Your insurance needs change constantly home improvements, new vehicles, asset growth, and life events all affect how much coverage you need. Yet most people buy insurance once and never review it again until renewal arrives, creating dangerous gaps that only reveal themselves during claims.

Knowing when and how to review your coverage ensures you’re neither underinsured nor overpaying for protection you don’t need.

1. The Annual Review: Your Baseline

Review all insurance policies at least once annually, preferably 60-90 days before renewal. This gives time to shop, compare, and make changes before policies auto-renew.

What to Check During Annual Reviews

Home Insurance:

- Has your home’s replacement cost increased? (Construction costs rise 3-8% yearly)

- Are coverage limits still adequate for your possessions?

- Should you increase liability coverage as assets grow?

- Are you eligible for new discounts (security systems, claims-free years)?

Auto Insurance:

- Has your vehicle’s value changed enough to drop collision/comprehensive?

- Do you still have adequate liability limits?

- Are teenagers added as drivers requiring coverage adjustments?

- Should deductibles change based on your financial situation?

2. Life Events Requiring Immediate Reviews

Don’t wait for renewal update coverage immediately after these changes:

Home-Related Triggers

Major Renovations: Kitchen remodels, additions, finished basements, new roofs increase rebuilding costs. Update dwelling coverage immediately being underinsured by $50,000-$100,000 after renovations is common.

New Valuables: Engagement rings, art purchases, inherited jewelry exceed standard sublimits. Schedule items immediately through personal property coverage.

Installing Pools/Trampolines: These increase liability exposure dramatically. Add liability coverage and notify insurers immediately failing to disclose can void coverage.

Starting Home Businesses: Personal policies exclude business activities. Obtain commercial coverage before operating any home business.

Rental Activities: Renting rooms (Airbnb) or entire properties requires specialized coverage. Personal policies void during rental activities.

Auto-Related Triggers

New Vehicle Purchase: Add comprehensive/collision coverage, update values, verify adequate liability.

Teenage Drivers: Adding teen drivers increases premiums significantly but is legally required. Discuss immediately when teens get licenses.

Vehicle Payoff: Once loans are paid, you can adjust coverage but don’t drop collision/comprehensive if vehicles are worth $3,000+.

Moving States: Different states have different requirements and rates. Update immediately when relocating.

Commute Changes: Longer commutes or work-from-home changes affect rates. Update mileage estimates for accurate pricing.

Life Milestones

Marriage/Divorce: Combine or separate policies, update beneficiaries, adjust coverage for changed household situations.

New Baby: Increase liability coverage protecting growing assets. Update beneficiaries on all policies.

Significant Asset Growth: Promotions, inheritances, or investments increasing net worth require higher liability limits. Consider umbrella coverage.

Retirement: Reduced income may warrant higher deductibles. Paid-off mortgages allow coverage adjustments.

Empty Nest: Children moving out may reduce some coverages but college students need verification of continued protection.

3. Warning Signs You Need Immediate Review

Beyond scheduled reviews, these red flags demand immediate attention:

- Premium Increases Over 15-20%: Sudden jumps without claims warrant shopping competitors immediately.

- Claims You Didn’t File: Errors on your record increase rates unfairly. Review claims history annually.

- Coverage Feeling Inadequate: If you’re uncomfortable with limits or worried about gaps, that’s your instinct telling you to review coverage.

- Neighbor’s Similar Claim Denied: Learning about coverage gaps from others’ experiences should prompt your own policy review.

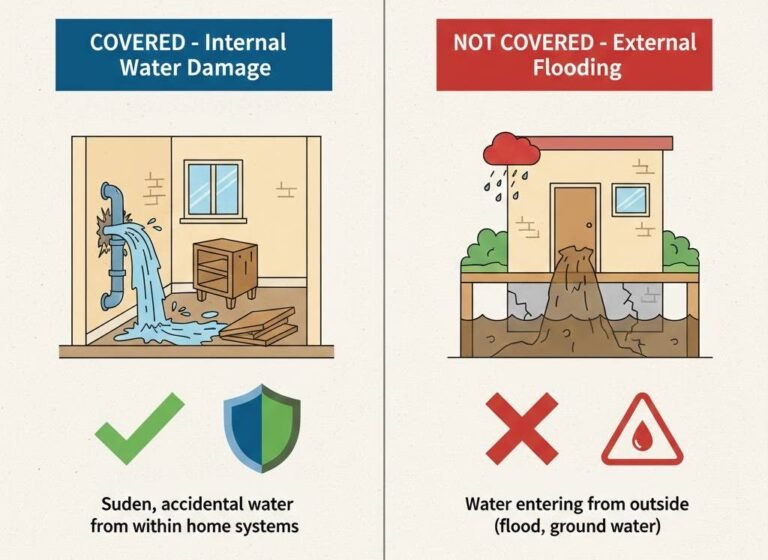

- News About Common Exclusions: Stories about flood damage, sewer backups, or other excluded perils should trigger gap analysis.

4. The 3-Year Deep Dive

Every 3 years, conduct comprehensive reviews beyond annual checks:

- Get New Replacement Cost Estimates: Professional estimates ensure dwelling coverage matches actual rebuilding costs.

- Complete Home Inventory: Update photos, values, and documentation for all possessions.

- Shop Multiple Insurers: Rates vary significantly. Compare 3-5 quotes ensuring you’re getting competitive pricing.

- Review All Endorsements: Verify optional coverages still make sense and identify gaps requiring new endorsements.

- Reassess Deductibles: Financial situation changes may warrant adjusting deductibles up or down.

Don’t Wait Until It’s Too Late

The worst time to discover inadequate coverage is during claims when nothing can be fixed. Proactive reviews ensure continuous, appropriate protection as your life and assets evolve.

Most people discover insurance problems only after:

- Claims reveal they’re underinsured by tens of thousands

- Excluded perils cause uncovered damage

- Liability limits prove inadequate for serious accidents

- Sublimits leave valuables unprotected

These discoveries happen when you can’t change anything—the damage is done and you’re personally liable for gaps.

We Make Reviews Simple

Our insurance specialists provide complimentary policy reviews ensuring your home insurance and auto insurance keep pace with your changing needs. We identify gaps, recommend appropriate limits, and ensure you’re neither underinsured nor overpaying.

Schedule Your Free Review Today: Don’t wait for disasters to reveal coverage problems. A 30-minute review now prevents thousands in uncovered losses later.

Whether you’re due for annual review, experiencing life changes, or simply want peace of mind that you’re properly protected we’re here to help optimize your coverage and save you money.

Contact us for your complimentary insurance policy review and discover how proper coverage protects everything you’ve built.

FAQ

No—insurance inquiries don’t affect credit scores. You can request multiple quotes without any credit impact. Review and shop freely without worry.

Not if done correctly. Always purchase new coverage effective before canceling old policies. We coordinate timing ensuring continuous protection during transitions without gaps or duplicate payments.