Bareboat charters offer an incredible opportunity, boat owners can offset ownership costs by renting their vessels, while renters enjoy the freedom of captaining a boat without the expense of ownership. But this arrangement creates complex insurance challenges that many people don’t fully understand until problems arise.

If you’re a boat owner considering bareboat charter operations or a renter planning to charter a vessel, understanding insurance requirements isn’t optional it’s critical protection against potentially catastrophic financial exposure.

The stakes are high. A single incident during a bareboat charter can result in hundreds of thousands in damage claims, liability lawsuits, and legal complications. Without proper coverage, both owners and charterers face personal financial liability that standard insurance policies simply don’t address.

What Is Bareboat Charter and Why Insurance Matters?

Bareboat charter means renting a vessel without captain or crew the charterer takes complete operational control and responsibility. Unlike crewed charters where professional captains maintain command, bareboat arrangements transfer all navigation, operation, and decision-making to the renter.

This transfer of responsibility creates unique insurance challenges. The boat owner no longer controls how their vessel is operated, while the charterer assumes liability for a boat they don’t own and may be unfamiliar with. Standard personal boat insurance doesn’t cover either party in these scenarios.

The Insurance Gap Problem

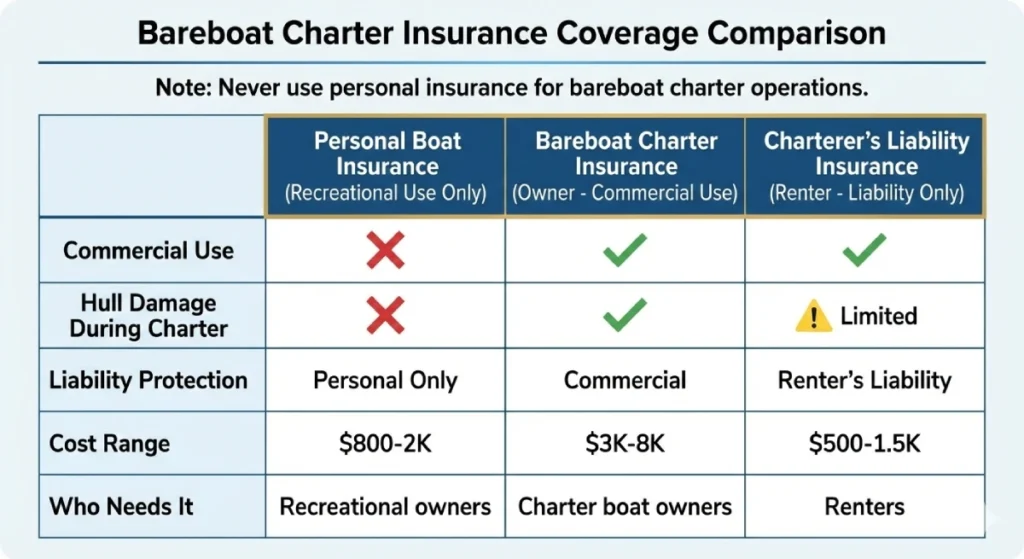

Most boat owners discover too late that their personal marine insurance excludes commercial activities and bareboat charter absolutely qualifies as commercial use. The moment you accept payment for vessel use, your personal policy provides zero coverage. You’re completely uninsured despite paying premiums.

Similarly, renters often assume the owner’s insurance protects them. It doesn’t. Even when owners carry proper charter insurance, charterers face significant liability exposure requiring their own coverage.

Bareboat Charter Insurance for Boat Owners

If you own a boat and want to charter it bareboat, you need specialized commercial marine insurance that standard policies don’t provide.

Why Personal Boat Insurance Doesn’t Cover Charters

Personal recreational marine insurance explicitly excludes any commercial use. The policy language is clear: accepting compensation for boat use whether through traditional charter companies or peer-to-peer platforms like Boat setter or Get My Boat, voids coverage entirely.

This means during charter periods:

- No hull coverage if the boat is damaged

- No liability protection if charterers injure someone or damage property

- No medical payments coverage for injured charterers

- No legal defense if you’re sued

Operating bareboat charters on personal insurance exposes you to unlimited personal liability. A single serious incident could cost hundreds of thousands or millions.

Essential Bareboat Charter Insurance Components

Proper Bareboat Charter Insurance includes several critical coverages:

- Commercial Hull Coverage: Protects your boat’s physical structure and equipment during charter operations. This covers damage charterers cause to your vessel, whether through negligence, accidents, or misuse.

- Commercial Liability Coverage: Provides protection when charterers injure third parties or damage other vessels and property while operating your boat. Minimum limits should be $1-2 million, higher for expensive vessels.

- Charterer Liability: Coverage specifically addressing claims by or against the people renting your boat. This protects both you and charterers from various liability scenarios.

- Protection and Indemnity (P&I): Specialized maritime liability covering crew injuries (if you provide any crew), environmental damage, wreck removal, and other maritime-specific exposures.

- Loss of Income: If your boat is damaged during a charter and requires repairs, this covers lost charter revenue during the down time.

Coverage Limits and Requirements

Bareboat charter insurance requirements depend on several factors:

- Vessel Value: Higher-value boats require proportionally higher coverage limits. A $200,000 boat needs different coverage than a $50,000 vessel.

- Charter Platform Requirements: Companies like Boatsetter, GetMyBoat, or traditional charter companies each have minimum insurance requirements—typically $1-2 million liability minimum.

- Marina and Storage Requirements: Many marinas require enhanced insurance for commercially operated vessels, often with the marina listed as additional insured.

- State and Local Regulations: Some jurisdictions mandate specific minimum coverage for commercial vessel operations.

- Lender Requirements: If you’re financing your boat, lenders typically require comprehensive commercial coverage for charter operations with them listed as loss payee.

Cost Considerations

Bareboat charter insurance costs significantly more than personal coverage—typically 2-4 times your recreational premium. Several factors influence cost:

- Vessel value and type

- Charter frequency and duration

- Charterer qualification requirements you implement

- Your claims history

- Geographic operating area

- Deductible choices

A $75,000 boat that costs $1,200 annually for personal insurance might require $3,000-$5,000 for bareboat charter coverage. While substantial, this expense is necessary business overhead, the charter revenue should more than offset the increased insurance cost.

Insurance Requirements for Bareboat Charterers (Renters)

If you’re chartering a bareboat, don’t assume the owner’s insurance protects you. You face significant liability exposure requiring your own coverage.

Why You Need Charterer’s Liability Insurance?

When you bareboat charter, you become the vessel’s operator with full responsibility for:

- Safe navigation and operation

- Preventing collisions and groundings

- Protecting passengers aboard

- Avoiding damage to other vessels and property

- Complying with navigation rules and regulations

If anything goes wrong—you damage the boat, injure someone, hit another vessel, or cause environmental damage—you’re personally liable. The owner’s insurance typically covers their vessel, but your liability isn’t automatically covered.

What Charterer’s Liability Coverage Provides

Charterer’s liability insurance (sometimes called renter’s insurance) protects you with:

Personal Liability Protection: Coverage if you injure third parties or damage their property while operating the chartered vessel.

Damage to Chartered Vessel: Protection against your responsibility for damaging the boat you’re renting beyond the security deposit.

Medical Payments: Coverage for injuries to you and your passengers.

Legal Defense: Protection if you’re sued for incidents occurring during the charter.

Environmental Liability: Coverage if you cause fuel spills or environmental damage.

Where to Obtain Charterer’s Coverage

You have several options for charterer’s liability insurance:

- Charter Company Insurance: Many bareboat charter operations offer insurance options when you book. These typically cost $200-$500 per charter week and provide damage waivers and basic liability protection.

- Peer-to-Peer Platform Insurance: Platforms like Boat setter include insurance in rental fees, but review coverage details carefully limits may be insufficient, and significant deductibles often apply.

- Standalone Charterer’s Policies: Marine insurers offer dedicated charterer’s liability policies for frequent renters. Annual policies covering multiple charters often provide better value and higher limits than per-charter insurance.

- Boat Owner’s Policy Extension: Some personal boat owners have insurance that extends limited coverage to charterers they rent from. Check with your insurer if you charter frequently.

Typical Charterer Insurance Costs

Costs vary based on coverage type and charter circumstances:

- Per-charter insurance through operators: $30-$75 per day

- Weekly charter insurance package: $200-$500

- Annual charterer’s liability policy: $500-$1,500 covering multiple charters

- Peer-to-peer platform insurance: Usually included in rental fee but verify coverage details

Security Deposits vs. Insurance: Understanding the Difference

Many charterers mistakenly believe the security deposit they pay protects them adequately. It doesn’t.

Security deposits (typically $1,000-$5,000) cover minor damage, missing equipment, or cleaning issues. They don’t protect against major claims:

- Total loss of the vessel: $50,000-$500,000+

- Serious injury claims: $100,000-$1,000,000+

- Collision damage to other vessels: $25,000-$500,000

- Environmental cleanup: $50,000-$200,000+

Your security deposit might cover a damaged depth finder or torn upholstery. It won’t cover sinking the boat or causing serious injuries. Only proper insurance provides adequate protection.

Pre-Charter Requirements and Qualifications

Both owners and charterers should understand qualification requirements that affect insurance coverage.

Owner’s Charterer Qualification Responsibilities

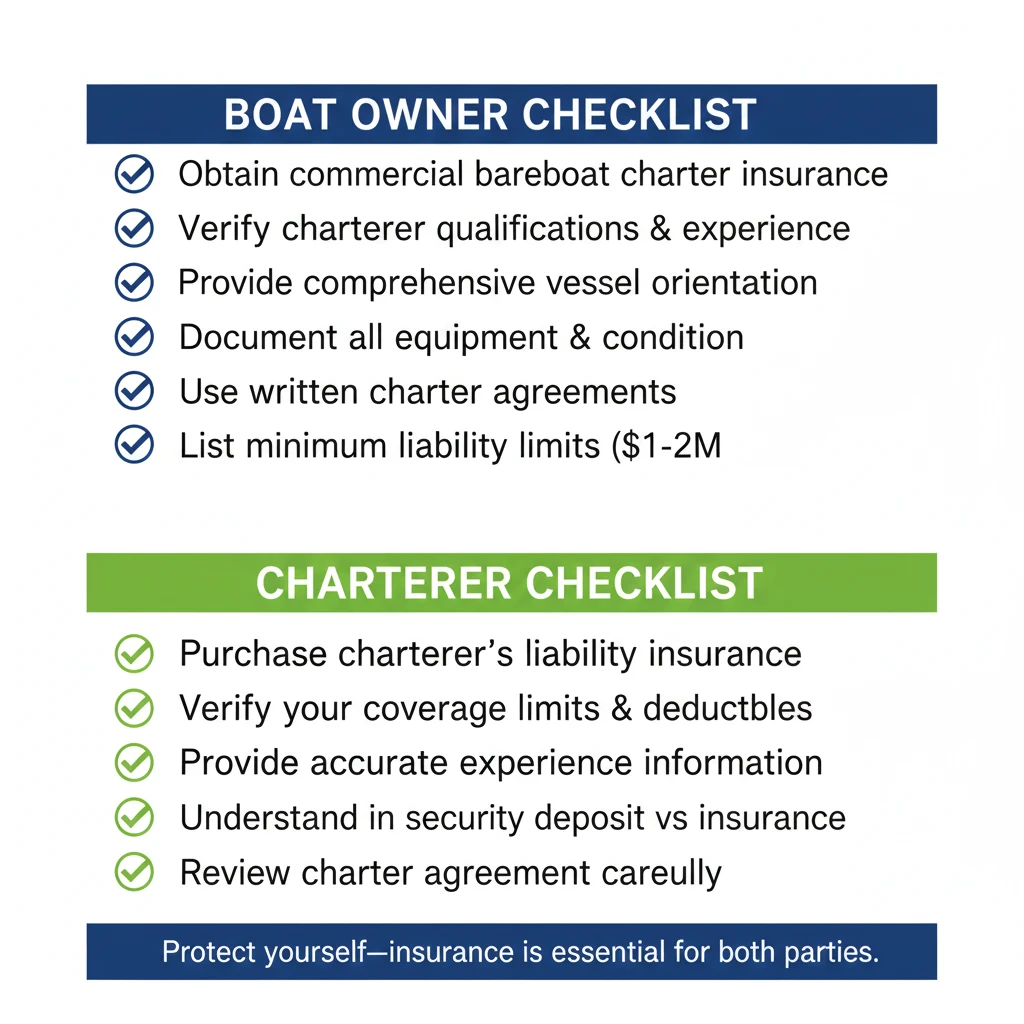

To maintain insurance coverage, boat owners must verify charterer qualifications:

Experience Requirements: Document charterers’ boating experience—years operating similar vessels, boat sizes they’ve captained, navigation experience.

Licensing and Certification: Verify charterers hold required boating licenses or certifications. Many states require boater education; some insurers mandate specific certifications.

Reference Checks: For peer-to-peer charters, checking references from previous charters helps verify competence.

Vessel Orientation: Provide thorough vessel orientation covering all systems, safety equipment, navigation electronics, and emergency procedures. Document this training.

Written Agreements: Use comprehensive charter agreements clearly defining responsibilities, insurance requirements, and liability provisions.

Failing to properly qualify charterers can void your insurance coverage. If an unqualified operator causes damage, insurers may deny claims citing inadequate screening.

Charterer’s Preparation Responsibilities

As a charterer, prepare properly to maintain insurance protection:

- Honestly represent your experience level, exaggerating qualifications can void coverage

- Obtain required licenses and certifications

- Participate fully in vessel orientation

- Ask questions about anything unclear

- Review the charter agreement carefully before signing

- Understand exactly what insurance covers and what your personal responsibility includes

What Happens When Incidents Occur?

Understanding the claims process for bareboat charter incidents helps both parties respond appropriately.

Immediate Actions After Incidents

If damage or injuries occur during a bareboat charter:

- Ensure Safety: Address any immediate safety concerns, medical needs, or dangerous situations first

- Document Everything: Photograph damage from multiple angles, gather witness information, note exact circumstances

- Notify Authorities: Contact Coast Guard or marine police for serious incidents, injuries, or environmental damage

- Inform the Owner: Charterers must immediately notify boat owners of any incidents

- Contact Insurers: Both parties should notify their respective insurance companies within required timeframes (typically 24-72 hours)

- Preserve Evidence: Don’t make repairs or alterations before insurers and surveyors inspect damage

Claims Process and Liability Determination

Bareboat charter claims can become complex with multiple parties involved:

Owner’s Insurance: Covers physical damage to the vessel, often subject to deductibles of $2,500-$10,000.

Charterer’s Insurance: Covers liability to third parties and may cover damage to the chartered vessel beyond security deposits.

Third-Party Claims: If other vessels or people are involved, multiple insurance policies may interact with complex liability determinations.

Subrogation: After paying claims, insurers may pursue charterers to recover costs if negligence caused the incident.

Working with marine insurance specialists who understand bareboat charter claims helps navigate these complications. Our Charter Commercial Lines Insurance includes comprehensive claims support for charter-related incidents.

Platform-Specific Requirements

Different charter platforms have varying insurance requirements.

Traditional Charter Company Requirements

Professional bareboat charter companies typically provide comprehensive insurance as part of the charter package. However, they often require charterers to:

- Purchase additional damage waiver coverage

- Accept liability for deductibles ($2,500-$5,000+)

- Carry supplemental liability insurance

- Provide proof of boating experience and certifications

Peer-to-Peer Platform Insurance

Platforms like Boat setter and Get My Boat include insurance in their fees, but understand the details:

Coverage Provided: Typically includes liability coverage and damage coverage with specific limits and exclusions.

Deductibles: Often $2,500-$5,000 that charterers are responsible for.

Coverage Gaps: May exclude certain situations, have sublimits for specific types of damage, or require additional coverage for international waters.

Owner Requirements: Boat owners must often maintain underlying commercial insurance, with platform insurance providing excess coverage.

Review platform insurance certificates carefully—don’t assume coverage is comprehensive without verification.

Regulatory and Legal Considerations

Bareboat charter operations involve regulatory compliance beyond insurance.

U.S. Coast Guard Requirements

Vessels used for bareboat charter must meet specific Coast Guard requirements:

- Proper vessel documentation or state registration

- Required safety equipment beyond recreational minimums

- Compliance with passenger vessel regulations if applicable

- Captain licensing requirements in some circumstances

State and Local Regulations

Individual states regulate bareboat charter differently:

- Some states require commercial vessel licenses

- Local jurisdictions may have specific permitting requirements

- Marina regulations often distinguish between recreational and commercial use

- Tax implications vary by state and charter arrangement

Consult with maritime attorneys familiar with your operating area to ensure full compliance.

Making Informed Decisions About Bareboat Charter Insurance

Even you’re an owner or charterer, proper insurance isn’t optional, it’s essential financial protection.

For Boat Owners: Never operate bareboat charters on personal insurance. The risk isn’t worth the savings. Invest in proper commercial coverage before accepting your first charter payment. The revenue should more than cover the increased insurance expense.

For Charterers: Don’t rely solely on security deposits or assume owner’s insurance protects you. Obtain proper charterer’s liability coverage for every bareboat rental. The cost is minimal compared to the liability exposure you face.

Both parties benefit from working with insurance specialists who understand bareboat charter complexities. Our team provides comprehensive Bareboat Charter Insurance for owners and can help charterers obtain appropriate coverage.

We also offer related coverage including Captained Charter Insurance for crewed operations and comprehensive Commercial Insurance for marine-related businesses.

Bareboat charters offer wonderful opportunities for both owners and renters. Proper insurance ensures those opportunities don’t become financial nightmares when unexpected incidents occur.

Frequently Asked Questions

No, this violates your personal policy and leaves you completely uninsured. You must obtain proper commercial bareboat charter insurance before listing your boat on any platform. Personal policies explicitly exclude commercial use, and platforms are commercial operations regardless of their peer-to-peer structure.

Typically no. The owner’s commercial policy covers their vessel, but your personal liability as the operator usually isn’t covered. You need separate charterer’s liability insurance to protect yourself from personal liability claims.

Without charterer’s insurance, you’re personally liable for all damage exceeding your security deposit. The owner’s insurance may cover their vessel repairs, but their insurer can then pursue you (subrogation) to recover those costs. This is why charterer’s liability coverage is essential.

Yes, bareboat and captained charters require different coverage. Captained Charter Insurance addresses crew liability and professional captain requirements that bareboat policies don’t include. If you offer both types of charters, ensure your coverage addresses both scenarios.