As a business owner, protecting your employees and your company from workplace injuries is both a legal responsibility and a smart business decision. Two terms you’ll hear frequently are “employers liability insurance” and “workers compensation,” but many business owners aren’t sure about the difference between them or whether they need both.

Here’s the crucial truth: these aren’t competing insurance options, they’re complementary protections that work together to shield your business from employee-related claims. Understanding the distinction between employer liability insurance vs. workers compensation could save your business from devastating financial losses.

At Casey Insurance Companies, we’ve helped countless businesses navigate these complex coverage requirements. This comprehensive guide by Casey insurance brokers will clarify everything you need to know about workers compensation and employers liability insurance, helping you make informed decisions about your business protection strategy.

What is Workers Compensation Insurance?

Workers compensation insurance is a state-mandated insurance program that provides medical benefits and wage replacement to employees who suffer work-related injuries or illnesses. Think of it as a safety net that protects both employers and employees when workplace accidents occur.

How Workers Compensation Works

When an employee gets hurt on the job, workers compensation insurance typically covers:

Medical Benefits:

- Emergency room visits and hospitalization

- Doctor visits and specialist consultations

- Prescription medications

- Physical therapy and rehabilitation

- Medical equipment and supplies

Wage Replacement:

- Partial income replacement during recovery

- Temporary total disability benefits

- Permanent partial disability payments

- Permanent total disability benefits

Additional Benefits:

- Vocational rehabilitation and job retraining

- Death benefits for surviving family members

- Return-to-work programs

Workers Compensation Requirements by State

Workers compensation laws vary by state, but most require coverage when you have:

- One or more employees (some states require more)

- Employees who work a minimum number of hours

- Certain types of business operations

Key Features of Workers Compensation:

- No-fault coverage (employees receive benefits regardless of who caused the accident)

- Exclusive remedy provision (prevents most employee lawsuits against employers)

- Mandatory in most states for qualifying businesses

- Premiums based on payroll and industry risk classification

What is Employers Liability Insurance Coverage?

Employers liability insurance is coverage that protects your business from lawsuits related to employee injuries that fall outside the scope of standard workers compensation. While workers compensation provides a “no-fault” system, employers liability insurance addresses situations where employees or their families can still sue your business.

When Employers Liability Insurance Applies

Liability coverage becomes crucial in several scenarios:

Third-Party Over Actions: When an employee is injured by a third party (like a defective product), they may sue that third party. If the third party then sues your business claiming you were partially responsible, employers liability insurance provides protection.

Consequential Bodily Injury Claims: If an employee’s spouse or family member suffers emotional distress or other damages due to the employee’s work-related injury, they might sue your business. Standard workers compensation doesn’t cover these claims.

Dual Capacity Claims: When your business has a relationship with the employee beyond just being their employer (such as also being their landlord), the employee might sue in that other capacity.

Claims in States Without Exclusive Remedy: Some states allow employees to sue employers under certain circumstances, even with workers compensation coverage in place.

What Employers Liability Insurance Covers

Legal Defense Costs:

- Attorney fees for defending against employee lawsuits

- Court costs and legal proceedings

- Investigation expenses

Settlement and Judgment Payments:

- Settlement agreements with injured employees or their families

- Court-ordered judgments against your business

- Damages awarded to plaintiffs

Additional Coverage Features:

- Protection against claims from employee family members

- Coverage for lawsuits in states where you temporarily work

- Defense against allegations of wrongful termination related to injury claims

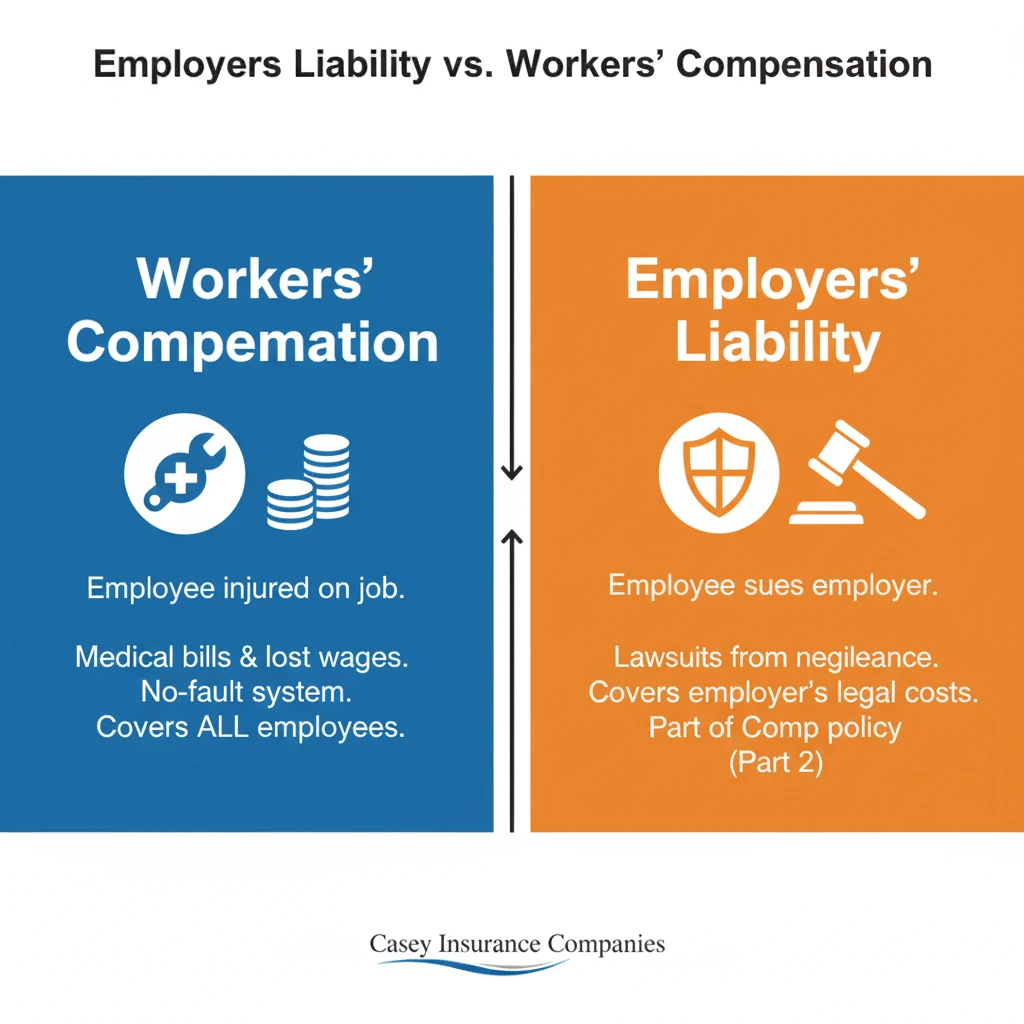

Employers Liability Insurance vs Workers Compensation: Key Differences

Understanding the major difference between these two types of coverage is essential for comprehensive business protection.

Coverage Scope Differences

Workers Compensation Coverage:

- Covers medical expenses and lost wages for injured employees

- Provides no-fault benefits regardless of who caused the accident

- Follows state-mandated benefit schedules

- Prevents most employee lawsuits against employers

Employers Liability Insurance Coverage:

- Covers lawsuits that fall outside workers compensation protection

- Protects against claims from employee family members

- Provides legal defense for covered claims

- Covers damages not addressed by workers compensation

Legal Framework Differences B/w Worker Comp and Employer Liability

Workers Comp:

- Governed by state workers compensation laws

- Mandatory coverage requirements in most states

- Standardized benefits and procedures

- No-fault system with exclusive remedy provisions

Employers Liability Insurance:

- Governed by general liability and tort law

- Not typically required by law (but highly recommended)

- Covers situations where exclusive remedy doesn’t apply

- Fault-based coverage for specific types of claims

Cost Structure Differences

Workers Compensation Costs:

- Premiums based on payroll and industry classification codes

- Rates regulated by state insurance departments

- Experience modification factors affect pricing

- Mandatory coverage with standardized benefits

Employers Liability Insurance Costs:

- Typically much less expensive than workers compensation

- Often included as part of workers compensation policies

- Premiums based on coverage limits and business risk factors

- Optional coverage with flexible limits

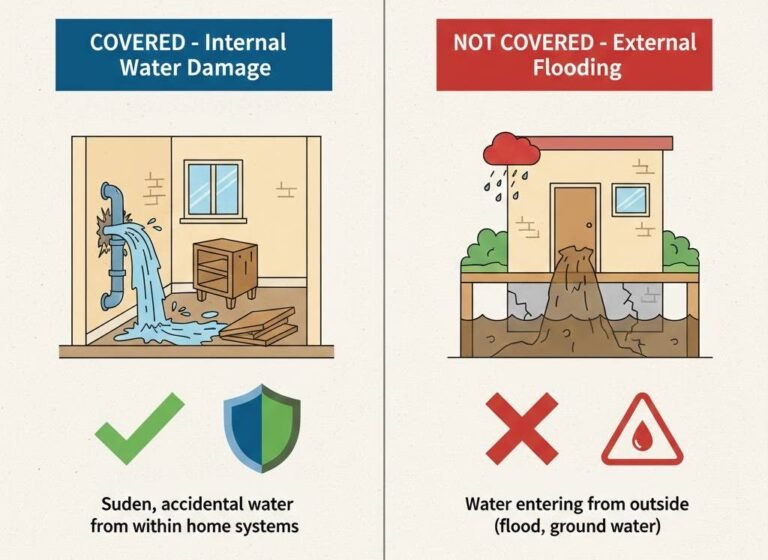

Is Employers Liability Insurance the Same as Workers Compensation?

No, employers liability insurance is not the same as workers compensation, though they’re closely related and often sold together.

Here’s why both are important:

Complementary Protection

Workers Compensation provides the primary protection for employee workplace injuries, covering medical expenses and lost wages under a no-fault system.

Employers Liability Insurance fills the gaps where workers compensation doesn’t apply, protecting against lawsuits that can still arise despite having workers compensation coverage.

Common Misconceptions to Understand Difference in Employer Liability and Worker Comp

1: “Workers compensation covers all employee injury claims.”

Reality: Workers compensation has limitations and exclusions that leave businesses vulnerable to certain types of lawsuits.

2: “Employers liability insurance replaces workers compensation.”

Reality: These coverages work together – you need both for comprehensive protection.

3: “Small businesses don’t need employers liability insurance.“

Reality: Even small businesses face significant risk from employee-related lawsuits that fall outside workers compensation coverage.

Workers Compensation and Employers Liability Insurance: How They Work Together

Most insurance companies offer these coverages together in a single policy, recognizing that businesses need both types of protection.

Standard Policy Structure

The standard policy structure includes two complementary components that provide comprehensive workplace injury coverage.

Workers compensation forms the foundation of this protection by covering state-mandated benefits for injured employees. This coverage strictly follows state workers compensation laws and provides essential medical care and wage replacement benefits to workers who suffer job-related injuries or illnesses.

Employers liability insurance serves as the second layer of protection. This component provides crucial legal defense services and covers damages when employees or their families pursue legal action against the employer for workplace injuries. The coverage typically includes specific limits, such as $1 million per occurrence, giving businesses defined financial protection against potential legal costs, settlements, and judgments that could arise from workplace injury disputes. Want to know more about liability insurances then you should read out our blog on Commercial General Liability Insurance vs Professional Liability Insurance.

Why Combined Coverage Makes Sense

- Seamless Protection: Having both coverages with the same insurer eliminates gaps and coordination issues.

- Cost Efficiency: Bundling these coverages is typically more cost-effective than purchasing separately.

- Simplified Management: One policy, one renewal date, one claims process for both types of coverage.

- Expert Underwriting: Insurers specializing in workers compensation understand the related liability risks.

Employers Liability vs Workers Comp: Coverage Gaps to Avoid

Even with both types of coverage, certain gaps can leave your business exposed:

Common Coverage Gaps

Independent Contractors:

- May not be covered under your workers compensation policy

- Could sue your business if injured while working for you

- Require separate liability coverage or contractual protections

Temporary Workers:

- Coverage may depend on who employs them

- Gaps can occur between staffing agency and client company coverage

- Need clear agreements about insurance responsibilities

Out-of-State Work:

- Workers compensation may not apply in all states where you work

- Employers liability coverage territories may be limited

- Need to verify coverage before working in new states

Intentional Acts:

- Neither coverage typically applies to intentional harm

- Workplace violence and harassment claims may not be covered

- May need separate employment practices liability insurance

Strategies to Close Coverage Gaps

Regular Policy Reviews: Work with experienced insurance professionals to identify and address coverage gaps.

Contractual Risk Transfer: Use contracts to transfer certain risks to subcontractors or other parties.

Additional Coverage: Consider employment practices liability insurance, commercial general liability, and other protective coverages.

Safety Programs: Implement comprehensive workplace safety programs to reduce injury risks.

Cost Factors for Workers Compensation and Employers Liability Insurance

Understanding what affects your premiums helps you manage costs while maintaining adequate protection.

Workers Compensation Cost Factors

- Payroll: The primary factor in determining premiums – higher payroll equals higher premiums.

- Industry Classification: Different industries have different risk levels and corresponding rates.

- Claims History: Your experience modification rate can significantly increase or decrease premiums.

- Safety Programs: Documented safety programs and training can reduce premiums.

- State Regulations: Workers compensation rates vary significantly by state.

Employers Liability Insurance Cost Factors

- Coverage Limits: Higher limits mean higher premiums, but the cost increase is typically modest.

- Industry Risk: Higher-risk industries face higher employers liability premiums.

- Business Size: Larger businesses typically pay more due to increased exposure.

- Claims History: Past employers liability claims can affect future premiums.

- Geographic Location: Some states have higher liability risks than others.

Choosing the Right Coverage Limits

Selecting appropriate coverage limits requires balancing protection needs with budget constraints.

Standard Employers Liability Limits

Minimum Recommended Limits:

- $1 million per occurrence

- $1 million per disease (per employee)

- $1 million policy aggregate for disease claims

Higher Limits for Increased Protection:

- $2 million or higher for businesses with significant exposure

- Consider umbrella coverage for additional protection

- Evaluate based on potential lawsuit severity in your industry

State-Specific Requirements and Considerations

Workers compensation and employers liability insurance requirements vary significantly by states in USA.

Key State Variations

Coverage Requirements:

- Number of employees needed to trigger requirements

- Specific benefits and coverage mandates

- Penalties for non-compliance

Exclusive Remedy Provisions:

- How strongly states protect employers from lawsuits

- Exceptions that allow employee lawsuits

- Impact on employers liability insurance needs

Monopolistic States:

- Some states require coverage through state-run programs

- Private employers liability insurance may still be needed

- Different rules for self-insured employers

Multi-State Considerations

Coverage Territories: Ensure your policy covers all states where you have employees.

Reciprocal Agreements: Some states have agreements that affect coverage requirements.

Temporary Work: Understand requirements for short-term work in other states.

Certificate Requirements: Some states require specific certificates or endorsements.

The Role of Professional Insurance Guidance

Given the complexity of workers compensation and employers liability insurance, professional guidance is invaluable.

Why Expert Advice Matters

Regulatory Compliance: Insurance professionals understand state-specific requirements and help ensure compliance.

Risk Assessment: Experienced agents can identify coverage gaps and recommend appropriate limits.

Claims Management: Professional support during claims helps protect your business interests.

Cost Management: Experts can help you find ways to reduce premiums while maintaining adequate protection.

Casey Insurance Companies’ Approach for Both Types of Insurance

At Casey Insurance Companies, we provide comprehensive workers compensation and employers liability insurance solutions tailored to your business needs.

Our Expertise:

- Deep understanding of workers compensation laws across multiple states

- Experience with complex commercial liability risks

- Relationships with top-rated workers compensation insurers

- Proven track record helping businesses manage employee-related risks

Our Process:

- Risk Assessment: We evaluate your specific business operations and exposures

- Coverage Design: We recommend appropriate coverage types and limits

- Market Access: We connect you with the best insurers for your situation

- Ongoing Support: We provide claims assistance and policy management

Best Practices for Managing Employee-Related Risks

Beyond insurance coverage, implementing strong risk management practices helps protect your business.

Workplace Safety Programs

Safety Training: Regular training programs help prevent workplace injuries.

Hazard Identification: Systematic identification and correction of workplace hazards.

Incident Reporting: Clear procedures for reporting and investigating workplace incidents.

Return-to-Work Programs: Structured programs to help injured employees return to work safely.

Documentation and Record-Keeping

Injury Reports: Detailed documentation of all workplace injuries and incidents.

Safety Records: Maintenance of safety training records and program documentation.

Policy Communication: Clear communication of workplace policies and procedures.

Legal Compliance: Proper documentation to demonstrate compliance with safety regulations.

Employee Relations

Clear Policies: Well-defined workplace policies and procedures.

Communication: Open communication channels between management and employees.

Conflict Resolution: Effective procedures for resolving workplace disputes.

Training Programs: Regular training on workplace safety and company policies.

Common Mistakes to Avoid

Understanding common pitfalls helps you avoid costly mistakes in your coverage decisions.

Coverage Mistakes

Assuming Workers Compensation is Enough: Many businesses don’t realize they need employers liability insurance for comprehensive protection.

Inadequate Limits: Choosing minimum limits without considering potential claim severity.

Geographic Gaps: Not ensuring coverage applies in all states where you have employees.

Classification Errors: Incorrect job classifications can lead to coverage gaps or overpayment.

Administrative Mistakes

Late Reporting: Failing to report claims promptly can jeopardize coverage.

Incomplete Applications: Providing inaccurate information during the application process.

Ignoring Renewals: Not reviewing coverage annually or at renewal time.

Poor Record-Keeping: Inadequate documentation can complicate claims and audits.

Risk Management Mistakes

Inadequate Safety Programs: Neglecting workplace safety increases both injury risk and insurance costs.

Ignoring Return-to-Work: Not having effective return-to-work programs increases claim costs.

Poor Vendor Management: Not ensuring subcontractors have adequate insurance coverage.

Inadequate Training: Failing to provide proper safety training to employees.

Frequently Asked Questions

Yes, most businesses need both types of coverage. Workers compensation provides the primary protection for employee workplace injuries, while employers liability insurance covers lawsuits that can still arise despite having workers compensation. These coverages work together to provide comprehensive protection, and most insurance companies offer them in a single policy.

Workers compensation is a state-mandated, no-fault system that provides medical benefits and wage replacement to injured employees. Employers liability insurance protects your business from lawsuits related to employee injuries that fall outside workers compensation coverage, such as third-party claims, family member lawsuits, or claims in states without exclusive remedy provisions.

Costs vary significantly based on your industry, payroll, claims history, and location. Workers compensation premiums are typically calculated as a rate per $100 of payroll, while employers liability insurance is usually much less expensive and often included with workers compensation policies. Contact Casey Insurance Companies for a customized quote based on your specific business needs.

Without employers liability insurance, your business could face significant financial exposure from employee-related lawsuits that fall outside workers compensation coverage. This includes claims from employee family members, third-party over actions, and lawsuits in states without strong exclusive remedy provisions. The legal defense costs alone could be substantial, even if you ultimately win the case.

Taking Action: Protecting Your Business Today

Understanding the difference between employers liability insurance vs workers compensation is just the first step. The most important action is ensuring your business has comprehensive protection against employee-related risks.

Your Next Steps

1. Review Your Current Coverage: Examine your existing workers compensation policy to understand what’s included and identify any gaps.

2. Assess Your Risks: Consider your industry, business size, and operations to determine appropriate coverage levels.

3. Get Professional Guidance: Work with experienced insurance professionals who understand both workers compensation and employers liability insurance.

4. Implement Safety Programs: Reduce your risk exposure through comprehensive workplace safety initiatives.

5. Plan for Growth: Ensure your coverage can adapt as your business grows and changes.

Conclusion: Comprehensive Employee Protection for Your Business

The question isn’t whether you need employers liability insurance or workers compensation, you need both for comprehensive protection. Workers compensation provides the foundation of employee injury protection, while employers liability insurance fills the critical gaps that could otherwise expose your business to significant financial risk.

At Casey Insurance Companies, we understand that every business is unique, with specific risks and coverage needs. Our expertise in commercial lines insurance, combined with our commitment to personalized service, ensures you get the right protection at the right price.

Don’t wait until an incident occurs to discover gaps in your coverage. The cost of proper insurance is always less than the cost of being uninsured when you need protection most.

Your employees are your most valuable asset, make sure they’re properly protected with the right combination of workers compensation and employers liability insurance. Let Casey Insurance Companies be your trusted partner in building comprehensive employee protection for your business.