Demise charters also known as bareboat charters are one of the most misunderstood areas of marine insurance. Many commercial operators assume that because the vessel is “chartered out,” their exposure is limited. In reality, demise charters carry some of the highest legal and insurance risks in the marine industry.

If you operate, own, manage, or insure vessels used for commercial charters, understanding demise charter insurance is critical. One mistake in structure or documentation can result in denied claims, uninsured losses, or regulatory violations.

This guide will explains:

- What a demise (bareboat) charter really is

- Why insurance is legally and contractually required

- How liability shifts under a full possession charter

- What commercial operators must insure

- Common mistakes that invalidate coverage

All explained clearly, without legal jargon.

What Is a Demise (Bareboat) Charter?

A demise charter is a charter arrangement where:

- The charterer takes full possession and control of the vessel

- The vessel owner does not provide a captain or crew

- The charterer becomes the “owner pro hac vice” (owner for the duration of the charter)

- The charterer is responsible for operation, navigation, and crew

This is very different from a captained charter.

Why Demise Charters Are Considered Commercial Operations

Even though the vessel owner may not operate the boat, demise charters are still treated as commercial activities because:

- The vessel is used for hire

- Money changes hands

- There is exposure to third parties

- Maritime law applies

Because of this, standard private boat insurance does NOT apply.

Using a personal policy for a demise charter is one of the fastest ways to void coverage.

Why Demise Charter Insurance Is Required

Demise charter insurance is required for three key reasons:

1. Liability Transfers to the Charterer

Under a true demise charter:

- The charterer assumes operational liability

- The charterer is responsible for accidents, injuries, and damages

- The vessel owner still retains residual legal exposure

Insurance must reflect this legal shift.

2. Courts Scrutinize Demise Charters Closely

Courts examine:

- Who controlled the vessel

- Who hired the crew

- Who maintained the vessel

- Who insured the risks

If insurance is improperly structured, courts may rule the charter invalid making the owner fully liable.

3. Commercial Operators Must Meet Regulatory Standards

Many marinas, lenders, ports, and insurers require:

- Proof of commercial charter coverage

- Named insured endorsements

- Waivers of subrogation

- Minimum liability limits

Without proper insurance, operations can be shut down.

Who Needs Demise Charter Insurance?

Demise charter insurance is required for:

- Commercial charter companies

- Yacht owners offering bareboat charters

- Fleet operators

- Vessel management companies

- Boat clubs using bareboat agreements

- Investors leasing vessels for charter income

If your vessel is chartered without a captain, this coverage applies.

Who Is Liable in a Demise Charter?

Liability in a demise charter is shared but legally shifted.

| Party | Primary Responsibility |

|---|---|

| Charterer | Operation, navigation, crew |

| Vessel Owner | Vessel seaworthiness |

| Crew | Negligence during duties |

| Charter Company | Contractual compliance |

This split makes insurance structure critical.

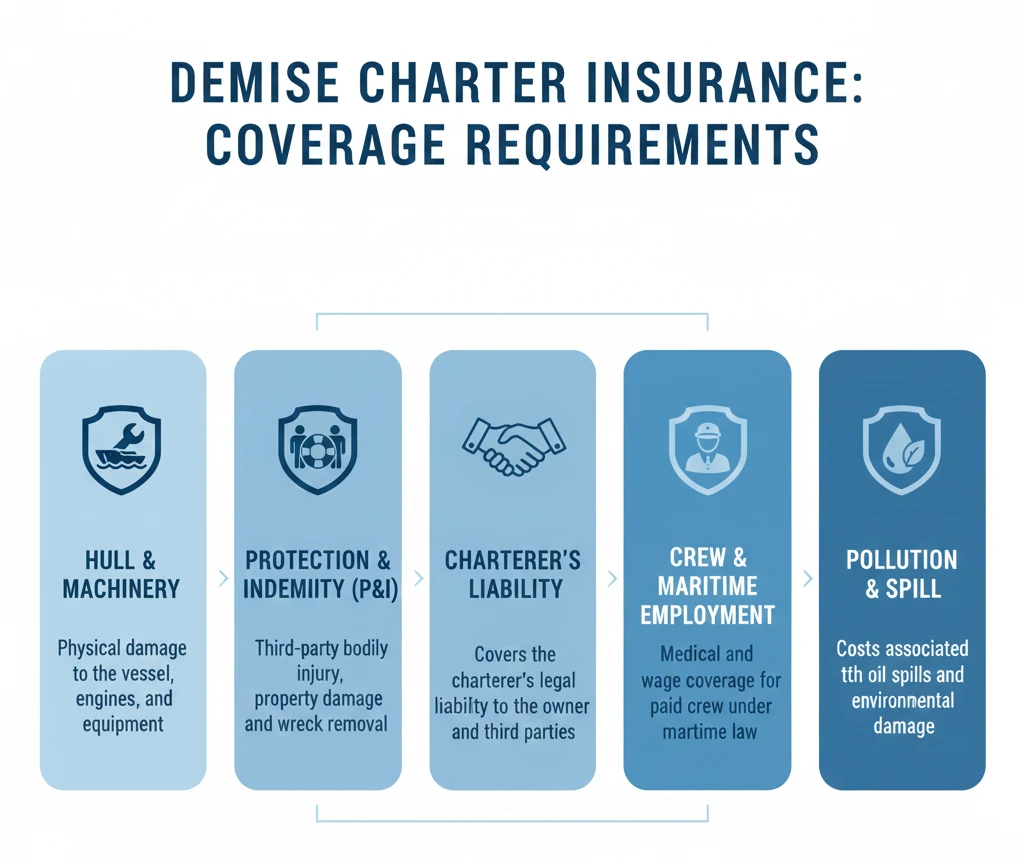

What Does Demise Charter Insurance Cover?

A proper demise charter insurance program typically includes:

1. Commercial Hull Coverage

Protects the vessel against:

- Collision

- Grounding

- Fire

- Sinking

- Storm damage

- Theft or vandalism

Coverage is usually written on an agreed value basis.

2. Protection & Indemnity (P&I)

Covers third-party liability including:

- Bodily injury

- Passenger injury

- Property damage

- Dock and marina damage

- Legal defense costs

3. Charterer’s Liability Coverage

Protects the charterer as the operator, including:

- Operational negligence

- Crew actions

- Charter guest injuries

This is essential under full possession charter agreements.

4. Crew Coverage

If the charterer hires crew:

- Crew medical

- Employer’s liability

- Jones Act exposure (where applicable)

5. Pollution & Wreck Removal

Often mandatory and includes:

- Fuel spills

- Environmental cleanup

- Removal of sunken vessels

Insurance for Commercial Charter Operators

Commercial charter operators must ensure:

- Policy explicitly allows demise/bareboat charters

- Charterer is properly named or endorsed

- Navigation limits are accurate

- Passenger limits are defined

- Contract terms align with insurance language

Any mismatch can void coverage.

Common Mistakes That Invalidate Demise Charter Insurance

These errors frequently lead to denied claims:

- Using private pleasure insurance

- Owner providing the captain (invalidates demise)

- Charterer lacks experience or qualifications

- No written charter agreement

- Charterer not listed on policy

- Misrepresenting charter type to insurer

- Improper crew arrangements

Courts often rule these as “sham charters.”

Demise Charter vs Captained Charter

| Feature | Demise Charter | Captained Charter |

|---|---|---|

| Captain provided by owner | ❌ No | ✅ Yes |

| Operational control | Charterer | Owner |

| Insurance type | Commercial demise | Commercial captained |

| Liability holder | Charterer | Owner/Captain |

| Regulatory scrutiny | Very High | High |

Minimum Liability Limits Commonly Required

| Coverage Type | Typical Limit |

|---|---|

| P&I Liability | $1M – $5M |

| Charterer Liability | $1M |

| Pollution | $1M |

| Hull Coverage | Agreed vessel value |

| Crew Coverage | Statutory |

Higher-value yachts and coastal operations often require umbrella coverage.

Is Demise Charter Insurance Legally Required?

There is no single federal law stating “demise charter insurance is mandatory,” but in practice it is effectively required due to:

- Maritime liability laws

- Contractual obligations

- Marina and lender requirements

- State commercial boating regulations

Operating without it exposes owners and charterers to unlimited financial risk.

How to Structure Demise Charter Insurance Correctly

Best-practice setup:

- Commercial hull policy

- P&I liability coverage

- Charterer’s liability endorsement

- Crew coverage (if applicable)

- Clear charter agreement

- Proper insured naming

Contact Us for Charter Insurance Services

FAQs About Demise Charter Insurance

It’s insurance designed for charters where the charterer controls the vessel.

No. Personal policies exclude commercial use.

Liability may revert entirely to the vessel owner.

Costs vary but are reasonable compared to potential liability exposure.

Why Demise Charter Insurance Is Non-Negotiable

Demise charters create significant legal and financial exposure. Without properly structured insurance:

- Claims can be denied

- Lawsuits can bypass coverage

- Vessel owners can lose asset protection

- Charter operators can face business-ending losses

For commercial operators, demise charter insurance is not optional it’s foundational.