You’re enjoying a spontaneous cruise to the Bahamas when your engine fails 100 miles offshore. You reach for your phone to call your insurer then realize with horror that you might not be covered. You’ve sailed outside your policy’s navigation limits.

Navigation limits are invisible boundaries defining exactly where your boat insurance provides protection. Cross them, even briefly, and your coverage vanishes instantly. No hull protection, no liability coverage, no emergency assistance nothing.

Understanding these boundaries and how to extend them properly could save you from devastating claim denials.

What Are Navigation Limits?

Navigation limits are geographic boundaries written into your policy. They’re not suggestions they’re contract terms that completely void your insurance when violated.

Common Navigation Restrictions

Most recreational boat policies include one of these standard limits:

- Inland Waters Only: Specific lakes, rivers, or protected bays—no coastal access

- Coastal Waters: Within 50-200 miles of U.S. coastline only

- U.S. Waters Only: All U.S. coastal and inland waters but no international territories

- Regional Restrictions: East Coast only, Gulf Coast only, Great Lakes only, or Pacific Coast only

- Seasonal Restrictions: Certain areas prohibited during hurricane season or winter months

Your policy specifies exactly which applies. Never assume coverage extends beyond these stated limits.

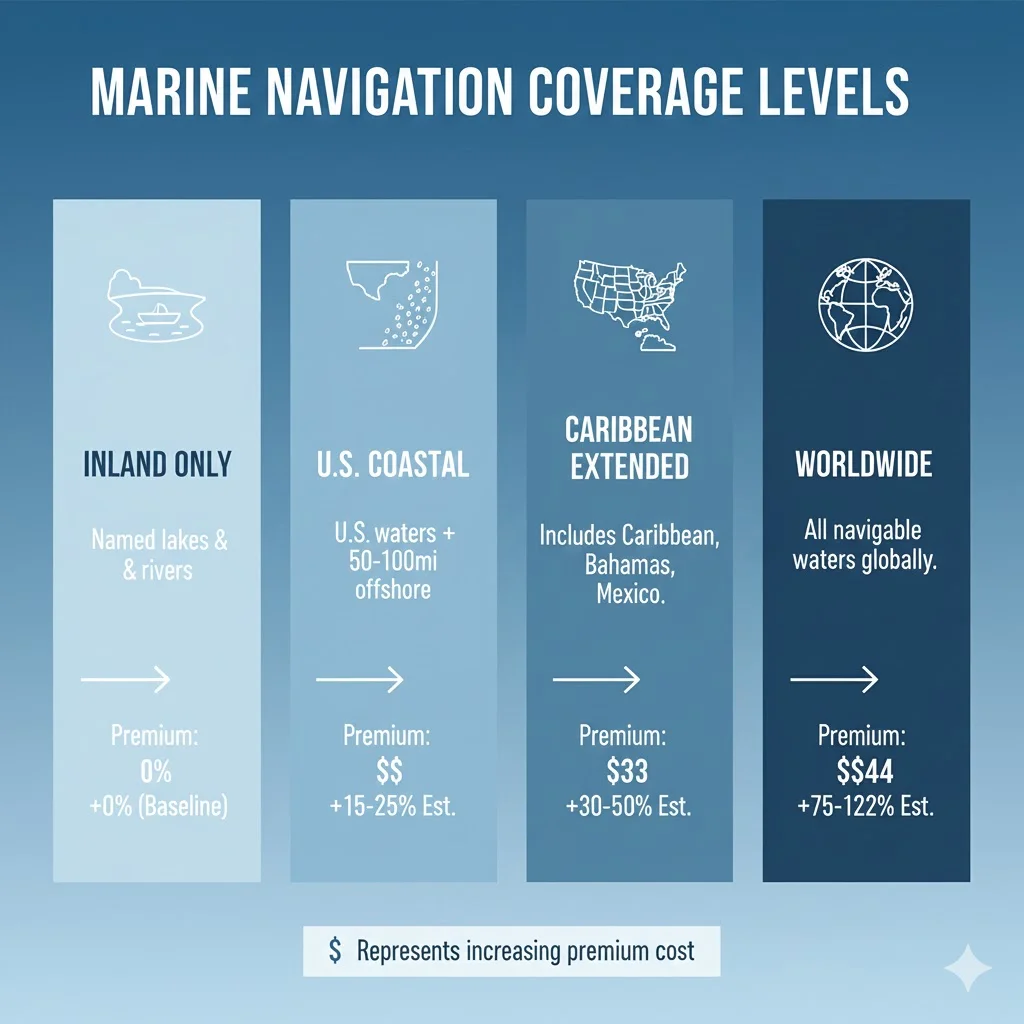

Navigation Coverage Levels & What They Include

| Coverage Level | Geographic Coverage | Typical Distance from Shore | Example Destinations Covered | Approximate Premium Range* | Best For |

|---|---|---|---|---|---|

| Inland Waters Only | Named lakes, rivers, protected bays | N/A (no ocean access) | Specific inland waterways only | $800 – $1,500/year | Small fishing boats, pontoons on lakes |

| Basic U.S. Coastal | U.S. coastline only | 25-75 miles offshore | Day trips, near-coastal cruising | $1,200 – $2,500/year | Weekend coastal boaters |

| Extended U.S. Coastal | U.S. coastline only | 100-200 miles offshore | Extended coastal passages, some offshore fishing | $1,500 – $3,000/year | Serious coastal cruisers |

| Caribbean/Bahamas | U.S. + Bahamas + Caribbean islands | Varies by route | Florida to Bahamas, Caribbean island hopping | $1,800 – $4,000/year | Seasonal tropical cruisers |

| Worldwide Navigation | All navigable waters globally | Unlimited | Mediterranean, South Pacific, transatlantic crossings | $2,500 – $6,000+/year | Blue water cruisers, circumnavigators |

*Premium ranges based on $100,000 boat value. Actual costs vary by vessel type, age, owner experience, and specific insurer.

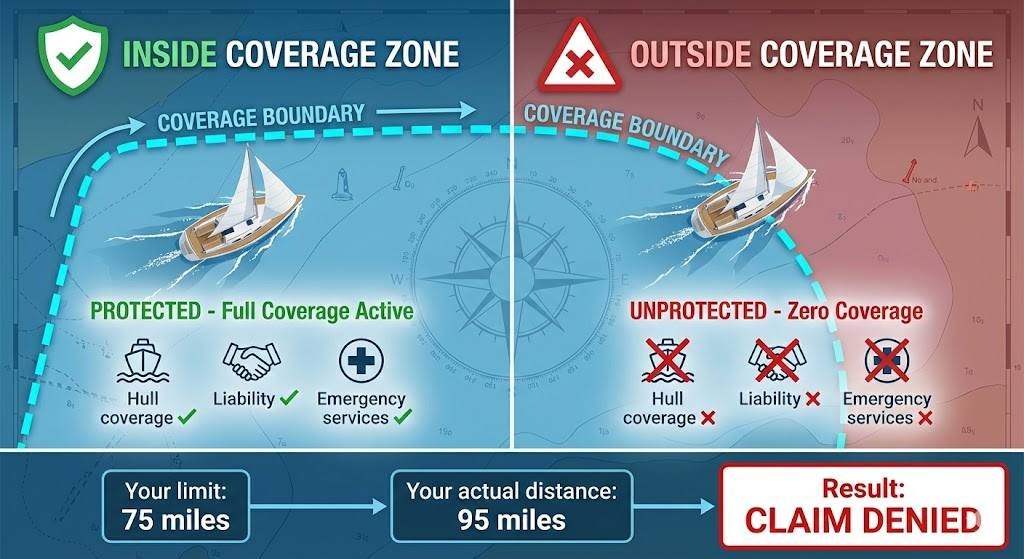

What Happens When You Violate Navigation Limits?

The consequences are immediate and severe.

Complete Coverage Loss

The moment you enter unauthorized territory:

- All coverage voids: Hull, liability, medical payments, towing, everything disappears

- No partial protection: You don’t get reduced coverage, you get zero coverage

- Damage claims denied: Engine failure, collision, sinking, all denied

- Personal liability exposure: Injuries or property damage become your personal responsibility

- No emergency services: Insurers won’t provide or pay for rescue, towing, or assistance

Real-World Claim Denials Examples

1: Owner with 75-mile coastal limit ventures 90 miles offshore for fishing. Engine fails. $8,000 towing bill. Claim denied outside limits.

2: Boat insured for “U.S. waters only” cruises to Bahamas. Hits reef causing $40,000 damage. Entire claim denied international waters excluded.

3: Vessel prohibited from “hurricane season offshore passages” attempts September ocean crossing. Storm damage occurs. Coverage void seasonal restriction violated.

How Insurers Prove Violations

When investigating claims, insurers examine:

- GPS tracking data

- Logbook entries

- Marina receipts and fuel stops

- Photo metadata showing locations

- Coast Guard reports

- Witness statements

If evidence shows you operated outside limits when damage occurred, expect complete claim denial.

Why Navigation Limits Exist

Insurers impose limits based on risk-based underwriting:

- Inland Waters: Calm conditions, short distances, nearby repairs, lowest risk, lowest premiums

- Coastal Waters: Increased weather exposure, navigation hazards, higher rescue costs, moderate risk, moderate premiums

- Offshore/International: Extreme weather potential, remote locations, limited emergency services, foreign jurisdiction complexities highest risk, highest premiums

Your premium reflects your stated navigation territory. Operating beyond it means you’re underinsured for the actual risk exposure.

How to Extend Your Navigation Limits

If you want to venture beyond current limits, proper extensions prevent coverage problems.

Permanent Navigation Extensions

For ongoing expanded cruising:

- Contact your insurer 30-60 days in advance

- Provide cruising details: Where you’ll go, how often, vessel qualifications

- Expect premium increases: Extended coverage typically costs 15-40% more

- Get written confirmation of new limits before departing

- Update as needed when cruising plans change

Our Worldwide Navigation coverage for private vessels and High-Value Worldwide Navigation for luxury yachts provide comprehensive international protection.

Temporary Navigation Endorsements

For one-time trips outside normal territory:

- Request temporary extension 2-4 weeks before departure

- Specify exact routes and destinations

- Pay additional premium (typically $200-$1,000 depending on trip)

- Obtain written confirmation before leaving

- Carry documentation aboard during the extended cruise

Never depart hoping to “deal with it later.” Get extensions before you need them.

International Waters Considerations

Cruising beyond U.S. waters requires specialized coverage and compliance with foreign requirements.

Foreign Country Requirements

Most nations require visiting vessels to carry:

- Minimum liability coverage: Often $300,000-$1 million

- Pollution liability: Environmental damage coverage

- Local insurance certificates: Proof meeting their standards

- Wreck removal coverage: Ability to pay for vessel removal

Without proper coverage, you may face denied port entry, fines, vessel detention, or forced departure.

International Claims Handling

Operating internationally requires insurers with:

- Global claims networks and foreign language capabilities

- International repair facility relationships

- Experience with foreign maritime law

- Ability to advance funds in foreign currencies

Standard U.S. only insurers lack these capabilities, leaving you stranded when problems occur abroad.

Offshore Distance Limitations

Coastal policies often restrict how far offshore you can operate:

- Basic Coastal: 25-50 miles from shore (day trips only)

- Standard Coastal: 75-150 miles from shore (most coastal cruising)

- Extended Coastal: 200-250 miles from shore (reaches Bahamas/near Caribbean)

- Unlimited Offshore: No distance restrictions (required for ocean crossings)

Know your exact limits. A 50-mile restriction means Bahamas trips from Florida aren’t covered.

The Cost of Proper Coverage

Extended navigation coverage costs more, but increases are often reasonable compared to exposure.

Typical Premium Increases

Adding 50-100 Miles Offshore: 10-20% premium increase

Caribbean/Bahamas Extension: 15-30% increase

Full Worldwide Coverage: 25-50% increase

Seasonal Tropical Cruising: 20-35% increase

For a $100,000 boat paying $1,500 annually for U.S. coastal coverage, adding Caribbean coverage might cost just $300-$450 more minimal compared to protecting a $100,000 vessel plus unlimited liability exposure.

Planning Cruises Within Your Coverage

Before any cruise:

Pre-Departure Checklist

- Review your policy’s exact navigation limits

- Map your planned route against coverage boundaries

- Contact your insurer about any questionable areas

- Obtain extensions before departing if needed

- Carry documentation of coverage limits and extensions

- Keep logs documenting your route

If Extensions Aren’t Possible

- Modify your route to remain within covered territory

- Postpone trips until proper coverage is obtained

- Understand you’re self-insuring if you proceed anyway

Never operate outside limits hoping nothing will happen. Problems occur precisely when you’re unprotected.

Penalties Beyond Claim Denial

Violating navigation limits creates problems beyond immediate claim denial:

- Policy Cancellation: Insurers may cancel your policy immediately or refuse renewal

- Future Coverage Issues: Violations reported to industry databases make future insurance expensive or unavailable

- Legal Problems: Operating without valid coverage can violate marina requirements, lender terms, or regulations

- Personal Liability: No insurance protection means unlimited personal exposure if you injure someone or damage property

Modern Tracking and Compliance

GPS and tracking systems make compliance easier and violations harder to hide:

- Many boats include tracking devices recording location continuously

- This technology proves compliant owners operated within limits

- It also exposes violators attempting to hide unauthorized cruising

Maintain detailed logs recording daily positions, routes, weather, and fuel stops. Proper documentation proves compliance when questions arise.

Working with Navigation Coverage Specialists

Proper navigation coverage requires working with marine insurance professionals who understand cruising needs.

Quality specialists help you:

- Understand current limits clearly

- Plan coverage matching actual cruising habits

- Obtain extensions efficiently when needed

- Avoid coverage gaps

- Navigate international requirements

Our team provides comprehensive navigation coverage and works with cruisers planning international voyages to ensure proper protection wherever you sail. We also offer complete marine protection including Hull Coverage, Liability Coverage, and Hurricane Coverage.

The Bottom Line

Navigation limits are serious policy provisions with severe consequences when violated. A single cruise outside covered territory can result in complete claim denial, policy cancellation, and unlimited personal liability.

Know your limits, plan cruises accordingly, and obtain proper extensions before venturing beyond covered areas. The modest cost of extended coverage is nothing compared to the catastrophic exposure of operating without valid protection.

Don’t discover your limits only when filing denied claims from international waters or offshore locations. Review your policy now, understand exactly where you’re covered, and ensure your insurance matches where you actually cruise.

FAQs About Insurance Navigation Limits

Genuine emergencies forcing you outside limits may maintain coverage if you can prove the situation was beyond your control and you took reasonable actions. However, deliberately approaching boundaries hoping conditions hold, then claiming emergency when they deteriorate, won’t be covered. Document everything if emergencies occur and contact your insurer immediately.

No. Navigation limits apply only to waterborne operation. You can trailer your boat anywhere without violating navigation limits. Coverage while trailering falls under transport provisions, but geographic limits don’t apply to land transport.

Yes. Many policies include seasonal variations broader limits during summer with restrictions during winter or hurricane season. Review your policy carefully to understand when different limits apply and comply with all seasonal requirements.