Running or booking a captained charter offers a professional and convenient way to enjoy the water but it also introduces complex liability and insurance responsibilities. Many vessel owners, charter operators, and even licensed captains misunderstand who is legally liable when something goes wrong.

So the real question is:

What liability does a captain hold on a captained charter and what insurance is actually required?

This guide breaks it all down clearly, from a marine insurance professional’s perspective.

Whether you are:

- A charter boat owner

- A USCG-licensed captain

- A yacht owner offering captained trips

- Or a broker structuring charter insurance

Here we’ll explain liability, insurance rules, and common (costly) mistakes to avoid.

What Is a Captained Charter?

A captained charter is a commercial charter where:

- The vessel owner provides the captain

- The charter guest does not control the vessel

- The captain operates under commercial regulations

- The trip is conducted for hire

This is different from:

- Bareboat (demise) charters, where the charterer acts as owner

- Private pleasure use, which is not commercial

Because the vessel is operated for hire, liability exposure is significantly higher.

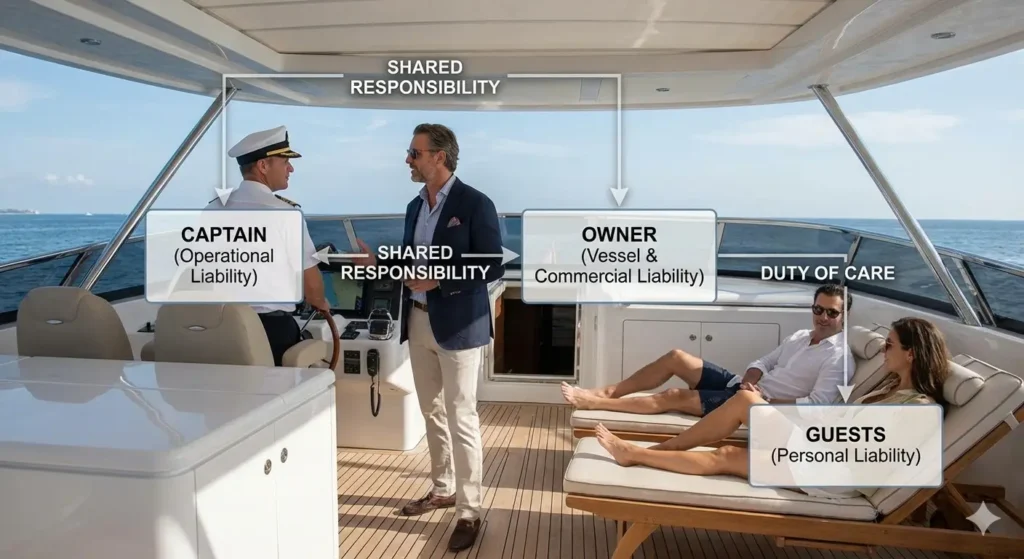

Who Is Responsible in a Captained Charter?

Liability in a captained charter is shared but layered, not simple.

Primary parties involved:

- Vessel Owner

- Charter Operating Entity

- Licensed Captain

- Charter Guests

- Crew (if applicable)

Each party can carry separate legal responsibility depending on the situation.

What Liability Does the Captain Hold?

A captain is personally responsible for their professional actions.

A captain may be liable for:

- Navigational errors

- Collision or grounding

- Failure to follow COLREGs

- Unsafe passenger handling

- Negligence or recklessness

- Operating outside license limits

- Alcohol or drug violations

- Weather-related poor judgment

Even if the vessel owner carries insurance, a captain can still be named personally in a lawsuit.

Captain vs Vessel Owner Liability – Key Difference

| Situation | Who Is Primarily Liable? | Notes |

|---|---|---|

| Collision due to navigation error | Captain | Captain’s professional negligence |

| Mechanical failure | Vessel Owner | Maintenance responsibility |

| Passenger injury | Owner + Captain | Shared exposure |

| Dock damage | Captain | Operator at the time |

| Unlicensed operation | Captain | Insurance may be void |

| Inadequate safety gear | Owner | Regulatory compliance |

| Alcohol-related incident | Captain | Personal liability risk |

This is why captained charter insurance must be structured correctly.

Does the Captain Need Their Own Insurance?

Yes — absolutely.

A vessel’s charter insurance does NOT fully protect the captain.

Captains should carry:

- Captain’s Professional Liability Insurance

- Mariner’s Liability Coverage

- Errors & Omissions (E&O)

This protects the captain if:

- They are sued personally

- The vessel owner’s policy denies coverage

- A claim exceeds policy limits

Without it, captains often pay legal defense costs out of pocket.

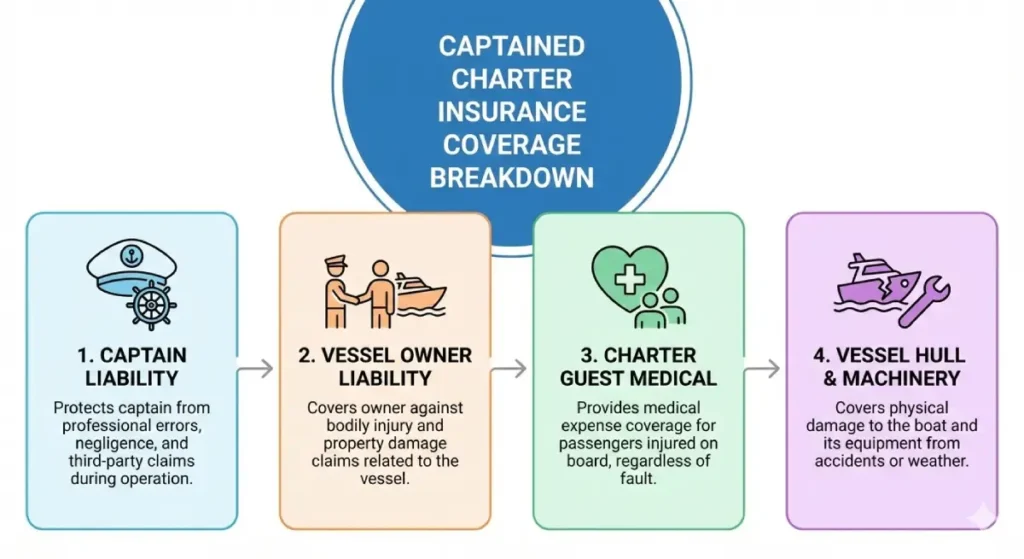

What Insurance Is Required for Captained Charters?

1. Captained Charter Vessel Insurance

This is carried by the vessel owner or charter entity.

Typically includes:

- Commercial hull coverage

- Protection & Indemnity (P&I)

- Passenger liability

- Crew liability

- Wreck removal

- Pollution liability

2. Captain’s Professional Liability Insurance

Carried by the individual captain.

Covers:

- Negligence claims

- Operational mistakes

- Legal defense costs

- Professional errors

This policy follows the captain, not the boat.

3. Workers’ Compensation / Crew Coverage

If crew are onboard:

- Required in many states

- Often mandatory for commercial operations

4. Charterer Liability

Covers:

- Charter guest negligence

- Accidental damage

- Personal injury exposure

Common Insurance Gaps in Captained Charters

These mistakes cause denied claims more than anything else:

- Using private pleasure insurance for charters

- Captain not named or excluded on policy

- Operating outside navigational limits

- Exceeding passenger capacity

- Hiring freelance captains without verifying coverage

- No captain’s E&O policy

- Improper charter contracts

One uninsured claim can easily exceed $250,000–$1M.

Insurance Rules for Charter Captains (U.S.)

In the U.S., captains must:

- Hold a valid USCG license

- Operate within license tonnage & route

- Follow COLREGs

- Comply with USCG inspection standards

- Carry required safety equipment

Failure to comply can:

- Void insurance

- Shift liability fully to the captain

- Result in fines or license suspension

Who Gets Sued First in a Charter Accident?

In most charter claims:

- Vessel owner

- Charter company

- Captain

- Crew

- Charter guests (sometimes)

Plaintiff attorneys name everyone to maximize recovery. Insurance determines who actually pays.

How to Properly Protect Captains & Owners

Best-practice insurance structure:

- Commercial charter policy on vessel

- Captain listed as approved operator

- Separate captain’s professional liability policy

- Clear charter contracts

- Crew properly insured

- Adequate liability limits ($1M+ typical)

Typical Liability Limits for Captained Charters

| Coverage Type | Common Limit |

|---|---|

| P&I / Liability | $1M – $5M |

| Passenger Liability | $1M+ |

| Captain E&O | $500K – $1M |

| Crew Coverage | Statutory |

| Pollution Liability | $1M |

Higher-value yachts and coastal operations often require umbrella coverage.

FAQs: Captained Charter Liability & Insurance

Yes. Captains can be sued individually for negligence.

Partially but not fully. Separate coverage is recommended.

No. This is illegal and extremely risky.

Often both the captain and vessel owner.

Yes. Liability shifts significantly under a true demise charter.

Liability in Captained Charters Is Shared — Insurance Is Critical

Captained charters are professional operations with real legal exposure.

- Captains carry personal professional liability

- Owners carry commercial vessel responsibility

- Insurance must be structured correctly to avoid denied claims

Whether you operate one vessel or manage a charter fleet, proper captained charter insurance protects everyone involved.