When you’re ready to hit the open road in your Class A motorhome, understanding insurance costs becomes crucial for budgeting your RV adventures. Class A motorhomes, being the largest and most luxurious RVs on the market, come with unique insurance considerations that differ significantly from standard auto insurance.

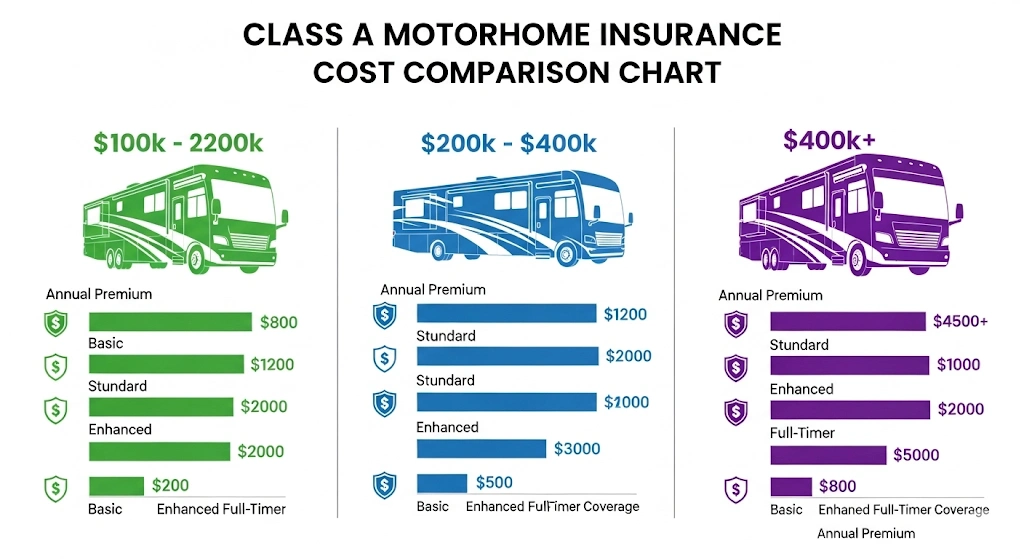

The average class A motorhome insurance cost varies dramatically based on multiple factors, but most owners can expect to pay between $1,000 to $4,000 annually for comprehensive coverage. This wide range reflects the substantial differences in vehicle values, usage patterns, and coverage needs among Class A motorhome owners.

What Influences Class A Motorhome Insurance Costs?

1. Vehicle Value and Age

The primary factor affecting class a motorhome insurance costs is the vehicle’s value. New Class A motorhomes can cost anywhere from $100,000 to over $500,000, directly impacting insurance premiums. Older models typically cost less to insure, but classic or well-maintained vintage motorhomes may require specialized coverage.

2. Usage Patterns

How you use your motorhome significantly affects rates:

- Full-time living: Higher premiums due to increased exposure

- Recreational use: Lower rates for occasional weekend trips

- Seasonal use: Moderate rates for summer vacation travel

- Storage periods: Some insurers offer discounts for months when the RV is stored

3. Driver Profile

Insurance companies evaluate your driving record, age, experience with large vehicles, and claims history. New RV drivers often face higher premiums until they establish a safe driving record with their motorhome.

Average Motorhome Insurance Rates by Category

| Coverage Type | Annual Cost Range | What’s Included |

|---|---|---|

| Basic Liability | $600 – $1,200 | State minimum requirements only |

| Standard Coverage | $1,000 – $2,500 | Liability, collision, comprehensive |

| Full-Timer Coverage | $1,800 – $4,000 | Enhanced personal property, liability |

| Luxury Class A | $2,500 – $6,000+ | High-value vehicles, premium features |

Understanding Average RV Insurance Rates

Average rv insurance rates for Class A motorhomes tend to be higher than other RV types due to their size, value, and complexity. However, when compared to the cost of replacing or repairing these substantial investments, insurance provides essential financial protection.

The motorhome insurance cost average includes several components:

- Liability coverage: Protects against injury or property damage to others

- Collision coverage: Pays for damage from accidents

- Comprehensive coverage: Covers theft, vandalism, weather damage

- Personal property coverage: Protects belongings inside the RV

- Emergency expense coverage: Covers temporary lodging if your RV is uninhabitable

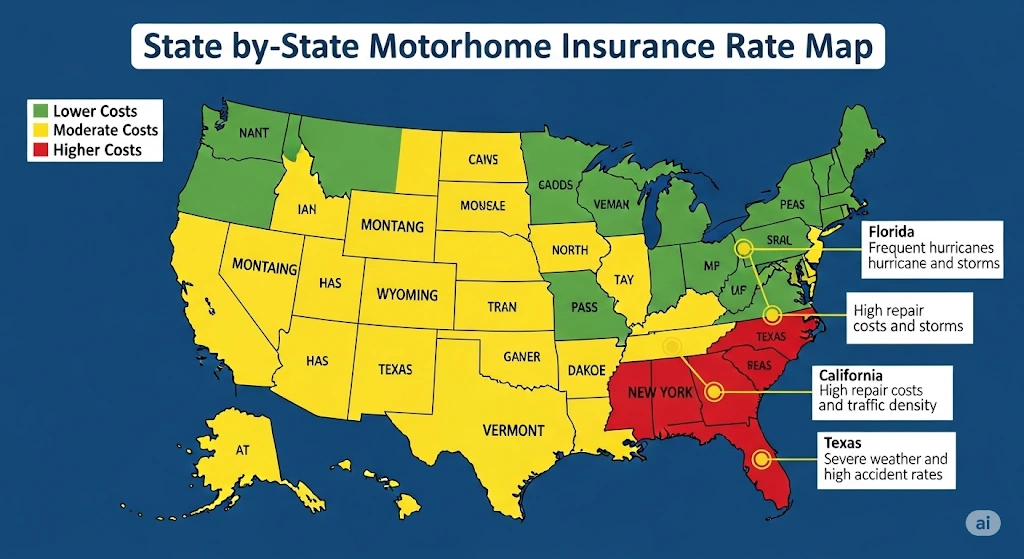

Motorhome Insurance Rates by State

Motorhome insurance rates by state vary significantly due to different regulations, weather patterns, and accident statistics. Here’s what affects regional pricing:

High-Cost States

States with severe weather, high accident rates, or expensive repair costs typically see higher premiums:

- Florida (frequent hurricanes and storms)

- California (high repair costs and traffic density)

- New York (expensive repairs and high population density)

- Texas (severe weather and high accident rates)

Lower-Cost States

Rural states with favorable weather and lower accident rates often offer more affordable rates:

- Montana

- Wyoming

- North Dakota

- Vermont

Special Considerations: Motorhome Insurance Plantation FL

For residents seeking motorhome insurance plantation fl, local factors include:

- Hurricane risk requiring comprehensive weather coverage

- High tourism traffic increasing accident potential

- Warm climate allowing year-round RV use

- Proximity to popular RV destinations

Florida residents should prioritize comprehensive coverage due to hurricane risks and consider gap coverage for newer, high-value motorhomes.

Typical Motorhome Insurance Cost Factors

The typical motorhome insurance cost depends on these key variables:

1. Coverage Limits

- Low limits: $100,000/$300,000 liability – Lower premiums but higher risk

- Standard limits: $250,000/$500,000 liability – Balanced protection

- High limits: $500,000/$1,000,000+ liability – Maximum protection, higher cost

2. Deductibles

Higher deductibles reduce premiums but increase out-of-pocket costs during claims:

- $250 deductible: Higher premiums, lower claim costs

- $500 deductible: Moderate balance

- $1,000+ deductible: Lower premiums, higher claim responsibility

3. Additional Coverage Options

- Roadside assistance: $50-150 annually

- Total loss replacement: $100-300 annually

- Personal effects coverage: $25-100 annually

- Vacation liability: $30-75 annually

Money-Saving Tips for Class A Motorhome Insurance

1. Shop Multiple Providers

Different insurers specialize in various RV types and offer varying rates. Companies to consider include:

- Progressive (competitive RV rates)

- Good Sam (RV-focused coverage)

- National General (comprehensive options)

- Foremost (specialized RV insurance)

2. Bundle Policies

Many insurers offer discounts for bundling RV insurance with auto, home, or other policies, potentially saving 10-25% on premiums.

3. Safety and Security Features

Installing anti-theft devices, GPS tracking, or taking RV safety courses can earn significant discounts.

4. Seasonal Adjustments

If you store your RV during winter months, ask about suspended coverage options that maintain comprehensive protection while reducing liability costs.

Insurance for Class A Motorhome: Special Considerations

Insurance for class a motorhome requires understanding unique coverage needs:

Full-Timer vs. Recreational Use

Full-time RVers need enhanced coverage similar to homeowners insurance, including:

- Higher personal property limits

- Additional living expense coverage

- Increased liability protection

- Coverage for permanent attachments

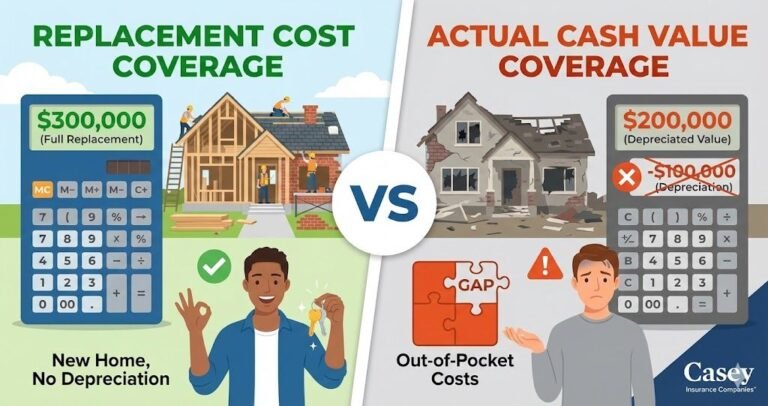

High-Value Motorhomes

Luxury Class A motorhomes may require:

- Agreed value policies instead of actual cash value

- Specialized repair shop networks

- Enhanced replacement cost coverage

- Higher liability limits due to asset protection needs

Finding the Right Coverage

When evaluating motorhome insurance average cost options, consider:

Essential Questions to Ask

- What’s included in basic coverage?

- Are there mileage restrictions?

- How does the claims process work?

- Are there preferred repair facilities?

- What discounts are available?

Red Flags to Avoid

- Extremely low quotes that may indicate inadequate coverage

- Companies without RV expertise

- Policies with excessive restrictions

- Poor customer service ratings

Planning Your Insurance Budget

Understanding average motorhome insurance rates helps with financial planning. Budget approximately:

- 1-3% of your motorhome’s value annually for insurance

- Additional costs for premium coverage options

- Potential rate increases based on claims or market conditions

Conclusion

Class A motorhome insurance costs vary widely based on vehicle value, usage patterns, location, and coverage choices. While the average class a motorhome insurance cost ranges from $1,000-$4,000 annually, finding the right balance of coverage and cost requires careful consideration of your specific needs.

Remember that the cheapest option isn’t always the best value. Focus on finding comprehensive coverage from a reputable insurer that understands RV-specific risks and provides excellent customer service. With proper coverage in place, you can enjoy your motorhome adventures with confidence and peace of mind.

Take time to shop around, compare quotes from multiple RV-specialized insurers, and don’t hesitate to ask questions about coverage details. Your Class A motorhome represents a significant investment in your lifestyle and freedom, protect it appropriately with quality insurance coverage.