Owning a yacht in Florida is a dream come true, offering access to pristine waters, endless adventures, and the ultimate luxury lifestyle. However, protecting this significant investment requires comprehensive yacht insurance that addresses Florida’s unique marine risks. With yacht insurance cost in Florida varying dramatically based on numerous factors, understanding how to secure the best coverage at competitive rates becomes essential for every yacht owner.

Yacht insurance can seem complex, especially when trying to balance comprehensive protection with reasonable premiums. Florida boat owners face some of the highest insurance rates in the nation, with average annual costs ranging up to $839, making it crucial to understand what drives these costs and how to optimize your coverage strategy.

In this detaild guide we will walk you through every factor that influences yacht insurance cost Florida and provide actionable steps for securing the best yacht insurance quote in Florida. As Florida’s trusted experts in luxury yacht coverage and marine insurance, Casey Insurance Companies brings decades of specialized experience to help you navigate these complex waters with confidence.

Yacht Insurance Cost in Florida: Key Factors

| Yacht Value | Yacht Length | Typical Annual Premium | Premium Range | Key Factors |

|---|---|---|---|---|

| $100,000 – $250,000 | 25-35 feet | $1,500 – $3,750 | $1,200 – $4,500 | Age, condition, usage area |

| $250,000 – $500,000 | 35-45 feet | $3,750 – $7,500 | $3,000 – $9,000 | Navigation limits, experience |

| $500,000 – $1,000,000 | 45-60 feet | $7,500 – $15,000 | $6,000 – $18,000 | Hurricane exposure, coverage |

| $1,000,000 – $2,000,000 | 60-80 feet | $15,000 – $30,000 | $12,000 – $36,000 | Crew requirements, equipment |

| $2,000,000+ | 80+ feet (Superyacht) | $30,000+ | $25,000 – $60,000+ | Commercial use, global navigation |

Note: These are estimated ranges based on Florida market conditions. Actual premiums vary significantly based on vessel specifics, owner experience, coverage selections, and current market conditions. Contact Casey Insurance for personalized quotes.

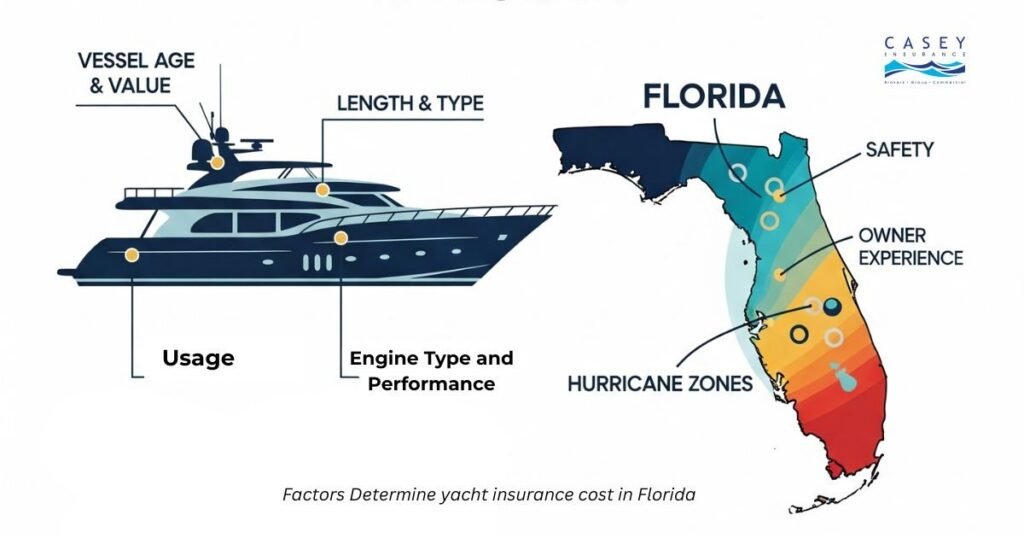

Multiple interconnected factors determine yacht insurance cost, creating a complex pricing structure that varies significantly between vessels and owners. Understanding these elements helps you make informed decisions about coverage levels and identify opportunities for premium savings.

1. Vessel Specifics That Impact Your Premium

Value and Age Considerations represent the primary cost drivers for yacht insurance. Marine insurance typically costs approximately 1.5% of your vessel’s value annually, meaning a $500,000 yacht might cost $7,500 per year to insure. However, this percentage can vary significantly based on the vessel’s age, condition, and maintenance history.

Newer yachts often command higher premiums due to their replacement value, but they may qualify for discounts through modern safety features and construction materials. Older vessels face different challenges, potentially requiring higher premiums due to increased maintenance needs, parts availability concerns, and higher mechanical failure risks.

Length and Type Classifications significantly influence insurance costs and available coverage options. Motor yachts typically face different risk profiles than sailing yachts, with high-performance vessels commanding premium rates due to increased accident potential. Superyachts over 80 feet often require specialized coverage with different underwriting criteria and significantly higher liability requirements.

Make and Model Reputation affects both insurability and cost, as certain manufacturers are known for quality construction, safety records, and parts availability. Vessels from respected builders often qualify for better rates, while exotic or rare models may face coverage limitations or premium surcharges due to repair complexity and parts scarcity.

Engine Type and Performance Specifications create additional rating factors, particularly for high-performance powerboats. Multiple engines, high horsepower ratings, and advanced propulsion systems can increase premiums due to elevated risk profiles and repair costs.

2. Usage and Navigation Impact on Costs

Cruising Area and Navigational Limits represent crucial cost factors for Florida yacht owners. Florida’s hurricane exposure creates significant seasonal risk, with Gulf Coast and Atlantic Coast locations facing different weather patterns and claim frequencies. While Florida doesn’t require boat insurance by law, marina requirements and financing terms often mandate comprehensive coverage.

Extended navigation beyond Florida waters dramatically impacts premiums. Caribbean cruising, international waters access, and blue water sailing create additional risks that require specialized coverage and higher liability limits. Many policies include navigational warranties that restrict coverage areas, with premium adjustments for expanded territories.

Usage Type Classifications determine appropriate coverage structures and premium calculations. Personal pleasure use represents the standard rating category, while chartering, racing, or commercial activities require specialized coverage with different liability exposures and risk assessments.

Seasonal Use and Lay-up Credits provide significant savings opportunities for Florida yacht owners. Hurricane season storage, whether hauled or in protected facilities, can reduce premiums through reduced exposure periods. Many insurers offer substantial discounts for vessels properly stored during high-risk seasons.

3. Owner Experience and History Factors

Boating Experience and Qualifications directly influence premium calculations and coverage availability. Experienced captains with extensive vessel operation history often qualify for preferred rates, while new yacht owners may face higher premiums or coverage restrictions until they demonstrate competency.

Boating Education and Certifications provide valuable premium discounts and demonstrate commitment to safe operation. US Power Squadrons certifications, Coast Guard Auxiliary courses, and captain’s licenses can result in significant rate reductions with most insurers.

Claims History Analysis represents one of the most significant rating factors for yacht insurance. Previous marine claims, regardless of fault, impact future insurability and premium calculations. Maintaining a clean claims record over multiple years often qualifies owners for substantial discounts and preferred coverage terms.

Driving Record Influence may seem unrelated to marine insurance, but many insurers consider automobile violations when assessing overall risk profiles. Multiple traffic violations or serious driving infractions can impact yacht insurance rates and availability.

4. Coverage Choices and Their Cost Impact on Yacht Insurance

- Agreed Value vs. Actual Cash Value represents a fundamental coverage decision with significant cost implications. Agreed Value coverage, while more expensive, provides guaranteed replacement amounts without depreciation deductions. This coverage type is often preferred for yachts due to their unique characteristics and market values.

- Liability Limits Selection dramatically affects premiums, with higher limits providing better asset protection at increased cost. Florida’s litigious environment and potential environmental liability exposures make adequate liability coverage essential for yacht owners.

- Optional Coverage Additions can significantly impact total premiums while providing valuable protection. Salvage and Wreck Removal coverage, Hurricane Haul-Out benefits, Personal Property protection, Towing and Assistance services, and Dinghy/Tender coverage each add value and cost to policies.

- Deductible Strategies offer direct premium control, with higher deductibles reducing annual costs. However, owners must balance savings against potential out-of-pocket expenses during claims situations.

- Security and Safety Features can provide premium discounts while enhancing vessel protection. Advanced alarm systems, GPS tracking devices, automatic fire suppression systems, and professional monitoring services often qualify for rate reductions.

Coverage Options and Cost Impact

| Coverage Type | Cost Impact | Recommended For | Why It Matters |

| Agreed Value | +10-15% premium | All yachts over $100k | No depreciation in claims |

| Actual Cash Value | Base premium | Older vessels only | Depreciation applies |

| Enhanced Liability | +$200-500/year | All Florida owners | Litigation protection |

| Hurricane Haul-Out | +$300-800/year | In-water storage | Mandatory haul coverage |

| Personal Property | +$150-400/year | Live-aboard, extended cruising | Belongings protection |

| Salvage & Wreck | +$200-600/year | All yacht owners | Environmental liability |

| Towing/Assistance | +$100-300/year | All vessels | On-water emergencies |

Ready to get Best Yacht Insurance Quote?

Contact Casey Insurance Companies for personalized Florida yacht insurance rates based on your vessel and needs.

How to Get the Best Yacht Insurance Quote in Florida?

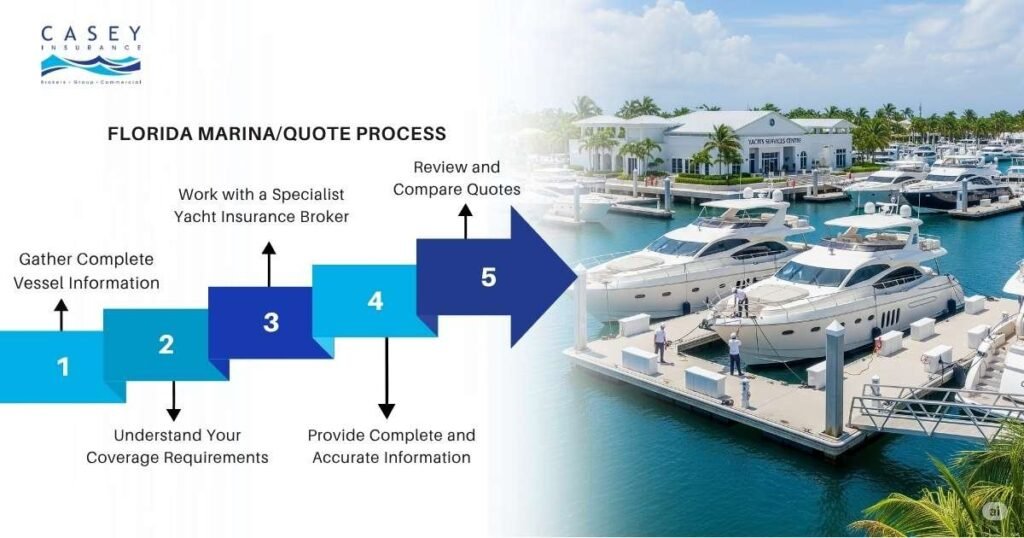

Securing competitive yacht insurance quotes requires preparation, market knowledge, and strategic approach to the quoting process. Following a systematic methodology ensures you receive accurate quotes that reflect your actual needs and risk profile.

1: Gather Complete Vessel Information

Detailed Specifications Documentation forms the foundation of any yacht insurance quote. Compile comprehensive information including make, model, year, length, beam, draft, hull identification number, engine specifications, and current market value.

Navigation and Usage Plans require clear documentation to ensure appropriate coverage and pricing. Detail your typical cruising areas, seasonal usage patterns, mooring or storage arrangements, and any planned extended cruising or racing activities.

Owner Experience Documentation should include your boating resume, certifications, training courses, and previous vessel ownership history. This information demonstrates competency and may qualify you for experience-based discounts.

2: Understand Your Coverage Requirements

Risk Assessment and Protection Needs extend beyond basic vessel protection to include liability exposures, environmental risks, and personal asset protection. Consider your total net worth, potential guest liability, crew responsibilities if applicable, and environmental cleanup obligations. Financial Capacity Analysis helps determine appropriate deductible levels and coverage limits.

Special Requirements Identification may include marina or financing company mandates, professional use considerations, or unique vessel characteristics requiring specialized coverage.

3: Work with a Specialist Yacht Insurance Broker

Independent Broker Advantages provide significant benefits over direct insurer relationships or captive agents. Independent brokers like Casey Insurance Companies offer access to multiple carriers, enabling comprehensive market comparison and competitive pricing.

Florida Market Expertise becomes crucial given the state’s unique risks, regulations, and insurance market characteristics. Brokers specializing in Florida marine insurance understand hurricane exposures, navigational challenges, and regulatory requirements that impact coverage and pricing.

Advocacy and Support Services extend throughout the policy lifecycle, from initial quoting through claims resolution. Experienced brokers provide ongoing policy management, claims advocacy, and market monitoring to ensure continued competitive coverage.

Tailored Solution Development addresses complex vessel characteristics, unique usage patterns, and individual risk management preferences. Specialist brokers can customize policies to match specific needs rather than forcing clients into standard coverage formats.

4: Provide Complete and Accurate Information

Honesty and Transparency in the application process prevents future coverage disputes and ensures accurate pricing. Disclose all relevant information about vessel condition, usage patterns, previous claims, and risk factors that might influence underwriting decisions.

Documentation Completeness expedites the quoting process and ensures accurate risk assessment. Provide all requested surveys, photographs, maintenance records, and operator credentials to facilitate thorough evaluation.

5: Review and Compare Quotes Comprehensively

Beyond Premium Comparison requires analysis of coverage limits, deductibles, exclusions, and policy endorsements. The lowest premium may not provide the best value if coverage gaps exist or claim handling quality is poor.

Carrier Financial Strength assessment ensures your insurer can meet claim obligations during catastrophic events. Focus on A-rated carriers with strong hurricane claim-paying histories and adequate surplus levels.

Policy Terms and Conditions vary significantly between insurers, affecting coverage scope, claim procedures, and policyholder obligations. Understand navigational warranties, lay-up requirements, and maintenance provisions that could impact coverage.

Why Choose Casey Insurance Companies for Your Florida Yacht Insurance?

As an independent broker specializing in luxury yacht insurance Florida, Casey Insurance Companies provides unmatched expertise, market access, and personalized service for discerning yacht owners. Our deep understanding of Florida’s marine insurance market and long-standing relationships with top-tier carriers ensure you receive optimal coverage at competitive rates.

- Specialized Market Knowledge in Florida’s unique marine environment enables us to identify coverage needs and opportunities that generalist agents might miss. Our expertise in hurricane risks, navigational challenges, and regulatory requirements ensures your policy addresses all relevant exposures.

- Multiple Carrier Access provides competitive advantage through comprehensive market comparison. Unlike captive agents representing single companies, we evaluate options from numerous A-rated marine insurers to find the best combination of coverage, service, and price for your specific situation.

- Personalized Service Commitment ensures your insurance program evolves with your needs and circumstances. Regular policy reviews, market monitoring, and proactive communication help maintain optimal coverage throughout your ownership experience.

- Claims Advocacy Support provides crucial assistance during stressful claim situations. Our experienced team guides you through the claims process, advocates for fair settlements, and ensures you receive the full benefits of your coverage investment.

Secure Your Investment, Enjoy the Water

Understanding yacht insurance costs and securing the best yacht insurance quote in Florida requires expertise, preparation, and strategic market approach. The complexity of marine insurance, combined with Florida’s unique risk environment, makes professional guidance essential for optimal results.

Working with specialist brokers who understand luxury yacht coverage ensures you receive comprehensive protection tailored to your vessel, usage patterns, and risk management preferences. The investment in proper insurance coverage provides peace of mind that allows you to fully enjoy your yacht ownership experience.

Don’t leave your significant investment to chance. Contact Casey Insurance Companies today for a personalized yacht insurance quote designed specifically for your vessel and your Florida boating lifestyle.