When you’re budgeting for boat ownership, insurance is one of those necessary expenses that shouldn’t be an afterthought. But here’s the challenge: marine insurance costs vary dramatically depending on what you own and how you use it.

A small fishing boat owner might pay just a few hundred dollars annually, while a luxury yacht owner could spend tens of thousands. Understanding these differences and what drives them helps you budget accurately and find the best value for your situation.

So let’s breakdown actual marine insurance costs by vessel type, reveal the factors that influence your premiums, and share proven strategies to reduce your rates without sacrificing coverage. From shopping for your first boat or reassessing your current policy, you’ll know exactly what to expect.

What Determines Marine Insurance Costs?

Before diving into specific numbers, let’s understand what insurers consider when calculating your boat insurance premiums. These factors apply across all vessel types but impact each differently.

1. Boat Value and Replacement Cost

This is the most obvious factor. A $15,000 boat costs less to insure than a $150,000 yacht simply because the potential payout is smaller. Insurers assess both the purchase price and current market value, considering depreciation for older vessels.

Your boat’s agreed value or actual cash value directly correlates with premium costs. Higher valued vessels mean higher premiums there’s no way around it.

2. Vessel Type and Construction

Different boats carry different risk profiles. Sailboats typically cost less to insure than similar-sized powerboats because they have simpler mechanical systems and lower speeds. Aluminum boats might get better rates than fiberglass due to durability. Personal watercraft costs like jet skis often have higher rates relative to their value because of increased accident frequency.

The vessel’s age matters too. Newer boats generally cost more to insure because replacement parts are expensive, but very old boats might also see increased premiums due to higher breakdown risks.

3. How You Use Your Boat

Recreational use for weekend trips costs less than commercial operations. If you’re running fishing charters or using your boat for business, expect significantly higher premiums. The frequency of use also matters, a boat used occasionally versus daily carries different risk levels.

Navigation range affects pricing as well. Boats limited to protected inland waters typically cost less than those venturing into coastal or offshore waters where conditions are more challenging.

4. Your Location and Storage

Geography plays a huge role in marine insurance rates. Boats in hurricane-prone areas like Florida, Louisiana, or the Carolinas face higher premiums. Similarly, regions with high theft rates or limited repair facilities see increased costs.

Where you store your boat matters too:

- Indoor heated storage: Lowest risk, best rates

- Covered slip at a marina: Moderate rates

- Outdoor slip or mooring: Higher rates

- Beach or dock storage in hurricane zones: Highest rates

Your zip code alone can cause premium variations of 20-40% compared to other regions.

5. Your Experience and Boating Record

Just like auto insurance rewards good drivers, marine insurers favor experienced boaters with clean records. Having boating safety certifications, years of experience, and no prior claims can significantly reduce your rates.

First-time boat owners often pay 10-20% more than experienced captains. Taking a U.S. Coast Guard-approved boating safety course can earn immediate discounts, typically 5-15% off your premium.

6. Coverage Levels and Deductibles

Higher liability limits increase premiums, as does adding optional coverages like towing assistance, personal effects coverage, or uninsured boater protection. Your deductible choice also matters selecting a $2,500 deductible versus $500 can save 15-25% on premiums.

Many boat owners choose higher deductibles to keep annual costs manageable, especially on less expensive vessels where they could potentially cover minor repairs out of pocket.

7. Safety Features and Equipment

Boats equipped with modern safety features often qualify for discounts:

- GPS tracking and theft recovery systems (5-10% discount)

- Fire suppression systems (3-7% discount)

- Engine cutoff switches (2-5% discount)

- Emergency position-indicating radio beacons (EPIRBs)

Insurers reward proactive safety measures because they reduce claim frequency and severity.

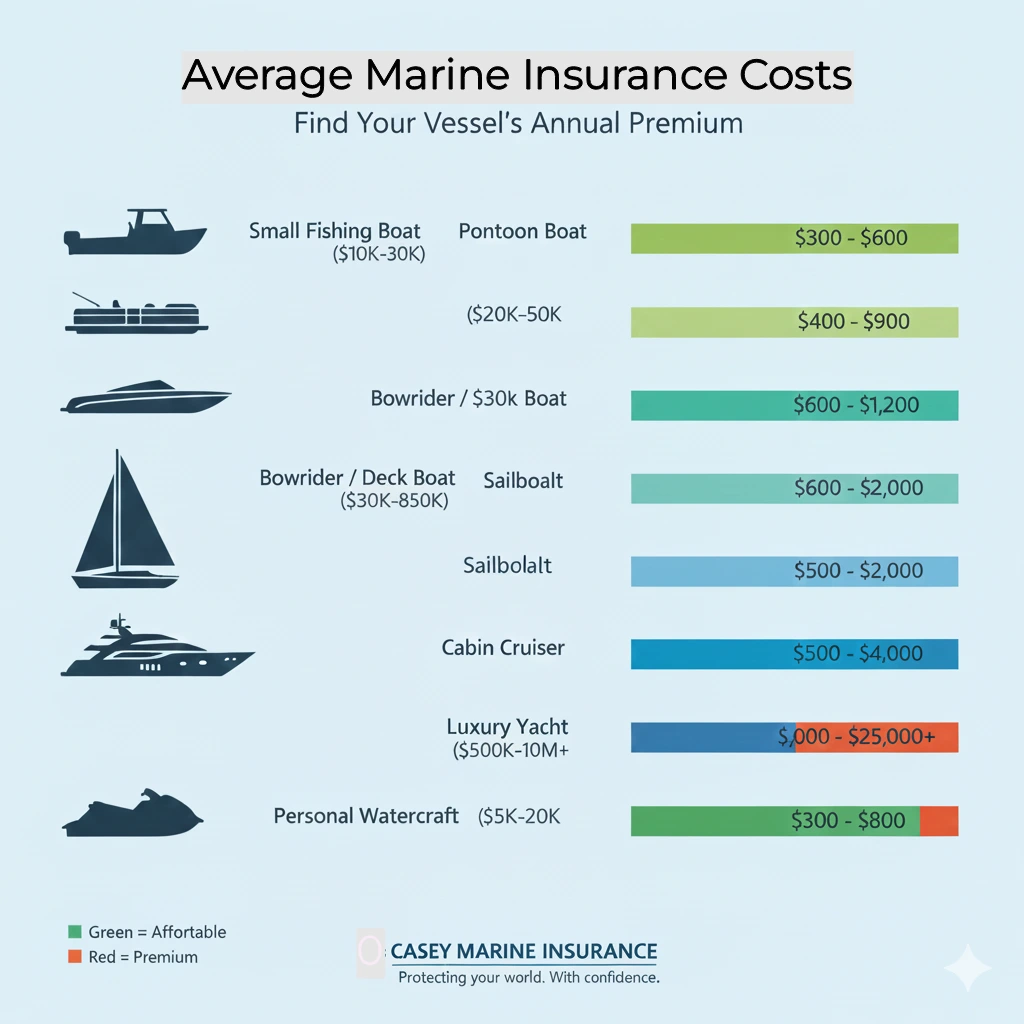

Average Marine Insurance Costs by Boat Type

Now let’s break down what you can actually expect to pay. These ranges represent typical annual premiums for recreational use with standard coverage. Remember, your specific rate depends on the factors mentioned above.

1. Small Fishing Boats and Runabouts (Under 20 Feet)

Typical Value Range: $5,000 – $25,000

Average Annual Premium: $300 – $600

Small boats represent the most affordable insurance category. A basic fishing boat or small bowrider used on inland lakes typically costs $25-$50 monthly to insure.

Example Scenarios:

- 16-foot aluminum fishing boat ($8,000 value): $275-$350/year

- 18-foot fiberglass runabout ($15,000 value): $400-$525/year

- 19-foot bass boat with electronics ($22,000 value): $500-$650/year

These boats benefit from lower replacement costs, simpler mechanical systems, and typically limited navigation ranges. If you store your boat properly during off-season and maintain a clean boating record, you’ll likely stay at the lower end of these ranges.

2. Pontoon Boats

Typical Value Range: $15,000 – $60,000

Average Annual Premium: $400 – $900

Pontoon boats have become incredibly popular for family recreation, and insurance rates reflect their relatively safe profile. These stable vessels have lower accident rates than many powerboats, which helps keep premiums reasonable.

Example Scenarios:

- 20-foot basic pontoon ($18,000 value): $425-$550/year

- 24-foot pontoon with 115hp motor ($35,000 value): $650-$800/year

- 26-foot luxury tritoon with high-power engine ($55,000 value): $850-$1,100/year

Pontoons used solely on calm lakes or rivers typically receive better rates than those venturing into larger bodies of water with potentially rougher conditions.

3. Bowriders and Deck Boats (20-26 Feet)

Typical Value Range: $25,000 – $70,000

Average Annual Premium: $600 – $1,200

Mid-sized powerboats in this category serve as family fun boats for water sports, cruising, and day trips. Insurance costs increase here due to higher speeds, more powerful engines, and greater damage potential.

Example Scenarios:

- 21-foot bowrider with 200hp engine ($32,000 value): $650-$850/year

- 24-foot deck boat with 300hp ($48,000 value): $900-$1,150/year

- 26-foot performance boat ($65,000 value): $1,100-$1,400/year

High-performance boats designed for speed may see premium increases of 15-30% compared to standard recreational models due to higher accident risks.

4. Sailboats

Typical Value Range: $20,000 – $150,000+

Average Annual Premium: $500 – $2,000

Sailboat insurance costs vary enormously based on size, age, and usage. Generally, sailboats cost about 0.75-1.5% of their insured value annually, which is typically less than comparable powerboats.

Example Scenarios:

- 25-foot coastal cruiser ($35,000 value): $500-$750/year

- 32-foot offshore cruiser ($75,000 value): $900-$1,400/year

- 40-foot bluewater yacht ($180,000 value): $2,200-$3,500/year

Sailboats with simpler auxiliary engines, good safety equipment, and experienced captains receive the best rates. Offshore sailing capabilities and international navigation increase premiums significantly.

5. Cabin Cruisers and Express Cruisers (26-40 Feet)

Typical Value Range: $60,000 – $300,000

Average Annual Premium: $1,200 – $4,500

Larger powerboats with overnight accommodations enter premium territory. These vessels have complex systems, expensive engines, and higher repair costs.

Example Scenarios:

- 28-foot express cruiser ($85,000 value): $1,300-$1,800/year

- 32-foot cabin cruiser with twin engines ($145,000 value): $2,200-$3,200/year

- 38-foot sport cruiser ($265,000 value): $3,800-$5,200/year

Boats in this category often include expensive electronics, appliances, and amenities that increase insured value. Many owners add personal property coverage for belongings kept onboard, which adds $100-$300 annually to premiums.

6. Luxury Yachts (40+ Feet)

Typical Value Range: $300,000 – Several Million

Average Annual Premium: $5,000 – $25,000+

Yacht insurance enters an entirely different realm. Premiums typically run 1-2% of the yacht’s value annually, sometimes more for vessels with extensive cruising plans or limited usage.

Example Scenarios:

- 42-foot motor yacht ($425,000 value): $5,500-$8,000/year

- 55-foot luxury yacht ($950,000 value): $12,000-$18,000/year

- 70-foot+ superyacht ($3 million+ value): $40,000-$70,000+/year

High-end yachts require specialized coverage through marine insurance companies that understand luxury vessel complexities. These policies often include captain and crew coverage, enhanced liability limits, and worldwide navigation territories.

Our Personal Marine Insurance specialists work with yacht owners to create comprehensive protection packages tailored to luxury vessels and their unique needs.

7. Personal Watercraft (Jet Skis, Wave Runners)

Typical Value Range: $8,000 – $20,000

Average Annual Premium: $300 – $800

Personal watercraft have disproportionately high insurance rates relative to their value. Why? Higher accident frequencies, younger operators, and increased injury risks drive up costs. Expect to pay roughly 3-5% of the PWC’s value annually.

Example Scenarios:

- Single PWC ($12,000 value): $400-$550/year

- High-performance PWC ($18,000 value): $650-$850/year

- Two or three PWCs on one policy: $600-$1,200/year (multi-unit discount applies)

Many boat owners bundle their PWC coverage with their primary vessel insurance to receive multi-policy discounts of 10-20%.

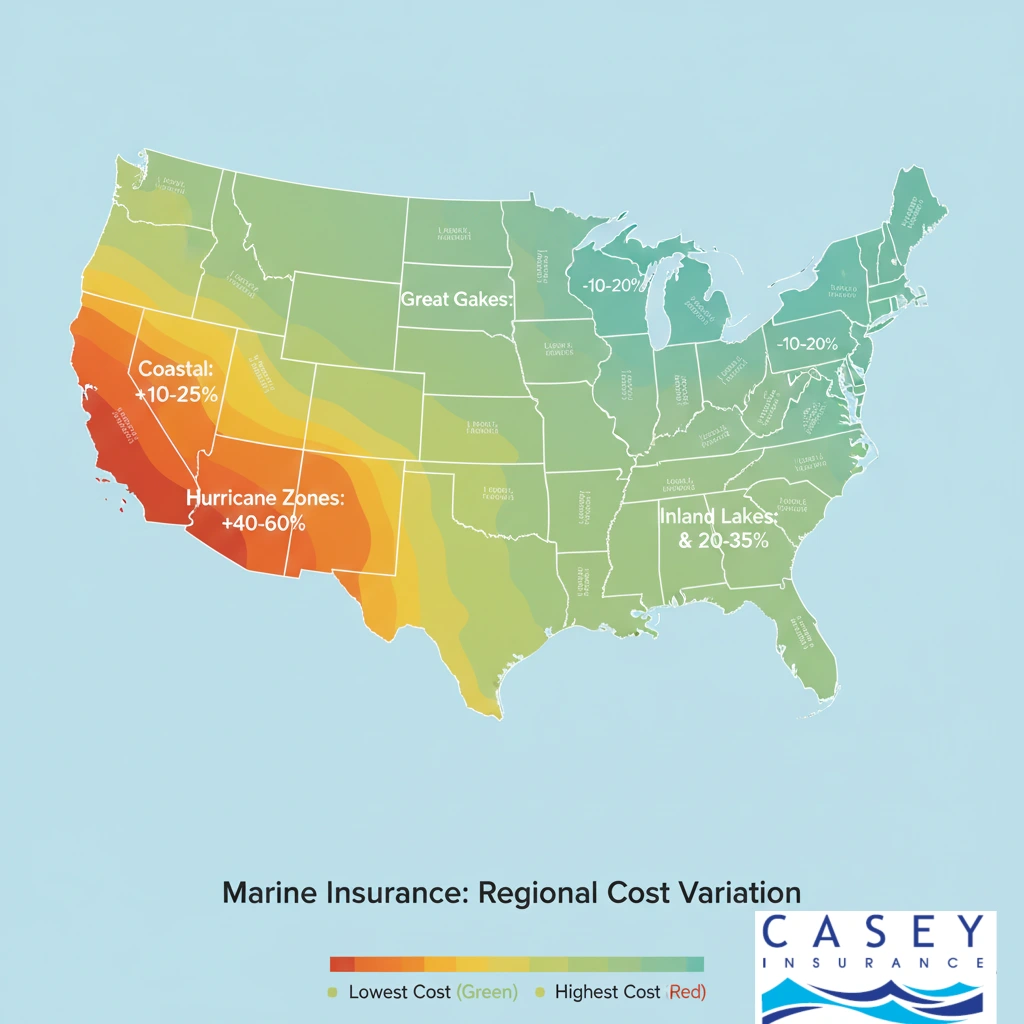

Regional Price Variations in Marine Insurance

Your location dramatically impacts what you pay for boat insurance coverage. Let’s look at how different regions compare.

Hurricane-Prone Coastal Areas

Florida, Louisiana, Alabama, Mississippi, Texas Gulf Coast, and the Carolinas face the highest marine insurance rates in the country. Hurricane risk drives premiums up by 30-60% compared to inland or northern coastal areas.

A $50,000 boat in Miami might cost $1,200-$1,500 annually to insure, while the same boat in Minnesota might only cost $700-$900. Some insurers restrict coverage or require hurricane haul-out clauses during storm season.

Great Lakes Region

Michigan, Wisconsin, Minnesota, Illinois, and other Great Lakes states see moderate rates. Shorter boating seasons (with mandatory lay-up periods) can reduce premiums, but cold weather damage risks and ice can offset some savings.

Pacific Coast

California, Oregon, and Washington generally have moderate to higher rates depending on specific location. Northern California and Pacific Northwest rates are reasonable, while Southern California’s boat theft rates increase premiums in some areas.

Inland and River Systems

Boats used exclusively on rivers, inland lakes, or protected waters typically receive the lowest rates—20-35% less than coastal equivalents. Less exposure to severe weather and calmer conditions mean fewer claims.

International Considerations

If you plan to navigate Mexican, Caribbean, or other international waters, expect significant premium increases or separate endorsement costs. Standard policies often limit coverage to U.S. coastal waters, requiring additional coverage for international cruising.

Commercial vs. Recreational: The Cost Difference

We’ve focused primarily on recreational boat insurance rates, but commercial operations face entirely different pricing structures.

Commercial marine insurance costs typically run 2-4 times higher than recreational coverage. A fishing charter captain operating a $75,000 boat might pay $3,000-$5,000 annually versus $1,200-$1,800 for recreational use.

Why the difference? Commercial operations involve:

- Higher liability exposure with paying passengers

- More frequent use increasing accident probability

- Need for higher liability limits (often $1-$2 million minimum)

- Additional coverages like Jones Act crew liability

- Commercial towing and rescue operations

If you run any business involving your boat fishing charters, water taxis, sailing lessons, or tours you need Marine Business Insurance specifically designed for commercial maritime operations. Using your boat commercially while insured recreationally voids your coverage entirely.

Hidden Costs Beyond Your Premium

When budgeting for marine insurance, consider these additional expenses that aren’t included in your base premium:

- Survey Requirements

Many insurers require professional surveys for boats over $50,000 or older than 10-15 years. Surveys cost $15-$30 per foot, so a 40-foot boat survey runs $600-$1,200. Most insurers accept surveys completed within the past year.

- Premium Financing Fees

If you pay monthly instead of annually, insurers or finance companies often charge installment fees totaling $25-$75 per year.

- Mid-Policy Changes

Adding coverage, increasing limits, or making significant boat modifications mid-policy may trigger endorsement fees of $25-$50.

- Required Safety Equipment

Some policies mandate specific safety equipment to maintain coverage fire extinguishers, flares, life jackets, etc. While these are wise investments regardless, factor them into your first-year costs.

How to Get Lower Marine Insurance Rates?

Nobody wants to overpay for boat insurance. Here are proven strategies to reduce your premiums without sacrificing essential protection:

1. Shop Around and Compare Quotes

Marine insurance rates vary significantly between providers. Get quotes from at least 3-5 insurers specializing in boat coverage. Don’t just compare prices evaluate coverage quality, customer service reputation, and claims handling.

2. Bundle Multiple Policies

Most insurers offer substantial discounts (15-25%) when you bundle marine insurance with Home Insurance, Auto Insurance, or other policies. If you own multiple boats, insuring them together typically saves 10-15% compared to separate policies.

3. Take a Boating Safety Course

U.S. Coast Guard Auxiliary, U.S. Power Squadrons, and state-approved courses qualify for discounts with most insurers. One course can save you 5-15% annually often hundreds of dollars over your ownership period.

4. Increase Your Deductible

Moving from a $500 to $1,000 deductible might save 10-15%. Going to $2,500 could save 20-25%. Just ensure you can comfortably afford the higher deductible if you need to file a claim.

5. Install Safety and Security Equipment

GPS tracking systems, engine cutoff switches, fire suppression systems, and security alarms all qualify for discounts. The equipment costs often pay for themselves through premium savings within 2-3 years.

6. Maintain a Claims-Free Record

Many insurers offer claims-free discounts that increase over time. After 3-5 years without claims, you might qualify for 10-20% reductions. Some policies feature diminishing deductibles that decrease $100-$250 annually when you’re claim-free.

7. Store Your Boat Properly

Indoor winter storage, quality mooring systems, and secure marina facilities all reduce risk and lower premiums. The storage upgrade cost might be offset by insurance savings.

8. Choose Agreed Value Carefully

While agreed value coverage costs more than actual cash value, it provides better protection. However, don’t over-insure. Be realistic about your boat’s market value to avoid paying for coverage you don’t need.

9. Pay Annually

Paying your full premium upfront rather than monthly eliminates financing fees and sometimes qualifies for small discounts (2-5%).

10. Join Boating Organizations

Some insurers offer discounts to members of Boat US, yacht clubs, or other maritime organizations. Membership benefits might include 5-10% insurance discounts.

Getting Accurate Marine Insurance Quotes

When requesting quotes, provide complete and accurate information to get reliable estimates:

Information You’ll Need:

- Boat make, model, and year

- Hull identification number (HIN)

- Current market value or purchase price

- Engine type, horsepower, and hours

- Navigation range and primary use area

- Storage location and method

- Your boating experience and any certifications

- Safety equipment installed

- Desired coverage limits and deductibles

Be honest about boat modifications, usage plans, and experience level. Inaccurate information can lead to coverage issues or claim denials later.

Questions to Ask Insurance Providers

Don’t just accept the premium quote dig deeper:

- What exactly is covered and what are the exclusions?

- What’s the process if I need to file a claim?

- Are there any navigation restrictions or lay-up period requirements?

- What discounts do you offer that I might qualify for?

- How does the claims settlement process work—agreed value or actual cash value?

- Is my trailer covered, or do I need separate coverage?

- What happens if I take my boat outside the covered territory?

Working with experienced marine insurance specialists who understand boats ensures you get appropriate coverage at fair prices. Our team provides detailed Marine Insurance quotes with clear explanations of what you’re getting for your investment.

Is Marine Insurance Worth the Cost?

Given these premiums, you might wonder if marine insurance is truly worth it. Consider this perspective:

Even a modest boat represents a significant investment often $20,000-$50,000 or more. Without insurance, you’re personally liable for:

- Total loss from theft, fire, or sinking

- Damage from storms, collisions, or vandalism

- Liability claims if you injure someone or damage property

- Legal defense costs if you’re sued

- Medical bills for injured passengers

A single serious incident could result in $50,000-$500,000+ in costs. Your annual premium is a fraction of that potential exposure.

For most boat owners, the peace of mind alone justifies the cost. You can enjoy time on the water without constant worry about financial devastation from an accident or loss.

When to Reassess Your Marine Insurance Costs

Your insurance needs change over time. Reassess your coverage annually or when:

- Your boat’s market value changes significantly

- You make major upgrades or modifications

- You change how you use your boat

- You relocate to a different region

- Your lender pays off and no longer requires specific coverage

- You add safety equipment qualifying for new discounts

- Your boating experience increases significantly

Many boat owners overpay by keeping outdated policies that no longer match their situation. An annual review with your insurance provider ensures you’re not paying for coverage you don’t need or lacking protection you do need.

Special Considerations for Financed Boats

If you’re financing your boat, your lender will mandate specific insurance requirements:

- Comprehensive physical damage coverage

- Agreed value or actual cash value meeting the loan amount

- The lender listed as loss payee

- Continuous coverage throughout the loan term

These requirements typically increase your premium by 15-30% compared to minimum coverage. However, once you pay off the loan, you can adjust your coverage though maintaining comprehensive protection usually remains wise.

Some boat owners reduce coverage on older, fully-paid boats to liability-only policies if the boat’s value has depreciated significantly. This saves 40-60% on premiums but leaves you unprotected against physical damage to your own vessel.

Working with Best Marine Insurance Specialists

Marine insurance differs significantly from auto or home coverage. Working with agents who specialize in boats and understand maritime risks ensures you get appropriate protection at competitive rates.

Look for:

- Specific experience with your boat type

- Knowledge of your local waters and regional risks

- Relationships with multiple marine insurers for comparison shopping

- Understanding of commercial vs. recreational needs

- Clear explanations of coverage options without pressure

Our marine insurance team specializes in matching boat owners with coverage that fits their vessels, usage patterns, and budgets. We also provide specialized coverage for related needs including Cargo Insurance for those transporting goods by water and Hull & Machinery Insurance for larger vessels requiring focused structural and mechanical protection.

Making an Informed Decision

Marine insurance costs are significant but manageable when you understand the variables at play. Whether you’re paying $400 annually for a small fishing boat or $8,000 for a yacht, you’re protecting a valuable asset and your financial security.

Focus on value rather than just price. The cheapest policy often provides inadequate coverage, while the most expensive doesn’t necessarily offer superior protection. The right policy balances comprehensive coverage with reasonable premiums based on your specific situation.

Take time to compare options, ask questions, and verify what you’re actually getting. Your boat represents freedom, adventure, and investment protecting it properly ensures those experiences continue without financial stress.

Ready to get accurate quotes tailored to your vessel and situation? Our experienced team provides transparent pricing and coverage explanations, helping you make confident decisions about protecting your marine assets. We can also assist with complementary coverage like Worker Compensation if you employ crew or operate marine-based businesses.

FAQs About Marine Insurance Costs

Boats face unique risks that don’t apply to cars. They’re exposed to harsh marine environments causing corrosion and damage, have complex mechanical and electrical systems that fail more frequently, operate in unpredictable water conditions, sit unused for extended periods increasing theft and deterioration risks, and have limited safety features compared to modern cars.

Most insurers require annual policies rather than month-to-month coverage. Even during off-season, your boat faces risks like theft, fire, vandalism, storm damage, and freezing-related damage. Some policies offer lay-up credits (5-15% premium reduction) for months your boat isn’t in the water, but you must notify the insurer and follow specific storage requirements. Canceling and reactivating coverage repeatedly typically costs more in fees than any savings, plus you risk coverage gaps and higher rates when reapplying.

Most insurers offer 5-15% discounts for completing approved boating safety courses. For a boat with a $1,000 annual premium, that’s $50-$150 in savings annually.

Some marine policies include trailer coverage automatically, while others require it as an add-on or exclude it entirely. Trailer coverage typically adds $50-$150 annually to your premium depending on the trailer’s value. If your policy doesn’t include trailer coverage, your auto insurance might cover it while towing as part of your vehicle’s comprehensive and collision coverage, but only during transport—not when disconnected. Check both policies carefully, as gaps are common. For expensive custom trailers worth $3,000+, dedicated coverage is worth the relatively small additional cost.

Marine insurance typically follows similar patterns to auto insurance. One claim might not affect your rates, especially if it’s weather-related or a comprehensive claim rather than a collision you caused. However, multiple claims within 3-5 years can increase premiums by 10-30% at renewal or cause non-renewal. If you have a minor claim just above your deductible, consider paying out of pocket to preserve your claims-free discount, which might save more than the claim payout over several years.