Every hurricane season, boat owners along the U.S. coast face the same critical question: “Am I actually covered if a hurricane damages my boat?” The answer isn’t a simple yes or no, It depends entirely on your specific policy terms and whether you comply with requirements.

Many owners assume their comprehensive marine insurance automatically covers hurricane damage. This assumption leads to devastating surprises when claims are denied after storms. Understanding exactly what your policy covers regarding named storms could mean the difference between full claim payment and complete denial.

What Are Named Storms?

Named storms include any tropical or subtropical cyclone designated by the National Hurricane Center. This encompasses:

- Tropical Storms: Sustained winds 39-73 mph

- Hurricanes: Sustained winds 74+ mph (Categories 1-5)

- Subtropical Storms: Hybrid characteristics between tropical and mid-latitude systems

Once the National Hurricane Center assigns a name (Alex, Bonnie, Colin, etc.), these become “named storms” triggering specific insurance provisions.

Does Marine Insurance Cover Hurricane Damage?

Most policies cover named storm damage, but with significant conditions, special deductibles, and requirements you must meet.

Standard Coverage Provisions

Quality boat insurance policies include named storm damage as a covered peril. This means physical damage to your vessel from:

- Wind and rain

- Storm surge and flooding

- Wave action

- Flying debris

- Dock collapse or vessel collision during storms

Damage from these causes is covered if you’ve complied with policy requirements.

Our Hurricane Coverage for private vessels and High-Value Yacht Hurricane Coverage provide comprehensive named storm protection when requirements are met.

The Hurricane Deductible: A Costly Surprise

Here’s where many boat owners get blindsided: hurricane damage doesn’t use your standard deductible.

How Hurricane Deductibles Work

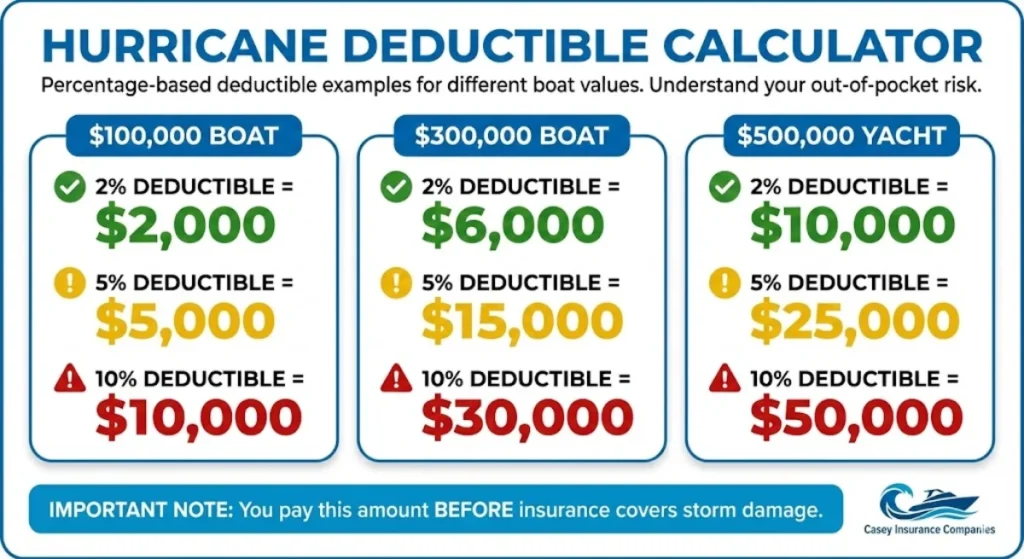

Instead of flat-dollar deductibles ($1,000, $2,500, $5,000), named storm damage triggers percentage-based deductibles calculated from your boat’s insured value:

- Standard Deductible: $2,500 (you pay first $2,500 of any claim)

- Hurricane Deductible: 5% of insured value

Example Calculations:

- $100,000 boat × 5% = $5,000 hurricane deductible

- $300,000 boat × 5% = $15,000 hurricane deductible

- $500,000 yacht × 5% = $25,000 hurricane deductible

Suddenly, that “comprehensive coverage” means you’re paying tens of thousands out-of-pocket before insurance covers anything.

Typical Hurricane Deductible Ranges

Geographic location dramatically affects hurricane deductibles:

- Florida and Gulf Coast: 5-10% deductibles are standard

- South Atlantic Coast: 3-7% deductibles common

- North Atlantic Coast: 2-5% deductibles typical

- Great Lakes and Inland: Often use standard deductibles (no hurricane-specific deductible)

High-risk areas face the highest percentage deductibles because insurers know storm exposure is greatest there.

When Hurricane Deductibles Apply

Hurricane deductibles trigger when:

- The National Hurricane Center names a tropical system

- The storm affects your area within specified timeframes (typically 72 hours before through 72 hours after)

- Damage occurs during this window

Even if the system is “only” a tropical storm (not yet hurricane strength), the hurricane deductible applies once named.

The Haul-Out Requirement: Non-Negotiable Compliance

The most critical hurricane coverage provision and the one most commonly violated is the haul-out requirement.

What Haul-Out Requirements Mandate

Most policies include “hurricane warranties” or “named storm clauses” requiring you to:

- Remove your boat from water when hurricane warnings are issued for your area

- Complete haul-out within 48-72 hours of warnings

- Secure the vessel properly on approved land storage

- Provide documentation proving compliance

This is mandatory, not optional. Failure to comply voids all hurricane coverage.

What Happens If You Don’t Haul Out

If you ignore haul-out requirements and your boat is damaged:

- Your claim is denied entirely

- No coverage for repairs, regardless of damage extent

- You’re personally liable for all costs

- Your premiums don’t matter coverage simply doesn’t apply

Insurers enforce this strictly. Countless boat owners have faced complete claim denial after hurricanes because they didn’t haul out when required.

Haul-Out Exceptions

Limited situations may exempt haul-out requirements:

- Approved Hurricane Holes: Some policies allow remaining in water at designated protected anchorages with proper securing.

- Physical Impossibility: If haul-out becomes genuinely impossible due to storm timing or facility availability, document everything thoroughly. Insurers may cover claims if you made good-faith efforts.

- Policy Variations: A few high-value yacht policies negotiate individual alternatives, though these cost significantly more.

Never assume exceptions apply without explicit policy language or insurer confirmation.

Coverage Territory and Hurricane Restrictions

Your policy’s navigation territory affects hurricane coverage significantly.

Seasonal Restrictions

Many policies include seasonal restrictions:

- Prohibited offshore passages during peak hurricane season (August-October)

- Requirements to relocate vessels from high-risk areas during certain months

- Enhanced preparation requirements for vessels remaining in hurricane zones

Operating in violation of seasonal restrictions voids coverage during those periods.

Geographic Limitations

Some policies exclude or restrict coverage in high-risk areas:

- Florida Keys during peak season

- Gulf Coast during certain months

- Caribbean islands during hurricane season

Review your policy’s territory provisions carefully. Operating outside covered areas—even temporarily—voids all protection.

What Hurricane Coverage Doesn’t Include

Understanding exclusions prevents false expectations.

- Wear and Tear: Damage from aging, deterioration, or deferred maintenance isn’t covered, even if a hurricane reveals these issues.

- Negligence: Failing to properly secure your vessel or ignoring obvious preparation requirements can result in denied or reduced claims.

- Flood Damage from Other Causes: Hurricane coverage doesn’t necessarily cover flooding from other sources. Review flood provisions separately.

- Consequential Losses: Loss of use, charter income, or depreciation from storm damage history may not be covered.

- Certain Property Types: Personal belongings, loose equipment, or items not permanently attached may have separate limits or exclusions.

Haul-Out Cost Reimbursement

Quality hurricane policies include haul-out reimbursement provisions offsetting storm preparation costs.

What’s Typically Covered

Haul-Out Expenses: Boatyard fees for removing vessel from water Blocking and Cradle: Proper support structures

Storage Fees: Secure storage during storm period Re-Launch: Returning vessel to water post-storm

Reimbursement Limits

Typical policies reimburse $2,500-$10,000 per named storm event. This doesn’t cover all costs for large vessels but significantly offsets expenses.

Important: You must haul out to receive reimbursement. You can’t ignore requirements, suffer no damage, and claim haul-out reimbursement.

Filing Hurricane Claims

If storm damage occurs despite preparation, proper claim filing is essential.

Immediate Post-Storm Actions

- Document damage thoroughly with photos and video before touching anything

- Contact your insurer within 24-72 hours of discovering damage

- Provide haul-out documentation proving you met requirements

- Don’t make permanent repairs before adjuster inspection

- Complete emergency repairs preventing further damage (usually covered)

- Keep all receipts for any storm-related expenses

Proving Compliance

Insurers scrutinize hurricane claims carefully. You’ll need:

- Photos proving haul-out timing

- Receipts from boatyard showing dates

- Documentation of securing methods

- Evidence you monitored storm forecasts

- Proof you acted within required timeframes

Comprehensive documentation is your best defense against claim disputes.

Reducing Hurricane Insurance Costs

Hurricane coverage in high-risk areas is expensive, but strategies can reduce costs:

Accept Higher Hurricane Deductibles: Increasing from 2% to 5% reduces premiums 10-20%, though you pay more out-of-pocket during claims.

Install Hurricane Protection: Storm shutters, enhanced securing points, and monitoring systems may qualify for discounts.

Seasonal Migration: Moving vessels to non-hurricane areas during peak season can earn substantial premium credits.

Claims-Free History: Years without claims often result in deductible reductions or premium discounts.

Bundling Policies: Combining boat, Home Insurance, and Auto Insurance provides multi-policy discounts.

The Bottom Line on Named Storm Coverage

Yes, boat insurance covers named storm damage but only if you comply with policy requirements. Hurricane coverage isn’t automatic; it’s conditional on your actions before storms arrive.

Never assume coverage without reading your policy’s specific provisions. Understand your hurricane deductible, know exactly when haul-out is required, and comply with all preparation requirements.

The difference between covered and denied hurricane claims often comes down to whether you followed your policy’s requirements. Don’t let non-compliance cost you everything when storms strike.

Our marine insurance specialists help boat owners understand their hurricane coverage and ensure compliance with policy requirements. We provide comprehensive Hurricane Coverage and High-Value Yacht Hurricane Coverage designed to protect vessels in hurricane-prone regions.

Frequently Asked Questions

Yes. Hurricane deductibles apply per storm event. If two separate named storms damage your boat in one season, you pay the hurricane deductible for each claim separately. This is why proper storm preparation is so critical multiple storms can result in massive out-of-pocket costs.

Yes, if you complied with all haul-out requirements and properly secured the vessel. Coverage applies to storm damage occurring while hauled out, though your hurricane deductible still applies. Proper securing is essential inadequate preparation may result in claim disputes.

Yes. Once a system receives a name from the National Hurricane Center, it triggers named storm provisions regardless of later classification. Even if it weakens to tropical storm status, the hurricane deductible applies to any damage during the designated timeframe.