Bundling your home and auto insurance with one provider is one of the simplest ways to save hundreds of dollars annually while often improving your overall coverage. Yet many people continue maintaining separate policies with different companies, leaving significant savings on the table.

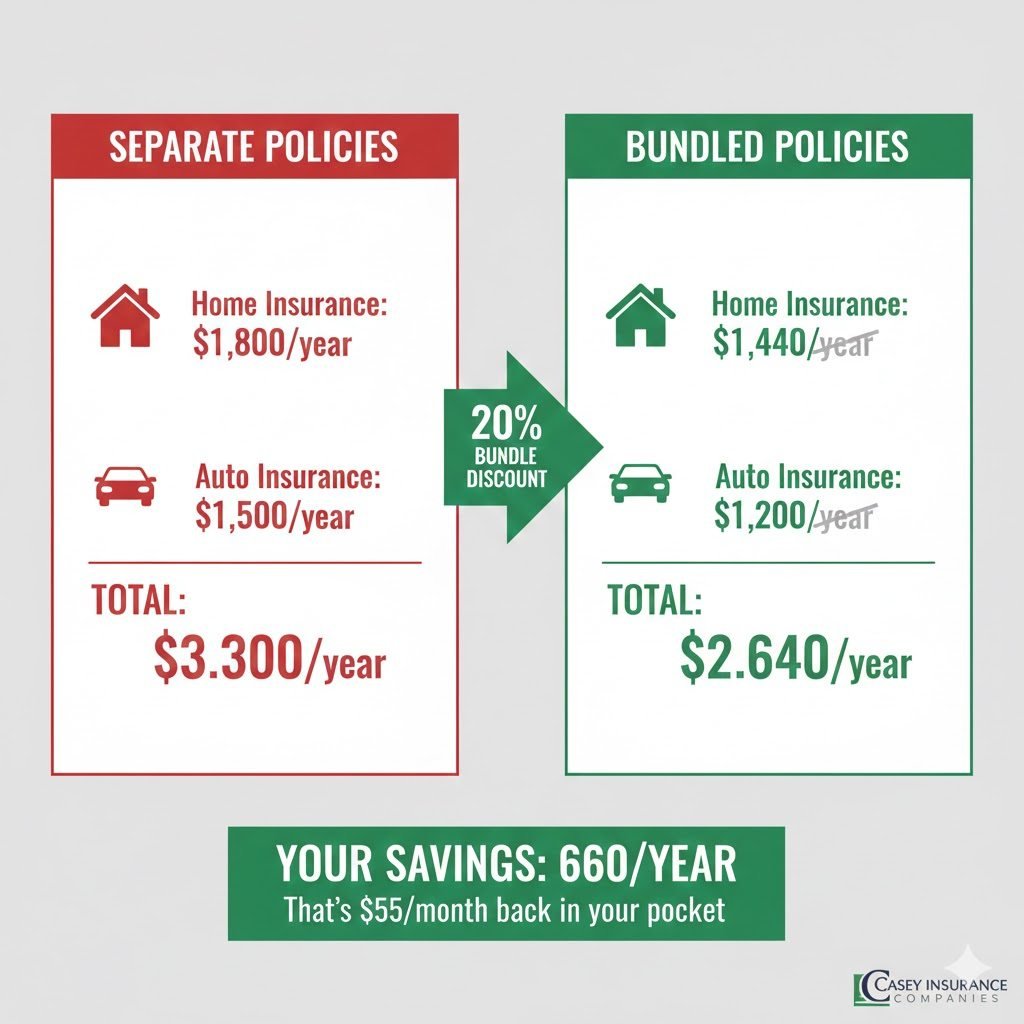

If you’re paying $1,800 for home insurance and $1,500 for auto insurance from different providers, bundling could save you $400-$800 yearly money that stays in your pocket with minimal effort. Beyond cost savings, bundling simplifies your insurance management and often provides additional benefits you wouldn’t receive with separate policies.

Here we’ll guide you through how bundling works, the real savings you can expect, and how to maximize both discounts and coverage when combining policies.

What Is Insurance Bundling?

Insurance bundling (also called multi-policy discounts) means purchasing multiple insurance policies from the same company. The most common bundle combines homeowners and auto insurance, though you can often add:

- Marine/boat insurance

- Umbrella liability policies

- Motorcycle insurance

- RV insurance

- Life insurance

- Renters insurance (if you don’t own)

Insurers reward bundling because it increases customer retention and reduces administrative costs. These savings pass to you through discounted premiums on all bundled policies.

How Much Can You Actually Save?

Bundling savings vary by insurer and your specific situation, but typical discounts are substantial.

Average Bundle Discounts

Standard Savings:

- Home insurance: 15-25% discount

- Auto insurance: 10-20% discount

- Combined savings: 15-25% on total premiums

Real Costs Examples:

1 – Moderate Coverage:

- Separate policies: $1,200 home + $1,400 auto = $2,600 total

- Bundled (20% average discount): $2,080 total

- Annual savings: $520

2 – Higher Coverage:

- Separate policies: $2,400 home + $2,000 auto = $4,400 total

- Bundled (20% average discount): $3,520 total

- Annual savings: $880

3 – Adding Third Policy:

- Separate: $1,800 home + $1,600 auto + $800 boat = $4,200 total

- Bundled (25% average discount): $3,150 total

- Annual savings: $1,050

Factors Affecting Your Discount

Savings percentages depend on:

- Insurer’s specific discount structure

- Number of policies bundled (more = higher discounts)

- Your claims history and credit score

- Coverage levels you choose

- State regulations (some states limit bundling discounts)

- Length of time with the insurer (loyalty bonuses)

Benefits Beyond Cost Savings

While discounts grab attention, bundling provides additional valuable benefits.

Simplified Insurance Management

One Point of Contact: Single agent or customer service team handling all your insurance needs

Consolidated Billing: One payment covers multiple policies easier budgeting and fewer missed payments

Unified Renewal Dates: All policies renew simultaneously, simplifying annual reviews

Single Digital Platform: Manage all coverage, documents, and claims through one website or app

Improved Coverage Options

Bundled policies often include enhanced benefits:

Higher Liability Limits: Some insurers increase standard liability limits for bundled customers

Broader Coverage: Access to endorsements and riders unavailable with separate policies

Reduced Deductibles: Some insurers offer lower deductibles or deductible waivers when bundling

Accident Forgiveness: First accident doesn’t increase rates often available only for bundled customers

Claims-Free Bonuses: Enhanced rewards for maintaining clean records across all policies

Streamlined Claims Process

When incidents involve multiple policies (vehicle accident near your home damaging both car and property), having one insurer simplifies claims significantly.

Benefits:

- Single claims adjuster handles both policies

- Faster processing with no inter-company disputes

- Clearer communication and fewer hassles

- Better overall claims experience

How to Bundle Home and Auto Insurance Effectively

Maximize your bundling benefits by following this strategic approach.

Step 1: Gather Current Policy Information

Before shopping, collect:

- Current home and auto insurance declarations pages

- Coverage limits and deductibles for both policies

- Premium amounts and payment schedules

- Policy expiration/renewal dates

- Claims history for past 3-5 years

Step 2: Compare Bundle Quotes from Multiple Providers

Don’t assume your current home or auto insurer offers the best bundle deal. Get quotes from at least 3-5 insurers specializing in personal lines coverage.

Request:

- Bundle quotes matching your current coverage

- Quotes with increased coverage (see if better protection costs less bundled)

- Itemized breakdown showing unbundled vs. bundled pricing

- Details on all discounts applied

Step 3: Compare Coverage, Not Just Price

The cheapest bundle isn’t always the best value. Compare:

Home Coverage:

- Dwelling coverage amount (replacement cost)

- Personal property limits

- Liability coverage limits

- Additional living expenses

- Deductible amounts

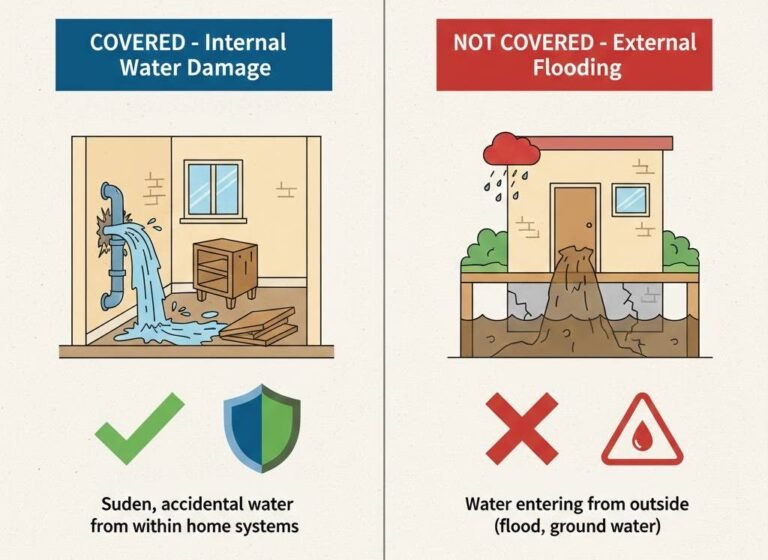

- Coverage for specific risks (water damage, theft, etc.)

Auto Coverage:

- Liability limits

- Comprehensive and collision deductibles

- Uninsured/underinsured motorist coverage

- Medical payments/PIP limits

- Rental car coverage

- Roadside assistance

Ensure you’re comparing equivalent coverage a bundle saving $500 but reducing liability from $500,000 to $300,000 isn’t a good deal.

Step 4: Ask About Additional Discounts

Beyond bundling, inquire about stacking additional savings:

Home Insurance Discounts:

- Security systems (5-15% off)

- Fire/smoke alarms (5-10% off)

- New home (10-15% off)

- Claims-free history (5-10% off)

- Impact-resistant roofing (10-30% off in wind-prone areas)

Auto Insurance Discounts:

- Good driver (10-25% off)

- Defensive driving course (5-10% off)

- Anti-theft devices (5-15% off)

- Low mileage (5-15% off)

- Good student (10-25% off for young drivers)

- Pay-in-full discount (5-10% off)

Combining bundling with these additional discounts can reduce premiums 30-40% or more.

Step 5: Review and Optimize Coverage Annually

Life changes affect insurance needs. Review your bundle annually:

- Home improvements requiring increased dwelling coverage

- Vehicle changes (new car, paid-off loans)

- Life events (marriage, children, retirement)

- Asset growth suggesting higher liability limits

- Claims affecting renewal rates

Our specialists help clients optimize Home Insurance and Auto Insurance bundles annually.

When Bundling Might Not Be Best

While bundling usually provides excellent value, exceptions exist.

Consider Separate Policies If:

One Policy Is Significantly Overpriced: Sometimes one insurer offers great home rates but terrible auto rates (or vice versa). If bundling saves 20% on both but one policy is still 40% overpriced, separate policies might cost less overall.

You Need Specialized Coverage: High-value homes, classic cars, or unique situations sometimes require specialty insurers that don’t bundle standard policies competitively.

You Have Complex Claims History: One major auto claim might spike your bundled rates across all policies. Separating might limit rate increases to just the affected policy.

Different Coverage Needs: If you need basic auto but premium home coverage (or vice versa), finding one insurer excelling at both can be difficult.

How to Test This

Calculate total premiums both ways:

- Best bundle quote total

- Best separate home quote + best separate auto quote

If separate policies cost less even without bundling discounts, that’s your answer. But factor in convenience value sometimes paying $100-$200 more for bundling simplicity is worth it.

Common Bundling Mistakes to Avoid

1: Assuming Your Current Insurer Offers the Best Bundle Shop around rates vary dramatically between insurers.

2: Bundling Without Reviewing Coverage Ensure bundled coverage matches or exceeds what you had separately.

3: Ignoring Policy Details Read exclusions, coverage limits, and policy terms cheap bundles sometimes sacrifice important coverage.

4: Not Re-Shopping Every Few Years Bundle rates that were competitive three years ago may no longer be best. Re-shop every 2-3 years.

5: Forgetting Umbrella Coverage If you have significant assets, add umbrella liability to your bundle for maximum protection and savings.

Beyond Home and Auto: Expanding Your Bundle

Once you’ve bundled home and auto, consider adding:

Umbrella Liability: $1 million coverage typically costs just $150-$300 annually when bundled, protecting all your assets across all policies.

Boat/Marine Insurance: If you own watercraft, adding Marine Insurance to your bundle typically earns 10-15% additional savings.

Motorcycle or RV: Recreational vehicle coverage bundled saves 10-20% compared to standalone policies.

Life Insurance: Some insurers offer small discounts for adding term life to property bundles.

The more you bundle, the deeper your discounts become.

Making the Switch

When you’ve found a better bundle:

- Purchase new policies before canceling old ones (avoid coverage gaps)

- Coordinate effective dates to minimize overlap and maximize refunds

- Notify mortgage company and auto lender of new policy information

- Update payment methods for the new bundle

- Keep old policy proof for at least one year in case questions arise

Most insurers prorate refunds for unused premiums when you cancel mid-term, so don’t let renewal timing prevent switching to better coverage.

Your Path to Savings and Better Protection

Bundling home and auto insurance delivers real savings typically $400-$1,000 annually for most households while simplifying your financial life and often improving coverage. For many families, bundling represents the single best insurance value decision they can make.

Don’t let inertia keep you overpaying for separate policies. Invest a few hours comparing bundle quotes and you’ll likely save hundreds or thousands over the coming years while enjoying better coverage and simplified management.

Our insurance specialists help clients find optimal Home Insurance and Auto Insurance bundles that maximize savings without sacrificing protection. We also provide Commercial Insurance for business owners needing coverage beyond personal lines.

Frequently Asked Questions

Yes! Bundle renters insurance with auto insurance for 15-20% savings on both policies. Renters insurance is inexpensive ($15-30/month) and bundling makes it even more affordable while providing essential protection for your belongings and liability.

No. You’re not locked in you can cancel bundled policies anytime (though staying claim-free often earns loyalty discounts over time). Most people find bundling remains competitive for 3-5+ years before needing to re-shop.

Typically no. Accidents affect only the policy where claims occur. An auto claim affects your auto rates but shouldn’t directly impact home rates, even when bundled. However, multiple claims across different policies might affect overall renewal terms.