Every day, business owners across America face financial catastrophes that could have been prevented with proper commercial auto insurance coverage. While most entrepreneurs understand they need insurance for company vehicles, the devil lies in the details, and these overlooked details can cost businesses hundreds of thousands of dollars.

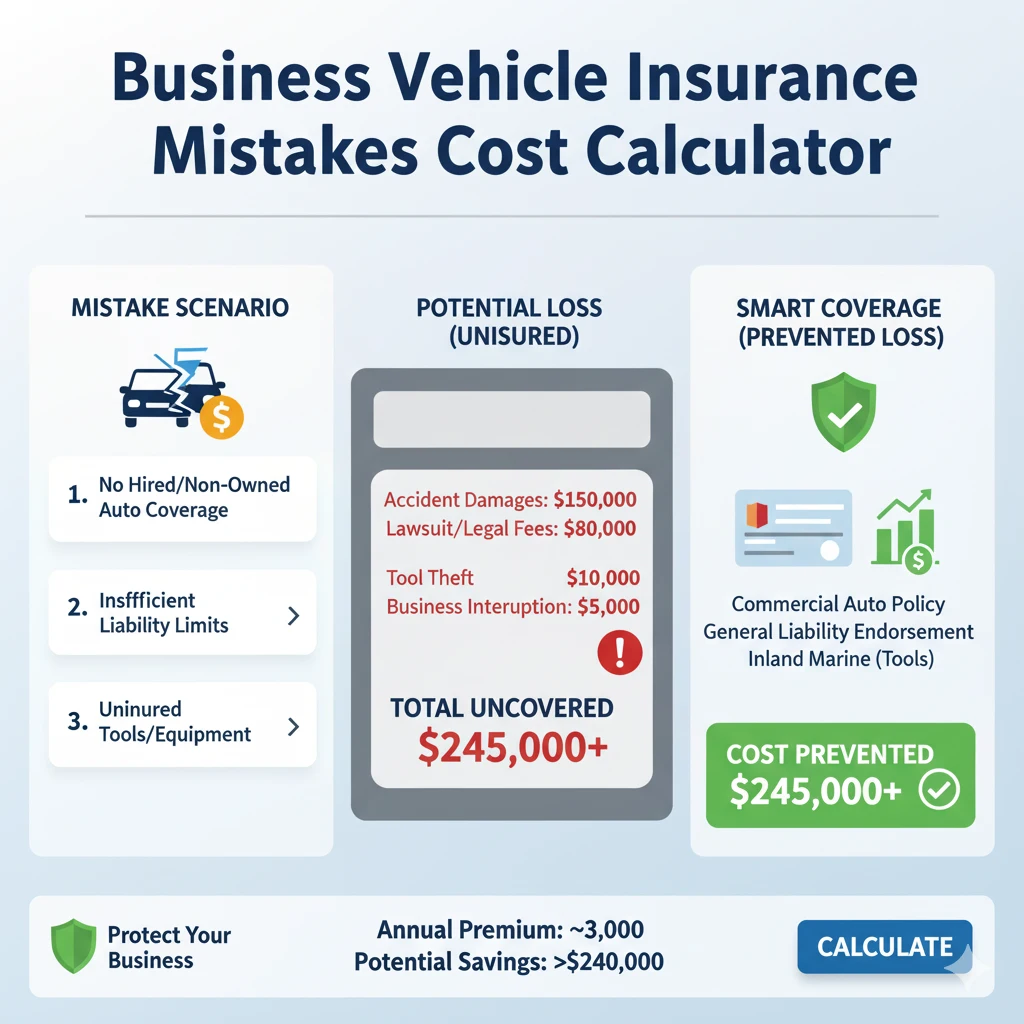

Recent industry studies reveal that 73% of businesses carry inadequate commercial vehicle coverage, with the average uninsured loss exceeding $247,000 per incident. These staggering numbers aren’t just statistics; they represent real businesses facing bankruptcy, lawsuits, and closure due to business vehicle insurance mistakes that were entirely preventable.

The Most Expensive Commercial Auto Insurance Oversights

1. Underestimating Liability Coverage Limits

The biggest mistake business owners make is treating commercial auto liability like personal car insurance. While your personal vehicle might carry $100,000/$300,000 in liability coverage, commercial vehicles face exponentially higher risks and potential lawsuit settlements.

What Business Owners Think They Need:

- State minimum liability requirements

- Coverage similar to personal auto policies

- “Enough to get by” mentalities

What They Actually Need:

- Minimum $1 million per occurrence for most businesses

- $2-5 million for high-risk operations (construction, delivery, transportation)

- Umbrella policies for additional protection beyond primary limits

Real-World Example: A small plumbing company’s van caused a multi-vehicle accident on Interstate 95. The resulting lawsuits totaled $2.3 million, but their policy only covered $500,000. The business owner had to liquidate personal assets, including his family home, to cover the remaining $1.8 million.

2. Misclassifying Vehicle Usage and Operations

Commercial auto insurance coverage pricing depends heavily on how vehicles are used, where they operate, and what they transport. Misrepresenting or underestimating these factors leads to coverage gaps and claim denials.

Common Classification Errors:

| Actual Usage | Owner’s Description | Risk Impact | Premium Difference |

|---|---|---|---|

| Long-haul trucking | Local delivery | 400% higher risk | 150-300% premium increase |

| Hazardous materials transport | General cargo | Catastrophic exposure | 200-500% premium increase |

| Employee personal use | Business-only use | Coverage void | Claims denied |

| Multi-state operations | Local business only | Jurisdiction issues | 50-100% premium increase |

3. Ignoring Non-Owned and Hired Vehicle Exposure

One of the most overlooked aspects of business vehicle insurance is coverage for vehicles the company doesn’t own but uses for business purposes.

Non-Owned Vehicle Scenarios:

- Employees using personal vehicles for business errands

- Rental cars during business trips

- Customer vehicles in service shops

- Contractor vehicles on job sites

The Financial Risk: When an employee causes an accident while driving their personal car for business purposes, both the employee’s personal insurance and the employer can be held liable. Personal auto policies typically exclude business use, leaving massive gaps in coverage.

Case Study: A real estate agent driving her personal car to show properties caused a $890,000 accident. Her personal insurance denied the claim due to business use exclusion, and the real estate company’s commercial policy didn’t include non-owned vehicle coverage. The company faced the entire settlement amount.

4. Inadequate Coverage for Specialized Equipment and Tools

Standard commercial auto insurance coverage typically includes limited coverage for business equipment and tools stored in vehicles. For many businesses, this limitation creates substantial exposure.

High-Risk Industries:

- Construction and contracting

- IT and technical services

- Medical equipment services

- Landscaping and maintenance

- Photography and videography

Equipment Coverage Gaps:

- Standard policies: $2,500-$5,000 for tools and equipment

- Actual replacement costs: Often $15,000-$100,000+

- Specialized equipment: May require separate inland marine coverage

5. Overlooking Commercial Auto Physical Damage Deductibles

While focusing on liability coverage, many business owners select physical damage deductibles that seem reasonable for one vehicle but become financially crushing when applied across an entire fleet.

Deductible Structure Mistakes:

- Choosing high deductibles to reduce premiums without calculating fleet-wide exposure

- Not considering seasonal vehicle usage patterns

- Failing to account for multiple simultaneous claims (weather events, vandalism)

- Ignoring the cash flow impact of large deductibles

Financial Impact Example: A landscaping company with 12 trucks chose $5,000 collision deductibles to save on premiums. During a severe hailstorm, all vehicles were damaged simultaneously. The company faced $60,000 in deductibles before insurance coverage began, nearly forcing closure during peak season.

Industry-Specific Commercial Auto Insurance Pitfalls

1. Construction and Contracting

Common Oversights:

- Inadequate coverage for specialized equipment and materials in transit

- Missing pollution liability for environmental hazards

- Insufficient coverage for projects requiring bonding

- No protection for tools left in vehicles overnight

Specialized Needs:

- Contractor’s equipment coverage

- Environmental liability endorsements

- Motor truck cargo insurance

- Inland marine policies for high-value tools

2. Delivery and Transportation Services

Critical Gaps:

- Cargo insurance insufficient for goods transported

- No coverage for spoilage or temperature-controlled goods

- Missing hired vehicle coverage for subcontractors

- Inadequate garage liability for vehicle storage

Essential Coverages:

- Motor truck cargo insurance

- Refrigeration breakdown coverage

- Loading and unloading liability

- Garage keepers liability

3. Professional Services

Overlooked Exposures:

- Professional liability extending to mobile services

- Cyber liability for laptops and devices in vehicles

- Errors and omissions related to travel delays

- Client property damage during transport

The Real Cost of Business Vehicle Insurance Mistakes

Direct Financial Impact

Immediate Costs:

- Uninsured claim settlements and legal fees

- Business interruption during vehicle replacement

- Higher insurance premiums after claims or coverage gaps

- Potential loss of business licenses and contracts

Long-Term Consequences:

- Difficulty obtaining adequate insurance after claims

- Increased scrutiny from clients and regulatory bodies

- Personal asset exposure for business owners

- Potential bankruptcy and business closure

Hidden Operational Costs

Productivity Losses:

- Employee downtime during accident investigations

- Management time dealing with insurance issues

- Customer service disruptions

- Delayed project completions

Reputation Damage:

- Loss of client confidence

- Negative publicity from accidents

- Difficulty winning new contracts

- Reduced competitiveness in bidding

Building Comprehensive Commercial Auto Insurance Coverage

Essential Coverage Components

Primary Liability Coverage:

- Bodily injury and property damage liability

- Medical payments coverage

- Uninsured/underinsured motorist protection

- Personal injury protection (where required)

Physical Damage Protection:

- Comprehensive coverage for theft, vandalism, weather

- Collision coverage for accident damage

- Specified perils coverage for older vehicles

- Replacement cost coverage for newer vehicles

Business-Specific Endorsements:

- Hired and non-owned vehicle liability

- Medical payments for passengers

- Roadside assistance and towing

- Rental reimbursement coverage

Advanced Protection Strategies

Umbrella and Excess Liability:

- Additional liability limits above primary coverage

- Broader coverage for gaps in underlying policies

- Protection against catastrophic losses

- Coverage for punitive damages (where legally allowed)

Fleet Management Programs:

- Driver qualification and training requirements

- Vehicle maintenance and safety programs

- GPS tracking and driver behavior monitoring

- Accident reporting and claims management protocols

Selecting the Right Commercial Auto Insurance Provider

Insurer Evaluation Criteria

Financial Stability:

- A.M. Best ratings of A- or higher

- Strong surplus levels for claim-paying ability

- Consistent profitability in commercial lines

- Positive industry reputation and reviews

Commercial Auto Expertise:

- Specialized commercial vehicle underwriters

- Industry-specific knowledge and programs

- Claims handling experience with business vehicles

- Risk management and loss control services

Coverage Flexibility:

- Ability to customize policies for specific industries

- Endorsement options for unique business needs

- Fleet discounts and package policies

- Multi-state operation capabilities

Working with Insurance Professionals

Commercial Insurance Agent Benefits:

- Industry expertise and market knowledge

- Access to multiple insurance companies

- Ongoing policy reviews and updates

- Claims advocacy and support

Risk Management Consultants:

- Comprehensive exposure analysis

- Loss control recommendations

- Driver training program development

- Fleet safety protocol establishment

Implementing Cost-Effective Commercial Auto Coverage

Premium Reduction Strategies

Risk Management Discounts:

- Driver training and certification programs

- Vehicle safety equipment installations

- GPS tracking and telematics programs

- Regular vehicle maintenance protocols

Policy Structure Optimization:

- Appropriate deductible selection

- Coverage bundling with other business insurance

- Fleet size discounts for multiple vehicles

- Experience rating programs for good drivers

Regular Policy Review Process

Annual Coverage Assessment:

- Vehicle value updates and replacement cost analysis

- Business operation changes and expansion

- Claims experience review and pattern analysis

- Market comparison and competitive pricing

Ongoing Risk Evaluation:

- New vehicle additions and deletions

- Driver record monitoring and updates

- Route and territory analysis

- Seasonal usage pattern adjustments

Final Thoughts: Protecting Your Business Investment

Commercial auto insurance coverage represents far more than a regulatory requirement, it’s the financial foundation protecting your business from potentially catastrophic losses. The business vehicle insurance mistakes outlined in this guide have bankrupted countless companies that thought they were adequately covered.

The key to effective commercial auto insurance lies in understanding that your business faces unique risks requiring specialized coverage solutions. Generic policies and minimum coverage limits might satisfy legal requirements, but they won’t protect your business when serious accidents occur.

Take action today by conducting a comprehensive review of your current commercial auto insurance coverage. Work with qualified insurance professionals who understand your industry’s specific risks and can design protection tailored to your operational needs.

Remember, the cost of comprehensive commercial auto insurance coverage pales in comparison to the potential cost of being underinsured when accidents happen. Invest in proper protection now, or risk paying exponentially more later when it’s too late to prevent the financial damage.

Your business, employees, and financial future depend on getting commercial auto insurance right the first time. Don’t let preventable oversights become the reason your business faces an uncertain future.