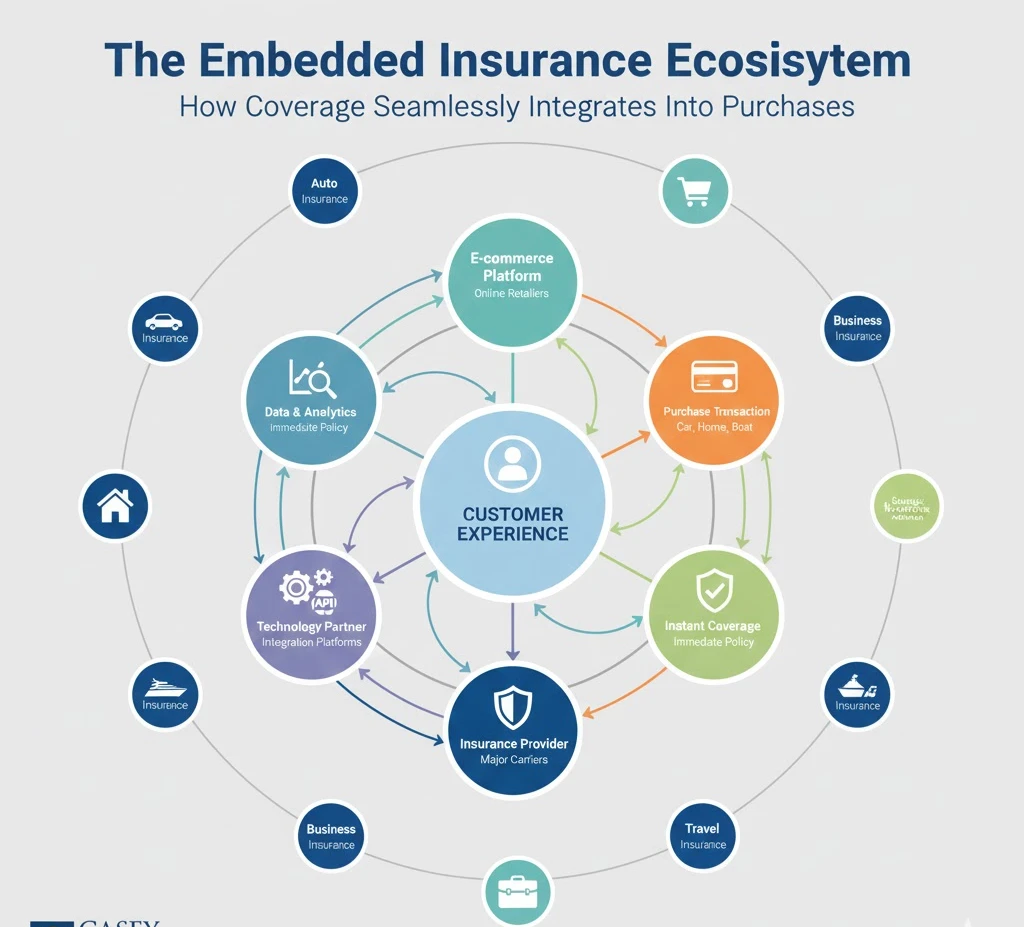

You’re booking a flight online and notice a checkbox offering travel insurance for $12. You’re buying a new laptop and the checkout offers device protection for $8/month. You’re financing a boat and coverage is automatically included in your monthly payment. So the new one is embedded insurance the fastest-growing insurance trend you’ve probably never heard of.

While traditional insurance requires you to actively shop for policies, embedded insurance seamlessly integrates coverage into your everyday purchases. It’s insurance that appears exactly when and where you need it, without the hassle of separate applications, lengthy forms, or confusing comparisons.

The embedded insurance market is experiencing explosive growth, with projections showing expansion from approximately $230 billion in 2025 to nearly $950 billion by 2030. Yet despite this massive shift in how insurance is distributed, most consumers don’t fully understand what embedded insurance is, how it differs from traditional coverage, or whether they’re getting adequate protection.

What Exactly is Embedded Insurance?

Embedded insurance is coverage that’s built directly into the purchase of another product or service. Instead of seeking out insurance separately, you’re offered protection at the exact moment you’re buying something that needs it.

There are three main types of embedded insurance:

Invisible Coverage – Insurance is automatically included in your purchase without any action required. For example, ride-sharing services like Uber and Lyft automatically provide liability coverage for drivers during trips, funded as part of the service.

Platform Sales – Insurance is offered on a retailer’s website or digital platform. When you buy a high-end bicycle from an online retailer, you’re offered theft and damage coverage customized to that specific purchase.

In-App or In-Product – Coverage is presented within a non-insurance app with an opt-in or opt-out option. Your digital banking app might offer renters insurance based on your spending patterns and transaction history.

Why Embedded Insurance is Exploding Right Now

The insurance industry faces a growing crisis called the “protection gap”—the difference between the coverage people actually need and what they have. Between 2000 and 2020, this gap doubled globally, driven by climate change, urbanization, and a fundamental disconnect between how insurance is sold and how consumers live their digital lives.

Traditional insurance distribution is broken in several ways. The process is complicated, time-consuming, and often confusing. Younger generations increasingly distrust insurance companies, with only 48% of Millennials and 40% of Gen Z owning life insurance. Many people don’t know what coverage they need until it’s too late, and by then, getting insured feels like homework nobody wants to do.

Embedded insurance solves these problems by meeting customers where they already are, in their daily transactions. The model benefits everyone involved:

For Consumers: Convenience, relevant coverage offered at the right moment, transparent pricing, and no separate shopping process required.

For Retailers and Platforms: Additional revenue stream, enhanced customer value proposition, deeper customer relationships, and increased transaction completion rates.

For Insurance Companies: Lower customer acquisition costs, access to new customer segments, data-driven underwriting opportunities, and faster policy distribution.

How Embedded Insurance Works Across Different Coverage Types

Auto Insurance: Usage-Based and Instant Coverage

The auto insurance sector is being transformed by embedded models. Instead of traditional six-month policies, embedded auto insurance can offer:

Mile-Based Coverage – Pay only for the miles you drive, with coverage embedded in telematics devices or apps that track your actual usage. Perfect for low-mileage drivers who overpay with traditional policies.

Dealership Integration – Studies show that 81% of Millennials and Gen Z consumers prefer buying insurance at the exact time of vehicle purchase. Dealers now offer instant coverage at the point of sale, with policies tailored to the specific vehicle and financing terms.

Ride-Share Protection – Automatic commercial coverage that activates only when you’re driving for Uber, Lyft, or delivery services, supplementing your personal auto policy.

The embedded approach is particularly valuable for gig workers and those with non-traditional driving patterns who fall outside standard underwriting models.

Home and Property Insurance: Smart Home Integration

Embedded home insurance is evolving beyond simple add-ons:

Mortgage Integration – Coverage bundled directly into your mortgage payment with automatic adjustments as your home value changes. Lenders increasingly partner with insurers to offer seamless protection at closing.

Smart Home Discounts – Insurance embedded in smart home device purchases (security systems, water leak detectors, smoke alarms) with instant premium reductions based on installed protection.

Short-Term Rental Coverage – If you list your home on Airbnb or VRBO, embedded policies activate only during rental periods, covering the unique risks of short-term hosting without requiring separate landlord insurance.

Solar Panel and Home Battery Coverage – As more homeowners install renewable energy systems, embedded insurance covers these expensive additions automatically through the installation contract.

Marine and Yacht Insurance: Seasonal and Usage-Based Protection

The marine insurance sector is particularly well-suited to embedded models:

Boat Purchase Integration – Coverage embedded directly into boat financing, with policies that understand the specific vessel, usage patterns, and navigation area from day one.

Marina and Storage Partnerships – Some marinas now offer embedded coverage as part of slip rental agreements, with policies that automatically adjust based on whether your vessel is in storage or actively used.

Charter and Rental Coverage – Instant commercial coverage when you charter your vessel, activating only during rental periods and reverting to personal use coverage otherwise.

Equipment and Electronics Protection – When you upgrade navigation equipment, fish finders, or communication systems, embedded coverage protects these additions without requiring policy endorsements.

Also Read: Commercial vs Personal Auto Insurance: Cost Difference & More

Business and Commercial Insurance: Closing Critical Gaps

Commercial embedded insurance addresses a massive underserved market:

E-commerce Platform Integration – Small businesses selling on Amazon, Etsy, or Shopify can add liability and product coverage directly through the platform, eliminating the complexity of traditional commercial policies.

Gig Worker and Freelancer Coverage – Professional liability and business property coverage embedded in platforms like Upwork, Fiverr, or freelance payment processors, providing protection only when you’re actively working.

Supply Chain and Shipping Insurance – Coverage embedded in shipping and logistics platforms, protecting goods in transit without requiring separate cargo policies.

Cyber Insurance for Small Business – As data breaches become more common, embedded cyber coverage offered through business software subscriptions (accounting tools, CRM platforms, email services) provides affordable protection that’s otherwise out of reach for small operations.

Equipment and Tool Coverage – Construction and trades professionals can get equipment coverage embedded in tool rental agreements or equipment financing.

The Hidden Risks: What Embedded Insurance Doesn’t Tell You

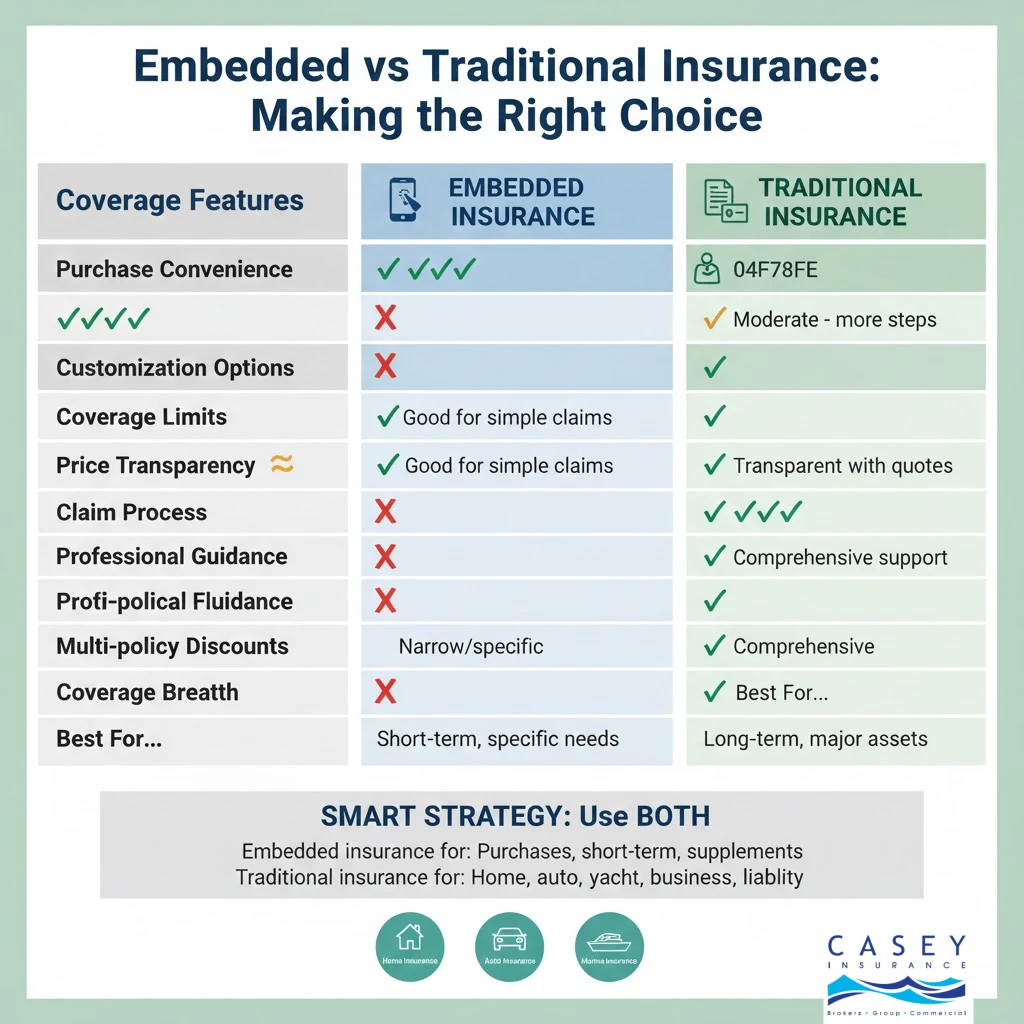

While embedded insurance offers convenience, it’s not without significant drawbacks:

1. Coverage Limitations and Gaps

Embedded policies are typically simplified versions of traditional coverage. They may have lower limits, more exclusions, or narrower protection than comprehensive policies. That $8/month device protection might only cover accidental damage, excluding theft, loss, or manufacturer defects.

2. Lack of Customization

Embedded offerings are one-size-fits-most. You can’t typically adjust coverage limits, add endorsements, or customize the policy to your specific needs. If you own high-value items or have unique risks, embedded insurance likely won’t provide adequate protection.

3. Pricing Transparency Issues

Because embedded insurance is bundled into purchases, it’s harder to comparison shop. That travel insurance checkbox might cost more than a standalone policy would, but the convenience factor masks the price difference.

4. Misunderstanding Coverage Scope

The simplicity of embedded insurance can lead to dangerous misunderstandings. Customers may believe they have comprehensive protection when they actually have limited, situational coverage. This gap becomes apparent only when filing a claim.

5. Regulatory and Licensing Concerns

Embedded insurance operates across state lines and regulatory jurisdictions in ways that traditional insurance doesn’t. Not all embedded offerings comply with state-specific insurance regulations, potentially leaving consumers unprotected in dispute situations.

How to Evaluate if Embedded Insurance is Right for You?

Before accepting embedded insurance, ask these critical questions:

What exactly is covered? – Request the full policy document, not just the marketing summary. Understand limits, exclusions, and claim procedures.

How does this compare to standalone coverage? – Get quotes for equivalent traditional policies. You might find better coverage for similar or lower prices.

Does this replace or supplement my existing coverage? – Determine if embedded insurance provides new protection or duplicates what you already have.

Who is the actual insurer? – The retailer or platform is just the distributor. Know which licensed insurance company is backing the policy and check their financial ratings.

What happens when the purchase period ends? – Many embedded policies are term-limited. Understand whether coverage continues and how renewal works.

Can I bundle this with my other policies? – Traditional insurance often offers multi-policy discounts. Fragmenting your coverage across multiple embedded policies might cost more overall.

The Future: Embedded Insurance in 2026 and Beyond

The embedded insurance market is evolving rapidly, with several key trends emerging:

Hyper-Personalization Through AI – Future embedded offerings will use artificial intelligence in insurance to analyze your specific behaviors, transaction patterns, and risk profiles in real-time, offering perfectly tailored coverage at individualized prices.

Ecosystem Integration – Insurance will become invisible within larger digital ecosystems. Your digital wallet, banking app, or mobility platform will manage all your insurance needs automatically, adjusting coverage as your life changes.

Micro-Insurance for Underserved Markets – Embedded models are making insurance accessible to populations that traditional insurers ignore, gig workers, low-income households, small businesses, and people with non-traditional employment or living situations.

Parametric and Usage-Based Models – Rather than traditional indemnity coverage, embedded insurance increasingly uses parametric triggers (when X happens, you receive Y payment) and precise usage-based pricing that better reflects actual risk.

Blockchain and Smart Contracts – Distributed ledger technology will enable instant, automated claims processing for embedded policies, reducing friction and improving the customer experience.

Making Smart Coverage Decisions in the Embedded Insurance Era

Embedded insurance represents a fundamental shift in how coverage is distributed and consumed. For many situations, especially short-term, specific-risk, or supplemental coverage, embedded options provide excellent value and convenience.

However, embedded insurance should complement, not replace, comprehensive traditional coverage for your major assets and risks. Your home, vehicles, business, and liability exposure still require robust, customized policies that provide broad protection.

The smart approach combines both models:

Use traditional comprehensive policies for: Your primary home, auto, business, and umbrella liability coverage. These need customization, higher limits, and extensive protection.

Consider embedded insurance for: Specific purchases, temporary situations, supplemental protection, and gaps in your traditional coverage.

Work with an insurance professional to: Review all your coverage regularly, identify gaps, eliminate redundancies, and ensure your embedded and traditional policies work together effectively.

Final thoughts

Embedded insurance is revolutionizing the industry by making coverage more accessible, convenient, and relevant to modern digital life. The market’s explosive growth, projected to reach nearly $1 trillion by 2030, reflects genuine consumer demand for simpler, more intuitive insurance purchasing.

But convenience shouldn’t replace comprehension. As embedded insurance becomes ubiquitous, consumers must become more sophisticated about understanding what they’re actually buying. That checkbox during online shopping might provide valuable protection or expensive peace of mind for coverage you don’t need.

The key is treating embedded insurance as one tool in your comprehensive risk management strategy, not a replacement for thoughtful, professional insurance planning. By understanding both the benefits and limitations of embedded coverage, you can make informed decisions that provide true protection when you need it most.

At Casey Insurance Companies, we help clients navigate the changing insurance landscape, including emerging embedded insurance options. Our experienced agents can review your embedded coverage, identify gaps, and ensure your overall insurance strategy provides comprehensive protection across all your assets and risks. Whether you need traditional policies, embedded solutions, or a strategic combination of both, we’re here to guide you through the complexity.