A guest trips on your front steps and breaks their arm. Your dog bites a neighbor. Your child accidentally damages a neighbor’s expensive property. In each scenario, you face potentially devastating lawsuits that could drain your savings, force you to sell assets, or bankrupt you entirely.

This is where homeowners personal liability insurance becomes your financial lifeline. Coverage E of your homeowners policy protects you from the catastrophic costs of injury claims and property damage lawsuits yet many homeowners carry dangerously inadequate limits or don’t understand what this critical coverage actually protects.

Understanding home liability insurance and ensuring you have appropriate coverage could mean the difference between a covered claim and personal financial ruin.

What Is Home Liability Insurance?

Home liability insurance (Coverage E on homeowners policies) protects you when you’re legally responsible for injuries to others or damage to their property. It covers both legal defense costs and settlements or judgments against you.

Think of personal liability coverage for homeowners as protection against the financial consequences of accidents you or your family members cause whether at home or away from home.

What Homeowners Liability Insurance Covers

Personal Injury to Others:

- Guest slip-and-fall accidents on your property

- Dog bites and animal-related injuries

- Injuries from swimming pool accidents

- Visitor injuries from property hazards

Property Damage You Cause:

- Your child breaking a neighbor’s window with a baseball

- Accidentally damaging someone else’s property

- Tree falling from your yard onto neighbor’s house (if due to your negligence)

Incidents Away from Home:

- Your child damaging school property

- Accidentally injuring someone while playing sports

- Damage you cause while visiting others’ homes

Legal Defense Costs:

- Attorney fees if you’re sued

- Court costs and legal expenses

- Expert witness fees

- Settlement negotiations

Medical Payments to Others:

- Small medical expenses for injured guests (typically $1,000-$5,000)

- No-fault coverage preventing minor injuries from becoming lawsuits

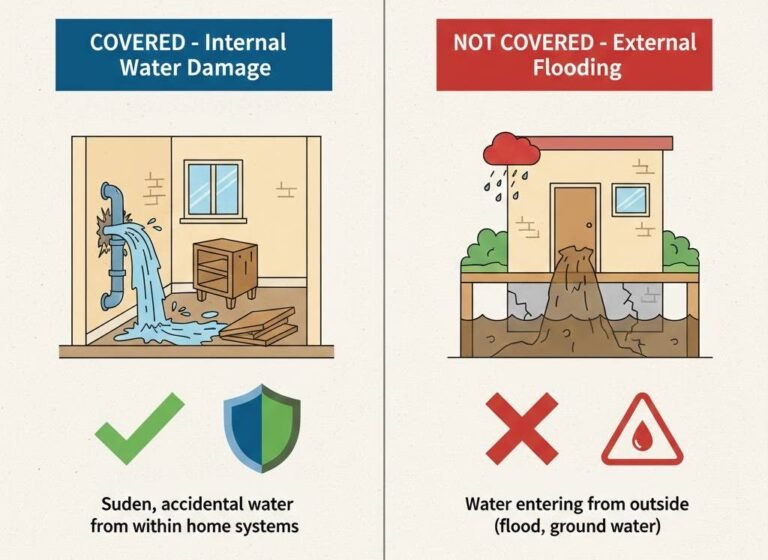

What Home Liability Insurance Doesn’t Cover

Intentional Acts: Deliberately causing injuries or damage isn’t covered.

Business Activities: Home-based businesses require separate coverage. General liability insurance for home care agency, professional liability insurance for home inspectors, or liability insurance for home inspectors operating businesses need commercial policies.

Auto Accidents: Vehicle-related injuries are covered by auto liability insurance, not homeowners.

Professional Services: Negligence in professional work requires professional liability coverage.

Contractual Liability: Obligations you assume through contracts typically aren’t covered.

Property You Own: Liability covers damage to others’ property, not yours (that’s dwelling coverage).

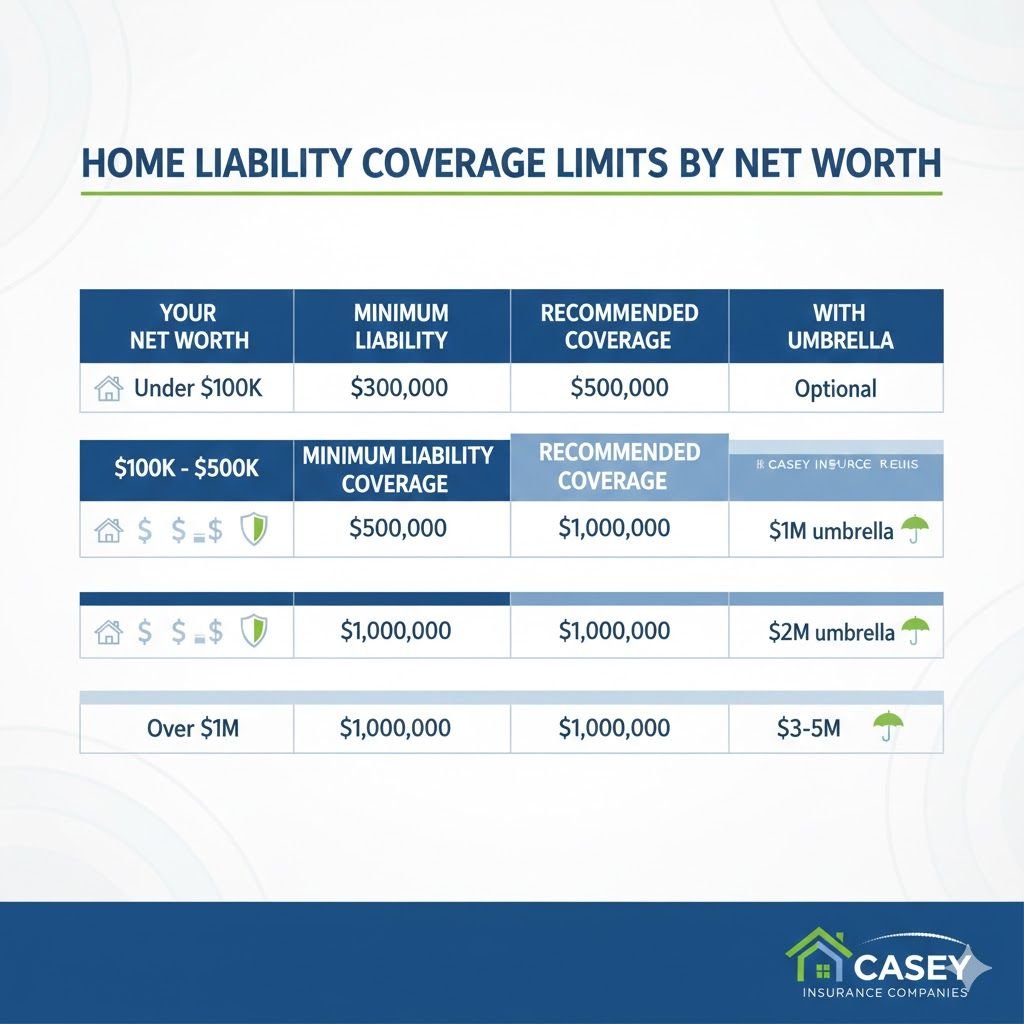

How Much Liability Coverage Do You Need?

Standard policies offer $100,000-$300,000 in liability coverage often grossly inadequate for serious claims.

The Asset Protection Rule

Recommended Coverage: At least equal to your total net worth (assets minus debts).

Calculate your net worth:

- Home equity

- Retirement accounts

- Savings and investments

- Vehicle values

- Other assets

If you have $500,000 in net worth but carry only $100,000 liability coverage, plaintiffs can pursue your remaining $400,000 in assets to satisfy judgments.

Recommended Minimum Limits

Basic Protection: $300,000-$500,000

- Adequate for modest assets and lower risk situations

Standard Protection: $500,000-$1 million

- Recommended for most homeowners

- Protects moderate asset levels

Enhanced Protection: $1 million+

- Essential for substantial assets

- Recommended for high-risk situations (pools, trampolines, dogs)

Special Considerations Requiring Higher Limits

Increase liability coverage if you:

- Have swimming pools or hot tubs (drowning/injury risk)

- Own certain dog breeds (higher bite risk perception)

- Host frequent gatherings (more guest exposure)

- Have trampolines or play equipment (injury magnets)

- Own rental properties (additional liability exposure)

- Have teenage drivers (higher accident rates)

- Employ household help (workers’ compensation issues)

- Live in high-litigation areas like Florida or California

In states like Florida (home liability insurance Florida searches reflect high awareness), litigation rates are higher and jury awards can be substantial making adequate coverage even more critical.

Umbrella Liability Insurance

For comprehensive protection, add umbrella coverage providing $1-5 million in additional liability protection beyond your homeowners limits.

Cost: $150-$400 annually for $1 million umbrella coverage

Benefits:

- Covers across all policies (home, auto, boat)

- Broader coverage than underlying policies

- Essential for high-net-worth individuals

Umbrella policies are remarkably affordable protection against catastrophic liability exposure.

Common Liability Claim Scenarios

Understanding real-world claims helps you appreciate why adequate coverage matters.

1. Slip-and-Fall Accidents

Scenario: Guest slips on icy steps, suffers serious back injury requiring surgery and months of physical therapy.

Damages: Medical bills ($75,000), lost wages ($25,000), pain and suffering ($100,000) = $200,000 total

With $100,000 Coverage: Insurance pays $100,000, you owe $100,000 personally

With $500,000 Coverage: Insurance pays full $200,000, you owe nothing beyond your assets being protected

2. Dog Bite Claims

Scenario: Your dog bites a child, causing facial scarring requiring plastic surgery and psychological counseling.

Damages: Medical costs ($50,000), cosmetic surgery ($30,000), psychological treatment ($15,000), pain and suffering ($150,000) = $245,000 total

Average Dog Bite Claim: $64,555 (2023 data), but severe cases exceed $200,000-$500,000

Coverage Consideration: Some insurers exclude certain breeds or won’t cover homes with dogs having bite histories.

3. Swimming Pool Accidents

Scenario: Neighbor’s child drowns in your pool despite fencing and safety measures.

Damages: Wrongful death claims often reach $500,000-$2 million+

Why Coverage Matters: Pool-related claims are among the most expensive homeowner liability scenarios. Even with safety measures, accidents happen and juries sympathize with injured children.

4. Property Damage Claims

Scenario: Your tree falls during a storm onto neighbor’s house, causing $40,000 damage.

Coverage: If the tree was healthy and storm damage wasn’t preventable, it’s typically covered. If you neglected a diseased tree, coverage might be disputed but likely applies with higher scrutiny.

Personal Liability Coverage for Homeowners: Geographic Variations

Liability needs vary by location and state laws.

High-Litigation States

- Florida, California, New York, Texas: Higher lawsuit frequency and larger jury awards make higher liability limits essential.

- Home Liability Insurance Florida: Florida’s high litigation rates, hurricanes, pools, and tourist-heavy areas create elevated liability exposure. Florida homeowners should carry minimum $500,000-$1 million coverage.

Why It Matters: State lawsuit climate affects both claim frequency and settlement/judgment amounts.

Tort Law Variations

Comparative Negligence States: Damages are reduced by your percentage of fault. If you’re 30% at fault, you pay 30% of damages.

Contributory Negligence States: Any fault by the injured party can eliminate your liability entirely (beneficial for defendants).

Pure Joint and Several Liability States: You can be held responsible for entire judgments even if only partially at fault (dangerous for defendants).

Understanding your state’s liability laws helps determine appropriate coverage levels.

Medical Payments to Others (Coverage F)

This companion coverage to liability provides no-fault medical payment coverage.

How Medical Payments Work

Coverage: Pays small medical expenses ($1,000-$5,000 typical limits) for guests injured on your property, regardless of fault.

Benefits:

- Prevents minor injuries from becoming liability claims

- Covers emergency treatment immediately

- No fault determination required

- Goodwill gesture maintaining relationships

Example: Guest cuts hand on broken glass at your party. Medical payments coverage pays $800 ER bill immediately without investigating fault or involving attorneys.

When to Increase Medical Payments Limits?

Standard $1,000-$2,000 limits often suffice, but consider $5,000-$10,000 if you:

- Host frequent parties or gatherings

- Have swimming pools or trampolines

- Have young children with playmates visiting regularly

- Want maximum protection against minor claims escalating

Exclusions and Coverage Gaps

Knowing what’s excluded prevents false assumptions.

Business and Professional Activities

Home-Based Businesses: If you run any business from home consulting, childcare, tutoring, e-commerce personal homeowners liability excludes claims arising from business activities.

Professional Services: Liability insurance for home inspectors, real estate agents, contractors, or any professional service providers requires professional liability insurance (errors & omissions coverage), not homeowners liability.

Home Care Agencies: General liability insurance for home care agency operations requires commercial general liability policies covering business-related risks.

Solution: Obtain appropriate business insurance or professional liability insurance for home inspectors and other professionals operating from home.

Intentional and Criminal Acts

Deliberately causing harm voids coverage. Even if you claim self-defense, insurers investigate thoroughly and may deny coverage for intentional acts.

Motor Vehicle Liability

Auto accidents require auto liability insurance. Homeowners liability doesn’t cover vehicle-related injuries except for:

- Golf carts on your property

- Riding lawn mowers on your property

- Other non-licensed recreational vehicles

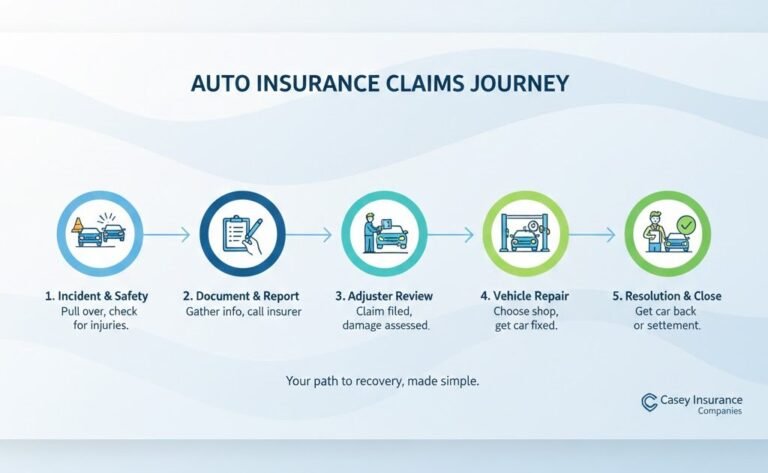

How Liability Claims Are Handled

Understanding the process helps you respond appropriately.

When Someone Is Injured on Your Property

Immediate Actions:

- Provide First Aid: Help the injured person and call 911 if needed

- Don’t Admit Fault: Be compassionate but avoid saying “it’s my fault” or “I’m sorry this happened”

- Document the Scene: Photograph conditions, hazards, and circumstances

- Get Witness Information: Collect names and contact info of anyone who saw the incident

- Notify Your Insurer Immediately: Report potential claims within 24-72 hours even if no lawsuit has been filed

The Claims Investigation Process

Insurer’s Investigation:

- Reviewing circumstances and determining fault

- Assessing injury severity and damages

- Examining your property for hazards or negligence

- Reviewing your liability coverage limits

Settlement Negotiations:

- Insurer handles all communications with claimants

- You’re typically not directly involved unless giving statements

- Settlements below your limits don’t require your approval

- Settlements exceeding limits require your participation

When Lawsuits Are Filed

Legal Defense:

- Your insurer provides attorneys defending you

- Defense costs are separate from liability limits (don’t reduce available coverage)

- Insurer manages the case and makes strategic decisions

- You must cooperate fully with defense

Judgments and Settlements:

- Insurance pays up to policy limits

- You’re personally responsible for amounts exceeding limits

- Insurers may settle within limits even if you disagree (to avoid higher judgments)

Protecting Yourself from Liability Claims

Prevention reduces claims and maintains coverage eligibility.

Property Safety Measures

Reduce Hazards:

- Repair cracked sidewalks and steps

- Install adequate lighting on walkways

- Clear ice and snow from paths promptly

- Secure handrails on stairs

- Fix loose flooring or carpets

- Remove tripping hazards

Pool Safety:

- Install required fencing (4-6 feet high, self-closing gates)

- Use pool covers when not in use

- Post safety rules and emergency equipment

- Prohibit diving in shallow areas

- Supervise all pool use

Dog Safety:

- Train and socialize dogs properly

- Secure dogs when guests visit

- Post “Beware of Dog” signs

- Never leave dogs unsupervised with children

- Consider dog liability endorsements or umbrella coverage

Documentation and Insurance Maintenance

Maintain Records:

- Document all property maintenance and repairs

- Keep records of safety improvements

- Photograph property conditions regularly

- Maintain insurance policy documents

Review Coverage Annually:

- Increase limits as assets grow

- Add umbrella coverage for comprehensive protection

- Update coverage for new risks (pools, trampolines, rental properties)

- Verify exclusions don’t create dangerous gaps

Special Liability Situations

Certain circumstances require additional consideration.

Rental Properties

If you rent rooms or entire properties, homeowners liability likely excludes claims from rental activities. You need:

- Landlord insurance or dwelling fire policies

- Commercial general liability for rental operations

- Higher liability limits for tenant-related claims

Home Businesses

Operating businesses from home voids personal liability coverage for business activities. Obtain:

- Business owners policy (BOP) for home businesses

- Professional liability insurance for professional services

- Commercial general liability for service businesses

For home inspectors specifically, professional liability insurance for home inspectors (E&O coverage) is essential—personal homeowners liability won’t cover professional negligence claims.

Short-Term Rentals (Airbnb, VRBO)

Personal Policies Exclude: Short-term rental activities typically void homeowners liability coverage.

Platform Coverage: Airbnb and VRBO provide some liability coverage, but gaps exist and limits may be inadequate.

Solution: Obtain short-term rental insurance endorsements or separate policies covering this exposure.

Your Complete Liability Protection Strategy

Home liability insurance protects your assets and financial future from devastating lawsuits. Adequate coverage matching or exceeding your net worth ensures accidents don’t destroy everything you’ve built.

Essential Protection Steps:

- Carry liability coverage at least equal to your total assets

- Add umbrella coverage for comprehensive protection

- Maintain safe property conditions preventing injuries

- Obtain separate business coverage for any commercial activities

- Review and increase coverage as assets grow

- Respond properly to incidents and claims

Don’t gamble with inadequate $100,000-$300,000 limits when serious claims regularly exceed these amounts. The modest cost difference for $500,000-$1 million coverage is insignificant compared to protecting your life’s work from liability claims.

Our specialists help homeowners build comprehensive liability protection through proper Home Liability Coverage, appropriate Home Insurance limits, and coordinated coverage across all policies.

Frequently Asked Questions

Possibly liability depends on circumstances and state laws. While you generally owe less duty to trespassers than invited guests, you can still be liable for “attractive nuisances” (pools, trampolines) that lure children, or for knowingly dangerous conditions you didn’t warn about. Some states apply comparative negligence reducing your liability. Never assume trespasser status eliminates liability report all incidents to your insurer.

Coverage typically extends to resident family members, including adult children, for non-business activities. However, once children move out and establish separate households, they’re no longer covered under your policy—they need their own coverage. If adult children live with you but operate businesses or engage in commercial activities, those exposures aren’t covered under your personal policy.

Liability claims can increase premiums, though typically less than property damage claims. The impact depends on claim severity, your claims history, and whether you were found negligent. Some insurers offer claim forgiveness for first incidents. However, multiple liability claims or very large settlements may result in substantial rate increases or non-renewal. This is why adequate limits matter preventing claims through safety measures is better than filing claims.