Small private boats are one of the most enjoyable ways to get out on the water, affordable, easy to maintain, and perfect for fishing, weekend cruising, or family fun. But one question almost every new boater asks is:

“Do I need insurance for a small private boat?”

The short answer:

Yes — even small boats need insurance, and in many cases, it’s strongly recommended or required.

No matter you own a Jon boat, dinghy, small sailboat, inflatable, bay boat, or a small 15–25 ft recreational craft, the risks on the water are the same: property damage, collisions, injuries, weather events, and legal liability.

This beginner-friendly guide for new boat owner’s explains why small boat insurance matters, what it covers, how much it costs, and how to protect your vessel the right way.

What Counts as a “Small Private Boat”?

In the United States, most insurers classify small private boats as:

- Under 26 feet in length

- Used for personal/recreational purposes

- Powered by an outboard or small inboard engine

- Occasionally used for light fishing or cruising

Common examples include:

- Jon boats (10–20 ft)

- Aluminum fishing boats

- Skiffs

- Dinghies & tenders

- Small bowriders

- Small sailboats & day sailers

- Inflatable RIB boats

- Kayaks, canoes & rowboats

- Bass boats & bay boats

These boats may be “small,” but the financial risks are real.

Do Small Boats Need Insurance?

Even if your state doesn’t legally require boat insurance, the financial protection is essential.

1. Liability protection

If your boat injures someone or damages another vessel, you can be held financially responsible.

Liability claims for small-boat accidents commonly reach $5,000–$75,000+, even for minor collisions.

2. Protection against storms and natural disasters

Small boats are even more vulnerable to:

- Hurricanes

- Storm surges

- Marina damage

- Flood-related losses

- Fire

A single storm can total a small craft insurance protects your investment.

3. Marinas and lenders often require insurance

Many marinas require proof of:

- Liability coverage

- Wreck removal coverage

- Pollution liability

If you finance the boat, lenders usually require comprehensive and collision coverage.

4. Theft & vandalism is common

Small boats are stolen more frequently than larger vessels because:

- They’re easier to tow

- Easier to store

- Often left unsecured

Insurance helps replace or repair your vessel.

5. Medical and legal protection after an accident

Many small boat accidents involve:

- Propeller injuries

- Passenger falls

- Dock mishaps

Medical payments and liability coverage protect your finances.

Is Small Boat Insurance Required by Law?

There is no federal law requiring boat insurance in the U.S.

However, some states, marinas, and loan providers have requirements:

You may be required to carry boat insurance if:

- You dock at a marina

- You take out a loan

- Your boat is above a certain horsepower (varies by state)

- You operate in certain state parks or waterways

Even when not required, insurance is still the safest financial decision.

What Does Small Private Boat Insurance Cover?

Every policy varies, but most small-boat policies include:

1. Physical Damage (Hull & Equipment)

Covers repairs or replacement from:

- Collisions

- Storm damage

- Sinking

- Fire

- Theft or vandalism

2. Liability Insurance

Protects you if:

- You damage another boat

- You injure someone

- Someone sues you for negligence

3. Medical Payments Coverage

Covers injuries to:

- You

- Your passengers

- Water skiers or guests

4. Uninsured/Underinsured Boater

If a boater without insurance hits you, this protects:

- Medical costs

- Damage payments

- Long-term injury costs

5. Towing & Assistance

Includes:

- On-water towing

- Fuel delivery

- Jump starts

- Soft ungrounding

6. Wreck Removal & Pollution Liability

Required by many marinas. If your boat sinks, you are legally responsible for removing it.

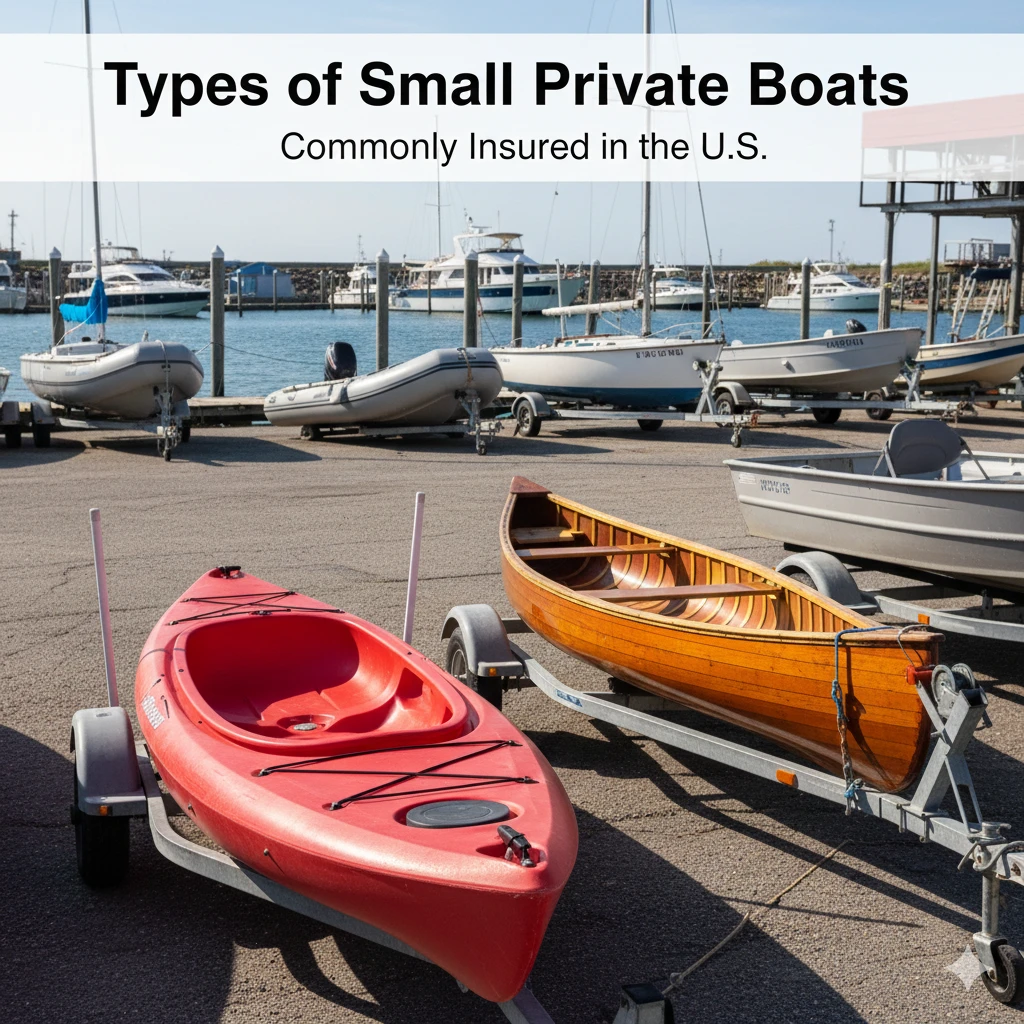

Common Boat Types Covered Under Small Boat Insurance

| Boat Type | Typically Insured? | Notes |

|---|---|---|

| Jon Boats | ✔ Yes | Low-cost policies available |

| Aluminum Fishing Boats | ✔ Yes | Very common for weekend anglers |

| Inflatable & RIB Boats | ✔ Yes | Often require theft coverage |

| Canoes & Kayaks | Optional | Usually cheap to insure |

| Small Sailboats | ✔ Yes | Weather coverage important |

| Dinghies/Tenders | ✔ Yes | Often added as auxiliary craft |

| Skiffs | ✔ Yes | Popular for inshore fishing |

| Rowboats | Optional | Very affordable coverage |

| Paddleboards | Optional | Usually low-cost add-on |

What Small Boat Insurance Usually Doesn’t Cover

Without specific add-ons, insurers typically exclude:

- Wear and tear

- Mechanical breakdown

- Damage from improper maintenance

- Commercial use (charters, rentals)

- High-speed racing

- Operating under the influence

Optional add-ons (endorsements) are available for many of these situations.

How Much Does Small Boat Insurance Cost?

Small private boat insurance is one of the most affordable marine insurance categories.

Average U.S. pricing:

- $100–$350 per year for basic liability-only

- $300–$900 per year for full coverage

Factors influencing cost:

- Boat value

- Engine size (HP)

- Age of the vessel

- Operator experience

- Storage location

- Navigation limits

- Claims history

- Safety equipment onboard

Tip: You can significantly lower costs by completing a certified boating safety course (recognized by the U.S. Coast Guard and NASBLA).

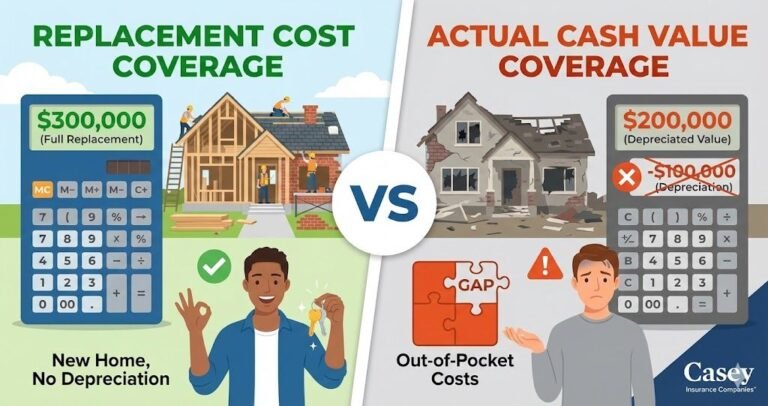

Is Home Insurance Enough for Small Boats?

Home insurance may cover very small, low-horsepower boats, but only with major limitations.

Typical homeowners policy limits:

- Only covers boats with less than 25–50 HP

- Caps coverage around $1,000–$2,500

- No liability coverage while boating

- No coverage if you store it at a marina

For anything larger than a canoe, kayak, or tiny rowboat, a separate marine policy is strongly recommended.

What Does Small Private Boat Insurance Cover?

Even the cheapest small boat policy in the U.S. typically includes several core protections. Coverage can vary by insurer, your state, and boat type but these are the standard inclusions:

Liability Coverage

Covers bodily injury or property damage you accidentally cause to others.

This is the minimum coverage every small boat owner should have.

Hull & Equipment Coverage

Protects the boat itself, including:

- Hull

- Motor (outboard or inboard)

- Fuel tanks

- Installed equipment

- Navigational gear

- Trailers (optional add-on)

Medical Payments

Covers medical expenses for you and passengers regardless of fault.

Uninsured/Underinsured Boater

Protects you if another boater injures you but has no insurance.

Theft, Fire, and Vandalism

Important for small boats kept outdoors, in driveways, storage lots, or moorings.

Towing & Assistance

Covers on-water towing, jump starts, fuel delivery, and emergency help.

Storm Damage & Natural Events

Policies may cover:

- Hurricanes

- Flooding

- Windstorms

- Lightning

Your state matters Florida, Louisiana, Texas, and coastal areas have higher risk classifications.

What Small Boats Can Be Insured?

If it floats, the chances are high it can be insured. Popular categories include:

Non-Motorized Boats

- Canoes

- Kayaks

- Paddleboards

- Rowboats

- Drift boats

(This category is often under $100/year.)

Small Motorized Boats

- Jon boats

- Dinghies

- Skiffs

- Small fishing boats

- Aluminum bass boats

- Pontoon boats under 16 ft

- Small RIBs (rigid inflatable boats)

Fishing & Recreational Boats

- Aluminum fishing boats

- Flats boats

- Small pleasure crafts

- Bay boats

Some insurers also offer bundled ‘small craft’ policies that include trailers and accessories.

Cost of Small Private Boat Insurance (U.S. 2026 Guide)

| Boat Type | Average Annual Cost | Liability-Only Cost | Full Coverage Cost | Notes |

|---|---|---|---|---|

| Non-motorized (kayak/canoe) | $75–$150 | $50–$80 | $90–$150 | Often added to homeowners policy |

| Jon boat / Aluminum fishing | $100–$250 | $75–$120 | $150–$250 | Most common small boat policy |

| Dinghy / Inflatable / RIB | $150–$300 | $100–$150 | $180–$300 | Higher theft risk in some states |

| Small outboard boat (10–16 ft) | $200–$400 | $120–$200 | $250–$400 | Coastal states typically pay more |

| Small pontoon | $250–$450 | $150–$250 | $300–$450 | Age of motor & storage affect price |

Do Small Boat Owners Legally Need Insurance?

Laws vary by state, but here’s the general rule:

U.S. states do NOT require insurance for small private boats

However, exceptions apply when:

- The boat is financed

- You store it at a marina

- You use state park lakes that require liability insurance

- You participate in organized events

States with more frequent marina/park insurance requirements:

- Florida

- California

- Texas

- Arizona

- Tennessee

- Washington

If your boat is small but motorized, many marinas request $100,000–$300,000 liability minimum.

9. When You Can Skip Small Boat Insurance (But Carefully)

You might skip insurance if:

- Your boat is under $1,000 in value

- It’s completely non-motorized

- You only use it on private property

- You store it securely indoors

But still consider liability coverage

Because liability is the one thing homeowners insurance rarely protects on the water.

Best Way to Get Cheap Insurance for a Small Private Boat

Here’s a short checklist for the cheapest possible policy:

1. Bundle With Home / Auto

GEICO, Progressive, State Farm, Allstate, and Travelers give multi-policy discounts.

2. Choose Liability-Only for Budget Boats

If your boat is older or under $2,500 in value, full coverage may not be worth it.

3. Increase Your Deductible

Higher deductibles drop premiums significantly.

4. Take a Boating Safety Course

Certified boaters in many states save 5%–15%.

5. Keep Your Boat in a Garage or Shed

Indoor storage reduces risk classifications.

FAQs

Yes Liability-only is cheap and often recommended.

Partially. Theft may be covered, but liability usually isn’t.

Not legally, but most marinas and docks require proof of liability coverage.

If it’s mounted on a small boat, yes—motorized = higher risk classification.

Yes, under medical payments and liability sections.

Conclusion: Do You Really Need Insurance for a Small Private Boat?

If your boat:

- Enters public water,

- Has any kind of motor,

- Is stored outdoors,

- Or could cause injury or damage

Then boat insurance is a smart and affordable investment, even if it’s not legally required.

Most small boat owners in the U.S. pay less than $20–$30/month for solid coverage, making it one of the cheapest marine insurance protections available.