When purchasing home insurance, one of the most critical decisions you’ll make is choosing between replacement cost and actual cash value coverage. This choice directly impacts how much money you receive after covered losses and many homeowners don’t understand the difference until they file claims and receive settlements far below what they need to fully recover.

The distinction between replacement cost vs actual cash value homeowners insurance isn’t just insurance jargon it’s the difference between receiving enough money to truly replace damaged property versus settling for depreciated values that leave you paying thousands out-of-pocket to rebuild or replace belongings.

Understanding what replacement value means in insurance, how these coverage types work, and which option best protects your financial interests ensures you have adequate protection when disasters strike.

What Is Replacement Cost in Insurance?

Replacement cost means your insurer pays the full amount needed to replace damaged or destroyed property with new items of similar kind and quality at current prices without deducting for depreciation or wear and tear.

What Does Replacement Value Mean in Insurance?

When people ask “what is replacement value in insurance,” they’re asking about coverage that replaces your property with brand-new equivalents. This insurance replacement valuation method focuses on current replacement costs, not what you originally paid or what the item is worth today after years of use.

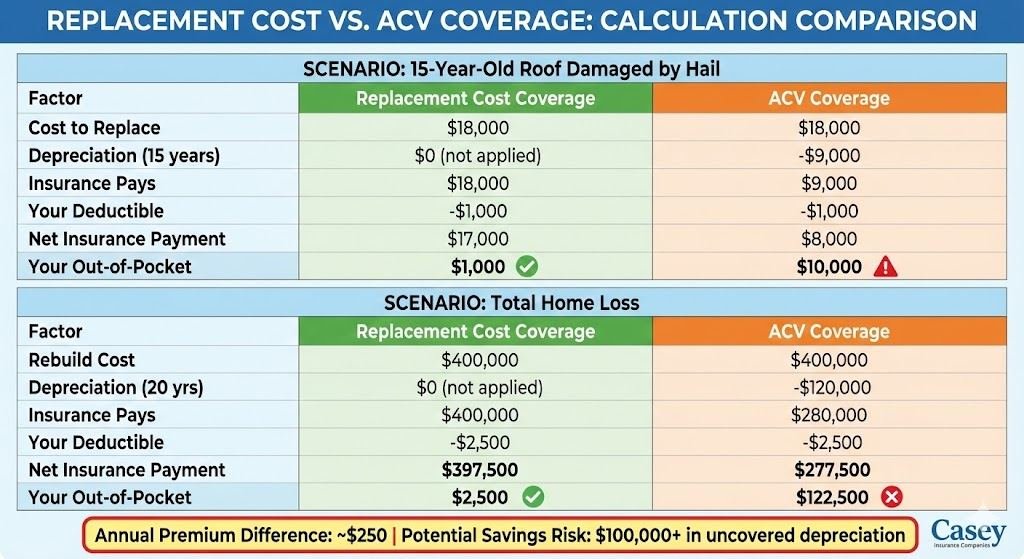

Example – Dwelling Coverage:

- Your 15-year-old roof is destroyed by hail

- Original cost: $12,000

- Current replacement cost: $18,000

- Replacement cost coverage pays: $18,000 (minus deductible)

- You can install a brand-new roof without paying depreciation

Example – Personal Property:

- Your 5-year-old $1,500 sofa is destroyed by fire

- Used value (depreciated): $600

- New comparable sofa cost: $1,600

- Replacement cost coverage pays: $1,600 (minus deductible)

- You can buy a new sofa without covering the depreciation gap

How Does Replacement Cost Insurance Work?

The replacement cost insurance process typically follows these steps:

- Damage Occurs: Covered peril damages or destroys your property

- Initial Payment: Insurer pays actual cash value (depreciated amount) initially

- You Replace the Item: Purchase replacement property

- Submit Receipts: Provide proof of replacement purchase

- Receive Final Payment: Insurer pays the remaining difference between ACV and full replacement cost

This two-step process prevents fraud while ensuring you receive full replacement value when you actually replace damaged property. You must replace items within a specified timeframe (typically 180-365 days) to receive full replacement cost benefits.

What Is Actual Cash Value in Insurance?

Actual cash value (ACV) means your insurer pays the depreciated value of damaged property replacement cost minus depreciation based on age, condition, and normal wear and tear.

Understanding ACV Policy Coverage

An ACV policy calculates payouts using this formula:

Actual Cash Value = Replacement Cost – Depreciation

Depreciation accounts for:

- Age of the item

- Condition and wear

- Expected lifespan

- Obsolescence

Example – Dwelling Coverage:

- Same 15-year-old roof destroyed by hail

- Replacement cost: $18,000

- Depreciation (15 years of life used): -$9,000

- ACV coverage pays: $9,000 (minus deductible)

- You pay out-of-pocket: $9,000+ to install a new roof

Example – Personal Property:

- Same 5-year-old sofa destroyed by fire

- Replacement cost: $1,600

- Depreciation: -$1,000

- ACV coverage pays: $600 (minus deductible)

- You pay out-of-pocket: $1,000 to buy a comparable new sofa

The depreciation gap the amount you must pay personally can be substantial, especially for older items or complete home losses.

Replacement Cost vs Actual Cash Value: Key Differences

Understanding the actual cash value vs replacement cost home insurance distinction is crucial for making informed coverage decisions.

| Feature | Replacement Cost | Actual Cash Value |

|---|---|---|

| Payout Calculation | Full cost to replace with new | Replacement cost minus depreciation |

| Depreciation Applied | No | Yes |

| Out-of-Pocket Costs | Minimal (just deductible) | Significant (deductible + depreciation) |

| Claim Settlement | Can fully replace property | Rarely covers full replacement |

| Premium Cost | 10-20% higher | 10-20% lower |

| Best For | Most homeowners | Very limited situations |

| Dwelling Coverage | Rebuild at current costs | Pays depreciated structure value |

| Personal Property | Replace with new items | Pays used/depreciated value |

Real-World Impact: Total Loss Scenario

Your Home:

- Replacement cost to rebuild: $400,000

- Home is 20 years old

With Replacement Cost Coverage:

- Insurance pays: $400,000 (minus deductible)

- You can rebuild your home completely

- Out-of-pocket: Only your deductible ($1,000-$5,000)

With ACV Coverage:

- Replacement cost: $400,000

- Depreciation (20 years): -$120,000

- Insurance pays: $280,000 (minus deductible)

- You pay: $120,000+ to fully rebuild

- Many homeowners cannot afford this gap

This dramatic difference explains why replacement cost coverage is recommended for almost all homeowners the premium savings of ACV isn’t worth the massive financial exposure.

Replacement Cost vs Market Value: A Critical Distinction

Many homeowners confuse replacement cost with market value, but they measure completely different things.

What Is Market Value?

Market value represents what buyers would pay for your home in current market conditions, including:

- Land value

- Location desirability

- Market trends and demand

- Comparable home sales

- Neighborhood characteristics

Replacement Cost vs Market Value Differences

Example:

- Your home’s market value: $500,000 (including $100,000 land value)

- Your home’s replacement cost: $420,000 (cost to rebuild structure)

- Correct dwelling coverage: $420,000

Why They Differ:

- Market value includes land (which can’t be destroyed and doesn’t need insurance)

- Market value reflects location premium (insurance doesn’t pay for location)

- Market value fluctuates with real estate trends (replacement cost is based on construction costs)

- Replacement cost focuses purely on rebuilding the structure

Common Mistake: Insuring for market value instead of replacement cost leads to either:

- Over-insurance: Paying for coverage you don’t need (when market value exceeds replacement cost)

- Under-insurance: Inadequate coverage to rebuild (when replacement cost exceeds market value due to construction costs)

Always insure for replacement cost, not market value. Our guide on how much dwelling coverage you need explains proper valuation methods.

When to Choose Replacement Cost Coverage

For most homeowners, replacement cost coverage is the clear choice despite higher premiums.

Who Should Choose Replacement Cost?

Recommended For:

- ✓ Homeowners with mortgages (often required by lenders)

- ✓ Homes less than 30 years old

- ✓ Properties you plan to repair/rebuild after losses

- ✓ Anyone who can’t afford large depreciation gaps

- ✓ Families who need to fully replace belongings

- ✓ Homeowners with well-maintained properties

Replacement Cost Benefits:

- Complete financial protection after covered losses

- No depreciation surprises during claims

- Ability to actually rebuild or replace damaged property

- Peace of mind knowing adequate coverage exists

- Better protection for personal property and belongings

Replacement Cost for Dwelling Coverage

For your home’s structure, replacement cost is almost always the right choice. The 10-15% premium increase is insignificant compared to potentially facing $50,000-$200,000+ depreciation gaps after major losses.

Real Scenario: A policyholder with ACV dwelling coverage faced a total loss fire. His 30-year-old home had $350,000 replacement cost but received only $210,000 after depreciation a $140,000 shortfall he couldn’t afford. He could rebuild only 60% of his former home despite paying insurance premiums for years.

Replacement Cost for Personal Property

Personal property coverage with replacement cost protection ensures you can actually replace your belongings after theft, fire, or other covered perils.

Consider: If you lost everything in a fire furniture, clothing, electronics, kitchenware could you afford to replace it all at garage-sale prices (ACV) or would you need full replacement value? Most families need replacement cost coverage to truly recover.

When Actual Cash Value Might Make Sense

Despite disadvantages, ACV coverage works in very limited circumstances.

Rare Situations Where ACV Is Appropriate

Potentially Acceptable For:

- Very old homes (50+ years) you don’t plan to rebuild

- Vacation properties or seasonal homes you might not replace

- Properties you’re planning to sell soon

- Investment properties where you’re risk-tolerant and self-insuring partially

- Situations where you have substantial savings to cover depreciation gaps

Important Warning: Even in these scenarios, the premium savings ($200-$500 annually) rarely justifies the massive exposure ($50,000-$150,000+ potential out-of-pocket costs).

Why Financial Advisors Recommend Against ACV

Most insurance professionals and financial advisors strongly discourage actual cash value coverage because:

- The premium savings are minimal compared to exposure

- Depreciation gaps often exceed homeowners’ ability to pay

- Recovery after major losses becomes impossible without adequate funds

- You’re essentially self-insuring the depreciation amount without planning for it

As financial expert Dave Ramsey states: “Actual cash value insurance is a terrible idea. The small amount you save in premium is nothing compared to what you’ll lose in the event of a claim.”

How to Ensure Adequate Replacement Cost Coverage?

Choosing replacement cost coverage is step one ensuring adequate limits is step two.

Calculating Correct Replacement Cost

Don’t Use:

- ✗ Your home’s market value

- ✗ Your purchase price

- ✗ Your mortgage amount

- ✗ Tax assessment values

Do Use:

- ✓ Professional replacement cost estimators from insurers

- ✓ Local builder estimates for rebuilding costs

- ✓ Certified appraisals for replacement cost

- ✓ Online replacement cost calculators (less accurate)

Key Factors Affecting Replacement Cost:

- Square footage and layout

- Construction quality and materials

- Special features (custom elements, high-end finishes)

- Local labor and material costs

- Building code requirements

Updating Coverage Regularly

Construction costs increase 3-8% annually. Update your dwelling coverage:

- Annually at policy renewal

- After renovations or significant home improvements

- When local construction costs spike dramatically

- Every 3-5 years with fresh replacement cost estimates

Many policies include inflation guard endorsements automatically increasing coverage 2-4% annually—but verify this keeps pace with actual cost increases in your area.

Common Mistakes to Avoid

1: Choosing ACV to save money without understanding the exposure

2: Assuming market value equals replacement cost

3: Not updating replacement cost limits as construction costs rise

4: Selecting replacement cost for dwelling but ACV for personal property

5: Failing to get professional replacement cost estimates

6: Underinsuring to reduce premiums, then facing coinsurance penalties

Making Your Coverage Decision

The choice between actual cash value vs replacement cost home insurance isn’t complex for most homeowners replacement cost is almost always the correct choice.

The modest premium increase (10-20% or $200-$500 annually) provides complete financial protection ensuring you can actually rebuild your home and replace your belongings after covered losses. ACV coverage’s small savings aren’t worth the massive financial exposure when depreciation gaps can reach $50,000-$200,000+.

Recommendation for Most Homeowners:

- ✓ Replacement cost for dwelling coverage

- ✓ Replacement cost for personal property

- ✓ Consider extended replacement cost for additional buffer

- ✓ Ensure coverage equals true replacement cost, not market value

- ✓ Update limits annually as costs increase

Only in very rare circumstances very old homes you won’t rebuild, properties you’re selling, substantial self-insurance capacity might ACV make limited sense. Even then, most financial advisors recommend against it.

Protecting Your Investment Properly

Your home and belongings represent your largest investments and the foundation of your family’s security. Proper insurance replacement cost vs actual cash value decisions ensure you’re truly protected when disasters strike not just nominally insured at inadequate levels.

Don’t let small premium savings create massive financial exposure. Choose replacement cost coverage, ensure limits match true replacement costs, and review coverage regularly as values change.

Our home insurance specialists help homeowners understand the insurance replacement valuation methods and ensure adequate dwelling coverage, proper personal property protection, and complete home insurance coverage matching their needs.

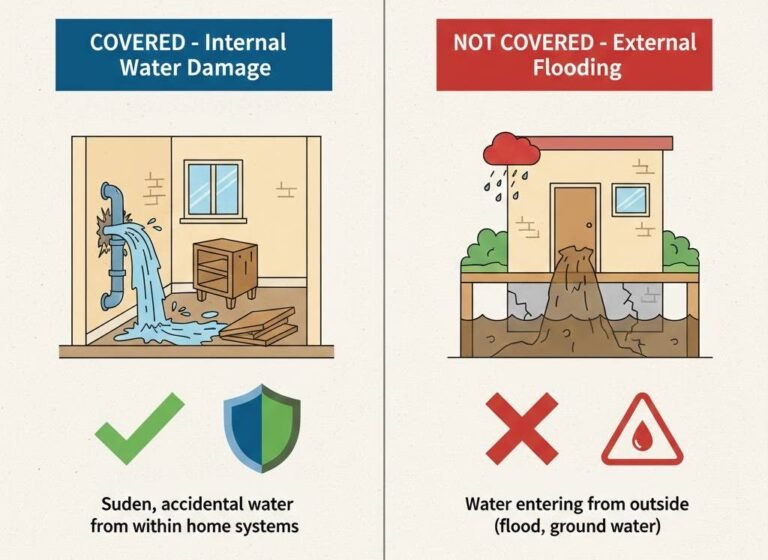

For more protection guidance, explore our articles on flood coverage and liability protection.

Frequently Asked Questions About Replacement Cost Insurance

Replacement value in insurance means the current cost to rebuild or replace property with new items of similar quality—regardless of what you originally paid. If you bought your home for $300,000 ten years ago but rebuilding it today costs $420,000, replacement value is $420,000. This differs from both your purchase price and market value because it focuses purely on current construction or replacement costs. Replacement value changes over time as material and labor costs fluctuate, which is why regular coverage updates are essential.

Replacement cost insurance typically requires you to actually replace or rebuild damaged property to receive full benefits. Most policies follow a two-step process: initially paying actual cash value (depreciated amount), then paying the remaining replacement cost after you submit proof of replacement. If you choose not to rebuild or replace, you receive only the ACV portion—the depreciated value. This prevents fraud and ensures the insurance benefit is used for its intended purpose: actual replacement of damaged property.

Yes, you can mix coverage types—replacement cost for dwelling and ACV for personal property—though most insurance professionals advise against this. The small premium savings ($50-$150 annually) on personal property isn’t worth the depreciation gaps when replacing belongings after major losses like fires or theft. Most families discover they can’t afford to replace all their possessions at garage-sale prices (ACV) and regret not choosing replacement cost coverage. The comprehensive protection of full replacement cost for both dwelling and belongings is worth the modest premium increase.