For vessel owners, few sounds are more unsettling than the scrape of fiberglass on rock or the sudden jolt of a submerged object. Hull damage is an inevitable reality of life on the water, where risks range from hidden debris to powerful storms. While experience and caution are your first line of defense, the rightmarine insurance coverage is your essential financial safeguard.

Understanding what can go wrong and precisely how a robust hull coverage policy responds transforms a potential crisis into a manageable event. Knowing the most common causes of hull damage and insurance mechanisms that protect your investment is important.

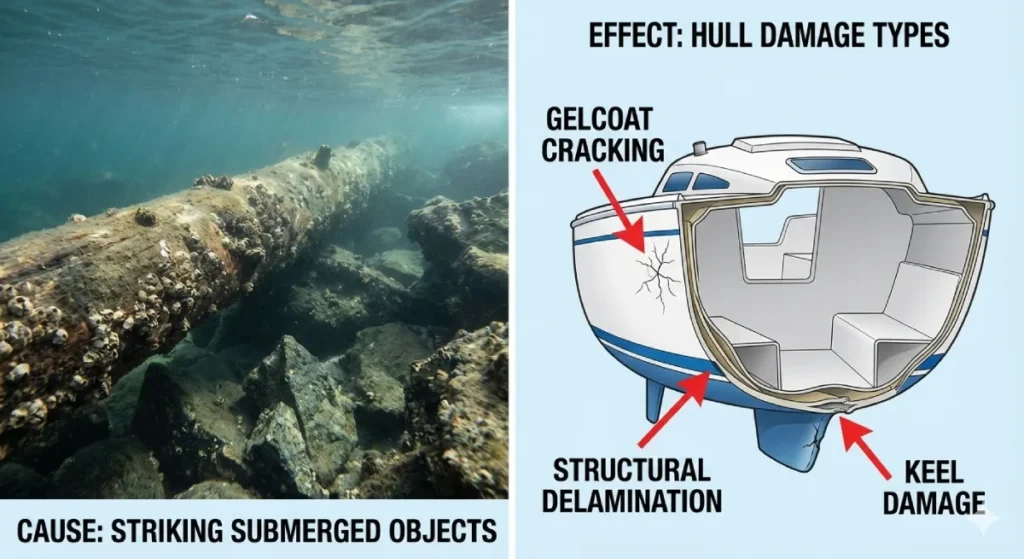

1. Groundings & Striking Submerged Objects

This is arguably the most frequent cause of hull damage claims. Whether it’s misjudging a tide, encountering an uncharted shoal, or striking a floating log or container, the impact can range from minor gelcoat scratches to severe structural compromise.

- How Insurance Handles It: A standard hull coverage policy typically covers this damage. The insurer will send a surveyor to assess the extent of the damage. Repairs are covered after you pay your deductible. It’s crucial to report the incident promptly and document everything. Your policy’s “navigation limits” must have been adhered to for coverage to apply.

2. Collisions (Vessel-to-Vessel)

Collisions in busy waterways, marinas, or during poor visibility can cause catastrophic damage. Liability for the accident is determined by maritime rules (COLREGs), but hull repair coverage is handled separately.

- How Insurance Handles It: Your own hull policy will cover repairs to your vessel, regardless of who is at fault. This is a key principle of marine insurance. Your insurer will then seek to recover the costs (subrogate) from the at-fault party’s insurer. Your liability coverage protects you if you are found at fault for damage to the other vessel.

3. Storm & Hurricane Damage

High winds, storm surge, and torrential rain pose a massive threat. Damage can occur from the vessel being driven ashore, striking docks or other boats, or from wind-blown debris.

- How Insurance Handles It: Comprehensive hurricane coverage is vital. Specific provisions, like a “named storm deductible” (often a percentage of the hull value), will apply. Many policies also cover the cost of “haul-out” to move the vessel to safety before a storm hits, which is always the best mitigation strategy. Proactively discussing your hurricane plan with your broker, like the experts at Casey Insurance, is essential.

4. Blistering, Osmosis, and Corrosion

These are gradual, long-term wear-and-tear issues rather than sudden accidents. Blistering (osmosis) occurs in fiberglass hulls, while corrosion affects metal hulls and components like shafts and propellers.

- How Insurance Handles It: This is a critical distinction. Standard marine insurance is designed for “fortuitous” or accidental losses, not for inherent vice, wear and tear, or gradual deterioration. Damage from long-term blistering or corrosion is generally not covered. However, if corrosion leads to a sudden and identifiable accident (e.g., a through-hull fitting fails because of corrosion, causing sinking), the resulting accidental damage may be covered. Maintenance is your primary defense here.

5. Theft, Vandalism, and Acts of Malice

Unfortunately, boats can be targets for theft of equipment (electronics, outboards) or outright vandalism, which can include deliberate hull damage.

- How Insurance Handles It: Comprehensive hull coverage includes protection against theft and vandalism. You will need to file a police report. Coverage typically extends not just to the hull but also to permanently attached equipment. For high-value, removable items, you may need to schedule them separately on your policy or confirm they fall under your personal property coverage.

6. Fire and Explosion

Though less common, onboard fires (from electrical faults, fuel leaks, or galley accidents) can be total losses. Explosions from fuel vapors are a related extreme hazard.

- How Insurance Handles It: Fire damage is a standard covered peril under a hull policy. The insurer will investigate the cause. If the fire resulted from a manufacturing defect in equipment, your insurer may pursue recovery from the manufacturer. Ensuring your electrical and fuel systems are professionally maintained is a critical risk management step.

Navigating the Claims Process Successfully

Knowing your policy covers the damage is one thing; ensuring a smooth claims process is another. Follow these steps:

- Ensure Immediate Safety: Address any immediate danger to persons or prevent further damage to the vessel (e.g., plugging a leak). This “sue and labor” cost is usually covered.

- Document Everything: Take extensive photos and videos of the damage from all angles and the surrounding circumstances. Note GPS coordinates if applicable.

- Notify Your Insurer Promptly: Contact your agent or the insurer’s claims department immediately. Delay can complicate the process.

- Do Not Begin Permanent Repairs: Wait for the insurance adjuster or marine surveyor to inspect the damage, unless repairs are necessary to prevent further immediate loss.

- Get Repair Estimates: Obtain detailed written estimates from reputable marine repair yards for the insurer’s review.

The Cornerstone of Protection: Your Hull Coverage Policy

Every scenario above hinges on the specific terms of your marine hull insurance policy. Key elements that determine how a claim is handled include:

- Agreed Value vs. Actual Cash Value: An agreed value policy pays the full, pre-determined amount in the event of a total loss. An actual cash value policy pays only the depreciated market value, which can lead to a significant shortfall. For most vessel owners, agreed value is strongly recommended.

- Deductibles: This is your out-of-pocket portion of any claim. Understand if you have a standard flat deductible or special deductibles for named storms or lightning.

- Navigational Limits: Your coverage is valid only within the geographical area specified in your policy. Venturing outside these limits without prior arrangement can void coverage. If you plan to cruise widely, discuss worldwide navigation coverage with your broker.

- Liability Limits: While separate from hull repair, ensure your liability coverage limits are sufficient to protect your assets if you cause damage to others.

Hull damage, in its many forms, is a foreseeable risk of boat ownership. The peace of mind that allows you to truly enjoy your vessel comes not from the hope that accidents won’t happen, but from the certainty that you are prepared when they do.

A meticulously crafted hull coverage policy from a specialist provider like Casey Insurance is more than a line item it’s a partnership in protection. By understanding the common perils, the claims process, and the critical details of your own policy, you transform insurance from an abstract concept into a concrete tool for preserving your investment and your passion.

Don’t let uncertainty be your biggest risk. Contact the marine insurance experts at Casey Insurance Companies today for a comprehensive review of your hull coverage. We’ll help you identify any gaps, explain your options in plain language, and ensure your policy is tailored to handle the specific challenges you face on the water.

Frequently Asked Questions

Not necessarily. While a claim can affect your rates, insurers consider the overall claim history, the severity of the incident, and your experience. A single, minor grounding claim may not trigger an increase, especially if you have a long, claim-free history. It’s always best to discuss the potential impact with your agent before deciding to file.

Yes, striking a submerged object or aquatic animal is a standard covered peril under most hull coverage policies. The damage to your vessel’s hull, prop, and running gear would be covered, subject to your deductible. There is typically no separate “animal strike” exclusion in marine policies.

Yes, a comprehensive marine insurance policy typically provides coverage for your boat whether it’s in the water, on a trailer, or in storage. This includes covered perils like fire, theft, vandalism, or damage from a falling object. Be sure to confirm your policy’s “lay-up” provisions or any specific restrictions during storage periods.

Hull coverage (or “Hull & Machinery”) protects your physical vessel against damage and loss. Protection and Indemnity (P&I), which is part of your liability coverage, protects you against third-party claims for bodily injury or property damage that you are legally liable for. They are two distinct, essential parts of a complete marine insurance program.