Bluewater cruising represents the ultimate sailing dream crossing oceans, exploring remote islands, experiencing different cultures from your own vessel. But this adventure requires specialized insurance that standard coastal policies simply can’t provide.

Many cruisers discover their comprehensive marine insurance doesn’t cover extended offshore passages, international waters, or the specific risks of long-distance voyaging. The realization often comes at the worst possible time when you’re thousands of miles from home with denied claims or no coverage at all.

If you’re planning bluewater passages, understanding your insurance options isn’t just important it’s essential protection for what may be the adventure of a lifetime.

What Is Bluewater Cruising?

Bluewater cruising means extended offshore voyaging in open ocean waters, typically involving:

- Ocean crossings: Transatlantic, transpacific, or other multi-day offshore passages

- International destinations: Cruising to foreign countries and remote locations

- Extended time away: Months or years away from home port

- Self-sufficiency: Operating far from professional services and rescue capabilities

- Serious weather exposure: Potential encounters with storms, heavy seas, and challenging conditions

This differs fundamentally from coastal cruising or weekend boating, creating unique insurance requirements.

Why Standard Marine Insurance Fails Bluewater Cruisers?

Most recreational boat policies are designed for coastal waters with several critical limitations:

1. Geographic Restrictions

Standard policies typically limit coverage to:

- U.S. coastal waters within 50-200 miles of shore

- Specific regional areas (East Coast only, Gulf only)

- No international waters or foreign territories

Once you venture beyond these boundaries which bluewater cruising requires you have zero coverage.

2. Seasonal Restrictions

Many policies prohibit:

- Offshore passages during hurricane season (June-November in Atlantic/Caribbean)

- Extended time in tropical cyclone zones

- Winter passages in high-latitude areas

Bluewater cruisers often need to cross oceans during specific weather windows that may fall within restricted periods.

3. Coverage Duration Limits

Policies may restrict:

- How long you can remain in one foreign location

- Total time away from home port annually

- Extended liveaboard situations

Long-distance cruisers routinely exceed these limitations during multi-year voyages.

4. Service and Support Gaps

Standard insurers typically lack:

- Global claims handling networks

- International repair facility relationships

- Emergency services in remote locations

- Foreign language support

- Experience with international maritime law

When problems occur in Indonesia, French Polynesia, or mid-Atlantic, these gaps become catastrophic.

Essential Coverage Components for Bluewater Cruising

Proper bluewater insurance includes specialized components beyond standard policies.

1. Unlimited Worldwide Navigation

The foundation of bluewater coverage is unrestricted geographic territory:

- Full Worldwide Coverage: Protection in all navigable waters globally

- No Distance Limits: Unlimited offshore passages regardless of distance from land

- International Waters: Coverage in territorial waters of all countries

- Remote Locations: Protection extends to South Pacific, remote Atlantic islands, polar regions (with appropriate endorsements)

Our Worldwide Navigation coverage and High-Value Worldwide Navigation for luxury yachts provide comprehensive bluewater protection.

2. Extended Offshore Passage Coverage

Specific provisions for ocean crossings:

- Multi-day passages: Coverage remains active during week-long or longer offshore transits

- Seasonal flexibility: Ability to make passages when weather windows dictate, not when policies allow

- Emergency deviation: Coverage continues if you must deviate from planned routes due to weather or emergencies

- Mid-ocean assistance: Satellite-based emergency services and coordination

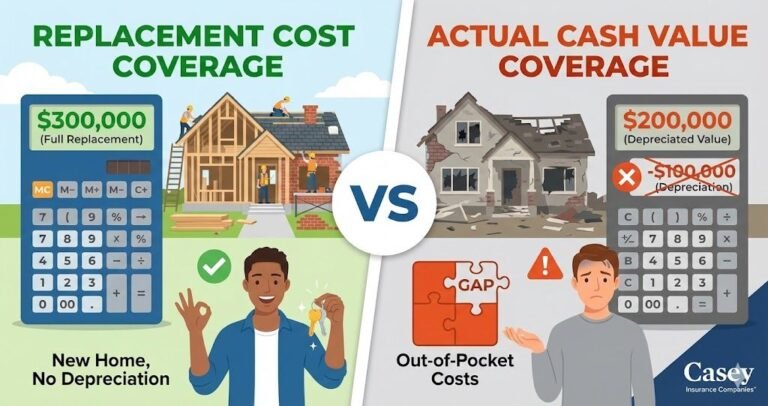

3. Comprehensive Hull and Machinery Protection

Bluewater hull coverage must address:

- Agreed Value: Full insured value payment without depreciation in total loss situations

- Heavy Weather Damage: Coverage for storm damage during extended passages

- Collision Protection: Damage from floating containers, whales, or uncharted hazards

- Mechanical Breakdown: Some policies include machinery breakdown coverage for extended voyages

- Jury-Rigged Repairs: Coverage for emergency repairs made at sea or in remote locations

4. Enhanced Liability Coverage

International cruising requires substantial liability protection:

- Minimum $1-2 Million: Many foreign countries require minimum coverage for port entry

- P&I Coverage: Protection and Indemnity addressing maritime-specific liabilities

- Environmental Liability: $300,000-$1 million for pollution and fuel spills

- Foreign Jurisdiction Defense: Legal protection under international and foreign maritime law

- Crew Liability: Coverage if you carry paid or unpaid crew members

5. Emergency Services and Assistance

Critical for remote locations:

- 24/7 Global Support: Emergency contact regardless of time zone or location

- Satellite Communication: Support via satellite phone when beyond cell range

- International Salvage: Coverage for expensive ocean salvage operations

- Medical Evacuation: Emergency medical transport from remote locations

- Parts and Repair Coordination: Assistance sourcing parts and arranging repairs in foreign ports

6. Uninsured Foreign Vessel Coverage

Many foreign vessels operate without insurance. Uninsured boater coverage protects you when:

- Uninsured vessels cause damage

- Foreign vessels have inadequate coverage

- Hit-and-run situations occur in international waters

This coverage is essential when cruising regions where insurance compliance is inconsistent.

Coverage for Different Bluewater Routes

Insurance needs vary by planned routes and destinations.

| Cruising Route | Typical Distance | Duration | Key Coverage Needs | Seasonal Considerations | Premium Impact |

|---|---|---|---|---|---|

| Transatlantic (U.S./Caribbean to Europe) | 3,000-4,000 nm | 14-25 days | Unlimited offshore, North Atlantic weather, EU compliance | Spring eastbound, Fall westbound | +25-40% |

| Transpacific (West Coast to Hawaii) | 2,400 nm | 12-18 days | Extended offshore, mid-ocean emergency services | Year-round possible, avoid winter storms | +30-40% |

| South Pacific Circuit (Hawaii-Marquesas-Fiji-NZ) | 6,000+ nm | 6-12 months | Cyclone season coverage, remote location support | Avoid Nov-April cyclone season | +35-50% |

| Caribbean Island Hopping | Varies | 3-6 months | Hurricane provisions, multiple country compliance | Hurricane season Jun-Nov restrictions | +20-35% |

| Mediterranean Circuit | 2,000-5,000 nm | 6-12 months | EU standards, multiple country coverage | Summer preferred, winter possible | +25-40% |

| World Circumnavigation | 25,000+ nm | 2-4 years | Unlimited worldwide, all-season flexibility, global emergency services | Careful timing avoiding cyclones globally | +40-60%+ |

1. Atlantic Crossings (Transatlantic Routes)

Typical Routes: U.S./Caribbean to Europe, Europe to Caribbean

Key Requirements:

- Unlimited offshore passage coverage

- North Atlantic weather protection

- European port compliance

- Mid-ocean emergency services Seasonal Considerations: Spring eastbound, fall westbound passages preferred Premium Impact: Generally 25-40% increase over coastal coverage

2. Pacific Crossings (Transpacific Routes)

Typical Routes: West Coast to Hawaii, Hawaii to South Pacific, Pacific island cruising

Key Requirements:

- Extended offshore passage coverage (2,000+ miles)

- South Pacific cyclone awareness

- Remote location support

- French Polynesia/Fiji/Tonga compliance Seasonal Considerations: Strict cyclone season avoidance (November-April) Premium Impact: 30-50% increase, higher for extensive South Pacific cruising

3. Caribbean and Central America

Typical Routes: Florida to Bahamas, island hopping, Panama Canal transit

Key Requirements:

- Caribbean hurricane season provisions

- Multiple country compliance

- Hurricane haul-out or storm evasion coverage

- Varying foreign requirements by island

- Seasonal Considerations: Hurricane season restrictions (June-November)

- Premium Impact: 20-35% increase over U.S. coastal

4. Mediterranean and European Waters

Typical Routes: Western Med, Eastern Med, North Sea, Baltic

Key Requirements:

- EU minimum coverage standards

- Multiple country compliance

- Mistral and Meltemi wind coverage

- European repair facility access

- Seasonal Considerations: Summer cruising preferred, winter Med possible

- Premium Impact: 25-40% increase

5. World Circumnavigation

Typical Routes: Multiple ocean crossings over 2-3+ years

Key Requirements:

- Unlimited worldwide coverage

- All-season flexibility

- Extended time away provisions

- Global emergency services

- Multiple high-risk area transits

- Seasonal Considerations: Careful route timing avoiding cyclone seasons globally

- Premium Impact: 40-60%+ increase, possibly higher for extended durations

Foreign Country Insurance Requirements

Nearly every nation requires visiting vessels to meet specific insurance standards.

Common International Requirements

- Minimum Liability Coverage: $300,000 to €3 million depending on country

- Proof of Coverage: Insurance certificates in English and sometimes local language

- Pollution Coverage: Separate environmental liability, typically $100,000-$500,000

- Wreck Removal: Demonstrated ability to remove vessel if it sinks

- Local Certificates: Some countries require purchasing local certificates or endorsements

Regional Variations

- European Union: Often requires €2-3 million liability, strict environmental standards

- Caribbean Islands: Widely varying requirements, some minimal, others substantial

- South Pacific: Generally relaxed requirements but increasing standards

- Southeast Asia: Inconsistent enforcement but requirements exist

- Central/South America: Varying by country, some require local insurance purchases

Failure to meet these requirements can result in denied port entry, fines, or vessel detention.

Liveaboard and Extended Cruising Considerations

Multi-year bluewater voyages create specific coverage needs.

Liveaboard Endorsements

If you live aboard full-time during cruising:

- Standard recreational policies may exclude or limit liveaboard situations

- Personal property coverage must reflect onboard belongings

- Enhanced medical coverage for crew living aboard

- Increased liability limits for residential situations

Extended Absence from Home Port

Policies may require:

- Annual home port returns (typically waived for bluewater policies)

- Survey updates every 2-3 years regardless of location

- Regular communication with insurers about whereabouts

- Compliance with long-term storage or care standards

Personal Property and Equipment

Bluewater cruisers carry substantial equipment:

- Navigation electronics: $15,000-$50,000+

- Safety equipment: $5,000-$20,000

- Communication gear: $3,000-$15,000

- Spare parts and tools: $5,000-$15,000

- Personal belongings for extended living

Ensure personal property coverage matches actual value standard $3,000-$5,000 limits are grossly inadequate.

What Bluewater Insurance Costs?

Comprehensive bluewater coverage costs significantly more than coastal policies, but provides essential protection.

Premium Factors

- Vessel Value: Higher values mean higher premiums

- Route Complexity: Single ocean crossing costs less than multi-year circumnavigation

- Experience Level: Extensive offshore experience earns better rates

- Vessel Type and Age: Well-found bluewater vessels get favorable rates

- Safety Equipment: Modern navigation, communication, and safety gear reduces premiums

- Survey Results: Recent positive surveys demonstrate vessel condition

Typical Premium Ranges

For a $200,000 bluewater cruising sailboat:

- U.S. Coastal Only: $2,000-$3,000/year

- Caribbean Extended: $2,500-$4,000/year

- Single Ocean Crossing: $3,000-$5,000/year

- Full Worldwide/Circumnavigation: $4,000-$7,000/year

For a $500,000 bluewater yacht:

- U.S. Coastal Only: $4,000-$6,000/year

- Caribbean Extended: $5,000-$7,500/year

- Single Ocean Crossing: $6,000-$9,000/year

- Full Worldwide/Circumnavigation: $8,000-$12,000+/year

While substantial, proper coverage protects your vessel, prevents personal liability exposure, and provides critical services in emergencies.

Choosing the Right Bluewater Insurance Provider

Not all marine insurers understand bluewater cruising. Choose specialists with:

- Bluewater Experience: Extensive history insuring ocean-crossing vessels

- Global Networks: Established relationships with international surveyors and repair facilities

- Cruiser References: Client testimonials from actual bluewater voyagers

- Claims History: Proven track record handling international claims

- Communication: Responsive support across time zones

- Flexibility: Understanding that cruising plans change and willingness to adapt coverage

Avoid insurers treating bluewater cruising as an afterthought or simple policy extension. This specialized coverage requires genuine expertise.

Pre-Departure Preparation

Before casting off for bluewater passages:

Documentation Checklist

- Complete policy review confirming worldwide coverage

- Written confirmation of coverage for all planned destinations

- Multiple copies of insurance certificates (originals and translations)

- Emergency contact information for insurer (including satellite phone numbers)

- Claims procedures documentation

- List of approved international surveyors and repair facilities

Vessel Preparation

- Complete pre-voyage survey documenting vessel condition

- Updated equipment inventory with photos and serial numbers

- Maintenance logs showing vessel care

- Safety equipment verification exceeding minimum requirements

- Communication equipment testing (satellite phone, EPIRB, etc.)

Insurer Communication

- Notify insurer of departure date and planned route

- Provide regular position updates during passages (many policies require this)

- Report any route changes or extended stays

- Maintain communication channels for emergency situations

The Bottom Line on Bluewater Insurance

Bluewater cruising represents significant investment in your vessel, time, and the dream itself. Proper insurance protection ensures mechanical failures, storms, or accidents don’t end your adventure prematurely or bankrupt you in the process.

Standard coastal policies categorically fail bluewater cruisers. You need specialized coverage from insurers who understand ocean passages, international cruising, and the unique challenges of extended voyaging.

Don’t discover coverage gaps mid-ocean or in remote foreign ports. Secure proper bluewater insurance before departing, verify it covers your entire planned route, and maintain compliance with policy requirements throughout your voyage.

The freedom of bluewater cruising is worth protecting properly. Our marine insurance specialists help cruisers secure comprehensive worldwide coverage for extended voyaging adventures. Contact us to discuss your bluewater cruising plans and ensure you have protection matching your ambitions.

We provide complete marine coverage including Hull Coverage, Liability Coverage, and specialized High-Value Yacht protection for serious cruising vessels.

Frequently Asked Questions

This is extremely difficult and often impossible. Most insurers require vessel surveys, inspections, and detailed route planning before issuing bluewater policies. Some may provide coverage if you’re in a major port with survey facilities available, but expect higher premiums, restrictions, and possible coverage gaps. Always secure proper insurance before departing.

This depends on your specific policy. Most bluewater policies include some crew coverage, but you must disclose crew arrangements during underwriting. Paid professional crew requires commercial endorsements. Carrying paying passengers (even expense-sharing) may require commercial coverage. Non-family crew and guests should be disclosed to ensure proper coverage.

Quality bluewater policies cover repairs at foreign facilities, though you should notify your insurer before authorizing major work. Insurers typically work with you to verify facility quality, approve estimates, and sometimes advance funds or provide payment guarantees to facilities. Keep detailed documentation, get insurer approval for significant repairs, and save all receipts and invoices.