Understanding what drives your yacht insurance premium can help you make informed decisions about coverage and potentially save thousands of dollars annually. At Casey Insurance, we frequently help yacht owners navigate the complex world of marine insurance pricing. While every policy is unique, certain key factors consistently influence premium calculations across the industry.

Primary Factors That Determine Your Yacht Insurance Premium

1. Vessel Value and Replacement Cost

Your yacht’s value is the foundation of premium calculations, but it’s more nuanced than simply looking at purchase price.

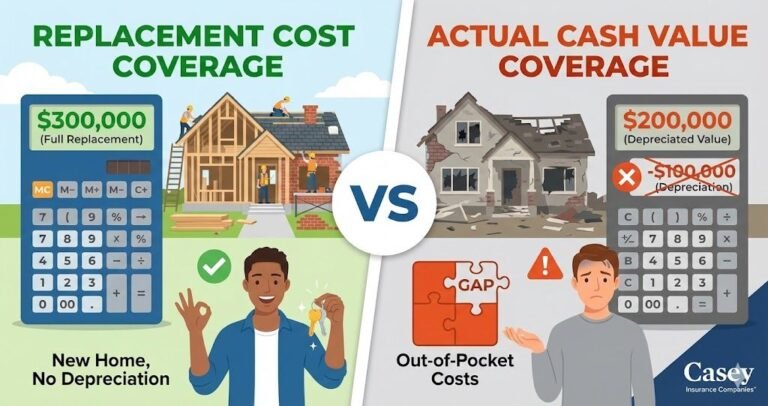

Market Value vs. Agreed Value

- Market value policies: Premium based on current market depreciation

- Agreed value coverage: Premium calculated on predetermined replacement amount

- Appreciated value: Classic or custom yachts may increase in value over time

For more info read our detaild blog on agreed value vs actual cash value boat insurance.

Valuation Methods:

- Recent marine survey appraisals

- Comparable sales data

- Replacement cost for custom builds

- Equipment and upgrade valuations

Premium Impact: Higher-value vessels generally pay 0.75% to 2.5% of insured value annually, with luxury yachts often seeing rates at the lower end due to better maintenance and experienced owners.

2. Yacht Age and Construction

The age of your vessel significantly impacts both insurability and premium costs.

Yacht Age Categories and Impact on premiums:

- New yachts (0-5 years): Lowest premiums, full coverage options

- Mature yachts (6-15 years): Moderate premiums, may require recent surveys

- Older vessels (16+ years): Higher premiums, limited coverage options, mandatory surveys

Construction Material Considerations:

- Fiberglass: Standard rates, widely accepted

- Aluminum: Slightly higher due to electrolysis concerns

- Steel: Higher premiums due to corrosion risk

- Wood: Significantly higher rates, limited insurers

- Carbon fiber/composite: Premium rates for specialized construction

3. Vessel Condition and Maintenance History

Insurance companies carefully evaluate your yacht’s condition as it directly correlates with claim likelihood.

Survey Requirements by Age:

- Vessels under 10 years: Survey may not be required

- 10-20 years: Survey within 3-5 years typically required

- Over 20 years: Recent survey (within 2 years) usually mandatory

Maintenance Factors:

- Professional maintenance records

- Engine service history

- Safety equipment inspection dates

- Haul-out and bottom survey records

- Electronics and systems updates

Condition Premium Modifiers:

- Excellent condition: 10-20% discount possible

- Average condition: Standard rates

- Poor condition: 25-50% premium increase or coverage denial

Geographic and Usage Factors of Boat Insurance

4. Navigation Range and Cruising Area

Where you operate your yacht is one of the most significant premium determinants.

Navigation Categories:

- Inland waters: Lowest risk, minimal premium impact

- Coastal cruising (20-75 miles offshore): Standard rates

- Extended coastal (75+ miles): 15-25% premium increase

- Ocean/worldwide navigation: 100-300% premium increase

Seasonal Restrictions:

- Hurricane-prone areas during storm season

- Ice-affected regions during winter months

- High-risk piracy zones

- Areas with limited rescue services

Geographic Risk Factors:

- Storm frequency and severity

- Theft and vandalism rates

- Availability of repair facilities

- Local marine infrastructure quality

5. Intended Use and Operation

How you plan to use your yacht significantly impacts premium calculations.

Usage Classifications:

- Pleasure use only: Lowest premiums

- Occasional charter: 25-50% premium increase

- Regular charter operation: Commercial rates (significantly higher)

- Racing participation: Additional premium or exclusions

Occupancy Patterns:

- Weekend/seasonal use: May qualify for lay-up credits

- Full-time liveaboard: Increased liability exposure

- Extended cruising: Higher premiums for remote operation

- Marina vs. mooring: Dock damage considerations

Owner and Operator Factors of Yacht

6. Captain and Crew Experience

The experience level of those operating your yacht directly impacts risk assessment.

Experience Factors:

- Years of boating experience

- Size and type of vessels previously operated

- Formal maritime education and certifications

- Coast Guard licenses for larger yachts

- Safety course completions

Professional Captain Considerations:

- Licensed captains may reduce premiums 10-20%

- Full-time professional crew additional discounts

- Rotating crew may increase premiums

- Owner-operator vs. hired captain risk profiles

Age and Claims History:

- Operators under 25 or over 75 may face higher premiums

- Previous marine insurance claims history

- Driving record for trailerable boats

- Overall insurance claim history

7. Safety Equipment and Features

Modern safety equipment can significantly reduce premiums while potentially saving lives.

Essential Safety Equipment:

- Life rafts (offshore-rated for ocean vessels)

- Emergency position indicating radio beacons (EPIRBs)

- Fire suppression systems

- Bilge pump systems and alarms

- Navigation and communication equipment

Security Features:

- Alarm systems and monitoring

- GPS tracking devices

- Secure mooring and docking

- Engine immobilization systems

Premium Discounts Available:

- Safety equipment discounts: 5-15%

- Coast Guard Auxiliary courses: 5-10%

- Yacht club membership: 5% discount

- Multi-policy discounts: 10-25%

Coverage and Policy Structure Factors Affecting Premium

8. Coverage Limits and Deductibles

Your chosen coverage structure significantly impacts premium costs.

Deductible Impact:

- Higher deductibles reduce premiums 15-30%

- Named storm deductibles for hurricane-prone areas

- Separate deductibles for different coverage types

- Total loss deductible considerations

Liability Limits:

- Minimum required coverage: Standard rates

- Higher liability limits: Relatively small premium increase

- Umbrella coverage: Cost-effective for high net worth individuals

Additional Coverage Options:

- Personal effects and equipment coverage

- Fishing equipment or water toys

- Emergency towing and assistance

- Fuel spill liability coverage

9. Mooring and Storage

Where and how you store your yacht affects risk exposure and premiums.

Storage Options:

- Full-service marina: Lowest risk, may qualify for discounts

- Dry stack storage: Reduced weather exposure, potential discounts

- Mooring field: Higher risk, standard rates

- Anchor/swing mooring: Highest risk, premium increases possible

Seasonal Storage:

- Winter haul-out and storage credits

- Hurricane season lay-up options

- Proper storage facility requirements

- Winterization and preparation standards

Market and External Factors

10. Insurance Market Conditions

External market forces beyond your control also influence premiums.

Market Factors:

- Recent catastrophic losses (hurricanes, etc.)

- Insurance company profitability

- Reinsurance market conditions

- Regional claim frequency trends

Economic Influences:

- Vessel replacement costs and inflation

- Repair labor and materials costs

- Currency fluctuations for international coverage

- Interest rates affecting investment income

Premium Calculation Examples to Undersatand Cost

Sample Premium Scenarios

1: Scenario 45-foot Motor Yacht

- Value: $400,000

- Age: 8 years, excellent condition

- Usage: Coastal cruising, pleasure only

- Experience: 15 years, safety courses

- Location: Chesapeake Bay

- Estimated Premium: $3,200-$4,800 annually

2: Scenario. 65-foot Sailing Yacht

- Value: $800,000

- Age: 12 years, good condition

- Usage: Extended coastal, some Caribbean

- Experience: Professional captain

- Enhanced safety equipment

- Estimated Premium: $8,500-$12,000 annually

3: Scenario 35-foot Fishing Boat

- Value: $150,000

- Age: 5 years, good condition

- Usage: Tournament fishing, coastal

- Experience: 20 years sport fishing

- Location: South Florida

- Estimated Premium: $1,800-$2,700 annually

Note: These are examples only to understand your yacht insurance premium. Actual premiums depend on numerous factors and require individual underwriting.

Ways to Potentially Reduce Your Premium

Proactive Steps Yacht Owners Can Take

Vessel Improvements:

- Install modern safety and security equipment

- Maintain detailed service and maintenance records

- Complete regular surveys and inspections

- Upgrade older systems and equipment

Operator Qualifications:

- Complete Coast Guard or Power Squadron courses

- Obtain appropriate captain’s licenses

- Join yacht clubs or boating organizations

- Maintain clean driving and insurance records

Risk Management:

- Choose secure marinas and mooring facilities

- Avoid high-risk areas during storm seasons

- Implement proper seasonal storage procedures

- Maintain adequate security measures

Policy Structure:

- Consider higher deductibles for significant savings

- Bundle with other insurance policies

- Review coverage annually for unused endorsements

- Work with specialized marine insurance agents

Understanding Boat Insurance Premium Quotes

What to Expect During the Quoting Process

Information Required:

- Detailed vessel specifications and equipment

- Recent marine survey (if applicable)

- Intended use and navigation plans

- Operator experience and qualifications

- Previous insurance and claims history

Quote Variations:

- Different insurers may vary significantly in pricing

- Coverage options and limits affect comparisons

- Seasonal vs. annual premium structures

- Payment plan options and fees

Timeline Considerations for Boat insurance Premium

- Simple quotes: 24-48 hours

- Complex or high-value vessels: 1-2 weeks

- New construction: Extended underwriting process

- Claims history review may add time

Working with Marine Insurance Professionals

The Value of Specialized Expertise

At Casey Insurance, we understand that yacht insurance premium determination involves numerous complex factors. Our marine insurance specialists work with multiple carriers to find the best combination of coverage and value for your specific situation.

Our Approach:

- Comprehensive risk assessment

- Multiple carrier comparisons

- Coverage optimization recommendations

- Ongoing policy management and claims support

Why Professional Guidance Matters:

- Navigate complex underwriting requirements

- Identify available discounts and credits

- Ensure adequate coverage for your specific needs

- Provide claims advocacy when needed

Final Thoughts on Yacht Insurance Premium

Your yacht insurance premium is determined by a complex interplay of factors including vessel characteristics, usage patterns, operator experience, and market conditions. While some factors like age and value are fixed, many others can be influenced through proactive risk management and smart policy choices.

Understanding these premium factors empowers you to make better decisions about your coverage and potentially save significant money while maintaining appropriate protection. Every yacht and owner situation is unique, making personalized quotes essential for accurate premium determination.

Ready to get personalized yacht insurance quotes? Contact Casey Insurance for personalized yacht insurance quotes tailored to your vessel, experience, and cruising plans. Our marine insurance specialists will evaluate all relevant factors and provide comprehensive quotes from leading insurers, ensuring you get the best possible coverage at competitive rates.