Navigating yacht insurance requirements can be confusing for new boat owners, especially when dealing with state-specific regulations and licensing requirements. At Casey Insurance, we’re licensed to operate in multiple states and help yacht owners understand their specific insurance obligations based on their location and vessel usage patterns.

If you’re purchasing your first yacht or relocating to a new state, understanding local insurance requirements, registration processes, and regulatory compliance ensures you’re properly protected while meeting all legal obligations. Each state has unique requirements that affect your insurance needs and coverage options.

Understanding State Insurance Requirements

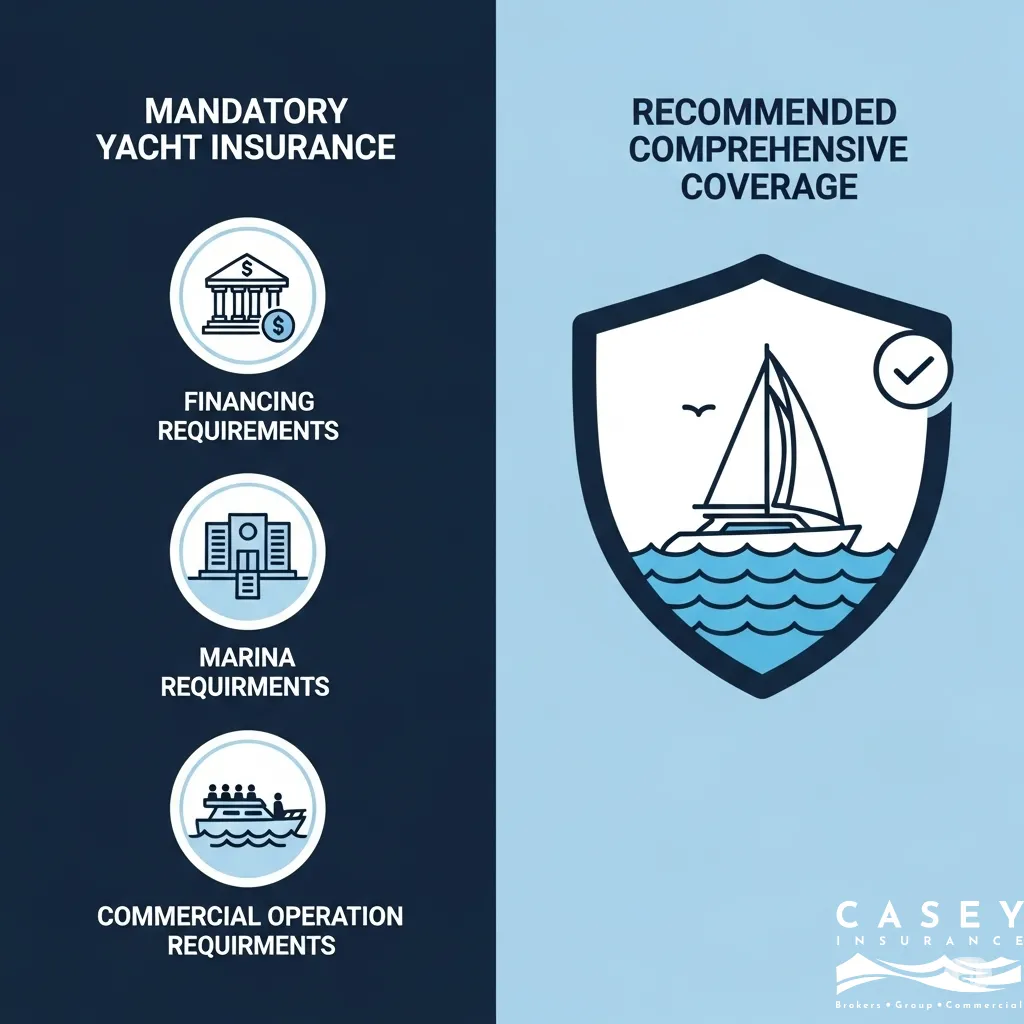

1. Mandatory vs. Recommended Coverage

While most states don’t legally require yacht insurance like automobile coverage, certain situations create mandatory insurance requirements that yacht owners must understand.

Situations Requiring Mandatory Coverage:

- Financed vessels (lender requirements)

- Marina slip rentals (marina insurance requirements)

- Commercial operations (state and federal regulations)

- Charter activities (passenger liability requirements)

- Vessels over certain size thresholds (varies by state)

Recommended Coverage for All Yacht Owners: Even when not legally required, yacht insurance provides essential financial protection. The cost of yacht insurance is minimal compared to potential liability exposure or vessel replacement costs. Most marine insurance experts recommend comprehensive coverage regardless of state requirements.

2. State Regulatory Framework

States regulate marine insurance through their insurance departments, which oversee licensing requirements for insurance companies and agents. This regulatory framework ensures consumer protection and maintains industry standards.

Insurance Department Oversight: Each state’s insurance department licenses marine insurance providers and regulates policy terms, claims handling procedures, and agent qualifications. This oversight protects consumers and ensures insurance companies maintain adequate financial reserves.

Agent Licensing Requirements: Insurance agents must be licensed in each state where they conduct business. At Casey Insurance, our agents maintain licenses in multiple states, allowing us to serve yacht owners regardless of their location with full regulatory compliance.

State-by-State Marine Insurance Requirements

Coastal States with High Marine Activity

1. Florida

Florida leads the nation in yacht registrations and has well-developed marine insurance regulations. The state requires liability insurance for vessels used commercially and mandates specific coverage levels for charter operations.

- Registration Requirements: All motorboats must be registered with the state

- Insurance Considerations: Hurricane coverage is crucial; many insurers require hurricane plans

- Special Requirements: Commercial vessels need specific liability minimums

- Casey Insurance Status: Fully licensed and experienced in Florida marine insurance

2. California

California’s extensive coastline and inland waterways create diverse marine insurance needs. The state has specific requirements for San Francisco Bay operations and environmental liability considerations.

- Registration Requirements: All motorized vessels must be registered

- Insurance Considerations: Environmental liability important due to strict pollution laws

- Special Requirements: Some areas require additional liability coverage

- Casey Insurance Status: Licensed and serving California yacht owners

3. New York

New York’s complex waterways, including the Great Lakes, Hudson River, and coastal areas, create varied insurance requirements depending on operating location.

- Registration Requirements: All motorboats require state registration

- Insurance Considerations: Different requirements for inland vs. coastal operations

- Special Requirements: Commercial operations have specific licensing needs

- Casey Insurance Status: Licensed for New York marine insurance

Great Lakes States Insurance Requirements

4. Michigan

With extensive Great Lakes coastline, Michigan has specific requirements for seasonal operations and winter storage considerations.

- Seasonal Considerations: Winter lay-up requirements affect coverage needs

- Registration Requirements: All motorized vessels require registration

- Insurance Considerations: Ice damage coverage important for year-round storage

5. Ohio

Ohio’s Lake Erie coastline and inland waterways create specific insurance needs, particularly regarding seasonal usage patterns.

- Inland Waterway Focus: Many policies designed for lake and river usage

- Registration Requirements: State registration required for powered vessels

- Insurance Considerations: Seasonal storage and usage patterns affect premiums

Southern Coastal States

6. Texas

Texas’s Gulf Coast presents unique challenges including hurricane exposure and extensive inland waterway systems.

- Hurricane Considerations: Mandatory hurricane plans for coastal areas

- Registration Requirements: All motorboats require state registration

- Insurance Considerations: Both coastal and inland coverage needs

7. North Carolina

North Carolina’s Outer Banks and inland waterways require specific insurance considerations for varied marine environments.

- Coastal vs. Inland: Different requirements based on operating areas

- Registration Requirements: State registration mandatory for motorized vessels

- Insurance Considerations: Hurricane coverage essential for coastal operations

Marine insurance Registration Requirements by State

1. Federal vs. State Registration

Understanding the difference between federal documentation and state registration helps yacht owners choose the appropriate registration method for their vessels.

Federal Documentation:

- Available for vessels over 26 feet

- Provides clear title evidence

- Allows unrestricted travel between states

- Preferred for vessels cruising multiple states

- May affect insurance rates and coverage options

State Registration:

- Required for most motorized vessels

- Varies by state in terms of requirements and fees

- Necessary even for federally documented vessels in some states

- Affects insurance requirements and available coverage

2. Multi-State Considerations

Yacht owners who cruise multiple states or maintain vessels in different locations face complex registration and insurance requirements.

Interstate Cruising:

- Temporary operation usually allowed with home state registration

- Extended stays may require local registration

- Insurance coverage must be valid in all operating states

- Some states have reciprocity agreements

Multiple Vessel Locations:

- Owners with homes in multiple states may need registration in each location

- Insurance coverage should account for all operating areas

- Seasonal movements between states require coverage coordination

Interstate Boating and Insurance Considerations

1. Reciprocity Agreements

Many states maintain reciprocity agreements that allow temporary operation of vessels registered in other states without additional registration requirements.

Typical Reciprocity Terms:

- 30-90 day temporary operation periods

- Valid home state registration required

- Insurance requirements of operating state may apply

- Commercial operations often excluded from reciprocity

2. Multi-State Coverage Needs

Yacht owners operating in multiple states need insurance coverage that provides adequate protection regardless of location.

Coverage Territory Considerations:

- Ensure policy covers all intended operating areas

- Understand any geographical limitations or exclusions

- Consider different liability requirements between states

- Verify coverage for transport between locations

Regulatory Compliance: Different states may have varying requirements for:

- Minimum liability coverage levels

- Environmental protection requirements

- Safety equipment mandates

- Operator licensing requirements

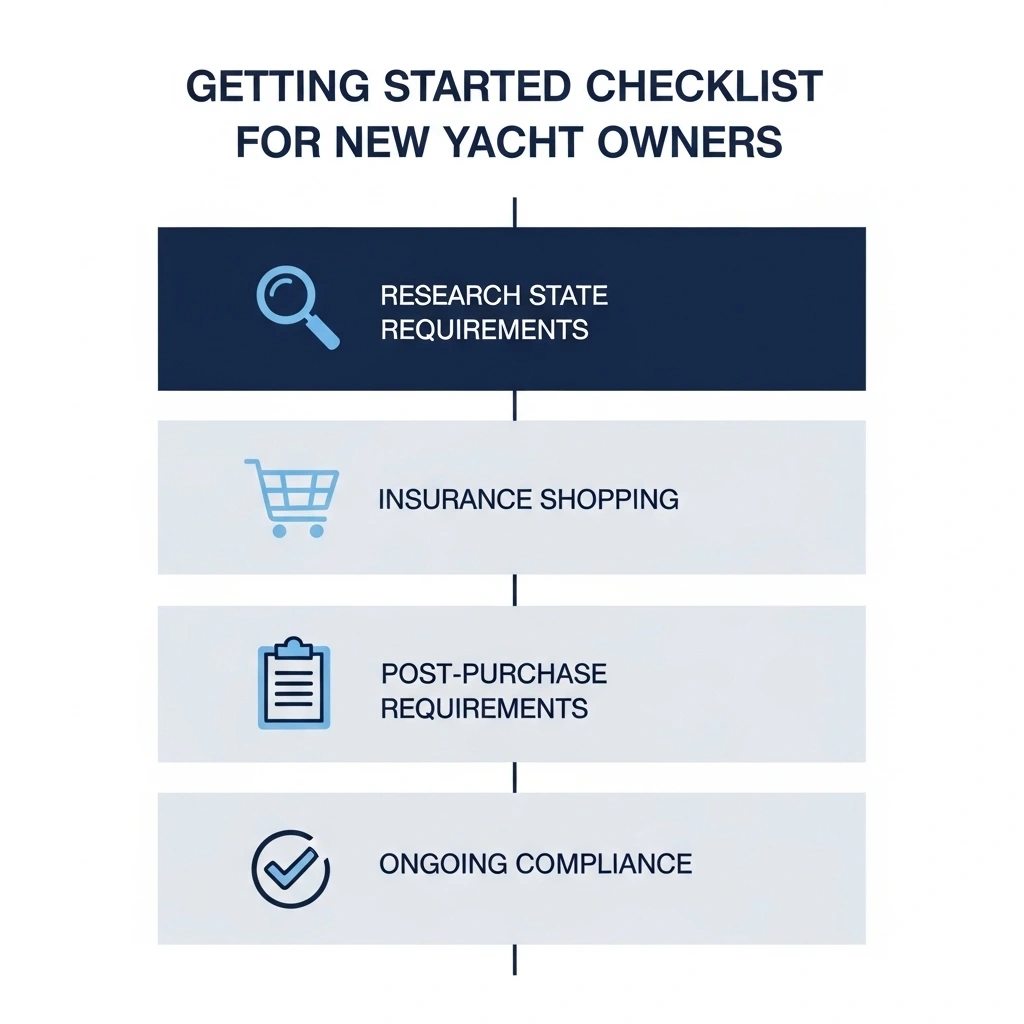

Getting Started Checklist for New Yacht Owners

1. Pre-Purchase Preparation

Research State Requirements:

- Understand your state’s registration requirements

- Research insurance requirements and recommendations

- Identify any special local regulations or restrictions

- Consider your intended usage patterns and locations

Insurance Shopping:

- Get quotes from licensed marine insurance specialists

- Compare coverage options and policy features

- Understand exclusions and limitations

- Consider bundling opportunities with other insurance

2. Post-Purchase Requirements

Immediate Steps (Within 30 Days):

- Register vessel with appropriate authorities

- Secure comprehensive marine insurance coverage

- Obtain required safety equipment

- Complete any mandatory operator education requirements

Ongoing Compliance:

- Maintain current registration and insurance

- Update coverage for vessel modifications or value changes

- Renew required certifications and training

- Review coverage annually for adequacy

3. Documentation Organization

Essential Documents to Maintain:

- Vessel registration or documentation certificates

- Insurance policy declarations and certificates

- Safety equipment inspection records

- Operator licenses and certifications

- Financing documents (if applicable)

Digital and Physical Copies: Maintain both digital and physical copies of all important documents. Keep copies aboard the vessel and in secure shore-based storage.

State-Specific Marine Insurance Laws

1. Liability Protection Requirements

Different states have varying approaches to liability protection requirements for recreational vessel operations.

States with Specific Liability Requirements: Some states mandate minimum liability coverage for certain vessel operations or sizes. These requirements typically apply to:

- Commercial operations

- Vessels over specific size thresholds

- Operations in certain waterways

- Charter or rental activities

Recommended Coverage Levels: Even without mandatory requirements, marine insurance experts recommend minimum liability coverage of:

- $300,000 per occurrence for smaller vessels

- $500,000-$1,000,000 for larger recreational yachts

- Higher limits for commercial operations

2. Environmental Protection Laws

Many states have specific environmental protection requirements that affect marine insurance needs.

Pollution Liability:

- Fuel spill cleanup can cost tens of thousands

- Some states require specific pollution liability coverage

- Environmental damage claims can exceed standard policy limits

- Specialized environmental coverage may be necessary

3. Uninsured Boater Protection

Some states are considering uninsured boater protection similar to automobile insurance requirements, though implementation varies significantly.

Casey Insurance: Licensed and Ready to Serve

1. Multi-State Licensing

Casey Insurance maintains licenses in multiple states, allowing us to serve yacht owners with complete regulatory compliance regardless of their location. Our multi-state licensing ensures:

Regulatory Compliance:

- Full compliance with state insurance regulations

- Proper agent licensing in all service areas

- Understanding of local requirements and restrictions

- Access to approved insurance carriers in each state

Consistent Service Quality:

- Same high-quality service regardless of state

- Uniform expertise in marine insurance across all locations

- Coordinated coverage for multi-state operations

- Simplified policy management for clients

2. Getting Started with Casey Insurance

Initial Consultation Process:

- Needs Assessment: We evaluate your specific vessel, usage patterns, and state requirements

- Requirements Review: We ensure compliance with all applicable state and local regulations

- Coverage Options: We present appropriate coverage options from licensed carriers

- Policy Implementation: We handle all paperwork and regulatory filings

Ongoing Support:

- Annual coverage reviews and updates

- Assistance with claims processing

- Regulatory compliance monitoring

- Multi-state coordination for cruising clients

3. State-Specific Expertise

Our team maintains current knowledge of marine insurance requirements across all states we serve, including:

- Current registration and insurance requirements

- Recent regulatory changes affecting yacht owners

- State-specific coverage recommendations

- Local carrier availability and specializations

Conclusion: Navigating State Requirements Successfully

Understanding yacht insurance state requirements doesn’t have to be overwhelming. With proper guidance from licensed marine insurance professionals, you can ensure full compliance while securing optimal coverage for your specific needs.

The key to successful yacht insurance compliance lies in working with experienced agents who understand both state requirements and marine insurance complexities. At Casey Insurance, we combine multi-state licensing with deep marine insurance expertise to provide seamless service regardless of your location.

Every state presents unique requirements and opportunities for yacht owners. Our expertise helps you navigate these differences while securing comprehensive protection that meets your specific needs and regulatory obligations.