies provide legal defense under multiple jurisdictions and work with maritime attorneys experienced in international claims. The insurer manages defense across international legal systems, though limits and coverage terms remain consistent regardless of jurisdiction. This is dramatically different from standard U.S.-only policies that exclude foreign jurisdiction claims entirely. Always review your policy’s jurisdictional coverage language—vague terms may create disputes during international claims.